Thematic funds, such as energy and power sector-based mutual funds, have garnered attention for their impressive returns.

Over the last year, this sector has provided an average return of 56.27%, highlighting its growth potential. With only three funds completing a year in the market, the SBI Energy Opportunities Fund has emerged as a promising option.

Delivering consistent returns and displaying resilience in down markets, this fund stands out as a strong contender for long-term investors seeking exposure to India’s booming energy sector.

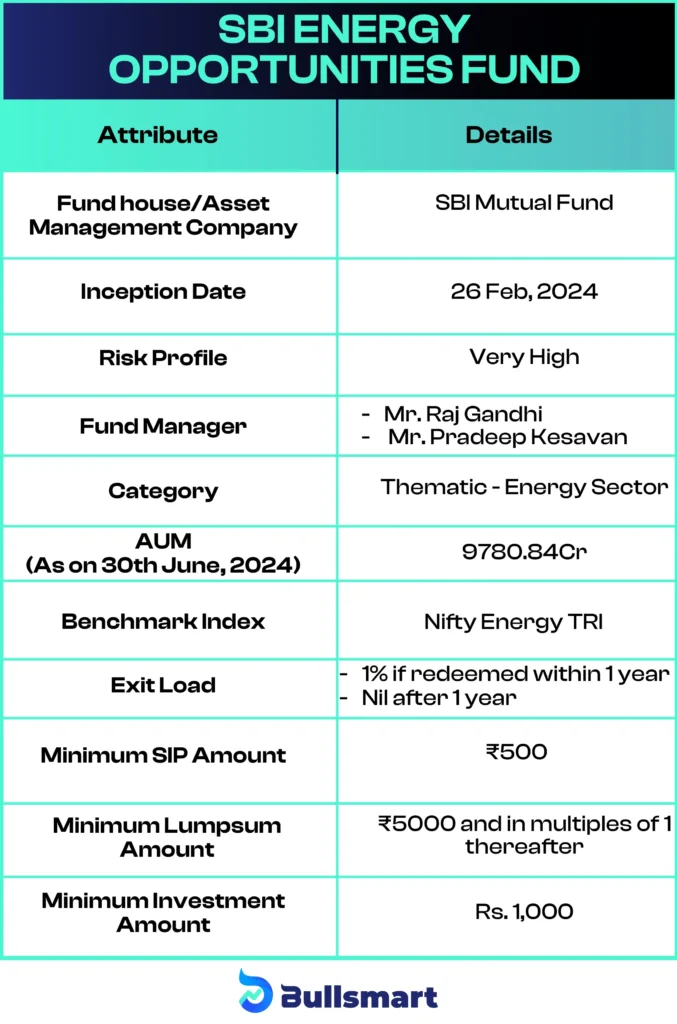

Details of SBI Energy Opportunities Fund

The SBI Energy Opportunities Fund is an open-ended equity scheme that specifically follows the energy theme. This means it invests primarily in companies within the energy sector, which includes oil, gas, renewable energy, and power generation.

The benchmark for SBI Energy Opportunity Fund is the Nifty Energy TRI, which tracks the performance of energy sector companies in India. The fund also considers BSE Sensex TRI as the additional benchmark.

Investment Objective of SBI Energy fund

The main objective of the SBI Energy Opportunities Fund is to provide long-term capital growth by investing in a diversified portfolio of energy-related companies. These companies could benefit from increasing demand for energy, innovations in renewable energy, and government policies to boost energy infrastructure.

The focus is on capital appreciation over time, making it ideal for investors with a high-risk tolerance and a long-term investment horizon.

