Hey there, fellow investors! Today, let’s embark on a journey into the heart of change – ESG investing! You’ve likely heard the whispers: it’s all about putting your money where your values lie, focusing on Environmental, Social, and Governance factors. And guess what? It’s igniting a revolution in India!

This article isn’t just a guide; it’s a rallying cry for the future. We’ll peel back the layers to reveal what’s fueling this movement, what seismic shifts are shaping the ESG landscape, and why it’s not merely about financial returns; it’s about rewriting the narrative of our world.

Prepare for a thrilling drive into the dynamic world of ESG investing in India! It’s a journey where every investment isn’t just a transaction but a step towards a brighter, more sustainable tomorrow.

What does ESG Stand For?

ESG, short for Environmental, Social, and Governance, serves as the foundation of ESG frameworks, encompassing the three primary areas companies are required to report on. The aim of ESG is to encompass all non-financial risks and opportunities arising from a company’s everyday operations.

Background

ESG investing started in the early 2000s when people realized that just looking at revenue wasn’t enough to see how companies were doing. It grew from earlier movements like socially responsible investing, but ESG added a focus on environmental, social, and governance factors. It got a big push after scandals like Enron, which showed how important good governance is. Now, it’s a mainstream thing in investing, helping investors consider more than just profits when choosing where to put their money.

Key Drivers of ESG Investing in India

Regulatory Support: India’s Securities and Exchange Board (SEBI) is leading the charge, mandating top companies to spill the beans on their ESG practices. It’s all about transparency and pushing for a sustainability upgrade.

Investor Demand: From big institutions to everyday folks, there’s a growing appetite for ESG. Investors want to back companies that care about the planet, people, and ethical governance – not just profits.

Business Opportunities: ESG isn’t just about warm fuzzies; it’s about cold, harsh cash too. Companies embracing ESG can boost efficiency, attract responsible investors, and stay ahead in the market game.

Current Trends in ESG Investing in India

Getting Green with ESG

More and more Indian investors are jumping on the ESG bandwagon. By June 2023, sustainable funds in India were holding onto a cool INR 110.4 billion in retail assets, showing a 2% uptick year-on-year. Looks like people are serious about putting their money where their values are.

Data and Ratings Game

Good data is key, especially when it comes to ESG investing. In India, there’s a push for clearer and more consistent ESG disclosures. Companies are stepping up their game, and rating agencies are hustling to develop better ways to measure a company’s ESG performance.

Green Bonds and More

Green bonds are all the rage in India, especially among clean energy giants like Adani Green, Renew Power, and Greenko. In 2021 alone, Indian companies ranked in a whopping US$13.7 billion from ESG debt, showing mad love for eco-friendly projects. And don’t sleep on sustainability-linked instruments; they’re on the rise too, giving companies a reason to step up their green game.

These trends show how ESG investing is taking off in India, with investors putting their money where their hearts are, companies stepping up their transparency game, and green initiatives getting major funding boosts.

What is an ESG Score and How is it Calculated?

An ESG score, according to MSCI, is like a report card for companies, grading them from “CCC” (poor) to “AAA” (excellent) on how well they handle environmental impact, social responsibility, and corporate governance.

It’s a way for investors to quickly see which companies are not just chasing profits but also caring for the planet, their people, and their practices, helping them make more sustainable and ethical investment choices.

MSCI ESG Scale & ESG Fund Scores in India

Applying this scale to the nine active ESG mutual funds in India, a recent CRISIL analysis found:

- The average ESG score of these funds is 64, with four out of the nine funds scoring above this level.

- The average Governance (G) score is 73, significantly higher than the average Environmental (E) and Social (S) scores of 58 each. This indicates that fund managers are currently focusing more on governance factors compared to environmental and social ones when selecting stocks.

- The Mirae Asset Nifty 100 ESG Sector Leaders ETF has the highest overall score of 67.

This analysis shows that while ESG investing is gaining traction, there is still room for improvement, especially in environmental and social factors.

Getting Green with ESG: Indian Government’s Move

The Interim Budget 2024 emphasizes sustainability, electric vehicles (EVs), and the blue economy. It allocates funds for various green initiatives and emphasizes the importance of eco-friendly practices. Highlights include:

Rooftop Solarization and Free Electricity

- Free Electricity: Aims to provide 300 units monthly to 1 crore households, potentially saving Rs. 15,000 – Rs. 18,000 yearly.

- Entrepreneurship & Jobs: Creates opportunities for vendors and skilled individuals in installation and maintenance.

Green Energy and Sustainability

- “Net Zero” Goals: Funds allocated for offshore wind energy and coal gasification, aiming to reduce imports by 2030.

