Got your sights set on some serious cash in 2024? Emerging markets, India included, are packed with juicy investment opportunities! But hold on a sec. Before you jump in, do your homework.

We’re talking about diving deep into the economic landscape, understanding what’s driving growth, and all those key factors that are shaping the market. It’s all about knowing the game before you play!

India’s Economic Momentum and Investment Appeal

Let’s chat about India’s economic momentum and why it’s getting all the buzz. India’s been standing out in the world of emerging markets, catching the eye of global investors. Why? Because it’s been showing some serious strength with its robust economic growth, significant structural reforms, and favorable demographics. The GDP growth rate? It’s been climbing, hitting 8.4% year over year in the last quarter of 2023.

Impressive, right? Predictions indicate that India’s real GDP is expected to keep growing, aiming for around 6.8% in 2024. sure, it’s a bit lower than last year’s 7.7%, but still solid progress!

Decade-ish Growth of Indian GDP

Pre-independence (1947 or earlier)

Before gaining independence, India’s economy grew slowly, averaging approximately 1% per year. This sluggish growth was caused by colonial policies that tightly regulated the industries, curbed independence and enforced unfavorable conditions on the Indian diaspora.

Britain vacated India after a century of torture in a devastated state, with millions crying for food and water. Post-independence casualties like the Indo-Pak war of 1947–48 (also known as the First Kashmir War) shook the Indian economy. Around that time, just 1 in every 6 Indians could read.

1950s

In a 1950s, India’s GDP grew at a rate of 3.9% per year. The government prioritized self-sufficiency, rapid industrialization,, and large state-owned enterprises. Investments In irrigation, dams, and infrastructure were key, along with advancements in modern industry, science, and technology. Despite these efforts, challenges like limited capital, Cold War dynamics, defense spending, population growth, and infrastructure deficiencies slowed progress.

1960s

In the 1960s, economic growth slowed to an average annual growth rate of 4.1%. This period was marked by enormous obstacles, including widespread droughts (which led to the Green Revolution) and wars with Pakistan and China.

1970s

During the 1970s, the GDP growth rate averaged just 2.9% annually, slowed by the aftermath of wars with Pakistan, severe droughts, inflation, Emergency, and so on. Poverty and inequality persisted despite efforts, like nationalizing banks and raising taxes meant to spur growth.

Later, India aimed for rapid progress, but this happiness was short-lived, as the decade ended with a stagnant economy and ongoing challenges, far from the early hopes of swift industrialization after independence.

1980s

In the 1980s, India’s GDP grew around 5.7% annually, driven by modest liberalization like expanding import licenses, reducing tariffs, and increasing private sector involvement. Government spending, fueled by domestic borrowing and external debt, also spurred growth.

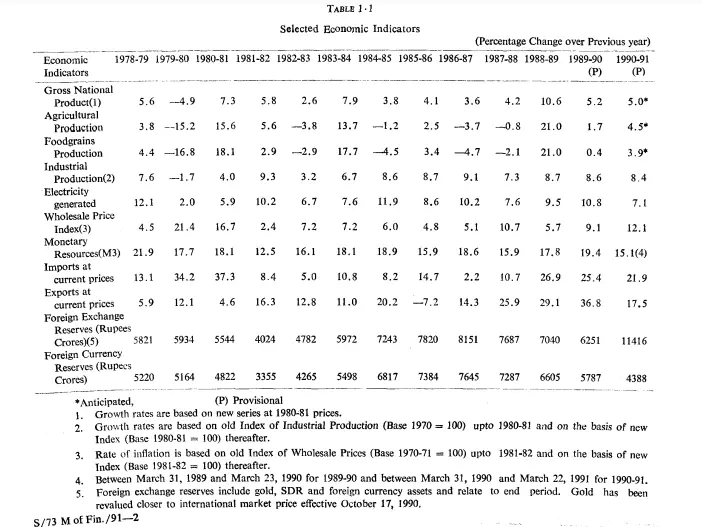

Source: Indian government budget archive

1990s

During this decade, India underwent significant reforms, following the 1991 balance of payments crisis. These reforms included the deregulation of industrial privatizationtion of state-owned enterprises, along with trade liberalization.

