Navigating India’s financial system can sometimes feel like a puzzle, and right at the center of it lies the Permanent Account Number (PAN). Issued by the Income Tax Department of India under Section 139A of the Income Tax Act, PAN is a unique ten-digit alphanumeric code that works much like a financial identity card. Instead of tracking every rupee you spend, it serves as a tool to link transactions-whether that’s opening a bank account, investing in mutual funds, buying property, or filing your income tax return.

Think of PAN as the thread that ties together different parts of your financial journey. From ensuring proper reporting of income and taxes to enabling smoother compliance with regulatory requirements, it plays a role in almost every formal investment activity.

In this blog, we’ll walk through why PAN is considered essential in the investment world, how it fits into different financial products, and what consequences may arise if it’s missing. Understanding PAN isn’t just for tax professionals, it’s a basic step for anyone looking to manage money responsibly.

What is PAN Card?

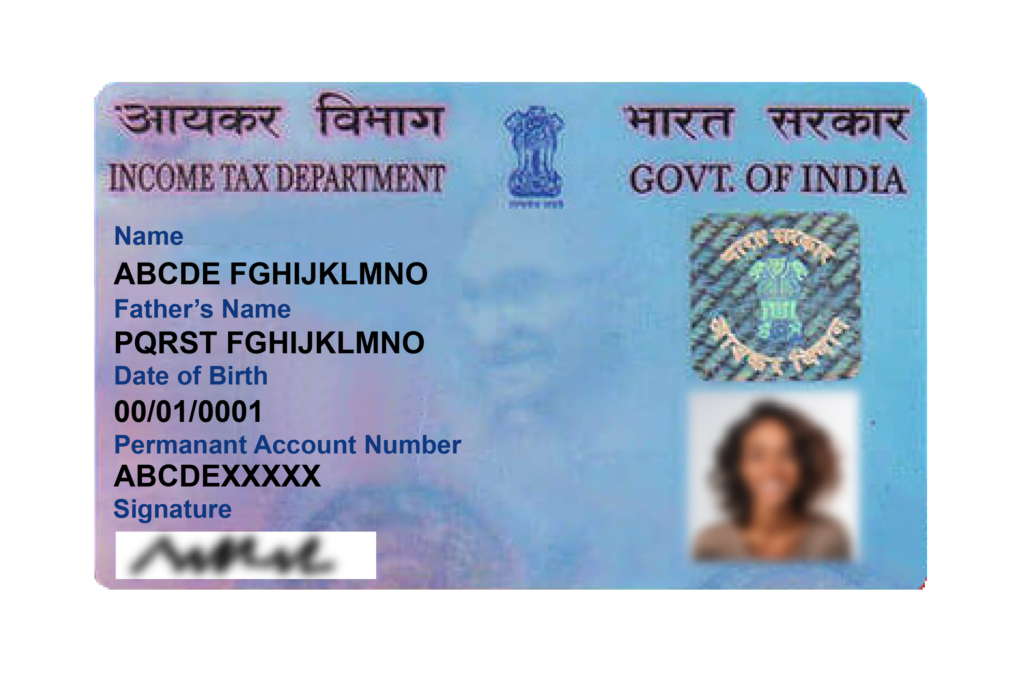

PAN (Permanent Account Number) is a ten-character alphanumeric identifier issued by India’s Income Tax Department under Section 139A. It is provided as a physical card or as e-PAN.

PAN links a taxpayer’s transactions with the department and is required for filing returns and many financial activities (opening bank/demat accounts, high-value investments).

Its structure is five letters, four digits, and one letter (e.g., ABCDE1234F). e-PAN, a digitally signed PDF, is legally valid like the physical card. It has lifetime validity, nationwide.

History of PAN in India: Important Milestones

- 1972: PAN was introduced in India to streamline the taxation system and curb tax evasion.

- 1976: PAN was made mandatory under Section 139A of the Income Tax Act, 1961.

- 1998: Nationwide rollout of new-series PAN completed and electronic processes expanded. (Reword from “commencement of online issuance” to avoid implying a single go-live date.)

- 2004 onward: Wider quoting of PAN mandated for specified transactions (Rule 114B).

- 2017: AN-Aadhaar linkage framework introduced (Finance Act 2017). Consequences for non-linkage effective 1 Jul 2023 until made operative.

- 2020-2025: Aadhaar-based instant e-PAN facility operational; e-PAN legally valid. (Avoid hard timelines like “45 days”.)

