If you’re looking for a way to earn a steady income while growing your wealth, dividend stocks have always been a solid bet. They give you regular payouts, making them a great option if you want some passive income along with long-term stock price appreciation.

For Indian investors, 2025 looks like an exciting year for dividend investing. With strong economic growth, business-friendly government policies, and companies reporting solid earnings, the stage is set for some great opportunities.

As India cements its place as a global economic leader, key sectors are expected to boom, and companies with strong fundamentals could keep delivering stable and attractive dividends.

With so many economic trends influencing the market, it’s more important than ever to pick the top dividend stocks for 2025.

In this blog, we’ll dive into the top dividend stocks, key sectors to watch, and strategies to help Indian investors build a solid dividend portfolio.

What are the Benefits of Investing in Dividend Stocks?

Dividend investing comes with some awesome benefits:

- Regular income: You get a steady cash flow, even when the market isn’t doing so great.

- Compounding: Compounding is one of the best features ever when it comes to systematic investing. Reinvesting those dividends can seriously boost your returns over time.

- Lower volatility: Stocks that pay dividends are usually less volatile than those that don’t.

- Inflation hedge: As dividends grow, they can help protect your purchasing power from inflation.

What Are Dividend Stocks?

Before we dive into what makes a good dividend stock, let’s break down what dividend stocks are.

Simply put, dividend stocks are shares of companies that pay you a portion of their profits regularly (usually quarterly). This payout is called a dividend. Think of it as getting a little reward just for owning the stock!

However, not all dividend-paying stocks are created equal. To find the best ones, investors need to look at several factors, like:

Dividend Yield & Payout Ratio

- Dividend Yield: This is the percentage of your investment that you earn back through dividends. It’s a quick way to see how much cash flow you can expect.

- Payout Ratio: This tells you how much of the company’s earnings are being paid out as dividends. A healthy payout ratio is usually between 30-60%. If it’s too high, the company might be stretching its finances too thin.

Dividend Consistency

Look for companies with a history of consistently paying or growing dividends. This shows they’re financially stable.

Avoid stocks that pay irregular or shrinking dividends—this could be a sign that the company is struggling.

Financial Health of the Company

- Revenue Growth & Profitability: A solid company should be steadily growing its revenue and making profits.

- Debt Levels: If a company is in heavy debt, it might not be able to keep up its dividend payouts.

- Cash Flow: Strong cash flow means the company has enough money to keep paying you those dividends regularly.

Industry Trends & Economic Factors

Pay attention to industries that are expected to do well in 2025, like banking, IT, FMCG, and utilities.

These industries are likely to offer stable dividend-paying opportunities.

Stock Price Growth vs. Dividend Income

While a high dividend yield is great, you also want to balance it with potential stock price growth. Some companies may offer high dividends, but if their stock price is flat or falling, it might not be the best long-term investment.

In short, a good dividend stock should offer you regular payouts, have strong financials, and be part of an industry poised for growth.

Keep these factors in mind when building your dividend portfolio!

How to Invest in Dividend Stocks in India: A Simple Guide

Investing in the best dividend stocks in India is a great way to earn regular income and grow your wealth over time. But picking the right ones–the High-Yield Dividend Stocks? That’s where the dividend investing strategy comes in.

Here’s a step-by-step guide to help you get started:

1. Understand Dividend Stocks

Before diving in, it’s important to know what dividend stocks are all about:

- Dividend Yield: This is the annual dividend payout as a percentage of the stock price.

- Payout Ratio: The percentage of a company’s earnings paid out as dividends.

- Dividend Growth: Look for companies that consistently increase their dividends over time. It’s a good sign of financial health.

2. Choose a Reliable Stockbroker

To buy dividend stocks, you’ll need a Demat & Trading account with a reliable stockbroker.

3. Research & Select Dividend Stocks

When picking stocks, look for:

- Consistent Dividend Payments: Companies that have a history of stable or growing dividends.

- Strong Financials: Focus on companies with low debt, steady revenue, and good profitability.

- Sector Stability: Sectors like FMCG, IT, Banking, Utilities, and Oil & Gas often offer strong dividends.

- High Dividend Yield (But Not Too High): Be cautious of companies with unusually high yields—this could be a red flag for financial trouble.

? Where to Research:

- NSE & BSE websites

- Financial news portals

- Stock analysis tools

4. Diversify Your Portfolio

- Spread your investments across different sectors to reduce risk.

- Mix high-yield stocks with dividend-growth stocks to strike a balance.

5. Buy & Hold for Long-Term Benefits

- Use your trading account to purchase stocks.