As a result, GDP grew at an average rate of 5.8% per year, fueled by increased FDI and integration into the Indian economy to adopt a more open, market-oriented approach, laying the foundation for India’s subsequent economic growth trajectory. Though India’s bold moves like the Pokhran nuclear test did impose certain restrictions on India, the path to economic growth had already been carved.

2000s

GDP growth accelerated to an average of 6.3% per year in the 2000s, driven by the growth dividends from the 1990s reforms as well as significant capital inflows.

2010s

GDP growth remained strong, averaging around 7% per annum from 2010-2018, though it faced challenges like high fiscal deficits, loose monetary policy, and the global financial crisis.

2020s-Present

- GDP growth rate contracted by 5.83% in 2020 due to the COVID-19 pandemic, but rebounded strongly to 9.05% in 2021 as the economy recovered.

- Growth is projected to average around 6-7% per year for the remainder of the decade, driven by factors like rising domestic consumption, increased digitization, and the government’s focus on infrastructure development and manufacturing.

- Despite agriculture performing slightly below expectations, provisional estimates show India’s GDP growth rate for fiscal 2024 hitting 8.2%. This surpasses the National Statistical Office’s February estimate of 7.6% growth.

India vs. Other Economies

| Country | 2024 GDP Growth Rate Estimate | 2021 GDP Growth Rate | Average GDP Growth Rate Past Decade |

| India | 8.2% | 9.05% | 6-7% |

| United States | 1.4% | 5.9% | 2-3% |

| China | 4.5-5% | 8.4% | 6-8% |

| European Union | 1% | 6% | 1-2% |

Involvement of FIIs in India

Here’s a rundown of what’s been happening with Foreign Institutional Investors (FII) investing in India:

FIIs have been on a rollercoaster lately!

- They sold-off more than ₹34,000 crore from the Indian stock market over April-May 2024.

- But things turned around in June 2024, with FIIs putting in over ₹32,000 in just 12 days.

Why the back-and-forth?

- Initially, the FIIs were selling due to global economic uncertainties, money flowing into China, as it reopened, and concerns about how India’s stocks were valued.

- Then they started buying again, likely because of the political stability post-election, good deals on top-tier stocks, and hopes for a budget that supports reform.

FIIs aren’t holding as they used to.

- Their stake in companies listed on the NSE dropped to its lowest in 11 years, down to 17.68% by March 2024.

- That’s a big drop from the previous quarter, showing a shift away from FIIs being players in India.

Limits on how much FIIs can invest in India.

- There’s a cap of 24% of a company’s capital that FIIs can own.

- The RBI keeps a close eye on this and steps in when FIIs reach the 22% mark.

The rise of local investors

- Domestic institutional investors (DIIs), like mutual funds and insurance companies, are stepping up.

- They now record 16.05% of NSE-listed companies as of March 2024.

In short, while FIIs have been a bit all over the place recently, the bigger picture shows a shift towards more involvement from local institutions and everyday investors in India, which could mean less reliance on foreign money coming in.

Top 11 Trends in the Investment Arena

1. Sovereign Gold Bonds (SGBs)

What They Are: Think of these as government-approved gold investments.

How to Get In: Buy them through banks, post offices, or stockbrokers.

Investment Amount: Start with 1 gram of gold, up to 4 kgs for individuals.

Returns: The investors are guaranteed the current market value of gold upon maturity, along with periodic interest investments of 2.5%. You’ll receive interest on your investments regardless of market fluctuations.

Maturity: Hold for eight years, with early redemption possible after five.

Tax Perks: No tax on gains at maturity.

2. National Pension Scheme (NPS)

What It Is: A government-monitored fund with stock market investments.

