The stock market has always been cyclical, experiencing both highs and lows due to various macroeconomic and geopolitical factors. As we step into 2025, investors are grappling with uncertainty regarding stock market loss recovery, potential economic rebounds, and ways to mitigate losses.

Amongst the chaos, every one of us is asking just one question, “when will the stock market recover in India?”

This article explores whether the stock market recovers in 2025, key influencing factors, historical patterns, and strategies to navigate market volatility.

Understanding the Current Stock Market Situation

The Indian stock market has seen significant corrections since late 2024, with the Nifty 50 and BSE Sensex facing consistent selling pressure. Some of the key reasons behind the market downturn include:

- Weak corporate earnings: Q3 FY25 saw single-digit PAT growth for the Nifty and BSE500.

- Economic uncertainty: Global recession fears and slow GDP growth impacted investor sentiment.

- Foreign Institutional Investors (FII) selling: FIIs pulled out over ₹29,000 crore from Indian equities by mid-February 2025.

- High valuations: The Nifty MidSmallcap400 Index P/E fell from 37.9x to 30.1x, reflecting a correction in valuations.

- Geopolitical tensions: US banks flying gold from London to New York fueled speculation of upcoming trade restrictions.

Despite these concerns, market analysts predict the potential that the market will recover in Q2FY25 or Q3FY25 as corporate earnings stabilize and global uncertainties ease.

Stock Market Crash: Factors and Recovery Time

Causes of Market Crashes

Stock market crashes are often triggered by a combination of fundamental economic weaknesses and external shocks. Some of the primary causes include:

- Economic Downturns: A decline in GDP growth, rising unemployment, or slowing industrial production can lead to lower corporate profits and stock market declines.

- Geopolitical Risks: Wars, trade tensions, and policy changes can create uncertainty, leading investors to withdraw from equities.

- High Market Valuations: Overpriced stocks tend to correct when investors realize valuations are unsustainable.

- Liquidity Crises: When financial institutions struggle with liquidity, they offload stocks to raise cash, further exacerbating the decline.

- Interest Rate Hikes: Central banks raising interest rates can reduce liquidity in markets, making borrowing more expensive and reducing corporate profits.

Stock Market Decline in the Past

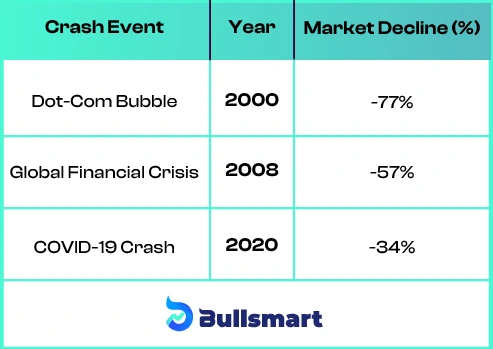

To understand the stock market recovery time, it is useful to analyze past crashes and subsequent rebounds. Below is a table highlighting major stock market recoveries and their respective timelines:

These examples show that while market crashes are inevitable, recoveries always follow.

Nifty 50 Recovery Analysis: Historical Trends

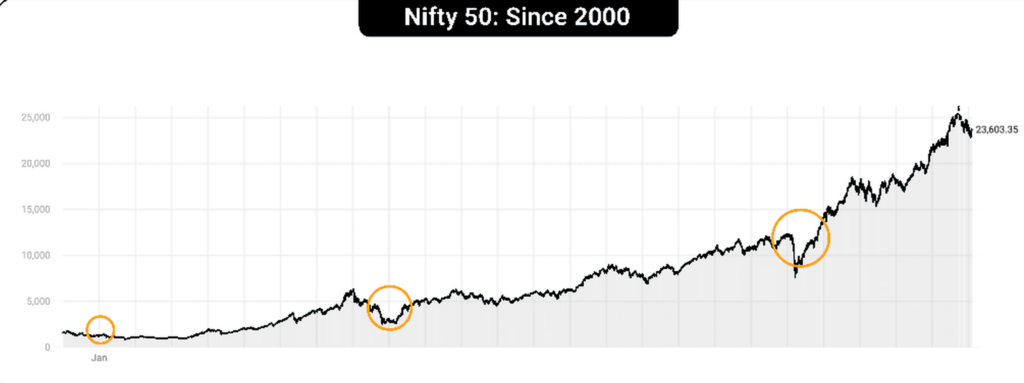

Below is a graph showcasing how Nifty 50 has performed post-major market crashes, highlighting its resilience and long-term growth potential.