Here are some basic details of the Fund

Portfolio Analysis

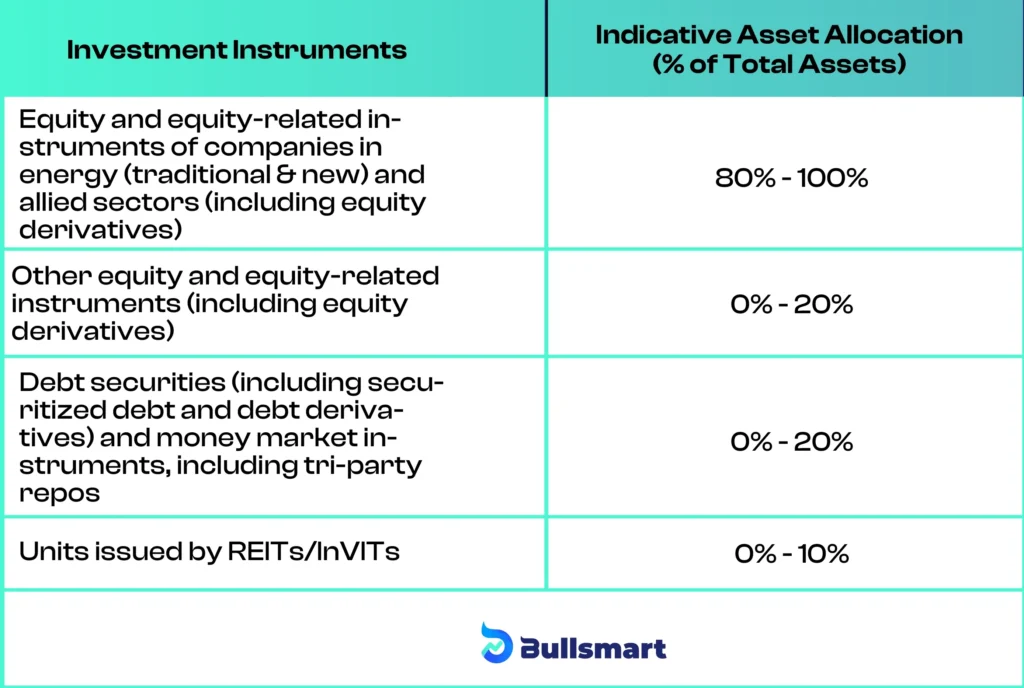

The fund aims to allocate its assets as follows:

Understanding Risks and Returns

Since its inception in February 2024, the SBI Energy Opportunities Fund has provided returns of 12.1%. However, its benchmark, the Nifty Energy TRI, has delivered significantly higher returns over the years, with 64.65% over 1 year, 29.74% over 3 years, and 27.78% over 5 years.

As the fund aims to track and outperform this benchmark over the long term, its performance will be closely aligned with the energy sector’s growth.

While the fund is still new and has yet to match the benchmark’s historical returns, investors should keep in mind that the energy sector can experience periods of volatility.

However, the sector’s long-term growth potential could drive future gains in the fund’s performance.

Suggested Read – SBI Innovative Opportunities Fund Review

SBI Mutual Funds (SBIMF)

SBI Mutual Fund (SBIMF) is a top asset management company in India, formed as a joint venture between the State Bank of India and French asset manager Amundi. As of 30th June 2024, it manages assets worth ₹1,039,785.49 crore

Founded on June 29, 1987, SBI Mutual Fund has a long history of helping Indian investors grow wealth. In 2004, SBI brought Amundi to sell 37% of its stake.

SBI Mutual Fund made notable achievements, including launching India’s first ‘Contra’ and ESG funds. Supported by SBI, the company has earned strong public trust and offers a wide range of 146 funds under its portfolio.

Some of the other popular schemes include the SBI PSU Fund, which has generated the highest returns within the PSU Theme Fund category over the past 3 years and SBI Small Cap Fund, which is one of the best funds offering protection against volatility

Meet the Fund Managers

The fund is managed by experienced fund managers:

Raj Gandhi

Raj Gandhi, age 41, has over 14 years of experience, mainly in commodities and related sectors like energy and metals. He joined SBIFML in 2017 and has managed the scheme since February 2024. He holds a CFA charter from the USA and a Master’s in Finance from KJ Somaiya Institute, Mumbai.

Pradeep Kesavan

Pradeep Kesavan, age 44, has 18 years of experience in financial services. He joined SBIFML in 2021 and specializes in international investments. He holds a CFA (USA) and an MBA in Finance, managing the scheme since February 2024.

Who should invest in this fund?

This fund is best suited for investors with a high-risk tolerance and a long-term horizon. Since it focuses on the energy sector, it may see more volatility than diversified equity funds. It’s ideal for:

- Investors seeking long-term capital appreciation.

- Those looking to benefit from the growing energy sector.

- Individuals are comfortable with sector-specific volatility.

The SBI Energy Opportunities Fund provides a unique opportunity to invest in the energy sector, one of the key growth drivers in the global economy. However, like any thematic fund, it carries higher risk due to its concentrated exposure. If you believe in the future of energy and are willing to hold for the long term, this fund may align well with your investment objectives

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.