- Bio-Gas Mandate: Phased blending of bio-gas in CNG for transport and domestic use, supported by financial assistance for biomass machinery.

Electric Vehicles and Infrastructure

- EV Ecosystem: Backing for robust manufacturing, charging infrastructure, and e-bus adoption.

- Market Growth: Expected EV market revenue of ₹7,50,000 crores (USD 100 billion) by 2030, alongside increased capital expenditure in the budget.

Bio-Manufacturing and Bio-foundry

- Introduction of a new scheme promoting eco-friendly manufacturing alternatives, with an allocated budget of Rs. 500 crores.

Blue Economy

- Implementation of plans for climate-resilient activities and aquaculture development, backed by an investment of Rs. 750 crores.

Sustainability in Domestic Tourism

- Prioritization of port connectivity and tourism infrastructure enhancements, with a budget allocation of Rs. 600 crores.

Top 5 ESG Stocks in India

Infosys Ltd.

A global leader in technology services, achieving carbon neutrality and promoting diversity and inclusion. They emphasize sustainable practices, transparency and strong governance.

Lupin Ltd.

It stands out in the pharmaceutical industry with its commitment to reducing environmental impact, improving healthcare access, and maintaining rigorous governance stands.

Nestlé India Ltd.

It excels in the food and beverage sector by focusing on sustainability, community health initiatives, and ethical governance, ensuring responsible sourcing and reducing environmental footprints.

Hindalco Industries Ltd.

Leads in aluminium and copper production with efforts in carbon reduction, community development, and transparent governance, prioritizing sustainable resource management.

DLF Ltd.

Is a real estate giant known for sustainable urban development, community support, and ethical business practices, integrating green building designs and maintaining high governance standards.

Taxation and Compliance Issues in India

Companies Act 2013

- Big companies must spend at least 2% of their average net profits on CSR activities. Initially, it was a “comply-or-explain” policy, but since 2019, it’s a legal mandate.

- This Act gives ESG a legal footing, making directors consider not just shareholders, but also other stakeholders.

National Guidelines on Responsible Business Conduct (NGRBC)

- Issued by Ministry of Corporate Affairs (MCA), these guidelines shape the legislative framework for ESG matters in India.

SEBI Regulations

- SEBI requires the top 1,000 listed companies to disclose ESG information under the Business Responsibility and Sustainability Reporting (BRSR) framework. From October 1, 2024, this will be mandatory for ESG schemes to invest only in companies with comprehensive BRSR disclosures.

- SEBI is also working on framework for ESG Rating Providers (ERPs) to ensure credibility and transparency of ESG ratings.

Income Tax Act, 1961

- Offers tax breaks for certain ESG initiatives, like investments in renewable energy projects.

- Imposes tax on activities with negative environmental impacts, such as carbon and plastic taxes.

Environmental Laws

- Companies must adhere to various environmental laws, including the Air (Prevention and Control of Pollution) Act, 1981, and the Water (Prevention and Control of Pollution) Act, 1974.

- Non-compliance can lead to penalties and liabilities.

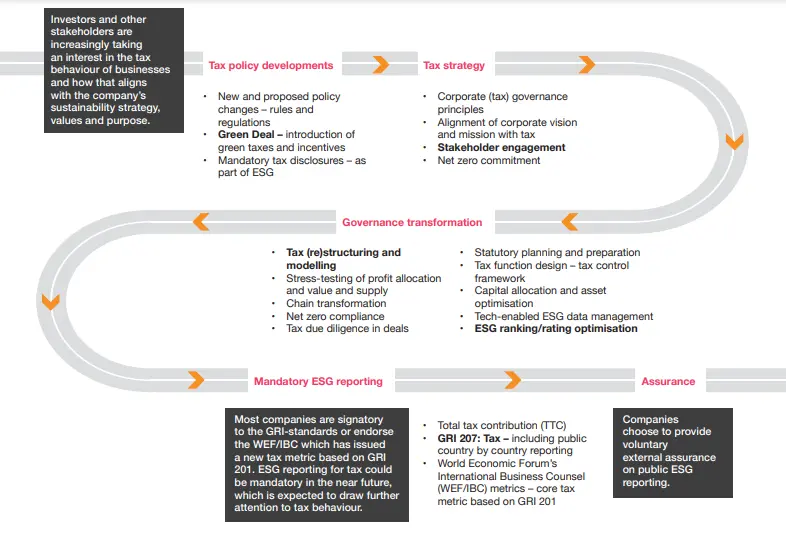

To keep up with the evolving ESG tax landscape, companies need strong tax governance frameworks, aligning tax behaviors with ESG policies, and integrating tax considerations into ESG strategies.

