2025 is alost here, and the mutual fund world is buzzing with one major question–will mutual fund crash in 2025? Over the past year, the mutual fund industry in India has been thriving, with massive growth in net inflows and a sharp rise in Assets Under Management (AUM). Retail investors have joined the game like never before, riding the wave of a strong economy and a booming market.

But as the calender inches closer to the new year, doubts are creeping in. Is this growth sustaiinable, or are we staring down a potential correction? Concerns, about market stability, global economic shifts, and evolving investor behavior are keeping everyone on edge. So, what’s the deal? Is it panic mode or business as usual?

Let’s unpack the factors that could shape the mutual fund scene in 2025 and find out if there’s really anything to worry about.

Indian Mutual Fund Industry: An Overview

As of December 30th, 2024, India’s mutual fund industry blossomed with a rich record of impressive growth and development, not to mention the big changes in the way investors are playing their cards.

The industry hit a major milestone with a record-breaking AUM of INR 50.2 trillion. With 46 registered AMCs and over 2,045 mutual fund schemes across equity, debt, hybrid and solution-oriented categories, investors have more options than ever to match their goals and risk levels.

What’s Trending in Indian Mutual Fund Industry?

Digital Transformation

The Indian mutual fund industry is on a roll and going digital. Investing is now easier and more accessible through platforms such as Bullsmart, which collaborates with asset management companies (AMCs) to provide seamless experiences from the investor’s side. Here are the benefits:

- Access to mutual funds through digital platforms.

- E-transaction and performance visibility.

- Improvement in investment processes through data-based tools.

Robo-advising is slowly emerging too:

- Tailor-made portfolio suggestions according to financial aspirations.

- Lower charges and automated investment strategies.

- New-age and old-age investors are coming forth with simple, user-friendly processes.

Rise of ESG investment

Sustainable investments have held an increasing trend, growing by 31% in assets of ESG (Environmental, Social, and Governance) funds. The following are key factors attributing to the growth:

- Strong global push for responsible investing.

- More rigorous and stronger ESG disclosure norms by SEBI.

- Growing demands from both institutional as well as retail investors.

Investors have all gotten more interested in aligning their portfolios with their values, hence the explosion in the popularity of ESG funds.

Boom of Passive Investment

Passive investment funds such as index funds and exchange-traded funds (ETFs) are rapidly gaining popularity; now constituting around 24.8% of total equity, as per AMFI reports. The following main factors account for their popularity:

- Reduced expenses incurred as a result of passive management (active share management is not needed).

- Steady performance in periods of upswings and downturns in the economy.

- Wide access via portals such as Bullsmart.

With these benefits, passive funds will be the choice for investors who focus on costs and longevity.

Emerging Fund Categories

Innovation introduces newly minted fund categories in the mutual-fund landscape. It is targeting an evolving investor preference. Risk-averse investors are inclined towards target-maturity funds because they provide predictable returns for “specific maturity dates”.

Also gaining speed are dynamic asset allocation funds, which change exposure to debt or equity based on how the market is performing. For instance, a multi-asset allocation fund emerged as a winner among those looking for variety in their schemes, with one product for allocating exposure to equity, debt, and even

In these innovations, one can see adaptiveness to trends in the markets. This adaptability is also shown in keeping the pulse of the investor to ensure wider choices and solutions for every possible financial objective.

These were some of the most popular trends rocking on the 2024 mutual fund stage. However, there are various strategies you can implement to make the most out of all the trends to come and increase your wealth.

Major Factors Influencing Mutual Fund crash in 2025

Macro-Economic Indicators

- Economic growth: India’s GDP growth is crucial for the performance of mutual funds. A strong economy means businesses perform well, which boosts their earnings and helps equity mutual funds (funds that invest in stocks). On the other hand, a slowdown in economic growth could lower corporate earnings and affect the performance of these funds. As of recent data, India’s GDP growth has been stable, but any dips could impact market returns.

- Inflation and Interest Rates: High inflation reduces people’s purchasing power, affecting consumer spending and corporate profits. In 2024, inflation levels have been fluctuating, and if they remain high, it could hurt equity fund returns. Additionally, higher interest rates tend to raise borrowing costs for businesses, reducing their profitability. This is especially important for debt funds (funds that invest in bonds), as rising interest rates could reduce the value of long-duration debt funds. For instance, a 1% hike in interest rates could reduce returns on long-term debt funds by 2-3%

Regulatory Environment

Taxation Policies

- Changes like higher capital gains and equity derivatives taxes can influence investor behavior and market sentiment.

- Recent tax hikes aim to encourage long-term investing but may cause short-term market volatility.

- The government’s tax stance will shape investor strategies in 2025.

Regulatory Oversight

- SEBI is tightening regulations to maintain market stability and protect investors.

- New rules on expense ratios, disclosure, and retail investor speculation could affect mutual fund operations.

- While promoting transparency, these regulations might increase compliance costs for fund managers.

