Hello, finance enthusiasts! Welcome to the Indian financial playground, where the money game is as wild as a music festival. Today, we’re diving deep into the epic showdown between the OGs of the investment scene—mutual funds—and the new kids throwing the hottest beats—Exchange-Traded Funds (ETFs). We’ll see what results this Mutual Funds vs. ETFs comparison shows.

Strap in for a rollercoaster of facts, figures, and vibes as we navigate this financial rave.

Mutual Funds: The Wise Elders

Let’s kick it off with Mutual Funds seasoned pros in the financial game. These bad boys are like the wise elders overseen by the Securities and Exchange Board of India (SEBI). Picture them as the financial elders pooling money from the crowd (that’s you and me) to throw an epic party in the stock and bond market.

They bring in big guns—professional managers—and serve up a diversified feast for all risk appetites. Their popularity? It’s like they’ve been headlining the investment scene forever.

ETFs: Their Definition

ETFs, or Exchange-Traded Funds, can be likened to diversified financial portfolios packaged into a single investment vehicle. They have been around for 23 years and offer investors exposure to a wide range of assets, such as stocks, bonds, or commodities, all within a single fund. In essence, ETFs function as efficient and accessible tools for investors to gain diversified exposure to various sectors, industries, or asset classes, mirroring the performance of a specific index or strategy. This amalgamation of assets, within an ETF provides investors with the benefits of diversification, liquidity, and flexibility in managing their investment portfolios.

The Showdown: Mutual Funds vs. ETFs

Let’s break down this clash into five rounds, each more exciting than the last:

Expense Ratios

ETFs emerge victorious with lower expense ratios; they’re the budget-friendly squad of the investment world. Think of them as the financial superheroes saving you some serious cash.

Liquidity Showdown

ETFs flex their muscles with intraday trading. Just like having a VIP pass to enter and exit the market whenever you feel like it. Advantage: ETFs, especially in the chaos of volatile markets.

Tax Efficiency Duel

ETFs play the tax game smartly, minimizing capital gains distributions. It’s like they’ve discovered the cheat codes in the tax world, giving them an edge.

Diversification Drama

Both mutual funds and ETFs offer a mix of assets, but their timing is a bit different. Mutual funds wait until the trading day’s end to set their price, while ETFs keep dancing with prices changing all day long.

Market Trends Smackdown

The investment jungle is always buzzing with market trends. You need to keep an eye on what’s hot. Certain sectors or asset classes might favor one investment buddy over the other.

Comparison of Growth: Mutual Funds vs. ETFs in Past Decade

Over the last 10 years, mutual funds and ETFs have both shown substantial growth in India. While ETFs initially outpaced mutual funds, their growth slowed after a financial crisis. However, for different years, the numbers also fluctuated for good. Take a read yourself:

ETF Era in India

In 2001, Benchmark introduced a new investment option in India called an ETF. They started with the Nifty BeES ETF, which people could trade on the NSE. Then, in 2007, they also launched the first Gold Exchange-Traded Fund.

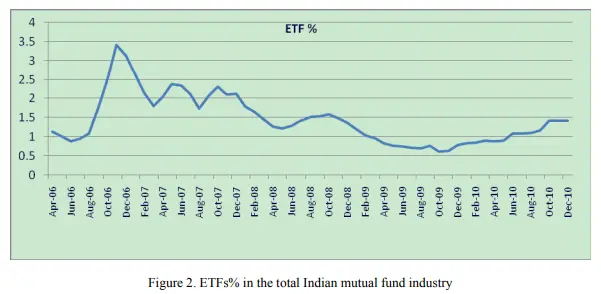

Comparatively, ETFs grew faster than traditional mutual funds in 2006–2007, but after a financial crisis, their growth slowed down. In 2006–2007, ETFs made up about 3% of all investments, but later this dropped to around 1.4%.

The Golden Era of ETFs

During the period from 2015 to 2020, Exchange-Traded Funds (ETFs) experienced a remarkable surge in Assets Under Management (AUM), marking a significant turning point in their trajectory within the investment landscape. Starting from a modest base of 1,000 crores (in 2010), ETFs witnessed extraordinary growth, expanding their AUM by an impressive factor of 26.

