When it comes to mutual fund investments, large-cap funds often stand out as a popular choice for those seeking a balance between stability and growth. Among the best large-cap funds in India, the Nippon India Large Cap Fund has carved a niche for itself.

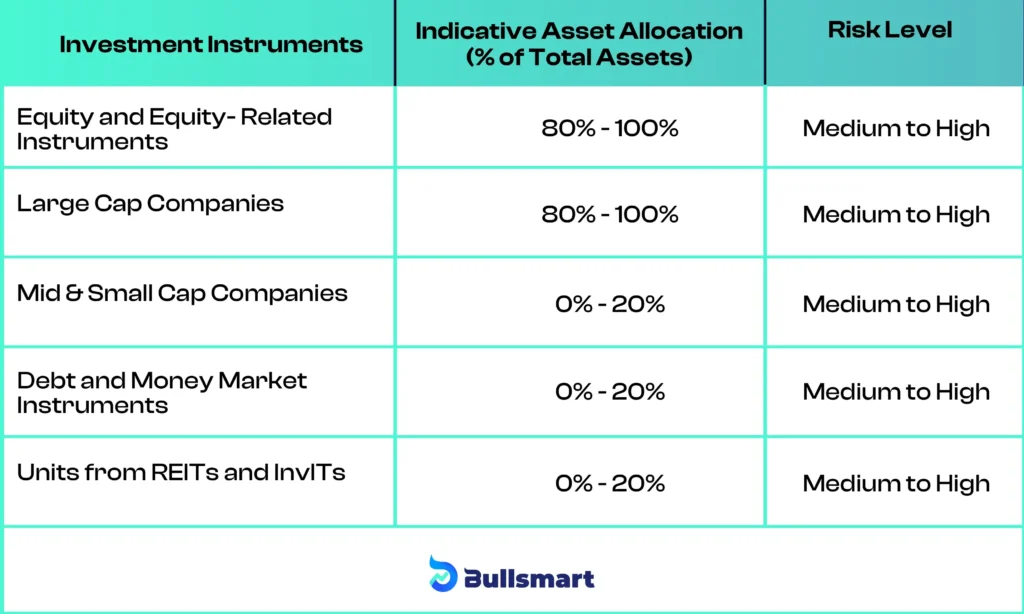

Large-cap mutual funds, by definition, invest at least 80% of their corpus in the top 100 companies by market capitalization.

The Nippon India Large Cap Fund, managed by one of India’s leading asset management companies, aims to capture the growth potential of these blue-chip companies. But what exactly does this fund hold? Let’s understand.

Review of Nippon India Large Cap Fund

The Nippon India Large Cap Fund aims to achieve long-term capital appreciation by predominantly investing in equity and equity-related instruments of large-cap companies.

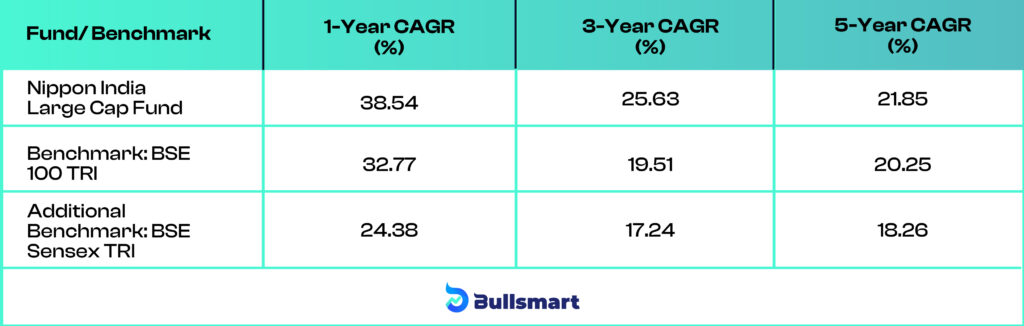

The fund considers the BSE 100 TRI as its benchmark and BSE Sensex TRI as its additional benchmark.

Investment Strategy of the fund

The primary investment objective of the scheme is to seek long-term capital appreciation by investing primarily in equity and equity-related securities of large-cap companies.

The secondary objective of the fund is to generate consistent returns through investments in debt securities, money market instruments, REITs, and InvITs.