Below is a graph showcasing how Nifty 50 has performed post-major market crashes, highlighting its resilience and long-term growth potential.

Source: TradingView

The three red circles represent major stock market crashes: the 2000 dot-com bubble, the 2008 global financial crisis, and the 2020 COVID-19 crash—one of India’s biggest recent crashes.

While the market has bounced back each time, it’s crucial to remember that market volatility can impact your financial goals. This is why diversifying your portfolio is essential.

It helps reduce risk and protects your investments during uncertain times.

Key Drivers for Market Recovery in 2025

- Economic Growth and Government Policies

The Union Budget 2025 is expected to play a key role in determining stock market trends. Increased capital expenditure in infrastructure, defense, and renewable energy could support corporate earnings and market sentiment.

- Inflation and Interest Rates

- A decline in inflation could allow the Reserve Bank of India (RBI) to cut interest rates, making borrowing cheaper for businesses and boosting economic activity.

- The US Federal Reserve’s monetary policy will also influence global market liquidity.

- Corporate Earnings Recovery

- Q4FY25 is expected to show better earnings growth across sectors like IT, healthcare, and financial services.

- Analysts predict a 13-15% growth in Nifty 50 EPS in FY26, which could attract institutional investors back into the market.

- Foreign Institutional Investors (FII) Flows

- FIIs have been net sellers in early 2025 but could return to emerging markets if global uncertainties ease.

- The stability of the Indian Rupee (INR) and better GDP growth forecasts could boost investor confidence.

Investment Strategies for 2025

With the stock market in a volatile phase, investors should adopt strategic approaches to minimize risks and optimize returns:

Portfolio Diversification

- Invest in blue-chip stocks with strong fundamentals.

- Include gold and fixed-income securities to hedge against market volatility.

- Consider exposure to sectors like healthcare, IT, and capital goods which have growth potential.

Systematic Investment Plan (SIP) Approach

- Continue SIP investments in mutual funds to average out costs during market fluctuations.

- Avoid panic-selling and stay invested in the long term.

Bullsmart’s got your back with a unique feature to get your SIP investments booming. Check out this tutorial for more:

Monitor Economic Indicators

- Keep an eye on inflation rates, RBI policies, and global cues.

- Use technical indicators like RSI and MACD to identify entry and exit points.

Conclusion: Will the Stock Market Recover in 2025?

While short-term volatility may persist, historical data suggests that stock market loss recovery is inevitable. The Nifty 50 and Sensex could see improved performance by Q3FY25, driven by:

- Economic stimulus and infrastructure investments

- Stabilizing corporate earnings

- FIIs returning to emerging markets

For investors, the key is to stay patient, follow a disciplined investment approach, and take advantage of market corrections for long-term wealth creation.

By staying informed and investing wisely, investors can navigate market downturns and capitalize on potential stock market recoveries. While predicting the exact stock market recovery time is challenging, history shows that resilient markets always bounce back.

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

FAQs

Why is the stock market falling?

The stock market is experiencing a downturn due to multiple factors, including rising interest rates, geopolitical tensions, and concerns over slowing global economic growth. Investors are also reacting to corporate earnings reports, inflationary pressures, and policy changes by central banks. In 2025, volatility remains high as markets adjust to macroeconomic uncertainties.

Will There Be a Bear Market in 2025?

While a bear market is defined as a decline of 20% or more in major indices, it’s uncertain if 2025 will see a full-blown bear market. The market is currently in a correction phase, but whether it turns into a prolonged downturn depends on economic indicators like GDP growth, inflation control, and corporate earnings stability. If global economies slow further or central banks tighten monetary policies aggressively, a bear market could emerge.

Why did the stock market crash in 1929?

The 1929 stock market crash was triggered by excessive speculation, high levels of margin trading, and an overheated economy. A sharp sell-off on October 29, known as Black Tuesday, led to widespread panic and massive losses. The crash contributed to the Great Depression, as consumer confidence collapsed, businesses failed, and unemployment soared.

What is the future of the stock market in 2025?

The future of the stock market in 2025 depends on how key economic factors unfold. If inflation stabilizes and interest rates ease, the market could see a recovery. However, if global uncertainties persist, volatility may continue. Sectors like technology, renewable energy, and healthcare could drive growth, while investors may look for defensive strategies, such as gold and bonds, to hedge against market fluctuations.