Small-cap mutual funds, which invest in a limited number of companies, delivered impressive returns of over 40.44% in 2023. This stellar performance has continued to attract investors, with small-cap funds receiving a significant inflow of ₹3,209.33 crore in August 2024 alone. This renewed interest highlights the potential for small-cap stocks to deliver high returns, especially during favorable market conditions.

One such fund to watch is the TRUSTMF Small Cap Fund NFO. With a focus on identifying companies that are rare, dominant, unchallenged, and long-lasting, the TRUSTMF Small Cap Fund seeks to generate long-term wealth for investors.

Let’s explore how this NFO could be a valuable addition to your equity portfolio.

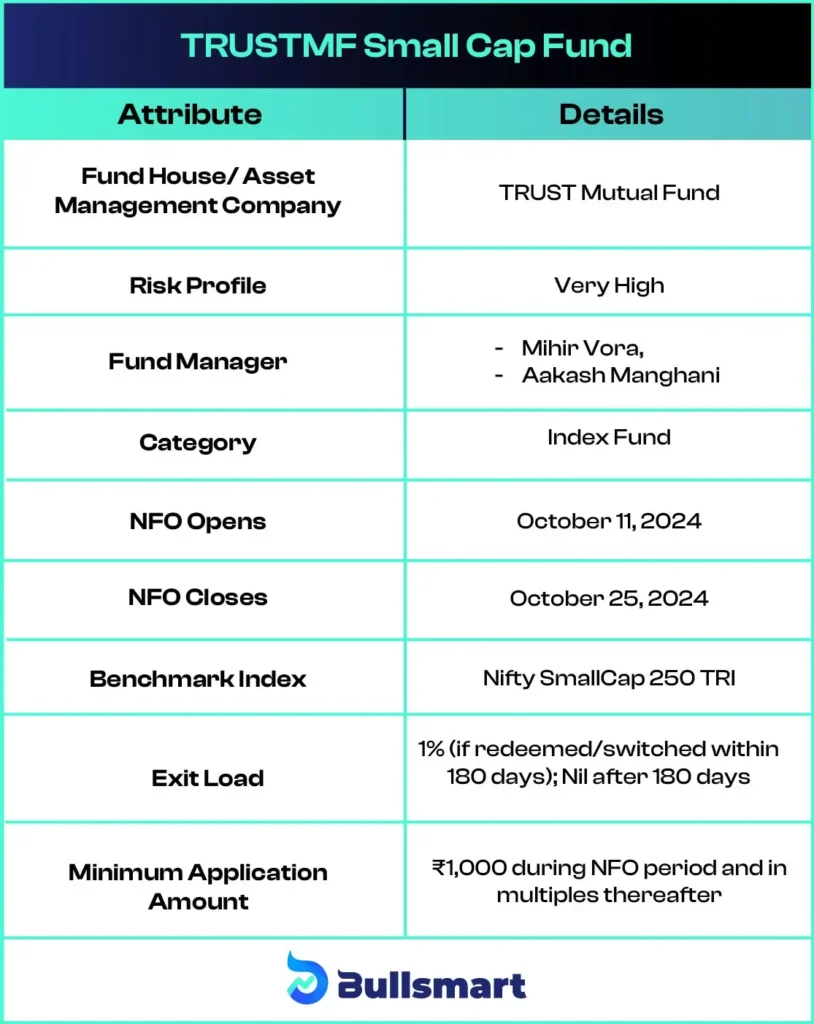

Details of TRUSTMF Small Cap Fund NFO

The TRUSTMF Small Cap Fund NFO is an open-ended equity scheme primarily focused on investing in small-cap stocks. These companies are known for their high growth potential, often offering significant returns as they mature and gain market share. The fund’s investment strategy is designed to identify companies that are well-positioned to benefit from long-term megatrends, have strong leadership, and possess valuable intangible assets.

Investing Strategy of the Fund

The investment objective of TRUSTMF Small Cap Fund NFO is to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of small-cap companies. However, there is no assurance that the objective will be realised.

