Investors are optimistic about the Indian economy due to its growth initiatives, making small cap funds an appealing option. Investing in small-cap mutual funds allows investors to tap into this potential through a diversified portfolio of promising stocks.

Given the vast number of small-cap companies in the market, selecting the right ones can be challenging. Therefore, investing in small-cap mutual funds offers exposure to a diversified selection of stocks, helping investors identify those with high growth potential.

One standout option is the “Quant Small Cap Fund”, which is known for delivering the highest five-year returns of 50.54%, earning its spot as the top performer in the category.

Let’s delve into the blog to find out what this fund brings to your portfolio.

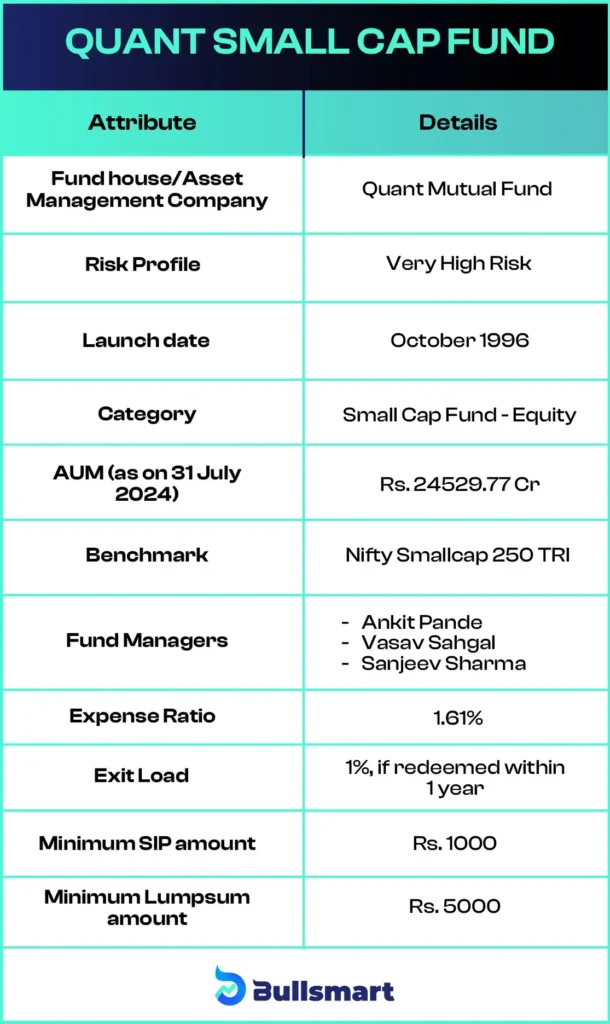

Details of the Quant Small Cap Fund

The Quant Small Cap Fund is an open-ended small-cap scheme launched by Quant Asset Management Company. It predominantly invests in equities and equity-linked securities within the small-cap segment, aiming to generate long-term capital appreciation.

The fund has an expense ratio of 1.61% which is less than the category average of 1.85% making it more affordable to investors. The fund considers Nifty Smallcap 250 TRI as its benchmark index.

Let’s have a look at the basic details of the fund:

Portfolio Construction

The fund allocates 86.87% of its investments to domestic equities, with 10.06% in large-cap stocks, 18.78% in mid-cap stocks, and 35.89% in small-cap stocks. Additionally, it holds 0.6% in debt, all of which is invested in government securities.

This fund features a dynamic portfolio with top stocks such as Reliance Industries Ltd, Jio Financial Services Ltd, Aegis Logistics Ltd, Aditya Birla Fashion and Retail Ltd, HFCL Ltd, Sun TV Network Ltd, and Adani Power Ltd. These high-impact companies drive the fund’s potential for impressive growth.

Understanding the risks and returns

The Quant Small Cap Fund has delivered a remarkable 50.54% return over five years, the highest in its category. It consistently outpaces both the category average and benchmark returns, showcasing its strong performance.

Let’s take a quick sneak peek at the returns of this fund and its benchmark index over the years:

Note: The returns mentioned above are as of 22 August 2024.

Meet the Fund Management Team

The fund will be managed by three seasoned professionals, Anikt Pande, Vasav Sahgal, Sanjeev Sharma, each bringing extensive experience to the table.

Ankit Pande has over 11 years of experience in the financial industry, beginning his career in equity research in 2011. Before joining Quant Mutual Funds, he worked with Infosys Finacle, gaining valuable insights into the financial technology sector.

Vasav Sahgal has held various operational and research-oriented roles at Quant Money Managers Limited. Prior to joining Quant Mutual Fund, he worked as an Equity Research Analyst at Eqestar Capital, where he honed his skills in equity analysis and market research.

Sanjeev Sharma holds an M. Com and a PGDBA in Finance from Symbiosis Pune, along with a Postgraduate Diploma in Computer Applications. He brings over 6 years of experience to his role, with a strong background in finance and technology.

Who should Invest in Quant Small Cap Fund?

It is a high-risk, high-return fund. Hence, investors seeking high returns and willing to take very high risks can consider investing in Quant Small Cap Fund. It aims for long-term wealth creation, making it best suited for those looking to invest for more than five years.

It is always advisable to conduct thorough research on the fund or consult a financial advisor before investing.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.