- Track dividend payments, which usually happen quarterly or annually.

- Reinvest your dividends to compound your returns and build wealth over time.

6. Monitor Your Investments Regularly

- Check how your companies are performing and whether they’re paying consistent dividends.

- If a company cuts its dividends without a solid reason, it might be time to reassess.

- Stay informed about sector performance and any economic changes that could affect your investments.

7. Consider Dividend ETFs or Mutual Funds (Alternative Option)

For a more hands-off approach, consider Dividend Mutual Funds or ETFs, which pool together dividend-paying stocks:

Examples of Dividend Mutual Funds in India

- ICICI Prudential Dividend Yield Equity Fund

- HDFC Dividend Yield Fund

- Aditya Birla Sun Life Dividend Yield Fund

These funds offer diversification and are managed by professionals.

What Are Dividend Mutual Funds?

Dividend Mutual Funds are equity mutual funds that primarily invest in dividend-paying stocks.

These funds aim to generate regular income and capital appreciation by investing in companies that consistently distribute dividends.

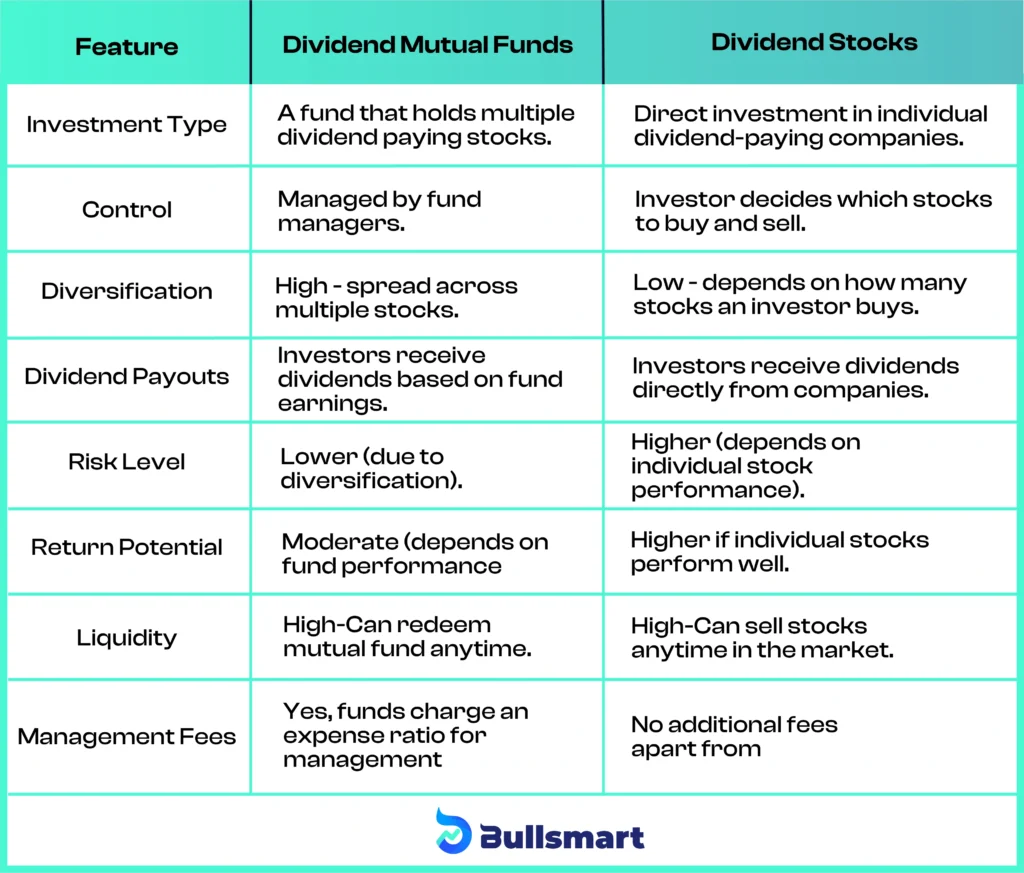

How Are Dividend Mutual Funds Different from Dividend Stocks?

Which One Should You Choose?

Choose Dividend Mutual Funds if:

✔️ You prefer diversification and lower risk.

✔️ You don’t want to actively manage your investments.

✔️ You want professional management to select stocks.

Choose Dividend Stocks if:

✔️ You want higher control over investments.

✔️ You have the time and knowledge to research and monitor stocks.

✔️ You seek higher return potential by picking individual winners.

Is 2025 a Good Year to Invest in Dividend Stocks?