Here are the key details of the fund:

Portfolio Analysis

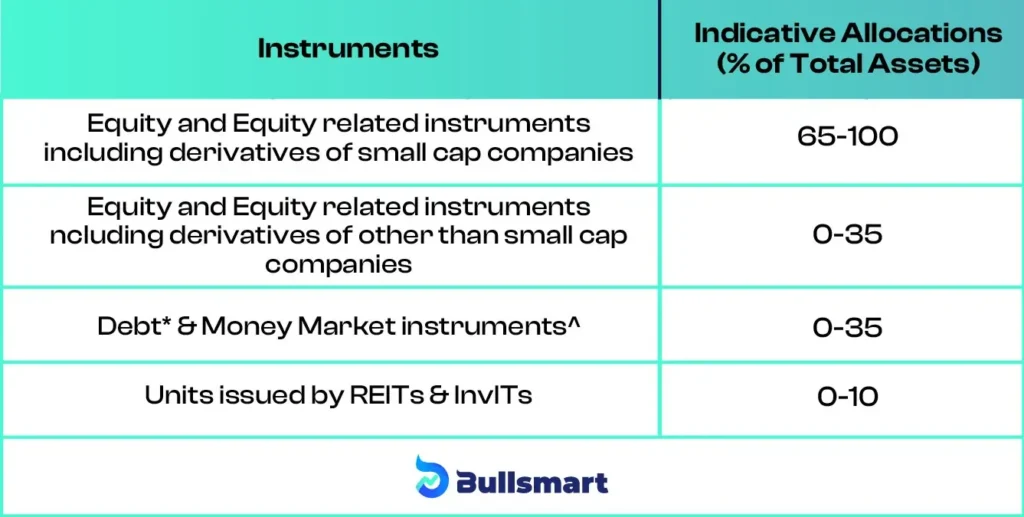

The TRUSTMF Small Cap Fund is structured to invest predominantly in small-cap stocks, ensuring that a significant portion of the portfolio is allocated to high-growth, small-sized companies. A minor portion will be reserved for liquidity and managing short-term market fluctuations.

Here’s a simplified table with two columns:

This allocation allows the fund to primarily invest in small-cap stocks while maintaining some flexibility to navigate market volatility.

Understanding Risks and Returns

The TRUSTMF Small Cap Fund is designed for investors with a very high-risk tolerance. Small-cap stocks are known for their volatility, but they also present opportunities for outsized gains over the long term. Historically, small-cap companies have shown the potential to outperform larger companies, especially during favorable market conditions.

By focusing on small-cap companies that demonstrate strong leadership, intangibles, and alignment with megatrends, this fund aims to capture high-growth opportunities.

The fund follows Nifty SmallCap 250 TRI as its benchmark, which has delivered results of 43.11%, 23.13%, and 32.44% in the past 1 year, 3 years, and 5 years respectively. Since it is the benchmark scheme, the goal is to meet or exceed its performance.

However, due to the nature of small-cap stocks, investors should be prepared for short-term fluctuations and should consider a longer investment horizon of 3-5 years or more.

Asset Management Company

Trust Asset Management Company, part of the Trust Group, is a leading money management firm in India with over 20 years in the financial sector. Originally a fixed-income distributor, the Trust Group has become a key player in the non-banking debt capital market. Established in October 2019, the Trust Mutual Fund operates under the Indian Trusts Act, sponsored by Trust Investment Advisors Private Limited (TIAPL), which is a top arranger for corporate bonds.

Trust AMC offers seven fixed-income products and collaborates with CRISIL to evaluate investments and build model portfolios. Committed to transparency, Trust AMC aims to provide risk-adjusted returns during market fluctuations. Most funds use a Limited Active Methodology, primarily investing based on internal model portfolios, except for the Overnight Fund.

Meet the Fund Managers

TRUST MF Small Cap Fund NFO is managed by experienced fund managers:

Mr. Mihir Vora

Mr. Mihir Vora brings over 29 years of experience in fund management, having worked in mutual funds, insurance, and sovereign funds. He currently serves as the Chief Investment Officer at TRUST Asset Management and will manage the TRUSTMF Flexi Cap Fund, alongside other schemes like the TRUSTMF Equity Fund and TRUSTMF Debt Fund.

Mr. Aakash Manghani

Mr. Aakash Manghani has over 14 years of expertise in equities, focusing on research and portfolio management across various sectors. He is currently a Fund Manager at TRUST Asset Management and will manage the TRUSTMF Flexi Cap Fund.

Who Should Invest in This Fund?

The TRUSTMF Small Cap Fund NFO is ideal for:

- Investors aiming for long-term wealth creation through high-growth portfolios.

- Individuals with an investment horizon of at least 3-5 years.

- Investors who are comfortable with high volatility and potential short-term losses.

- Those looking to build a core equity portfolio with a focus on small-cap stocks.

Suggested Read – Motilal Oswal Digital India Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.