The Invesco India Technology NFO is here, and this might be your ultimate chance to dive into the exhilarating growth and potential of the tech sector. Be at the forefront of the future!

Given the nature of how advanced technologies are changing the face of every sector and human endeavor, Invesco India Technology Fund NFO is a perfect chance to be part of the growing trend from the beginning. Specializing in fresh technologies and advancing developments, it is ideal for those wanting to be pioneers. This is a great trip, go further and find out where it may lead you in the future!

Fun fact: The contribution of the IT sector to India’s GDP is currently valued at ₹11.47 lakh crore, and by the year 2026, it is projected to touch ₹28.96 lakh crore, which is approximately 10% of India’s GDP. The technological industry is expanding fairly rapidly, primarily because public spending on IT has increased, and data costs have continued to drop as governments have provided robust support, making India one of the largest IT markets in the world.

About the Invesco India Technology Fund NFO

Invesco India Technology Fund NFO will be an open-end equity scheme which will seek to invest in technology and other related sectors that would mean going deep into the tech front. It will finance firms that will spearhead innovation in such technologies as artificial intelligence, robotics, and cloud computing. The intended beneficiaries under the Invesco India Technology Fund scheme include a list of industry heavyweights as well as emerging players with the ultimate goal of earning you better returns in the long-run. The scheme covers as many trends as possible in technology and distributes them to large, mid, and small companies. It reflects fast-paced digitalization and world’s IT progress; however, risk management remains one of the fund’s key concerns.

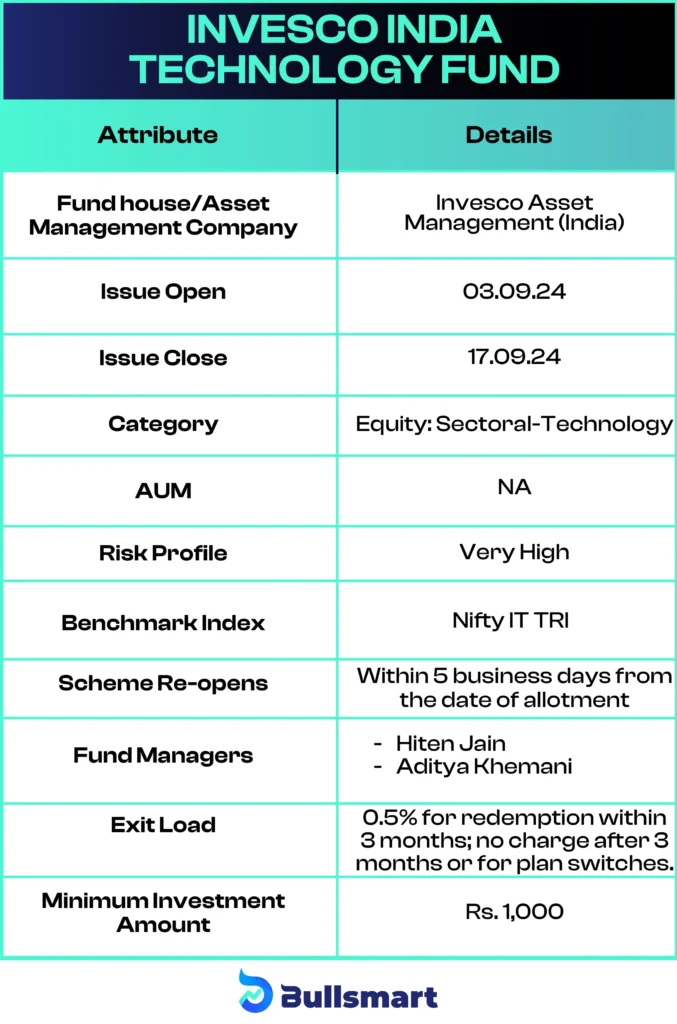

Take a glance at the details:

Note: Data updated as of 23.08.24

Invesco Mutual Fund

Invesco Mutual Fund, a subsidiary of Invesco Ltd., a global investment firm, entered India with a bang. This happened in 2006. The company is engaged in the distribution of a large variety of investment products, including equity as well as fixed income and hybrid funds, which are an amalgam of global expertise and local insights. Invesco India has the support of its parent company’s foreign network apart from the fact that it also develops strategies that fit the demands of Indian investors. The company’s main advantage in this scenario is the fact that it is data driven and risk prudent making long-term acquisitions possible

The most famous funds are Invesco India Arbitrage Fund, which focuses on stable returns and low risk, and Invesco India Midcap fund, a fund that targets mid-sized companies with growth prospects, while Invesco India Dynamic fund, is a hybrid fund that alternates its equity and debt exposure according to market conditions.

About the Benchmark Index

The Nifty IT TRI includes stocks of some of the top IT companies in India like Infosys, TCS, Wipro etc. It follows stock prices along with their dividends in order to present a more complete picture of the returns available in regard to investments in the IT sector.