Structure of PAN Number

A PAN is a 10-character code in this format: AAAAA9999A

- 1st to 3rd characters: Random letters (from AAA to ZZZ).

- 4th character: Tells the type of holder:

- P = Individual (person)

- C = Company

- H = Hindu Undivided Family (HUF)

- A = Association of Persons (AOP)

- B = Body of Individuals (BOI)

- F = Firm/Partnership

- T = Trust

- G = Government

- L = Local Authority

- J = Artificial Juridical Person

- P = Individual (person)

- 5th character: First letter of the person’s surname (for individuals) or the entity’s name.

- 6th to 9th characters: Numbers (0001 to 9999).

- 10th character: A letter used as a check digit (to verify correctness).

Who can own a PAN Card?

- PAN cards are available to individuals of all ages, including minors (with the consent of a guardian).

- They’re also accessible to various entities, such as businesses, partnerships, and trusts.

- Permanent Account Number serves as a unique identifier for tax purposes and financial transactions.

- Individuals and entities alike rely on Permanent Account Number cards for tax compliance and regulatory purposes.

- Regardless of age or group, Permanent Account Number cards play a crucial role in managing finances and ensuring adherence to tax laws in India.

If you’re new to this and Wondering “How can I get a PAN Card?” Then, the next part is specially for you!

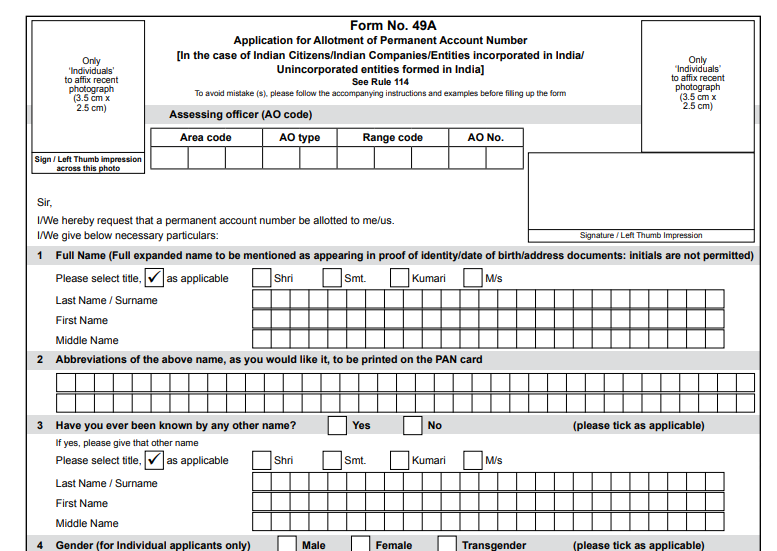

How to Apply for a PAN Card Using Form 49A

Online Procedure for PAN (Form 49A)

Step 1: Visit the official portal of Protean (formerly NSDL) or UTIITSL.

Step 2: Select Form 49A for Indian citizens and start filling details like full name, father’s name, date of birth, gender, and contact details.

Step 3: Upload documents like Proof of Identity, Proof of Address, Proof of Date of Birth, along with a scanned passport photo and signature.

Step 4: Pay the fee i.e., ₹107 for Indian communication address or ₹1,017 for foreign address. Payment can be made online.

Step 5: Complete verification, either through Aadhaar OTP (e-Sign) or by posting signed acknowledgment with documents.

Step 6: Receive a 15-digit acknowledgment number to track status.

Step 7: e-PAN is emailed (if Aadhaar-based instant Permanent Account Number is used, it may be generated within 10 minutes). Physical Permanent Account Number card is delivered in about 15-20 working days.

Offline Application for PAN

Offline Procedure (Form 49A)

Step 1: Collect Form 49A from a PAN service center or download and print it.

Step 2: Fill the form in block letters with details such as name, father’s name, date of birth, gender, and address.

Step 3: Attach documents like Proof of Identity, Proof of Address, Proof of Date of Birth, and two passport-size photographs.

Step 4: Pay the fee, i.e., ₹107 (India) / ₹1,017 (foreign). Cash, cheque, or demand draft is accepted at the center.

Step 5: Submit the form along with documents at an authorized PAN service center.

Step 6: Get acknowledgment slip with 15-digit number for tracking.

Step 7: Permanent Account Number card is processed and dispatched in about 15-20 working days. e-Permanent Account Number may also be sent to the registered email.

