“Loan Against Mutual Funds” sounds like a scam? Well, it’s not if you know the right way in;)

Hey there, fellow cash-strapped friend! Ever found yourself in need of a quick dough but didn’t want to break the bank?

Well, hold onto your hats because here comes some juicy info for you: your mutual funds might just be the secret sauce to getting your hands on some fast cash loans in India!

How do Loan Against Mutual Funds Work?

Alright, so you’ve been faithfully pouring your savings into mutual funds, watching them grow like magic beans. But when an unexpected expense hits, you don’t have to panic.

You can use your mutual fund units as collateral to snag a loan. It’s like tapping into your own financial stash without having to dip into your savings account!

Plus, the process is straightforward: pledge your units, open a current account with an overdraft facility, and bam! You’re ready to rock and roll with a loan ranging from Rs. 25,000 to a jaw-dropping Rs. 5,00,00,000.

The perks? Oh, they’re sweet!

Now, you’re probably wondering, “What’s the catch?” Well, here’s the sweet part—there isn’t much of one! These loans come with some seriously tasty perks. Imagine getting lightning-fast access to cash—no more waiting around for weeks on end.

And the cherry on top? The interest rates are often super low, especially if you’ve got a sparkling credit score. Plus, here’s the kicker: you can keep on investing in your mutual funds while using them as collateral. Yup, your money keeps doing its thing and growing while you’re out there tackling life’s pitfalls.

[Note: SEBI has even released a circular on lending processes in the world of mutual funds.]

But Hey, let’s Talk Turkey…

Before you dive headfirst into this money-saving hack, there are a few things to chew on. First off, consider how taking out a loan might jiggle your credit score.

And don’t forget about those pesky tax implications—ain’t nobody got time for surprise bills!

Mutual funds don’t just provide an amazing tax-saving opportunity; they also devise a route for a more secure future.

Oh, and while the interest rates are usually sweet, they might be a tad higher than loans against gold or fixed deposits. So, take a beat, crunch the numbers, and make sure it’s the right move for you.

How Much Loan Can You Take Against Mutual Funds?

Can mutual funds really be your knight in shining armor when it comes to quick cash loans? You betcha! With their low interest rates, lightning-fast access to funds, and the freedom to keep your investments growing, it’s no wonder why more and more folks are turning to mutual funds for their borrowing needs.

And hey, let’s not forget about the numbers—loans ranging from Rs. 25,000 to a whopping Rs. 5,00,00,000? Now that’s what we call financial flexibility!

Crunching the Numbers for Loan Against Mutual Funds

Alright, let’s break it down with an example to see how mutual funds can actually hook you up with some quick cash loans, especially for all the folks in India.

Imagine you’ve thrown some cash into a mutual fund in India and suddenly you’re in a pinch, needing some quick cash. Here’s how you can figure out how much cash you can snag against your mutual fund stash:

- Check Your Mutual Fund’s Value: First off, tally up the value of your mutual fund. Easy peasy math: just multiply the number of units you’ve got by the Net Asset Value (NAV) of your fund.

Say you’ve got 500 units, and the NAV is Rs 20,

then your total investment is 500 * Rs. 20 = Rs. 10,000.

- Scope Out Your Eligible Loan Amount: This one’s all about the Loan-to-Value (LTV) ratio, which tells you how much of your mutual fund’s value you can grab as a loan. In India, lenders usually throw around 50% to 70% of your total mutual fund value as a loan.

- Mind the Interest Rate and Monthly Payments: Now, don’t forget about the interest rate dance. Interest rates for loans against mutual funds in India can do the cha-cha depending on the lender and how much you’re borrowing. And don’t snooze on calculating that monthly interest—it’s based on how much of the loan you’ve actually used and the yearly interest rate.

- So, let’s say the LTV ratio is 60% and the interest rate is 10% per year. Crunching the numbers:

| Item | Calculation | Result |

| Your Mutual Fund Value | Rs. 10,000 | Rs. 10,000 |

| Your Eligible Loan Amount | Rs. 10,000 * 60% | Rs. 6,000 |

| Interest Rate | 10% per annum | 10% per annum |

| Monthly Interest | (Rs. 6,000 * 10%) / 12 months | Rs. 50 |

See? Your mutual fund investment isn’t just sitting there looking pretty; it’s got your back when you need some quick cash in India.

Mutual Funds as Flexible Cash Reserves: Loan Essentials

- Interest rates for loans against mutual funds usually range from 8% to 13% per year.

- Loan durations typically last from 12 to 36 months, but some lenders might stretch them to 60 months.

- Lenders usually offer loan-to-value (LTV) ratios up to 90% of your mutual fund’s value. That means you can borrow up to 90% of what your mutual fund is worth.

- The LTV might change depending on whether your mutual fund is more debt-focused or equity-focused. Debt mutual funds have an LTV of up to 90%, while equity mutual funds have an LTV of 50%. However, the exact amount depends on the lender.