Getting Started: Open an account at a bank or online.

Investment: Start with just INR 500.

Returns: Varies based on market performance and plan selected

Tax Perks: INR 2 lakh investment is exempt. Though LTCG would still remain applicable for amounts larger than that.

Types of Plans:

Tier I Account: This is your main retirement savings account with restrictions on withdrawals before the age of 60.

Tier II Account: Optional for more flexible withdrawals, but you need Tier I account first.

Getting Started: Open Tier I NPS account online, through a bank, Point of Presence (PoP), or authorized financial institution.

Withdrawals: You can start making partial withdrawals from your NPS account after 3 years of being a subscriber. For a complete withdrawal, salaried employees need to stay invested for at least 10 years, while self-employed individuals can withdraw fully after 5 years.

3. Equity Mutual Funds

What They Are: Fund Managers pool your money, along with others investor’s to invest in stocks.

Joining In: Sign up online to an AMC or through brokers and mutual fund distributors.

Lock-in Period: 0 for all types and 3 years for ELSS

Investment: Start with at least INR 100.

Returns: Depends on market conditions and the type of plan selected.

Maturity: Redeem anytime.

Taxation:

- Taxed based on profit, long-term gains over INR 1 lakh are taxed.

- Long-Term Capital Gains (LTCG) and Short-Term Capital Gains (STCG) on equity funds are taxed according to specific rates. For debt funds, profits are taxed according to your income tax slab rates.

4. Public Provident Fund (PPF)

What It Is: A safe government-backed savings scheme.

Getting In: Open an account at banks or post offices.

Investment: Start with INR 500 annually, up to INR 1.5 lakh.

Returns: Currently 6-8% per year.

Maturity: Lock-in period of 15 years.

Tax Perks: Tax-free investments and interest earned.

5. Gold Exchange-Traded Funds (ETFs)

What They Are: Buy gold without physical ownership.

How to Start: Open a demat account.

Investment: Start with just one unit.

Returns: Depends on gold ETF performance.

Maturity: No lock-in period.

Taxation: Taxed as per your income slab.

6. Post Office Monthly Income Scheme

What It Is: A monthly income scheme offered by post offices.

Joining In: Available at post offices.

Investment: Start with INR 1,000.

Returns: Typically offers returns between 6.6% and 8.4% per annum. Recent rates have been around 7.4% for 2023-24, 7.1% for 2022-23, and 6.6% for 2021-22, adjusted quarterly by government of India to ensure stable monthly income for investors.

Maturity: Can be closed after five years.

Taxation: Interest earned is taxable.

7. Unit-linked Insurance Plans (ULIPs)

What They Are: Insurance plans with investment options.

How to Start: Available at banks with insurance companies.

Investment: Min INR 1,500 per month.

Returns: Varies, calculated based on fund value.

Maturity: Lock-in period of five years.

Taxation: Tax-exempt on investment, returns, and withdrawal.

8. Government Bonds

What They Are: Bonds issued by the government.

How to Get Them: Purchase through banks or demat accounts.

Investment: Depends on bond price.

Returns: Indian government bonds currently yield around 7-7.1% for 10-year bonds. Over the past year, the 10-year yield range has changed from 7.005% – 7.036%.

Maturity: Varies based on bond type.

Taxation: Taxed based on income bracket.

9. Corporate Bonds

What They Are: Debt securities issued by companies.

Getting Started: Available through financial institutions and corporates.

Investment: Regular interest payments.

Maturity: Varies by bond.

Taxation: Tax treatment varies, usually taxable.

10. Initial Public Offerings (IPO)

What They Are: When private companies go public by offering shares.

Getting In: Through brokerage firms.

Investment: Varies by company, often small amounts.

Returns: Can be significant if the company grows.

Maturity: No lock-in period.

Taxation: Tax implications vary based on holding the LTCG and STCG norms.

11. The ESG-way

What It Is: ESG investments focus on environmental, social, and governance factors, aiming for sustainable growth and ethical practices.