Well, different investors have different preferences. Hence, the answer to the question “Is 2025 a Good Year to Invest in Dividend Stocks?” can vary from one person to the other. However, here are a few factors you should definitely consider while making a decision on whether or not to invest in these stocks:

Macroeconomic Trends

- India’s GDP growth is expected to be 6.5-7%, creating a strong environment for businesses.

- Stable inflation rates mean steady consumer spending and healthy corporate earnings.

- The government’s focus on infrastructure, digitalization, and manufacturing is driving business growth.

Government Policies Supporting Dividend-Rich Industries

- Tax benefits and incentives are boosting sectors like infrastructure, banking, and energy.

- Favorable monetary policies are helping keep interest rates stable.

Impact of Global Economic Shifts

- There’s an increase in global investments pouring into Indian equity markets.

- Shifts in global trade dynamics are opening up new growth opportunities for Indian companies.

Sectors Set to Benefit from India’s Economic Growth

- Sectors like banking, IT, FMCG, and power are primed for steady earnings growth, making them great for dividend investing.

Top Dividend-Paying Sectors in India for 2025

1. Banking & Financial Services

- Big private and PSU banks that offer steady dividends.

- Examples: HDFC Bank, ICICI Bank, SBI

2. Energy & Power Utilities

- These are essential services with reliable cash flows.

- Examples: NTPC, Power Grid Corporation, Tata Power

3. FMCG (Fast-Moving Consumer Goods)

- A sector that keeps growing because of strong consumer demand.

- Examples: Hindustan Unilever, ITC

4. IT & Technology

- Solid revenue models and plenty of cash flow make for consistent dividend payouts.

- Examples: Infosys, TCS

5. Pharmaceuticals & Healthcare

- A defensive sector with steady demand, even in tough times.

- Examples: Sun Pharma, Dr. Reddy’s Laboratories

6. Oil & Gas

- Big PSUs and private players offering great dividends.

- Examples: ONGC, Reliance Industries

7. Infrastructure & Real Estate

- A growth-focused sector benefiting from government initiatives.

