Have you ever wished for an investment that changes as per the market conditions? Well, that’s what Balanced Advantage Funds try to do. These funds invest in both equity and fixed-income securities, changing how much they put in each based on what’s happening in the market.

One fund that has been doing this for a long time is the HDFC Balanced Advantage Fund. It started way back in 1994 and has been helping investors ever since. The fund has been doing well, often earning more money than the market average it’s compared to.

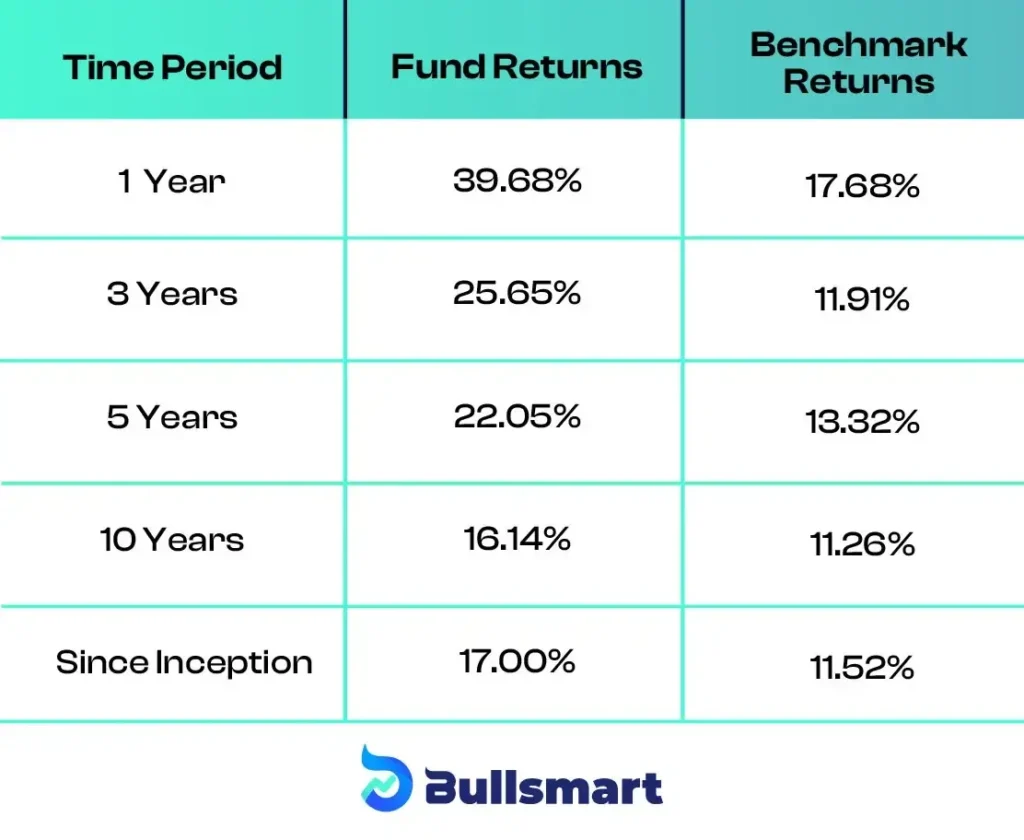

As of July 31, 2024, the HDFC Balanced Advantage Fund has been beating its benchmark for the past 1, 3, and 5 years. This means it’s been growing investors’ money better than expected.

Let’s take a closer look at this fund to see how it works and if it might be a good fit for your savings goals.

Review of HDFC Balanced Advantage Fund

HDFC Balanced Advantage Fund is an open-ended balanced advantage fund that aims to provide long-term capital appreciation and income from a mix of equity and debt investments.

The fund manager adjusts the asset allocation between equity and debt based on market conditions, aiming to optimise returns while managing risk.

The fund considers the NIFTY 50 Hybrid Composite Debt 50:50 Index as the benchmark.

Investment Strategy of the fund

The Scheme aims to provide long-term capital appreciation/income from a mix of equity and debt investments.

