The WhiteOak Capital ESG Best-In-Class Strategy Fund NFO is an open-ended equity scheme that focuses on investing in companies adhering to the Environment, Social, and Governance (ESG) theme. The fund employs a Best-In-Class Strategy, meaning it invests in top-performing companies in terms of ESG standards.

This makes it an appealing option for investors looking to achieve long-term capital appreciation while supporting sustainable and responsible businesses.

Let’s explore how this NFO can be a valuable addition to your portfolio.

WhiteOak Capital ESG Fund: Best-In-Class Strategy Explained

The WhiteOak Capital ESG Best-In-Class Strategy Fund NFO aims to generate long-term wealth by investing in companies that demonstrate strong performance on ESG factors. WhiteOak Capital ESG Best-In-Class Strategy Fund NFO focuses on businesses that excel in reducing environmental impact, fostering positive social practices, and maintaining high governance standards.

The Best-In-Class Strategy selects top companies across industries, ensuring that investors are supporting the most responsible businesses in each sector.

Fund Investment Objectives and Goals

The investment objective of the WhiteOak Capital ESG Best-In-Class Strategy Fund nfo is to achieve long-term capital appreciation by investing in companies identified based on the ESG theme and following the Best-In-Class Strategy. The fund’s goal is to provide sustainable returns by aligning investments with global ESG trends, though there is no assurance that the objective will be achieved.

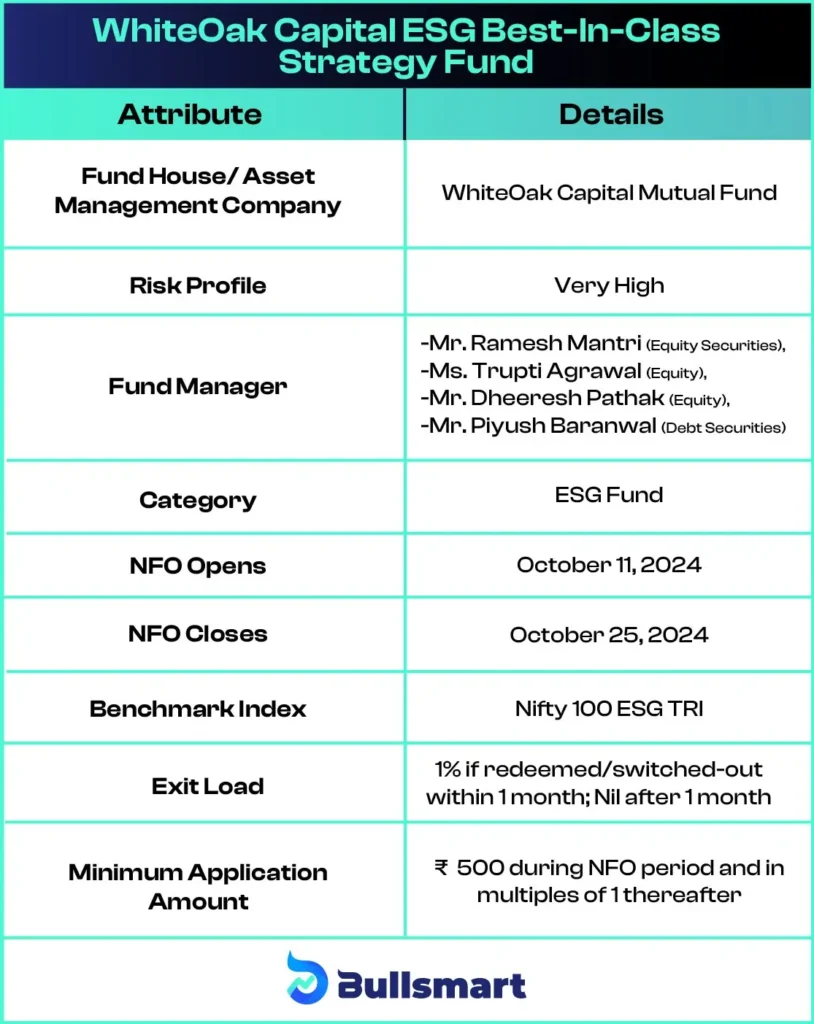

Key Details of WhiteOak Capital ESG Best-In-Class Strategy Fund:

How the Fund Allocates Its Portfolio

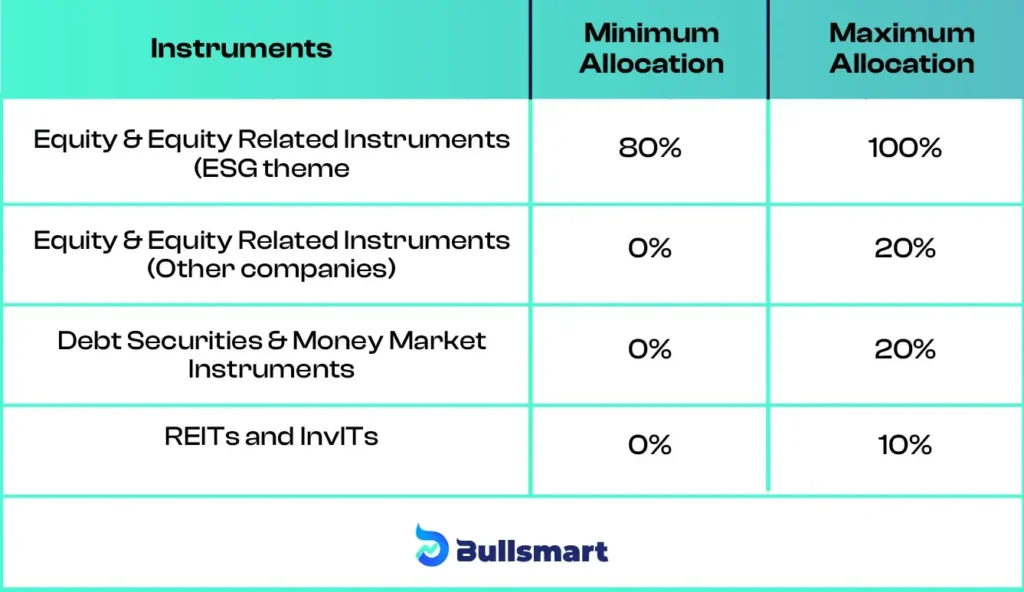

The WhiteOak Capital ESG Best-In-Class Strategy Fund will predominantly invest in equity securities of companies that follow ESG principles. The fund ensures that a large portion of the portfolio is allocated to companies excelling in environmental, social, and governance performance while maintaining flexibility to invest in other companies or instruments for liquidity and risk management.

Here’s a simplified allocation of the WhiteOak Capital ESG Best-In-Class Strategy Fund’s portfolio:

Fund Risks and Returns Overview

The WhiteOak Capital ESG Best-In-Class Strategy Fund is designed for investors with a very high risk tolerance. The focus on ESG companies ensures that the fund invests in businesses that are more sustainable and responsible, which is increasingly important in today’s market. However, ESG-focused investments can also be volatile, especially over the short term, and investors should be prepared for fluctuations in returns.

WhiteOak Capital ESG Best-In-Class Strategy Fund NFO is benchmarked against the Nifty 100 ESG TRI, a benchmark that has delivered returns of 37.49%, 12.66%, and 20.55% in the past 1 year, 3 years, and 5 years respectively.

Investors should consider a long-term horizon of 3-5 years or more to fully benefit from the potential growth of ESG-compliant companies.

Understanding Asset Management Company

WhiteOak Capital Asset Management Limited is an important part of the respected WhiteOak Capital Group, which was founded by Mr. Prashant Khemka, a well-known investment expert with over 20 years of experience. The group has research teams located in India, Singapore, and Spain, and sales offices in Switzerland, the UAE, and the UK.

In India, the AMC is led by CEO Mr. Aashish P. Somaiyaa, who also has more than 20 years of experience in asset management. As of March 2024, WhiteOak Capital Mutual Fund manages assets totaling ₹11,878.38 crores and serves a diverse global clientele, including sovereign wealth funds, pension plans, endowments, and individual investors looking to invest in the Indian market. They manage investments through both separately managed accounts and investment funds.

Expert Fund Management Strategies

WhiteOak Capital ESG Best-In-Class Strategy Fund is managed by an experienced team of Mutual Fund managers:

Mr. Ramesh Mantri

Mr. Ramesh Mantri, 44, holds an MBA, CFA, and CA, bringing over 20 years of experience in the financial markets. He has been with WhiteOak Capital Asset Management since December 21, 2021, and has previously worked at White Oak Capital Management and Ashoka Capital Advisers. Ramesh manages several funds, including the WhiteOak Capital Flexi Cap Fund, which provides flexible equity exposure, and the WhiteOak Capital Mid Cap Fund, focusing on medium-sized companies.

Ms. Trupti Agarwal

Ms. Trupti Agarwal, 39, is a B.Com graduate and a CA with over 15 years in the industry. She joined WhiteOak Capital Asset Management on December 21, 2021, after working at Khoob Saree and L&T Infrastructure Finance. Trupti oversees the WhiteOak Capital Large Cap Fund, which targets large-cap companies, and the WhiteOak Capital Balanced Advantage Fund, aiming to balance equity and debt investments.

Mr. Dheeresh Pathak

Mr. Dheeresh Pathak, 41, has a PGDBM and a BE in Electronics and Communication Engineering, with over 16 years of experience in financial markets. He came to WhiteOak Capital Asset Management in June 2022 after a long career at Goldman Sachs. Dheeresh manages the WhiteOak Capital Pharma and Healthcare Fund, focusing on the healthcare sector, and the WhiteOak Capital Banking & Financial Services Fund, which targets the financial services industry.

Mr. Piyush Baranwal

Mr. Piyush Baranwal, 38, holds a Bachelor of Engineering and a PGDBM, having passed all three levels of the CFA. With over 15 years of experience in portfolio management and trading fixed-income securities, he joined WhiteOak Capital on November 1, 2021. Piyush manages the WhiteOak Capital Liquid Fund, designed for short-term investments, and the WhiteOak Capital Ultra Short Duration Fund, which focuses on very short-term debt securities.

Who Should Invest in This Fund?

The WhiteOak Capital ESG Best-In-Class Strategy Fund NFO is ideal for:

- Investors aiming for long-term wealth creation through ESG-compliant investments.

- Individuals with a strong interest in sustainability and responsible investing.

- Investors who are comfortable with high volatility and potential short-term fluctuations.

- Those looking to diversify their equity portfolio with a focus on ESG themes.

This fund is an excellent option for investors who want to align their investment goals with their personal values by supporting businesses that prioritize environmental, social, and governance standards.

Suggested Read – Whiteoak Capital Digital Bharat Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.