The buzz around infrastructure funds is growing louder, driven by its impressive 87% returns over the past year and the government’s hefty Rs 26,000 crore investment in the sector as a part of Union Budget 2024.

The government provides financial assistance for developing various infrastructure spendings such as Roadways, Railways, water systems etc., that has put forth a strong start to the sector’s growth.

This is not a momentary development but a clear demonstration of India’s infrastructure growth since 2019, driven by increased government spending. This surge in spending makes infrastructure funds a hot pick for investors.

Overall, Infrastructure sector is the key driver for the economy, playing an important role in propelling India’s overall development.

Among these infrastructure funds, the UTI Infrastructure Fund stands out with an impressive 56.63% return in just one year (as of July 31, 2024).

Let’s delve into this blog to learn more about the infrastructure fund and find out if it’s the right choice for you.

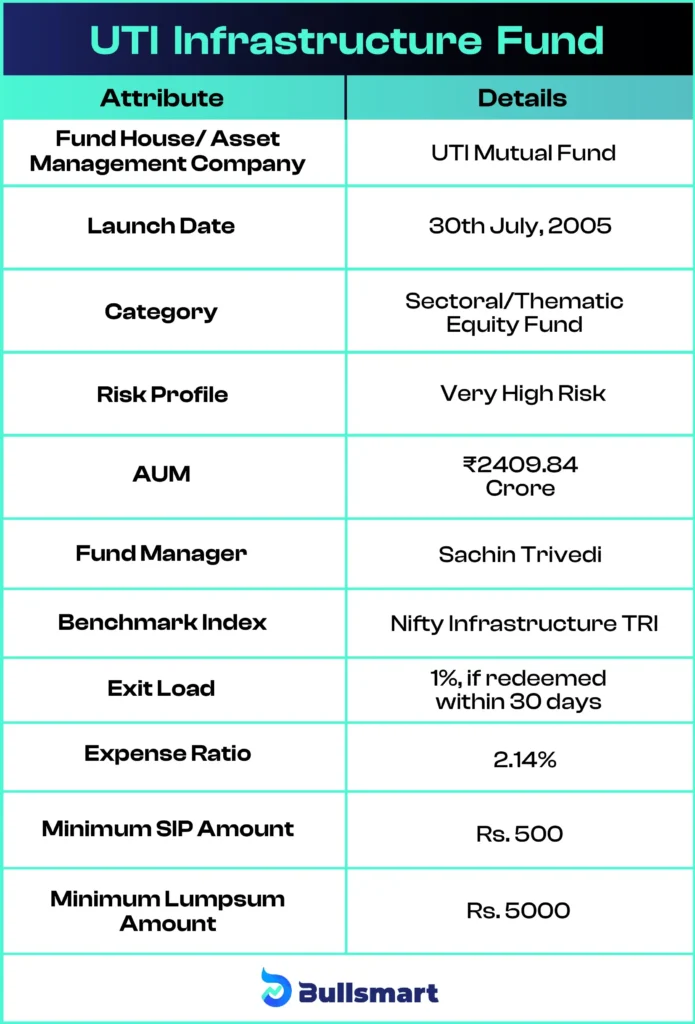

Details of UTI Infrastructure Fund

UTI Infrastructure Fund is an Open ended Sectoral or Thematic fund launched by UTI Mutual Fund AMC. As on July 31st, 2024, the scheme holds an AUM of Rs.2409.84 Crore

The Funds goal is to generate capital appreciation by investing in companies involved directly or indirectly in infrastructure-related activities.

Investment Style of fund

The fund aims to provide risk diversification by investing in a range of stocks within the same sector in a cost-effective manner. It follows a growth investment style with moderate stock concentration.

Fund emphasizes Bottom-Up strategy to pick stocks.

Let’s have a quick glance at the basic details of the Fund:

Investment strategy and portfolio construction

The UTI Infrastructure Fund has put almost 96% of its investments into equities. This strategic allocation leans heavily towards large-cap stocks, followed by mid and small-cap stocks, offering a dynamic blend of growth and stability.

While this fund carries high risk due to its exclusive focus on equities, it also holds the potential for exceptional returns.

Meet the Fund Manager : Mr. Sachin Trivedi

The fund is managed by Mr. Sachin Trivedi, an expert with over 16 years of experience in research and portfolio management. He has been with UTI Mutual Funds since 2001 and specializes in sectors such as capital goods and auto OEMs.

Navigating the risks and returns of fund

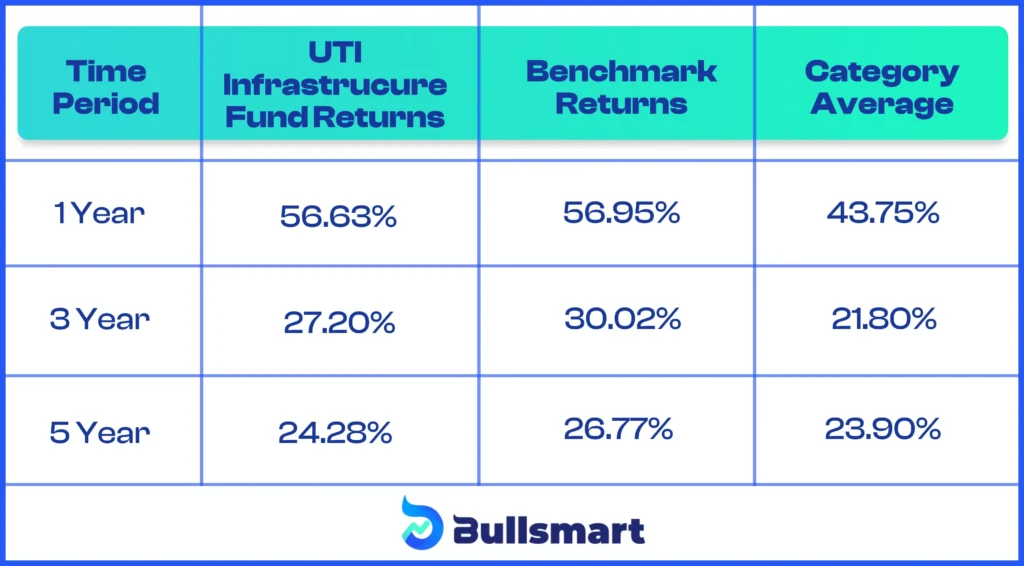

The UTI Infrastructure Fund has delivered impressive returns, consistently outperforming the category average.

Let’s look at its returns in comparison with the category average and benchmark returns:

Returns as on 31 July 2024.

The fund’s 56.63% return over one year is among the highest in the infrastructure category, making it highly appealing to investors.

Suggested read: Motilal Oswal Manufacturing Fund NFO

Who should invest in UTI Infrastructure Fund?

Investors with advanced knowledge of macroeconomic trends may find this fund appealing. It carries higher risk due to its major allocation to equities.

This fund is suited for those with a very high-risk appetite, seeking substantial returns and optimistic about the growth of India’s infrastructure sector.

Consulting financial advisors can help you select funds that align with your risk profile.