Global Economic Environment

- Geopolitical Tensions: International events ranging from trade disputes to wars tend to create ripples in the markets. Since India is part of the global trade economy,sectors dependent on exports or international supply chains might suffer. This could lead to mutual funds with heavy exposure to these sectors underperforming. As of now, geopolitical tensions like ongoing trade issues and instability in certain regions are key risks to monitor.

- Foreign Investment Flows: Foreign Institutional Investors (FIIs) account for a huge portion of the Indian stock market, with their investments having a significant impact on the market’s performance. For instance, global investment strategies can change through shifts in monetary policy with the U.S. For example, shifts in global investment strategies, driven by changes in U.S. Federal Reserve policies, could lead to changes in FII inflows or outflows. This, in turn, could impact market liquidity and valuations, with capital outflows leading to a potential market downturn.

Global Factors Affecting mutual fund crash in 2025

- Economic Growth Projections

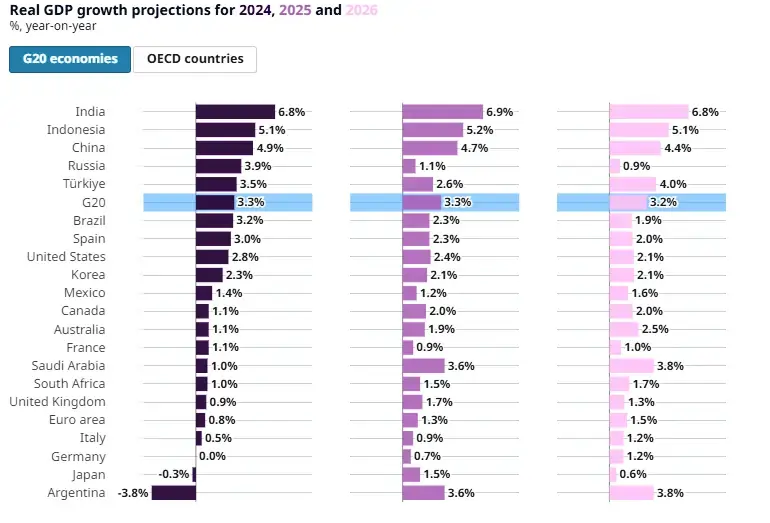

- Global GDP Growth: The Organisation for Economic Co-operation and Development (OECD) projects global GDP growth of 3.3% in 2025, a slight increase from 3.2% in 2024. This growth is expected to be uneven, with certain economies outperforming others.

- U.S. Economic Outlook: Goldman Sachs Research forecasts that the U.S. economy will outperform expectations in 2025, contributing significantly to global economic stability.

- Monetary Policies and Interest Rates Developed markets are anticipated to maintain higher policy rates for an extended period, with continued divergence between U.S. and euro area rates. The European Central Bank is expected to cut rates below neutral, to 1.75%, by the end of 2025. (JP MorganChase Report)

- Geopolitical Tensions and Trade Policies

- The potential return of Donald Trump to the U.S. presidency introduces uncertainties regarding trade policies. Proposed import tariffs could incite trade wars, raising inflation and unemployment globally.

- Ongoing conflicts in regions like Ukraine and the Middle East, along with political gridlock in European nations such as Germany and France, add layers of complexity to the global economic environment.

- Technological Advancements The rapid development of artificial intelligence (AI) and green technology is expected to drive significant corporate investments. Top-performing fund managers have capitalized on these trends, with substantial investments in mega-cap tech companies.

Domestic Factors Influencing India’s Market Performance in 2025

- Economic Growth: In a report published by the Economic Times, India’s GDP growth is projected to moderate to around 6% in 2025 and 2026, influenced by both global and domestic challenges. Despite this moderation, India is expected to remain the fastest-growing large economy.

- Inflation and Monetary Policy: Headline inflation in India is expected to average 4.2% year-on-year in 2025, with food inflation at 4.6%, indicating a relatively stable price environment.

- Climate Change Impacts: Climate change poses a significant threat to India’s economic growth, with potential GDP reductions of up to 25% by 2070 if unaddressed. Immediate impacts are evident in sectors like agriculture and infrastructure, necessitating urgent adaptation measures.

- Political Landscape: The global political environment, including potential shifts in U.S. trade policies under a Trump administration, could have indirect effects on India’s economy, particularly concerning trade relations and foreign investments.

Warren Buffett’s Veteran Move and Analysis

Warren Buffett’s Berkshire Hathaway just made a big move by selling around $133 billion stocks in 2024, including cutting its Apple stake by 25%. This fits with Buffett’s usual strategy of cashing out on high-value sticks and redirecting funds into fresh opportunities.

Experts believe this cautious approach is tied to the current market conditions. Stock prices are high, with the total market cap now sitting at twice the U.S. GDP. With a whopping $325 billion in cash reserves by the end of September 2024, Buffett seems to be preparing for a potential market dip or looking to jump on the next big investment opportunity.

This move has analysts predicting that Buffet is anticipating some market volatility. Investors should take note, as this trend points to a more careful, defensive investment strategy in these uncertain times.

How to Predict a Market mutual fund crash: A Simple Guide

Predicting a market crash isn’t easy, but there are certain signs that can help you spot trouble before it hits. Here are some simple ways to watch out for potential crashes:

- Increased Market Volatility

When the stock market moves wildly in a short time, it means investors are nervous. High volatility often signals uncertainty, and if it gets extreme, it might hint at a downturn.