Starting Out: ESG options are offered by financial institutions, aligning with investor’s sustainability goals.

Investing: ESG allocates funds to companies with strong ESG practices, promoting environmental conservation and social responsibility.

Maturity: ESG investment’s maturity varies by product; investors should match maturity with their investment timeline.

Tax Considerations: Taxation of ESG investments follows standard rules; consulting tax advisors is wise for understanding implications.

12. Stocks

What they are: Buying a stock means owning a piece of company. When you buy a stock, you become a shareholder entitled to a company’s assets and earnings, traded on exchanges like BSE and NSE.

History: The Bombay Stock Exchange (BSE), established as the Native Share & Stock Brokers Association in 1875 and renamed in 1957, was India’s first stock exchange (NSE), launched in 1994, was country’s first electronic exchange.

Investing: To invest in stocks, open a mutual funds account with a stockbroker, allowing you to trade stocks directly or online, offering a range of options across sectors to match your risk tolerance and investment objectives.

Maturity: No fixed maturity date. You can hold them for as long as you want.

Redemption: Sell your stocks through your broker, the money you get will depend on the current market price, unlike bonds which have a fixed value when redeemed.

Tax Considerations: In India, profits from selling stocks are taxed: short-term gains (under 1 year) at 15%, long-term gains (over 1 year) at 10% on gains over Rs. 1 lakh, and dividends are tax based on the investor’s tax slab rate.

How do you Select the Best Investment Options for You?

Know Thyself: Understand your financial goals and risk tolerance.

Diversify: Spread investments across different assets to reduce risk.

Stay Updated: Keep abreast of market trends and economic indicators.

Research: Dive deep into potential investments, scrutinizing risks and returns.

Seek Advice: Consult with financial advisors or mentors for insights.

Mind the Fees: Watch out for hidden costs that can eat into returns like termites.

Regular Review: Monitor your investments periodically to ensure they align with your goals.

Stay Calm: Avoid knee-jerk reactions.

Trust Yourself and Your Gut: Ultimately, make decisions that resonate with your instincts and financial vision.

Bottom Line

So, as we wrap up our journey through the territory of emerging markets, particularly focusing on India, it’s clear that 2024 holds promising investment opportunities. But remember, success in these markets requires more than just a leap of faith. It demands informed decisions, meticulous research, and a keen eye on economic dynamics. From gold bonds to mutual funds, the landscape offers a plethora of avenues, each with its own set of benefits and considerations.

As you navigate this terrain, keep your financial goals in mind, stay diversified, and stay updated. Seek advice when needed, but ultimately, trust your instincts and vision. In the ever-evolving world of investments, it’s your confidence and clarity that will guide you to success.

Cheers to seizing those opportunities and making your mark in the world of finance!

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

What are the five leading emerging economies?

The five leading emerging economies are typically identified as Brazil, Russia, India, China, and South Africa, often referred to as the BRICS nations.

What is emerging market investment?

Emerging market investment involves putting money into financial assets or businesses located in countries that are experiencing rapid economic growth and industrialization, but may still lack the stability and infrastructure of developed nations. These investments often offer high potential returns but also carry higher risks due to factors like political instability and currency fluctuations.

Why is India an emerging market?

India is considered an emerging market due to its significant economic growth, structural reforms, and favorable demographics. It boasts a large and growing middle class, a vibrant entrepreneurial culture, and ongoing efforts to modernize its influence and industries. While India faces challenges like income inequality and bureaucratic hurdles, its potential for growth and development makes it an attractive destination for investors.

What is policy risk in emerging markets?

Policy risk in emerging markets refers to the uncertainty and potential negative impact on investments caused by changes in government policies, regulations, or laws. These changes can include shifts in economic policies, taxation rules, trade agreements, or legal frameworks that affect businesses and investments. Policy risk can create volatility and unpredictability in emerging market economies, influencing investor confidence and decision-making.