The technology sector in India has been growing rapidly, driving innovation and contributing significantly to the country’s economic growth. With more companies adopting digital solutions and an increasing focus on digital transformation, the technology sector presents an attractive investment opportunity.

One way to tap into this growth is through the WhiteOak Capital Digital Bharat Fund, an open-ended equity scheme that primarily invests in technology and technology-related companies.

Let’s explore the details of this New Fund Offer (NFO) to determine if it aligns with your investment strategy.

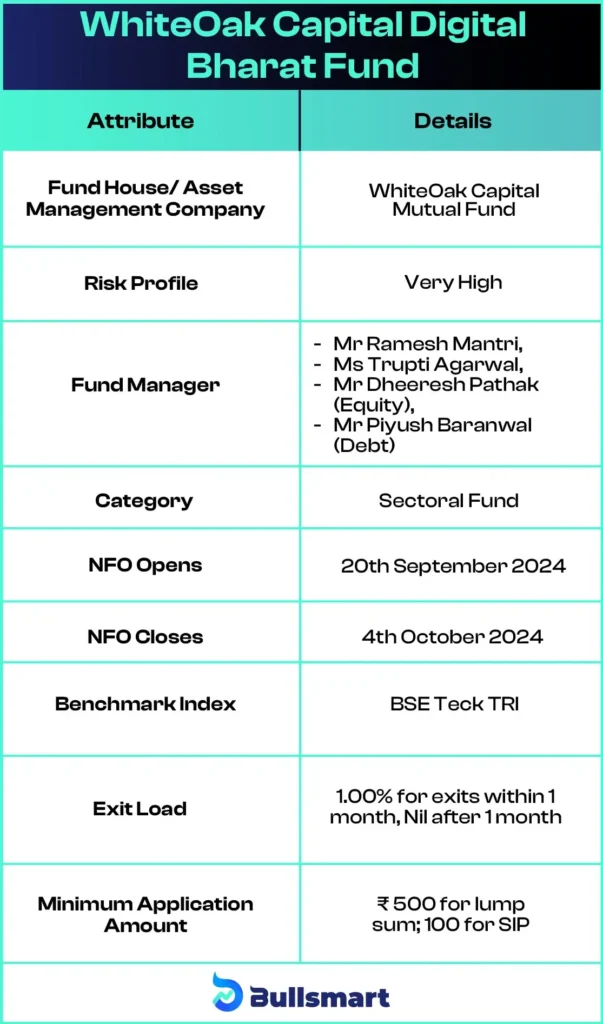

Key Facts about WhiteOak Capital Digital Bharat Fund

The WhiteOak Capital Digital Bharat Fund is designed to capitalize on India’s growing digital and tech landscape by investing in companies at the forefront of technological innovation.

The fund focuses on long-term capital appreciation by investing in equity and equity-related instruments of technology companies, positioning itself as a strategic choice for tech-focused investors.

Investment Goals of the Fund

The WhiteOak Capital Digital Bharat Fund aims to provide long-term capital appreciation by predominantly investing in equity and equity-related instruments of technology and technology-related companies.

However, it’s important to note that there is no assurance that the investment objective will be achieved.

Essential Fund Details

Here’s a look at the basic details of the WhiteOak Capital Digital Bharat Fund:

Portfolio Allocation

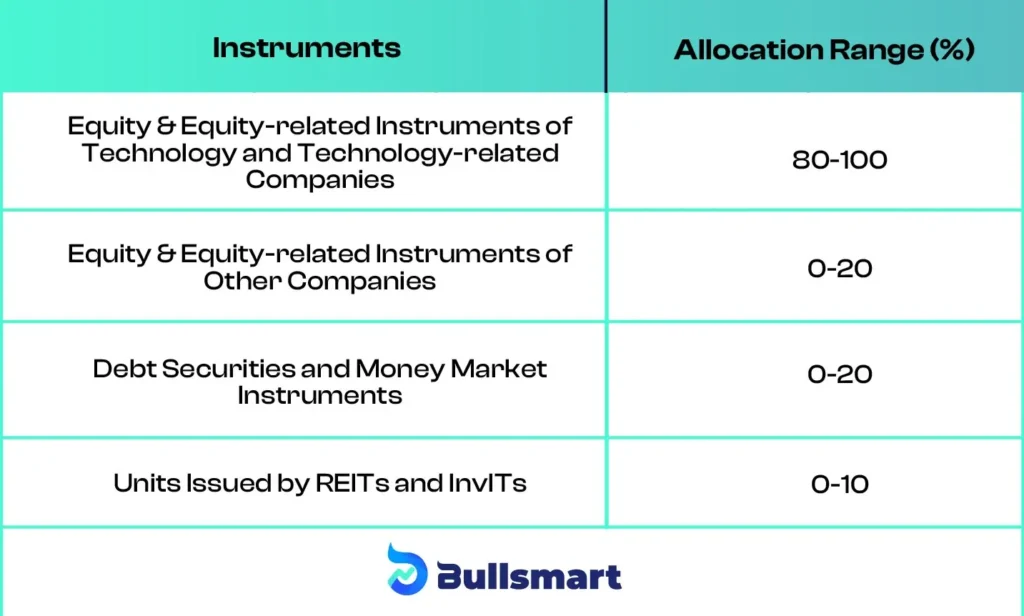

The asset allocation of the WhiteOak Capital Digital Bharat Fund is as follows:

This allocation ensures that the fund remains heavily invested in technology and related sectors while providing some flexibility in other equity and debt instruments.