Watch for: Big price swings and an unstable market.

- Bad Economic Signs

Some economic indicators can warn of trouble, like:

- Rising inflation: If prices go up too fast, people spend less, and businesses struggle.

- Slow growth: If the economy grows too slowly, it leads to layoffs and lower spending.

- High unemployment: More job losses mean the economy isn’t doing well, which hurts stocks.

Watch for: News on inflation, slow growth, or rising unemployment.

- Inverted Yield Curve

Normally, long-term bonds have higher rates, but when short-term rates are higher (an “inverted yield curve”), it signals a possible recession and market crash.

Watch for: Short-term rates above long-term rates.

- Too Much Debt

When people, businesses, or governments borrow too much, it can lead to trouble. A sudden downturn could trigger a crash.

Watch for: Rising debt levels or people taking on too much personal debt.

- Stocks Are Too Expensive

Sometimes stocks get overpriced, creating a bubble. When it bursts, prices can crash.

Watch for: Stocks rising faster than the company’s earnings or the economy’s growth.

- Corporate Earnings Decline

If companies report lower profits, it can lead to falling stock prices and a potential crash.

Watch for: Many big companies reporting poor earnings.

- Global Problems

Global events like wars, trade disputes, or disasters can cause panic and affect the market.

Watch for: News about political tension, wars, or crises affecting the global economy.

- Central Bank Actions

When central banks raise interest rates too quickly, borrowing gets more expensive, which can slow the economy and hurt the market.

Watch for: Central banks raising interest rates aggressively.

- Investor Sentiment

If investors are overly excited or fearful, they can drive the market up or down. Over-optimism or fear often leads to a crash.

Watch for: Irrational investor behavior, like buying stocks just because everyone else is.

How to Stay Safe?

The market can be a wild ride, but if you have the right strategies, you can dodge losses and still put yourself in line for growth over the long haul. Here’s how to stay safe in hard times:

Diversify Your Portfolio

Don’t put all your eggs in one basket. Spread your investments over stocks, bonds, real estate, and other assets. Even within stocks, mix it up across different sectors and regions, since not every market reacts the same way to changes.

Why it works: If one sector takes a hit, other sectors in your portfolio might do better, balancing things out.

Stick to Your Long-Term Goals

It’s tempting to make snap decisions when the market’s bouncing around, but remember that markets move in cycles. Stick to your long-term plan and don’t stress over short-term drops.

Why it works: The market tends to recover over time, even after big dips. Keeping your focus helps you avoid panic selling and locking in losses.

Keep Cash on Hand

Make sure you have cash or cash-equivalents (like money market funds) in your portfolio. It helps you meet any immediate needs and gives you flexibility to act if the market dips and presents opportunities.

Why it works: Cash lets you weather storms without selling investments at a loss, plus you can jump on good deals when they pop up.

Use SIPs (Systematic Investment Plans)

If you’re into mutual funds, try SIP Investments. You invest a set amount regularly, no matter what the market’s doing. This helps average out the cost of your investments over time.

Why it works: SIPs take the emotion out of investing and keep you from trying to time the market, which can backfire during instability.

Reassess Your Risk Tolerance

If market swings stress you out, it might be time to reevaluate your risk tolerance. Maybe it’s time to shift some of your investments to more stable options like bonds or dividend stocks.

Why it works: Investing according to your risk comfort level helps keep you calm and avoid making rash moves.

Stay Informed, But Don’t Overdo It

It’s good to stay updated on market news, but checking every minute can just make you anxious. Focus on reliable sources and make decisions based on solid research and long-term trends, not on daily headlines.

Why it works: Reacting to news in the moment can lead to emotional decisions. Staying calm helps you stick to your plan and make better choices.

Consult a Financial Advisor

If you’re unsure about how to navigate the chaos, a financial advisor can offer guidance. They can help you assess risk, adjust your portfolio, and keep you on track with your long-term goals.

Why it works: A pro can create a strategy tailored to you, helping you manage risk while reaching your financial goals.

Check out this video to learn how you can make most sense out of market history lessons:

Conclusion

As 2025 draws near, the future of top mutual funds in India hangs in the balance, and the larger question looms: Will the market crash in 2025? With a market that’s experienced immense growth in recent years, questions about sustainability and potential risks are inevitable.

While economic fluctuations, global shifts, and evolving investor behavior present challenges, the mutual fund industry has shown resilience and adaptability. From the rise of digital platforms and ESG investing to increasing popularity of passive funds, there are plenty of opportunities for growth, even in uncertain times.

The key to weathering any market turbulence in 2025 lies in being prepared. By diversifying portfolios, sticking to long-term goals, and staying informed, investors can safeguard their investments while navigating the unpredictable.

As new into the new year, one thing is certain: mutual funds will remain a cornerstone of investment strategies in India, and with the right approach, the future looks promising–crash or no crash.

Suggested Read – Best Mutual Funds for Beginners in 2025

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.