Additional Tips

- Lost Card: Replace it by filling a correction form on either the website or at the Permanent Account Number center.

- Link with Aadhaar: Ensure that your Permanent Account Number is linked with Aadhaar to avoid any hassle.

“What if I Need to Fix Something in my PAN?”

Here’s a crisp tally to do the same:

Online

- Go to NSDL or UTIITSL website.

- Select “Correction/Changes in PAN Data”.

- Fill form with the correct details and upload supporting documents.

- Pay fee online.

- Submit form.

Offline

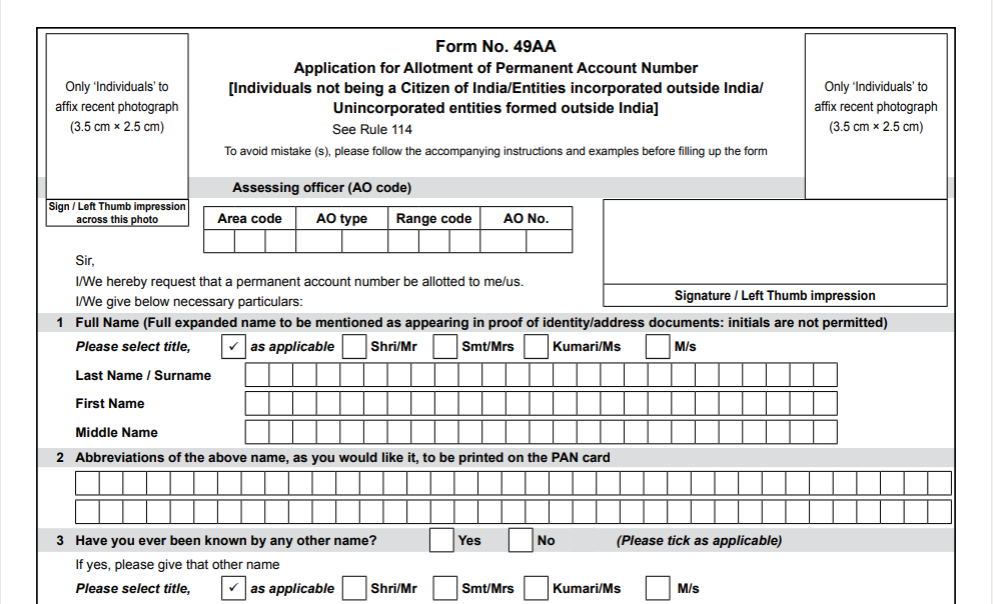

- Download Form 49A or 49AA.

- Fill form with correct details.

- Attach supporting documents.

- Visit PAN service center.

- Submit form and documents, and pay fee.

PAN’s Reign in the Tax-world and Other Legal Requirements

Ever wondered why Permanent Account Number is such a big deal in investing? Let’s explore the magic and see why it’s a game changer:

Tax Shield

PAN is an identifier that links reportable transactions and enables correct TDS/TCS reporting.” (No claim that PAN itself “saves tax”.)

PAN requirements arise under Section 139A of the Income-tax Act, 1961, and Rule 114B (specified transactions where quoting PAN/Aadhaar is mandatory).

Identity Key

Beyond its digits, Permanent Account Number is your gateway to financial security. It protects your investments and verifies your ownership. Grab yours from NSDL or UTIITSL, it’s a unique 10-digit alphanumeric code.

Legal Essential

Permanent Account Number is governed by Section 139A of the Income Tax Act, 1961 and Rule 114B of the Income Tax Rules. PAN is also required under SEBI KYC guidelines and the Prevention of Money Laundering Rules for opening and operating investment accounts.

Tax with Permanent Account Number

PAN is required for ITR filing/compliance; 80C deductions depend on eligible investments, not on PAN itself.

Financial Guardian

The Permanent Account Number isn’t just a number; it’s your financial guardian. It ensures smooth sailing on your financial journey. And linking it with AADHAAR adds an extra layer of security.

Consequences of not Owning a PAN

Not having a Permanent Account Number when investing in India can lead to several consequences:

- Failure to comply may attract a penalty of ₹10,000 under Section 272B.

- Higher TDS/TCS is deducted under Sections 206AA and 206CC if Permanent Account Number is not furnished.

- Banks and other payers apply TDS at standard thresholds: ₹40,000 (₹50,000 for senior citizens) on interest from bank/post office deposits, and ₹5,000 for other payers. Without Permanent Account Number, higher rates apply.

