The popularity of multi-asset allocation funds has grown substantially over the years as investors increasingly seek diversified investment strategies. As a result, the AUM of these funds surged from Rs. 20,404.37 crore in July 2022 to Rs. 33,779.6 crore in July 2023. The growth did not stop here, the upward trend continued in 2024 as well with its assets under management skyrocketing to Rs. 89,592.72 crore by July.

This explosive rise in AUM highlights how multi-asset allocation funds are becoming the preferred choice for investors who aim to balance risk, maximize returns, and capture opportunities across various asset classes.

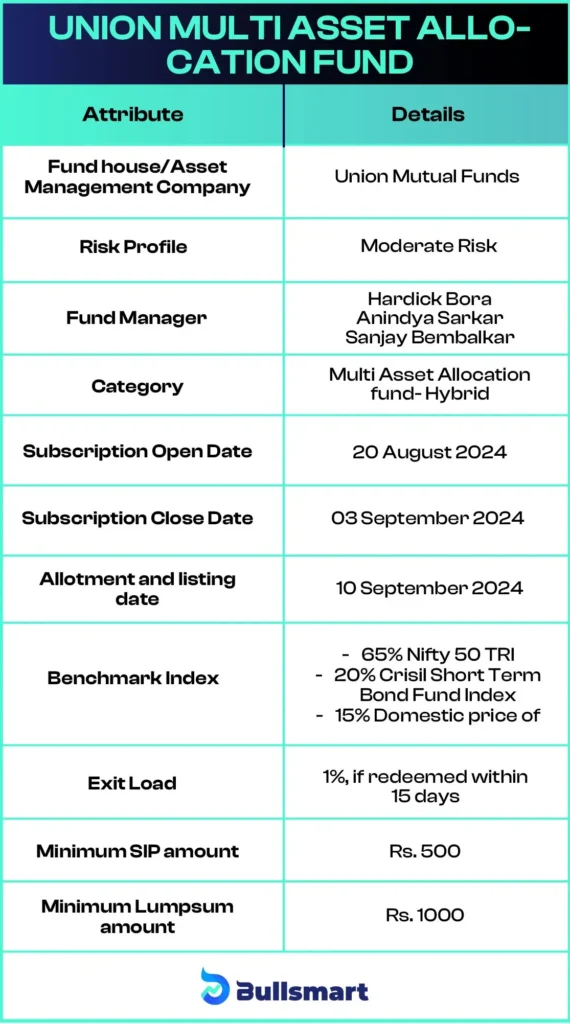

Riding this wave of growing popularity, Union Mutual Fund has launched a New Fund Offer (NFO), the “Union Multi Asset Allocation Fund” on August 20, 2024, which is open for subscription until September 3, 2024.

Details of the Union Multi Asset Allocation Fund

Union Multi Asset Allocation Fund is an open-ended hybrid scheme launched by Union mutual fund house. The fund aims to invest in various asset classes such as equities, debt, gold and silver.

With just Rs. 500 investors can kickstart their SIP journey or opt for a one-time lumpsum investment starting at Rs. 1000 to begin their financial journey.

Investment strategy of fund

The fund uses a strategy that combines bottom-up and top-down approaches to select and determine asset allocation. This involves analyzing macroeconomic factors, evaluating industries, benchmarking industry allocations, assessing market outlook, and more.

Let’s have a quick look at the basic details of the fund:

Understanding the Risk Profile and Benchmarking

Since the fund aims to invest in multiple asset classes, it uses three benchmarks to guide its performance: 65% of the Nifty 50 TRI for equities, 20% of the CRISIL Short-Term Bond Fund Index for debt instruments, and 15% of the domestic gold price for gold exposure.

This diversified approach reflects the fund’s mix of equities, debt instruments, and gold.

The returns generated by the fund’s benchmarks over the years are as follows:

Note: The returns mentioned above are as of August 21, 2024. However past performance is not an indicator of future returns.

Meet the Experienced Fund Management Team

The fund will be managed by three seasoned professionals, Hardick Bora, Anindya Sarkar, Sanjay Bembalkar, each bringing extensive experience to the table.

Mr. Hardick Bora has over 15 years of experience in the financial sector, and he is the present Co-Head of Equity at Union Asset Management Company. Prior to joining Union mutual funds, he honed his expertise at Motilal Oswal as Senior Manager.

Mr. Sanjay Bembalkar, another seasoned professional with over 15 years of experience, is also the Co-Head of Equity Research and Fund Management. He previously served as Fund Manager of Equities at Canara Robeco.

Mr. Anindya Sarkar has over 20 years of experience in financial services. He serves as the Fixed Income Fund Manager at Union AMC. And he also co-manages key funds, including the Union Corporate Bond and Union Gilt Fund.

Who should consider investing in Union Multi Asset Allocation Fund?

This fund presents an exciting opportunity for investors to tap into a richly diversified portfolio, featuring a dynamic mix of asset classes designed to optimize returns and manage risk.

It is a moderate-risk fund, ideal for investors with a moderate risk appetite who are seeking stable returns. Those looking for medium to long-term wealth creation might find this fund particularly suitable.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.