Top defense stocks are grabbing major attention in 2025 as India’s push for military modernization and self-reliance gains momentum. With the new Nifty India Defence Index and growing FII interest, this sector is a hot spot for investors, both retail and institutional.

A report highlights a strong outlook for Indian defense stocks, fueled by rising indigenisation, a growing private sector, and record export goals. The government’s efforts to boost defense PSUs while empowering private players have reshaped the market.

In just five years, some top defense stocks have turned Rs 1 lakh into Rs 14 lakh, says the Financial Express. Names like Tata Defence and aerospace firms tied to Garuda Aerospace are gaining serious traction.

Whether through thematic funds or ETFs, the defense sector holds huge potential. This blog dives into the top defense stocks to watch in 2025, backed by key trends and policy updates.

The Booming Indian Defense Sector: A Quick Look

Government Push

- India’s defense has changed a lot in the last 10 years, thanks to government support.

- The ‘Make in India’ campaign (started in 2014) encourages local companies to build advanced weapons here.

- It also invites foreign companies to invest and partner with Indian firms.

- Defense sector budget for 2025-26: Rs 6.81 lakh crore (up from Rs 5.93 lakh crore in 2023-24).

- More money is going toward buying Indian-made equipment and modernizing the armed forces.

- New rules make it easier for Indian companies to get contracts quickly.

Export Boom

- India’s defense sector exports are at an all-time high.

- In 2023-24, exports reached Rs 21,083 crore, with a target of Rs 30,000 crore by 2025.

- Products like drones, missiles, patrol ships, and surveillance tools are sold to 80+ countries.

- This boosts India’s economy and makes its defense sector firms global players.

Tech Progress

- India is making big strides in homegrown defense tech.

- Solar Industries recently launched Bhargavastra, an anti-drone system made in India.

- Advances include AI-powered surveillance, smart weapons, and naval tech.

- These innovations help Indian companies grow and attract long-term investors.

Key Drivers of Growth in 2025

Geopolitical Tensions

- Rising border conflicts and global alliances have pushed India to spend more on defense sector.

- The government is focused on upgrading and modernizing the military, creating demand for new tech and contracts.

Modernization Efforts

- Big projects like the Akash missile, Tejas Mk2 fighter jet, and homegrown submarines show India’s tech progress.

- These programs bring lots of business to Indian defense sector companies, especially government-owned and aerospace firms.

Private Sector Growth

- Private companies like Data Patterns, Paras Defence, and Zen Technologies are stepping up with new innovations.

- Supportive policies and teamwork with DRDO have helped them grow fast.

- More players mean better competition and faster tech improvements.

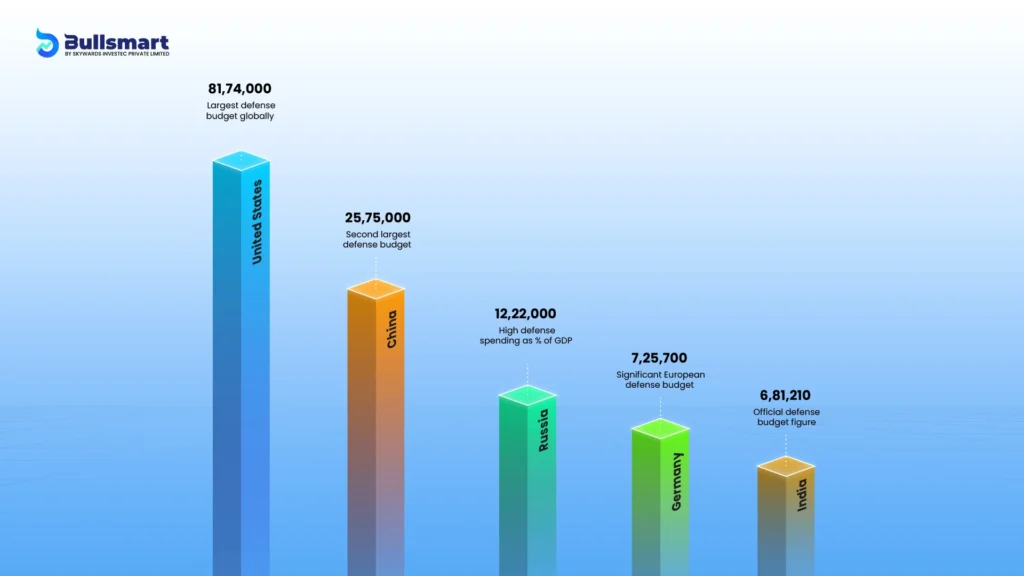

Where Does India Stand Among the World’s Top Defense Powers?