- Demat and trading accounts cannot carry out transactions until a valid Permanent Account Number is furnished and operative.

Inability to File Tax Deduction

Role of PAN in Different Investment Avenues

Stock Investments : KYC & Demat

KYC (Know Your Customer) Process: Before you start investing in stocks, you’ve got to go through KYC. It’s like your investor ID check. Your Permanent Account Number card is key here, you’ll need it along with other docs to prove who you are and where you live. Make sure you submit these to your stock broker or depository participant.

Demat Account

Ever heard of a Demat Account? It’s your digital locker for stocks. But here’s the deal: you can’t get one without a Permanent Account Number card. Your Permanent Account Number details are needed to track your stock transactions and keep the tax folks happy. You’ll set up your Demat account with entities like NSDL or CDSL.

Mutual Funds

Linking Permanent Account Number isn’t just for taxes; it’s crucial for mutual funds too. Linking your PAN with your mutual fund folio is mandatory and helps track your investments and keep the taxman happy. It’s like your mutual fund passport.

SIP (Systematic Investment Plan) Registration

Thinking of starting an SIP? It’s like setting up a monthly investment plan in mutual funds. But here’s the catch- you need your Permanent Account Number card to get started. It’s also about verifying your identity and making sure your SIP journey is smooth.

Real Estate

TDS on Property Transactions: Buying or selling a big property? TDS is deducted at 1% if it’s worth over Rs. 50 lakhs. Your Permanent Account Number card helps track the transaction and ensures TDS is deducted right.

Bank Accounts & Fixed Deposits

Permanent Account Number for Banking Bonanza: Earned big on your fixed deposit? For banks/post offices/co-op banks, TDS u/s 194A applies only if interest exceeds ₹40,000 (₹50,000 for resident senior citizens); other payers: ₹5,000.” (State thresholds; don’t lock to a fixed % in prose, rate is in section.)

In short, your Permanent Account Number card is your ticket to the investment world in India. From stocks to real estate and banking, it’s crucial for keeping your investments on track and staying tax compliant.

Bottom Line

By now, it’s clear that the Permanent Account Number is more than just a card with ten alphanumeric characters – it’s a cornerstone of India’s financial and tax system. Whether you’re opening a bank account, buying shares, registering for a Systematic Investment Plan, or making a big-ticket purchase like property, your Permanent Account Number acts as the official identifier that ties all your transactions together.

Think of it this way: without a Permanent Account Number, most formal investment doors remain closed. Higher tax deductions, penalties, and even delays in account openings can crop up if you don’t have one. On the other hand, with a Permanent Account Number, compliance becomes smoother, record-keeping more transparent, and financial planning much more reliable.

For investors, especially first-timers, understanding the role of the Permanent Account Number is not about memorizing tax codes – it’s about knowing that this number helps keep your financial journey legitimate, traceable, and hassle-free. And the best part? Applying for it today is simple, quick, and mostly online.

So, if you haven’t yet secured your Permanent Account Number, consider it your first step toward responsible investing. With this card in hand, you’re better prepared to participate confidently in India’s growing financial markets.

FAQs

What is PAN for investing?

A Permanent Account Number is like your financial fingerprint in India. It’s a must-have for diving into the world of investing. Here’s why:

Unique ID: Think of Permanent Account Number as your special code that the taxman uses to identify you. It’s required for various money moves, like opening a Demat account, dabbling in stocks, or even buying property.

Track Your Trails: With Permanent Account Number,the government keeps tabs on your investments. It’s their way of making sure everyone plays by the tax rules and pays their fair share.

Is PAN compulsory for trading?

Absolutely! If you want to dip your toes into trading waters, Permanent Account Number is your golden ticket. SEBI says so. It’s mandatory to flash your Permanent Account Number details whenever you make investment moves. It keeps things legit and helps the tax folks stay on top of things.

Is a PAN card required for SIP?

Yes, If you have your eye on SIPs, you’ll need your trusty PAN card. SIPs are all about investing regularly in mutual funds, and Permanent Account Number helps your tax game strong and your investments on track.

So, remember, Permanent Account Number isn’t just a random set of numbers. It’s your key to unlocking the world of investments in India.

Can I invest without PAN?

No, you cannot. In India, you need a PAN card for lots of financial stuff like opening a bank account, buying or selling property, investing, and filing taxes. So, if you’re planning to invest in India, getting a Permanent Account Number card is a must.