- Examples: L&T, DLF

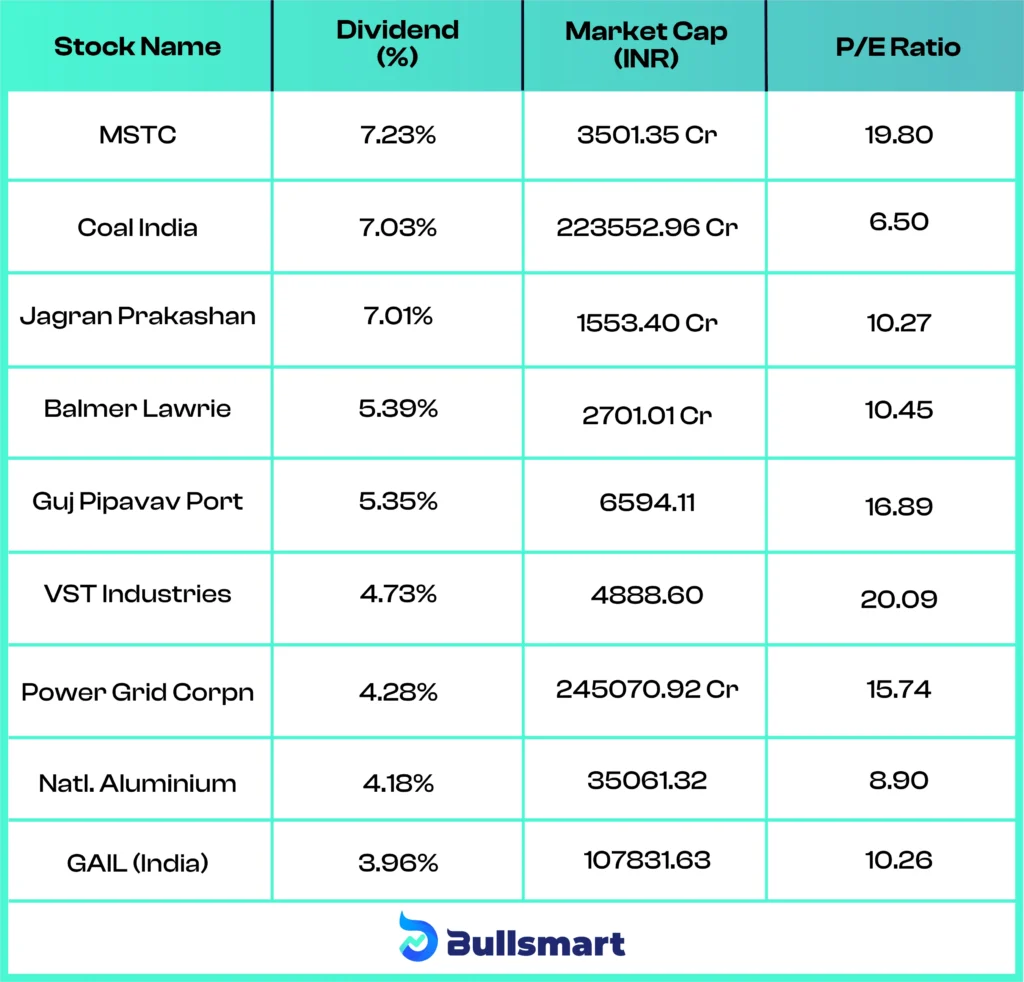

Top 10 Dividend Stocks in India for High Returns in 2025

Here are the top 10 dividend yield shares shortlisted just for you:

Data available is available as of 20.02.25

Let’s break down what you’re looking at:

- Dividend Yield: This is the percentage return you get from the stock’s dividend. Higher yield means more cash in your pocket. For example, MSTC gives you 7.23%, which is pretty attractive!

- Market Cap: This tells you how big the company is. The larger the market cap, the more established the company. Coal India, with a huge market cap of ₹2,23,552 Cr, is a giant in the game.

- P/E Ratio (Price-to-Earnings Ratio): This helps you understand if the stock is priced fairly based on its earnings. A lower P/E ratio (like Coal India’s 6.50) often means the stock might be undervalued, making it potentially a good buy.

So, if you’re after dividend stocks in 2025, look at the dividend yield for returns, market cap for stability, and P/E ratio to gauge if the stock is priced right.

These 10 picks give you a great mix of solid dividends and growth potential—just what you need for that perfect income boost.

Key Factors to Consider Before Investing in Dividend Stocks

- Steer Clear of Dividend Traps: High dividend yields can be tempting, but make sure they’re sustainable. Too high a yield could signal trouble down the road.

- Check Earnings Consistency & Growth: Look for companies that consistently deliver earnings and show potential for future growth. Steady performance is key to reliable dividends.

- Diversify Your Portfolio: Spread your investments across different sectors to minimize risk. Diversification can help protect your returns in case one sector underperforms.

- Understand Tax Implications: In India, dividends are taxed based on your income slab, so it’s important to factor in the tax impact when planning your investments.

How to Build a Strong Dividend Portfolio in 2025: A Simple Guide

- Mix It Up with Diversification: Don’t put all your eggs in one basket! Spread your investments across different industries to reduce risk and boost your chances of steady returns. Think of it like a balanced diet for your portfolio.

- Balance Growth and Dividend Stocks: Go for a winning combo! Mix growth stocks (for capital appreciation) with solid dividend stocks (for that regular cash flow). It’s all about optimizing those total returns.

- Put Your Dividends to Work: Don’t just let your dividends sit there—reinvest them! It’s like giving your money a chance to grow and multiply. Over time, compounding will work its magic on your wealth.

- Stay on Top with Regular Monitoring: Don’t just set it and forget it! Regularly check in on your portfolio to make sure it’s still in line with your goals. A quick review can help you make adjustments and keep your strategy on point.

Building a strong dividend portfolio in 2025 is all about staying smart, staying diversified, and letting time do the heavy lifting!

How Are Dividend Stocks Taxed in India in 2025?

- In India, dividends from stocks are taxed based on your income tax slab in 2025.

- Dividends are added to your total income and taxed at your applicable rate.

- If your total dividend earnings exceed ₹5,000 in a year, companies will deduct 10% TDS (or 20% for non-PAN holders).

- For NRIs, the TDS rate is 20%, plus surcharge and cess.

- If your dividend income exceeds ₹10,000, you may need to pay advance tax.

- You can no longer claim deductions on expenses, except for loan interest (up to 20% of dividend income).

- High-income investors may find growth stocks or DRIPs more tax-efficient options.

? Tip: Investors in higher tax slabs (30%) may find growth stocks or dividend reinvestment plans (DRIPs) more tax-efficient.

Risks & Challenges in Dividend Investing: What You Should Know

While dividend investing can be rewarding, it’s not without its risks. Here’s a quick breakdown of what to watch out for:

- Dividend Cuts: Companies might reduce or even stop dividend payouts during tough times, which can affect your income.