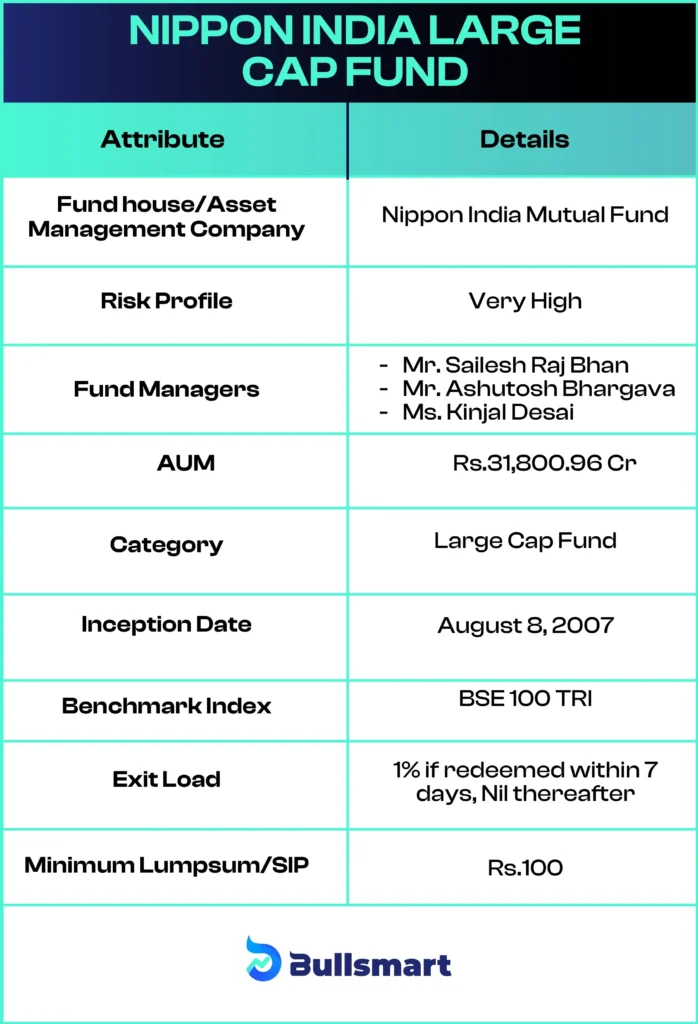

Here are the key details of the fund:

Portfolio Analysis

The fund aims to allocate its assets as follows:

Know the Risks and Returns

As a large-cap fund, Nippon India Large Cap Fund aims to provide relatively stable returns compared to mid or small-cap funds, but with the potential for capital appreciation. Here’s a snapshot of its performance:

Nippon India Mutual Fund

Nippon India Mutual Fund (NIMF), initially known as Reliance Mutual Fund, was founded in June 1995 through a partnership between Reliance Capital and Japan’s Nippon Life Insurance Company. In October 2019, Nippon Life acquired Reliance’s shares, prompting the rebranding to Nippon India Mutual Fund. Significantly, NIMF was the first Asset Management Company (AMC) to list on stock exchanges in 2017.

Nippon Life India Asset Management Limited (NAM India) manages NIMF’s assets, with Reliance Capital Limited and Nippon Life Insurance Company, together holding a 75.93% stake in its total issued and paid-up equity share capital.

As of June 30, 2024, Nippon India Mutual Fund managed assets totalling ₹ 516,267.80 crore, which includes mutual funds, alternative investments, pension funds, and offshore funds.

NIMF offers 180 primary schemes, featuring 45 equity funds, 27 debt funds, and other schemes like liquid and gold funds, making it the fourth-largest in the industry by Assets Under Management (AUM).

Some of the other popular funds offered by AMCs are the Nippon India Small Cap Fund, Nippon India Gilt Securities Fund, and Nippon India Tax Saver (ELSS) Fund.

Meet the Fund Managers

Sailesh Raj Bhan

Deputy CIO at NAM India, managing schemes since August 2007, Sailesh brings over 28 years of expertise in equity research and analysis. He has held various roles at NAM India, including Senior Fund Manager and Senior Analyst.

Ashutosh Bhargava

As a co-fund manager since September 2021, Ashutosh has been in capital markets. He served as Deputy Investment Strategist at NAM India and previously worked as an economist at Reliance Capital and JPMorgan India.

Ms Kinjal Desai

Fund Manager for Overseas Investment at NAM India since May 2018, Kinjal has 11 years of experience. She previously worked as an Associate in Equity Investments, supporting research and fund management tasks.

Suggested Read – Nippon India Nifty 500 Equal Weight Index Fund

Who should invest in this fund?

The Nippon India Large Cap Fund may be suitable for investors who:

- Have a long-term investment horizon (5+ years)

- Seek capital appreciation through equity investments

- Prefer relatively stable returns with growth potential

- Are comfortable with moderate to high-risk

The Nippon India Large Cap Fund offers exposure to India’s blue-chip companies, aiming to provide a balance of stability and growth potential. Its focus on large-cap stocks may appeal to investors looking for relatively lower volatility compared to broader market funds.

However, like all equity investments, it carries market risks. It’s crucial to align any investment with your financial goals and risk tolerance. Consider consulting a financial advisor to determine if this fund fits well within your overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.