As of May 2025, India ranks as the 5th largest defense sector spender globally, with a record allocation of ₹6.81 lakh crore (approximately $86.1 billion).

This places India behind only the United States, China, Russia, and Germany in absolute defense sector expenditure, according to the latest SIPRI data and budget disclosures.

Check this image for a clear-visual understanding:

India’s global standing is strengthened not just by budget figures, but by:

- Its strategic modernization programs, including Tejas Mk2, Akash missiles, and UAV tech.

- An aggressive push toward self-reliant defense sector production under Make in India.

- A rise in defense sector exports, with ₹30,000 crore targeted for 2025.

Notably, India is also Asia’s second-largest defense sector spender after China, and one of the few countries simultaneously investing in all three key domains: land, air, and naval modernization.

Top Defense Stocks for 2025 in India

Below is a carefully curated list of the top defense stocks in India you can go for:

| Defense Stock Name | Market Cap (in Cr.) | CMP | P/E Ratio | Dividend Yield |

| Hind.Aeronautics | 324957.76 | 4859.00 | 38.89 | 0.73 |

| Bharat Electron | 254124.46 | 347.65 | 50.89 | 0.63 |

| Mazagon Dock | 127508.39 | 3161.00 | 46.37 | 0.46 |

| Solar Industries | 125092.52 | 13823.90 | 111.50 | 0.06 |

| Bharat Dynamics | 65504.70 | 1787.00 | 115.73 | 0.29 |

| Cochin Shipyard | 47278.25 | 1797.10 | 57.45 | 0.56 |

| Garden Reach Sh. | 25923.05 | 2263.00 | 49.14 | 0.42 |

| Zen Technologies | 15433.33 | 1709.30 | 72.62 | 0.06 |

| Data Pattern | 14631.14 | 2613.45 | 81.82 | 0.25 |

| Azad Engineering | 11542.34 | 1787.25 | 150.60 | 0.00 |

Data available is as of 15.05.25.

Comparative Analysis of the Defense Stocks

- Market Leaders: Hindustan Aeronautics (largest market cap) and Bharat Electronics show strong market presence with relatively lower P/E ratios (~39 and ~51), indicating more reasonable valuations among top defense stocks.

- High Valuation, High Expectations: Solar Industries, Bharat Dynamics, and Azad Engineering have very high P/E ratios (above 110), signaling the market expects strong future growth but valuations are expensive, which could mean higher risk.

- Mid-sized & Private Sector Opportunities: Mazagon Dock, Cochin Shipyard, Zen Technologies, and Data Patterns have moderate market caps with P/E ratios ranging from 46 to 82, balancing growth potential with current earnings, making them attractive for investors seeking a mix of stability and growth.

Historical & Recent Performance Table of Defense Stocks in India

| Event/Period | Date | Stock/Index Movement | Key Drivers/Notes |

| India-Pakistan Tensions | Apr–May 2025 | Sector gained ₹86,000 Cr in value | Triggered by post-Kashmir attack response and military ops |

| Stocks rose 20%–40% (Paras, BDL, GRSE, etc.) | Focus on missile, drone, UAV success | ||

| Nifty Defence Index ↑ 9.39% vs Nifty50 ↑ 1.98% | Sector clearly outperformed broader market | ||

| Defense ETFs up 7% (Groww, Motilal Oswal) | High investor interest in themed ETFs | ||

| Kargil War | May–Jul 1999 | Sensex ↑ ~30% post-conflict | Massive increase in defense allocation |

| Long-Term Growth Trends | 2019–2025 | Consistent export rise and private sector participation | Boost from ‘Make in India’ and Atmanirbhar Bharat push |

| Recent Risks & Corrections | Q1 2025 | HAL posted profit dip due to supply delays | Execution risks, overvaluation, profit booking observed |

Interpretation

- During Conflict: Defense stocks surge, driven by patriotic sentiment, institutional buying, and expectation of future orders.

- Post-Conflict: Budget reallocations toward defense tech provide tailwinds.

- Long-Term: Structural reforms and export focus make the sector attractive.

- Risks: Overvaluation, project execution delays, and one-time spikes create volatility for retail investors.

Risks to Keep in Mind Before Investing in Top Defense Stocks

- Dependence on Government Orders: Most Indian defense companies, especially the big public ones like HAL and BEL, get most of their business from the government. If the government changes its buying plans or delays contracts, these companies’ earnings and stock prices can take a hit.

- Unpredictable Global Politics: Tensions or conflicts can make defense stocks jump temporarily. But long conflicts can hurt the economy and cause delays. Just because there’s a border clash doesn’t mean companies will get orders right away.