This exponential rise saw the AUM soar from 7,032 crores in 2015 to a staggering 2 lakh crores by 2020. As of 2024, the AUM of ETFs has continued to climb, reaching approximately 6.5 lakh crores, indicating a sustained and robust momentum in their property and adoption among investors.

| Year | 2010 | 2015 | 2020 | 2024 (As of April 30th) |

| ETF total AUM | Rs. 1,000 crore | Rs. 7,032 crores | Rs. 2 lakh crores | Rs. 6.5 lakh crores |

[Source of the image: A report titled “Performance of Exchange-Traded Funds in India” by P. Krishna Prasanna.]

Growth of AUM of Mutual Funds Over the Same Time Period

| Years | 2010 | 2015 | 2020 | As of April 2024 |

| AUM of Mutual Fund (in resp. years) | Rs. 6.13 lakh crore | Rs. 13.46 lakh crore | Rs. 31.02 lakh crore | Rs. 57.26 lakh crore. |

The Number Game

Now, let’s delve into the numbers, the pulsating core of this financial fiesta.

In India, the average return rate of mutual funds takes a lively dance between 5% and 15%, contingent on the specific category. But wait, it spices things up with a surprising revelation, boasting an average ten-year return that will keep you wide-eyed at a staggering 20%. a numerical spectacle that’ll keep you on the edge of your financial seat.

Conversely, ETFs are like the rockstars of short-term returns, with a one-year average ranging from 15.25% to 18.13%. that’s like hitting a jackpot at the new-age casino. But remember, this gig isn’t without risks, and numbers can swing like a rollercoaster depending on the ETF and the market mood.

Jungle Wisdom

As you’re crunching these numbers, remember that the Indian investment jungle is a wild ride. Let’s infuse this article with some quintessential flair to make it pop.

When choosing between the classics (Mutual Funds) and the trendsetters (ETFs), remember to groove with the vibes that match your financial beats. The Columbia Indian Consumer ETF might be dropping the hottest beats in the last year, but the old financial goals, risk tolerance, and investing style dictate whether you’ll be jamming with the rockstars of ETFs or chilling with the classics of mutual funds.

And here’s the twist in the tale: the Indian investment jungle is ever-evolving. To keep the adventure alive, spice up this article with insights from financial experts and market trendsetters. Imagine getting advice from the financial gurus who navigate this jungle daily or hearing firsthand experiences from fund managers. It’s like upgrading your safari tour from standard to VIP.

In conclusion, the Indian investment scene is a symphony of numbers, choices, and vibes. Whether you vibe with the OGs or the newcomers, always conduct your financial remix. Remember, the right choice isn’t just about the returns; it’s about making your money dance to your tune.

So, as you navigate this wild financial jungle, armed with the wisdom of mutual funds and the energy of ETFs, here’s a toast to your financial adventure. May your investments be as wild and rewarding as the Indian jungle itself.

Happy investing 😉

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.

FAQs

Which is better ETF or a mutual fund?

The superior choice between ETFs and mutual funds hinges on your investment goals. ETFs are favored for their liquidity and lower expense ratios, making them attractive for short-term trading and cost-conscious investors. In contrast, mutual funds, with their active management, appeal to those seeking professional expertise and a long-term investment horizon.

Why choose a mutual fund over an ETF?

Opting for a mutual fund over an ETF is advantageous if you prioritize professional fund management and prefer a more hands-off investment strategy. Mutual funds are actively managed by professionals who make informed decisions based on market research analysis. Furthermore, mutual funds often provide automatic investment plans, facilitating a systematic and disciplined approach to investing.

What are the disadvantages of ETFs compared to mutual funds?

While ETFs have notable benefits, they come with some downsides compared to mutual funds. ETF transactions may incur brokerage commissions, impacting overall returns, particularly for frequent traders. Additionally, the intraday nature of ETFs can expose investors to market volatility, whereas mutual funds, being priced at the end of the day, offer a more stable valuation. Mutual funds also typically offer a broader range of investment options compared to many ETFs.

When should I buy ETFs instead of mutual funds?

Choose ETFs over mutual funds in situations where cost efficiency, liquidity, and intraday trading flexibility are priorities. ETFs often have lower expense ratios, trade on stock exchange like stocks, and offer real-time transparency. Additionally, they can be more tax-efficient and are available for specific asset classes or themes, making them suitable for short-term trading and niche investment strategies.