Exploring Risk and Return Factors

The WhiteOak Capital Digital Bharat Fund comes with a very high-risk profile due to its equity-heavy portfolio and concentration in the technology sector. However, the tech sector has shown immense growth potential in India, and by focusing on this sector, the fund aims to deliver long-term capital appreciation.

The fund’s benchmark scheme BSE Teck TRI has delivered returns of 32.2%, 7.8%, and 21.6% in the last 1-year, 3-year, and 5-year.

As the fund tracks the BSE Teck TRI index, its goal is to match or exceed the returns of this benchmark, which has historically performed well in the technology sector.

WhiteOak Capital Asset Management Company

WhiteOak Capital Asset Management Limited is a key part of the respected WhiteOak Capital Group, founded by Mr. Prashant Khemka, a well-known investment expert with over 20 years of experience. The group has dedicated research teams in India, Singapore, and Spain, as well as sales and distribution offices in Switzerland, the UAE, and the UK.

In India, the AMC is headed by CEO Mr. Aashish P. Somaiyaa, who also has over 20 years of experience in asset management.

As of March 2024, WhiteOak Capital Mutual Fund manages assets worth ₹11,878.38 crores and serves a global client base that includes sovereign wealth funds, pension plans, endowments, and individuals seeking to invest in the Indian market.

Their investments are managed through both separately managed accounts and investment funds.

The Team Behind Your Investments

The WhiteOak Capital Digital Bharat Fund is managed by a team of seasoned fund managers with extensive experience in equity and debt markets:

Mr. Ramesh Mantri (For Equity Securities)

Mr. Ramesh Mantri, 44 years old, holds an MBA, CFA, and CA, and has over 20 years of experience in the financial markets. Currently at WhiteOak Capital Asset Management since December 21, 2021, he has previously worked at White Oak Capital Management and Ashoka Capital Advisers. He manages several schemes, including the WhiteOak Capital Flexi Cap Fund, which offers flexible equity exposure, and the WhiteOak Capital Mid Cap Fund, focusing on medium-sized companies.

Ms. Trupti Agarwal (Assistant Fund Manager – Equity)

Ms. Trupti Agarwal, 39 years old, is a B.Com graduate and a CA with over 15 years of experience in the industry. She has been with WhiteOak Capital Asset Management since December 21, 2021, and has also worked at Khoob Saree and L&T Infrastructure Finance. Trupti manages the WhiteOak Capital Large Cap Fund, aimed at investing in large-cap companies, and the WhiteOak Capital Balanced Advantage Fund, which seeks to balance equity and debt investments.

Mr. Dheeresh Pathak (Assistant Fund Manager – Equity)

Mr. Dheeresh Pathak, 41 years old, holds a PGDBM and a BE in Electronics and Communication Engineering, bringing over 16 years of experience in the financial markets. He joined WhiteOak Capital Asset Management in June 2022, after a long tenure at Goldman Sachs. Dheeresh manages the WhiteOak Capital Pharma and Healthcare Fund, which focuses on investments in the healthcare sector, and the WhiteOak Capital Banking & Financial Services Fund, targeting the financial services industry.

Mr. Piyush Baranwal (For Debt Securities)

Mr. Piyush Baranwal, 38 years old, holds a Bachelor of Engineering and a PGDBM, and has cleared all three levels of the CFA. With over 15 years of experience in portfolio management and trading fixed-income securities, he has been with WhiteOak Capital since November 1, 2021. Piyush manages the WhiteOak Capital Liquid Fund, designed for short-term investments, and the WhiteOak Capital Ultra Short Duration Fund, focusing on very short-term debt securities.

Suitable Investors for This NFO

The WhiteOak Capital Digital Bharat Fund is suitable for investors who are:

- Looking for long-term capital appreciation through exposure to the technology sector.

- Comfortable with high-risk, equity-oriented investments.

- Interested in benefiting from India’s digital and tech revolution.

- Willing to invest for a minimum of 5 years or more.

WhiteOak Capital Digital Bharat Fund fund is designed for tech-savvy investors who believe in the long-term growth of technology and digital companies and are looking to build wealth through exposure to this sector.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.