- To get the loan, you pledge your mutual fund units as collateral. Once approved, the lender puts the loan money straight into your bank account.

- Pledged mutual fund units cannot be sold during the tenure of the loan.

- Even though your mutual funds are pledged, you still own them and can still earn returns on them during the loan period.

- There are more than 6,000 mutual fund schemes that allow sanctioning loans against mutual fund investments.

- These loans let you access cash without selling off your investments, which is handy for immediate expenses while keeping your long-term investment plan intact.

- For repayment, you can either choose the overdraft facility or term loans.

- If you have chosen an overdraft facility for a loan against a mutual fund, then the monthly repayment of the loan will only include the interest amount. While with the term loan, you will have to repay the principal amount as well in the monthly repayment.

Example of Loan Against Mutual Fund with Overdraft Facility

Example 1:

Let’s say you have mutual fund investments of Rs 2 lakh in a particular equity scheme with an LTV of 50%. This means that you can take a loan of up to Rs 1 lakh.

If you decide to take up a loan of Rs 1 lakh for 12 months at an interest rate of 10%, then your monthly payment will look like:

- Mutual Fund Value: ₹2,00,000

- Loan Amount: 50% of Mutual Fund Value = ₹1,00,000

- Interest Rate: 10% per annum

- Loan Tenure: 1 year

- Repayment: Interest only until the principal amount is repaid

Monthly interest amount = (Principal x Interest rate x Tenure)/12

(1,00,000 x 0.1 x 1)/12 = Rs 833.33

Hence, your monthly payment for this loan against mutual funds will be Rs 833.33 for 12 months. You can pay up the principal amount anytime during the loan tenure to close the loan and save yourself from the remaining interest payments.

The repayment can be done at the convenience of the borrower, but interest will continue to accrue on the outstanding amount until you repay the outstanding amount.

Example of Loan Against Mutual Fund with Term Loan

Example 2:

Assumptions:

- Mutual Fund Value: ₹10,00,000

- Loan Amount: 60% of Mutual Fund Value = ₹6,00,000

- Interest Rate: 10.5% per annum

- Loan Tenure: 1 year (12 months)

- Repayment: Monthly installments (EMI)

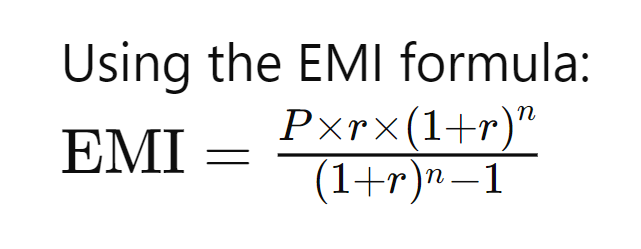

Where:

- P is the loan amount (₹6,00,000)

- r is the monthly interest rate (10.5% per annum / 12 = 0.875% per month)

- n is the loan tenure in months (12 months)

Result:

- Monthly EMI: ₹53,430.28

- Total Repayment Amount: ₹53,430.28 \times 12 = ₹6,41,163.36

Thus, with a loan amount of ₹6,00,000 at an interest rate of 10.5% per annum for one year, the monthly EMI would be approximately ₹53,430.28, and the total repayment amount over the year would be approximately ₹6,41,163.36.

In this case, the principal amount will be paid with the EMI, unlike the overdraft facility in the previous example, where only the interest amount was supposed to be repaid. The principal amount can be repaid anytime but interest will be accrued until it is repaid.

Bottom Line

In closing, remember, when life takes you into pitfalls and you need cash pronto, don’t sweat it! Your mutual funds could be your golden ticket to financial freedom. With their knack for providing quick cash loans, they’re like your trusty sidekick in the world of finance.

So, next time you’re in a pinch, don’t hesitate to tap into this hidden gem of opportunity.

Here’s to smart borrowing and even smarter investing—may your financial future shine brighter than ever.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.

FAQs

Can I use mutual funds as collateral for a loan?

Absolutely! You can use your mutual funds as collateral to get a loan. It’s like saying, “Hey, I’ve got these mutual funds, and I need some cash. Can you hook me up?” It’s a handy way to borrow money without touching your savings directly.

Are mutual funds allowed to lend?

Yes, some mutual funds can lend money, but not all of them. It really depends on the rules of the specific fund you’re dealing with. So, it’s a good idea to check with your fund provider to see if they offer this service.

Can I pledge mutual funds for a loan?

For sure! Pledging your mutual funds is like saying, “I promise to use these funds as security for a loan.” It’s a way to reassure the lender that you’ve got backup in case you can’t repay the loan.

How much loan can we get on mutual funds?

Well, that depends on a few things, like the value of your mutual funds and the policies of the lender. Typically, you can borrow anywhere from a few thousand bucks to several crores. It varies, so it’s worth checking with your lender to see how much you can borrow based on your mutual fund holdings.