Following ESG-related taxes and regulations is essential to manage legal risks and and demonstrate a commitment to sustainability.

How will an Investor be Taxed?

Short-Term Capital Gains (STCG) Tax

- If you hold the investment for less than 12 months, the gains are considered STCG and are taxed at 15%.

Long-Term Capital Gains (LTCG) Tax

- If you hold the investment for more than 12 months, the gains are considered LTCG.

- LTCG up to Rs. 1 lakh are exempt from tax, and any gains above Rs. 1 lakh are taxed at 10%.

- Gains made before January 31, 2018, are exempt from LTCG tax due to a grandfathering clause.

The tax treatment for ESG funds is the same for any other equity mutual funds in India. The key factor affecting the tax rate are the holding period and the amount of capital gains. There are no special tax incentives or disincentives specifically for ESG funds.

Challenges in the Growth of the ESG Sector in India

India’s ESG sector faces several hurdles, grabbing attention of millions. Here’s some of them:

Lack of Awareness and Education

- As per KPMG India Readiness Survey of 2022, only 27% of Indian organizations feel adequately equipped to meet their ESG strategy and compliance requirements, highlighting a significant gap in awareness and preparedness.

- The education system is still in the early stages of integrating sustainability and ESG education, leading to a shortage of qualified ESG professionals.

Aligning ESG with Business Strategies

- More than 70% of Indian companies in India do not have ESG integrated into their core strategic vision, treating it as a compliance or obligatory requirement rather than a value-creation opportunity. (Source: PwC India ESG Survey 2021)

- Many businesses prioritize short-term financial gains over long-term sustainability, making it challenging to align ESG principles with their core objectives.

Data Collection and Reporting

- Reliable, consistent, and comparable ESG data is scarce, as 85% of Indian suppliers are not prepared to comply with their organization’s ESG mandates.

- The lack of systems, processes, and standards makes it difficult for Indian companies to collect and report on key ESG indicators.

Regulatory and Compliance Hurdles

- While SEBI has mandated the top 1000 listed Indian entities to disclose their ESG risks and responsibilities, many are struggling to comply.

- There isn’t a single codified law regulating ESG in India, with various pieces of legislation addressing different aspects.

Supply Chain Integration

- Integrating ESG practices across the supply chain is a significant challenge, as a large number of suppliers in India are small, unlisted firms with unlimited awareness, readiness, and financial strength.

- Only 15% of Indian organizations believe their suppliers are prepared to comply with their ESG mandates.

Adapting Reporting Requirements

- Adapting the one-size-fits-all BRSR (Business Responsibility and Sustainability Report) reporting requirements to specific sectors and industries is challenging, as some ESG parameters are more relevant for certain industries.

Despite these challenges, the ESG agenda is gaining momentum in India, driven by regulatory initiatives, corporate governance scrutiny, and alignment with global sustainability goals. With the right strategies and collaboration, Indian companies can overcome these challenges and leverage ESG for sustainable growth.

Conclusion

In conclusion, India’s foray into ESG investing signifies more than just a financial returns; it reflects a collective commitment to sustainability and societal progress. As elucidated, the government’s initiatives, particularly in the realm of electric vehicles, underscore a strategic vision aimed at fostering a greener, more resilient economy.

However, amidst the optimism lie challenges, notably in infrastructure development and consumer adoption. Nevertheless, through collaborative efforts and informed investment decisions, stakeholders can surmount these obstacles and propel India towards a more sustainable future.

Thus, let us remain vigilant, leveraging our insights and resources to drive positive change and realize the full potential of ESG investing in India.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.

For more insights, check out this fun conversation between our experts:

FAQs

What is India doing for ESG?

In 2007, the Government of India introduced the National Voluntary Guidelines on Business Responsibilities, updated in 2009 and 2011. These were later replaced by the National Guidelines on Responsible Business Conduct, marking the latest vision.

What is the size of ESG market in India?

In 2021, India’s ESG and sustainability consulting market was worth USD 255.21 million. It’s projected to grow by 7.42% from 2022 to 2030. Indian firms are increasingly embracing sustainability, launching various initiatives.

What are the benefits of ESG investing in India?

As India faces significant environmental and social challenges, the adoption and growth of sustainable practices are rising in the country, which implies that investments in these sectors can be beneficial to investors. ESG activities help improve company’s reputation which in turn ensures economic stability of the nation.

Why is ESG replacing CSR?

Corporate Social Responsibility (CSR) practices vary widely and are often self-regulated, making them qualitative and hard to define precisely. In contrast, ESG offers investors a clear framework for assessing which companies are worth investing in.