Fund managers and investors also consider it as an important standard to measure up their performance with regards to investments in this particular sector. The Nifty IT TRI has gained proclivity to the extent of its commendable performance thanks to the rapid surge in the use of technology and the need for technology-related services. However, the Nifty IT TRI has a downside as its value can be affected by various factors, such as, trends in the global information technology industry, changes in foreign exchange rates, and changes in economic conditions in general.

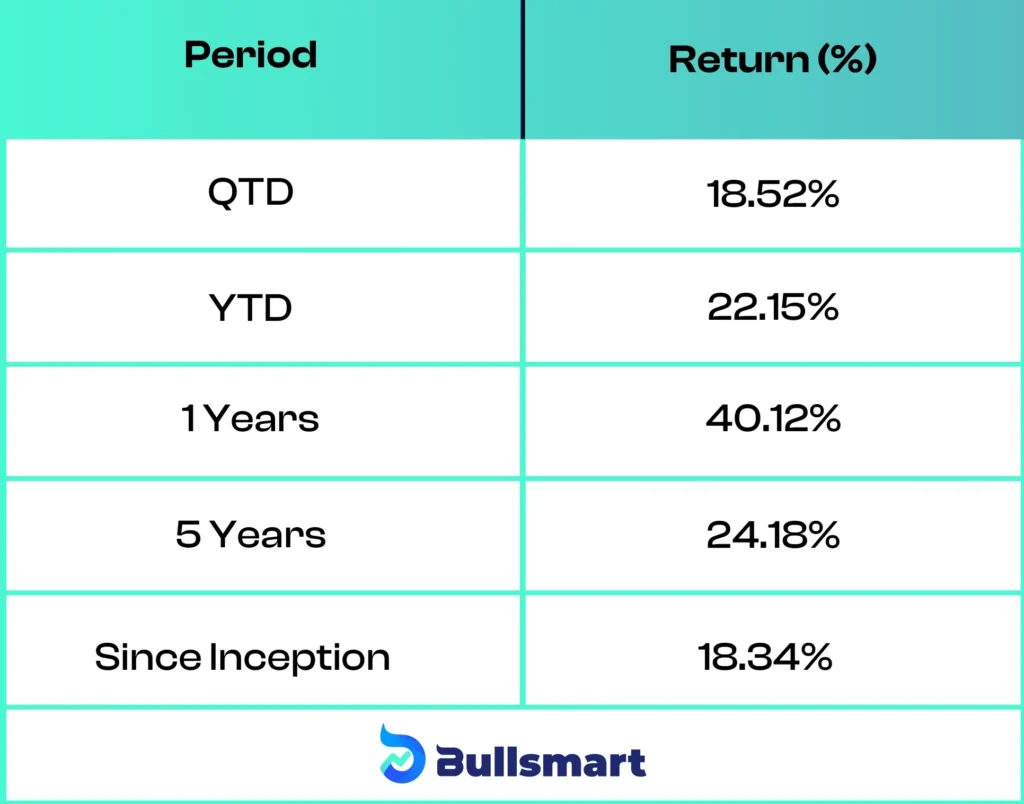

Here’s a quick rundown on the benchmark index’s returns:

Meet the Fund Manager

Hiten Jain

- BE, CFA, MBA (Finance)

- Has over a decade of work experience at highly rated firms, such as CRISIL Limited (a Reputable rating agency) & Dunia Finance LLC, Dubai (a leading financial institution in the UAE) recognized for his strong analytics skills and extraordinary international finance knowledge.

Aditya Khemani

- B.Com (Hons.), PGDM from IIM Lucknow

- Has a strong work reputation and experience with premier finance firms, such as Motilal Oswal Mutual Fund, HSBC AMC, SBI Mutual Fund, ICICI Prudential AMC, and Morgan Stanley Advantage Services. Distinguished with a solid education and progression of work with top finance firms.

Who should apply for Invesco India Technology Fund NFO?

For investors who love technology, Invesco India Technology Fund NFO is a chance to establish a portfolio aligned to their values. Invesco India Technology Fund is designed for technology enthusiasts as well as for those with a long-term growth orientation. Invesco India Technology Fund NFO explores technology enabled sectors of the global economy including AI, robotics, and cloud computing. This is a timely and high potential investment for those who want to take advantage of digitization trends and global technology demand with investments anchored in large, mid and small cap companies to provide opportunity and diversity to your portfolio for the future.

Invesco India Technology Fund NFO is especially suitable for investors with high risk tolerance who are comfortable being at the leading edge of investing principles. Rebuilt from the ground up by applying tenets undergirding dynamic omnidirectional thinking on technology trends and innovations while leveraging strong risk management frameworks to pursue above market returns over time.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.