- Market Volatility: Even if a stock pays strong dividends, its price can still go up and down. So, you need to be ready for some ups and downs in the market.

- Inflation Risk: The dividends you receive should ideally grow faster than inflation. If they don’t, the purchasing power of your income can shrink over time.

- Sector-Specific Risks: Certain industries, like energy or healthcare, might face government regulations or other challenges that can affect their ability to pay dividends.

Being aware of these risks can help you make smarter choices and build a more stable dividend portfolio!

Who Should Invest in Dividend Stocks?

Dividend stocks can be a fantastic choice for the right investor. Here’s who might benefit:

- Long-Term Investors: If you’re after steady income and wealth growth over time, dividend stocks are your friend. Reinvesting those dividends can really boost your returns in the long run.

- Retirees & Conservative Investors: If you’re looking for regular income without selling off stocks, dividend stocks are a solid choice. They’re also considered Passive Income Stocks as they’re generally less volatile than growth stocks, helping preserve your capital. One can actually consider them to be some of the best Long-Term Investments in India.

- Investors Seeking Stability & Lower Risk: Companies that consistently pay dividends tend to be financially strong and less volatile. They’re perfect for building a balanced portfolio with moderate risk.

- Passive Income Seekers: If you want regular payouts without constantly monitoring the market, dividend stocks can provide that passive income flow.

- Investors Looking to Hedge Against Inflation: Dividend stocks with growing payouts can help protect against rising prices, keeping your income stable over time.

Who Should Avoid Dividend Stocks?

Dividend stocks aren’t for everyone. Here’s who might want to look elsewhere:

- High-Growth-Oriented Investors: If you’re all about rapid capital growth, dividend stocks might not be the best fit. These stocks typically have slower price appreciation compared to high-growth options.

- Short-Term Traders: If you’re after quick gains and trading for short-term profits, dividend stocks won’t align with your strategy. They focus more on long-term income.

- Investors Seeking High-Risk, High-Reward Opportunities: If you like to take big risks with small-cap stocks, IPOs, or even cryptocurrencies, dividend stocks may not satisfy that appetite for high-reward bets.

- High-Income Investors: In India, dividends are taxed based on your income tax slab, making them less appealing to those in higher tax brackets who might prefer capital gains strategies.

- Young Investors Who Prioritize Aggressive Growth: If you’re young and willing to take on more risks, high-growth tech stocks or emerging market investments may give you a bigger bang for your buck compared to slow-growing dividend payers.

Bottom Line

As we look towards 2025, it’s clear that dividend stocks are not just a safe bet—they’re a smart one. With India’s economy gaining momentum and key sectors like banking, IT, FMCG, and utilities poised for growth, dividend investing presents an exciting opportunity for both steady income and long-term wealth accumulation.

Whether you’re a seasoned investor or just starting, the potential for explosive returns is there, but choosing the right stocks is crucial.

A well-diversified dividend portfolio, focusing on companies with strong fundamentals and a history of consistent payouts, can help ensure that you stay on the right track. And while dividend stocks offer steady cash flow, it’s important to keep an eye on their growth potential as well.

By balancing high-yield stocks with growth-focused picks and reinvesting those dividends, you set yourself up for a powerful compounding effect that can significantly boost your returns over time.

So, as you plan your investment strategy for 2025, take advantage of the booming sectors, choose wisely, and build a robust portfolio that not only delivers consistent dividends but also positions you for long-term success.

Which dividend stocks are you investing in for 2025? Drop your thoughts in the comments!

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

Which stock will boom in 2025 in India?

Stocks in sectors like renewable energy, electric vehicles (EVs), artificial intelligence (AI), banking, and infrastructure are expected to grow due to strong government policies, increased capital investments, and global market trends. Companies with high earnings growth, strong financials, and innovative business models are likely to outperform.

Which stock will give dividends in 2025?

Stocks in banking, FMCG, power, and oil & gas sectors typically offer stable dividends due to consistent cash flows. Many well-established companies with strong balance sheets and regular earnings maintain a high dividend payout ratio, ensuring continued returns for shareholders.

Which stock gives the highest dividend in India?

Companies with high dividend yields are often found in public sector undertakings (PSUs), utilities, and mature industries that generate stable revenues. These firms distribute a significant portion of their profits as dividends, benefiting long-term investors looking for passive income.

What are good stocks to invest in in 2025?

Stocks with strong fundamentals, sustainable growth, and sectoral tailwinds make good investment choices. Key industries include technology, financial services, healthcare, manufacturing, and infrastructure, driven by economic expansion, policy support, and increasing domestic consumption.