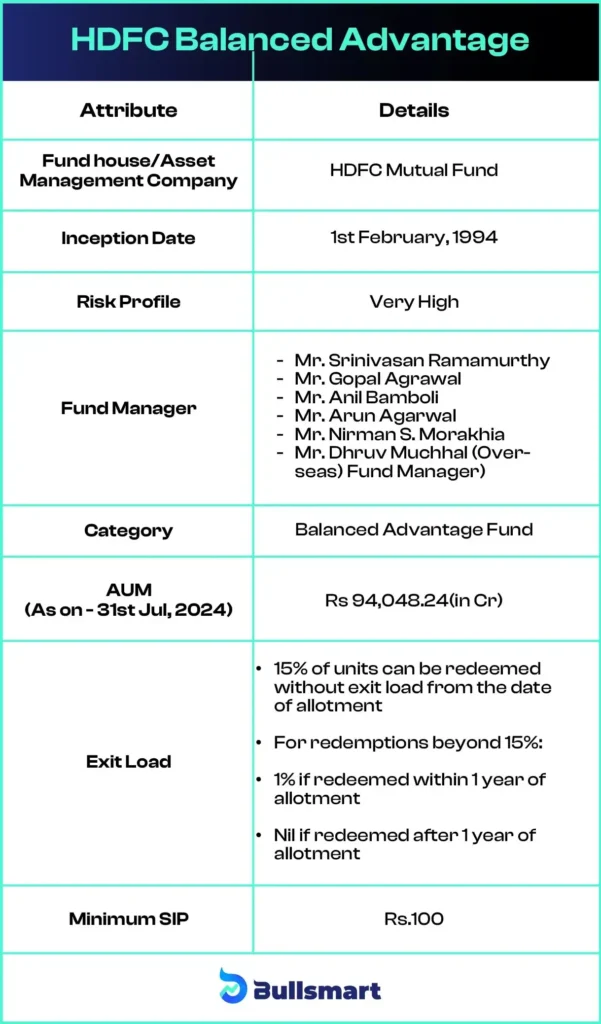

Let’s have a quick look at the key basic details of the fund:

Portfolio Analysis

The asset allocation of the HDFC Balanced Advantage Fund is dynamic:

Understanding Risks and Returns

The HDFC Balanced Advantage Fund carries a very high-risk profile but has the potential for significant returns. As of July 31, 2024, the fund has shown the following performance:

As evident from the table, the fund has consistently outperformed its benchmark across all time periods, demonstrating its potential to generate higher returns compared to the market average.

Note: Past performance may not be sustained in the future

HDFC Mutual Fund AMC

HDFC Mutual Fund, which is supported by India’s largest private bank, is the top asset management company in the country, overseeing assets worth INR 6,14,665.43 crore as of March 31, 2024.

Founded in 1999 through a collaboration between HDFC and ABRDN Investment Management Limited, HDFC Mutual Fund went public in 2018. With a strong track record of 28 years, the company is known for its profitability and offers a wide range of savings and investment products. Their focus is on helping investors generate income and build wealth.

The fund serves millions of active investors and works with thousands of distribution partners, including mutual fund distributors and banks, consistently delivering strong performance.

Suggested Read – HDFC Defence Fund Review

Meet the Fund Managers

The fund is managed by a team of experienced professionals:

- Mr. Srinivasan Ramamurthy oversees equity fund management

- Mr Gopal Agrawal is the senior Equity Fund Manager with over 17 years of experience and manages multiple HDFC funds.

- Mr. Anil Bamboli and Mr. Arun Agarwal are the Senior Fixed Income Fund Managers

- Mr. Nirman S. Morakhia manages equity funds and trades

- Mr. Dhruv Muchhal is the Equity Analyst and Fund Manager for overseas investments.

Who should invest in this fund?

The HDFC Balanced Advantage Fund may be suitable for investors who have an investment horizon of three years or more and seek a blend of growth and stability. It is designed for those who are comfortable with moderate to high risk and want exposure to both equity and debt markets through a single investment.

The HDFC Balanced Advantage Fund offers a dynamic approach to balancing equity and debt investments. Its long track record and strong performance may make it an attractive option for investors seeking a balanced investment approach. However, as with all investments, it’s really important to consider your financial goals, risk tolerance, and overall portfolio strategy before investing.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.