- Delays and Project Risks: Defense sector projects take time and can run late, like HAL’s fighter jets or shipbuilding at Mazagon Dock. Delays mean extra costs and can make investors nervous. Also, new tech products take years to develop and test, which adds risk.

- Money-Heavy Business & Low Trading: Building defense equipment needs lots of money and patience. Plus, some stocks don’t trade much daily, so they can be volatile and risky for quick buyers.

- Ethical Concerns and Fund Restrictions: Some big investment funds avoid defense stocks because of ethical rules, which can limit how much money flows into these companies.

- Stock Jumps After Conflicts: Sometimes stocks shoot up after military actions or border fights, but these are usually short-term hype. Real gains come only when actual government orders follow.

When to Invest in Defense Stocks?

- Before elections or budget announcements when defense sector spending is highlighted.

- Right after big contract wins or government partnerships are announced.

- During defense expos or when new defense stock indexes launch.

- During tense geopolitical times, but only if backed by real business, not just news headlines.

What About War-Like Situations?

Defense stocks often spike after big incidents like airstrikes or clashes, but these rises usually don’t last. So, don’t buy just because of headlines. Wait for solid contracts and long-term growth signs.

Suggested Read: India-Pakistan War Shocking Economic Impact on Indian Stock Market (2025 Analysis)

Who Should Invest in Defense Stocks

- Long-Term Investors: If you’re building a portfolio with a 5–10 year horizon, defense stocks like HAL, BEL, and Solar Industries offer strong compounding potential due to government contracts and India’s modernization push.

- Thematic or Sector-Based Investors: Investors who believe in the Make in India movement and want exposure to strategic sectors with geopolitical relevance should consider defense sector as a high-growth theme.

- Experienced Retail Investors: Those who understand government policy cycles, budget trends, and sector-specific news can tactically invest in PSUs or dual-use tech defense firms.

- Value or Dividend Seekers: Many defense PSUs like BEL and BDL offer regular dividends and are undervalued compared to private peers.

- Investors in ETFs/Funds: Those preferring diversified exposure can opt for instruments like the Motilal Defence Fund or upcoming defense sector ETFs tied to the Nifty India Defence Index.

Who Should Avoid Defense Stocks

- Short-Term Traders Expecting Quick Gains: Defense stocks often move on government policies or event-driven spikes, but may stay stagnant for long periods between orders.

- ESG-Focused Investors: If you strictly follow ethical investing frameworks, many global ESG funds exclude defense and weapons-related companies.

- Low-Risk or Conservative Investors: Due to capital intensity, regulatory dependencies, and volatile earnings, these are not ideal for risk-averse profiles like retirees or FD-oriented savers.

- Investors Without Sectoral Knowledge: Understanding MoD policies, DRDO collaborations, and defense acquisition timelines is crucial. Blindly investing in a “hot” theme can be risky without proper context.

Bottom Line

The Indian defense sector in 2025 is definitely one to watch—booming with government backing, tech innovation, and global export ambitions. Whether you’re a long-term investor eyeing steady growth or someone looking to back India’s self-reliance journey, defense stocks offer exciting opportunities. But remember, this isn’t your usual quick-win game.

Delays, government dependencies, and geopolitical twists mean patience and understanding the sector’s rhythm are key. Keep an eye on contract wins, budget announcements, and real business updates; not just the headlines or border skirmishes.

For those who do their homework, defense stocks could be a powerful addition to a diversified portfolio.

And now, for a little defense humor to wrap up: Why don’t defense stocks ever get lost? Because they always have a strong defense strategy!

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

Which is the best defence stock in India?

Some of the most prominent defense companies in India are engaged in aerospace, electronics, shipbuilding, and advanced weapons technology.

Their performance and scale are often aligned with national procurement plans and modernization efforts under government initiatives.

Which is the largest Defence company in India?

India’s largest defense organizations are involved in producing combat aircraft, missile systems, and naval platforms.

These companies often work closely with the Ministry of Defence and DRDO on large-scale strategic projects.

Are Defence stocks a good buy?

Defense sector stocks are known for their long-term strategic importance, especially amid rising budget allocations and global security concerns.

However, they are subject to policy cycles, contract delays, and global supply chain fluctuations, making due diligence critical.

What is the future of Defence stocks in India 2025?

India’s defense industry is poised for growth in 2025, driven by a record ₹6.81 lakh crore budget, increased capital spending, rising exports, and expanded private-sector participation.

Long-term structural reforms support innovation and indigenous production.

Which sector is growing fast in India?

Beyond defense, fast-growing sectors in India include electric vehicles (EVs), renewable energy, semiconductors, artificial intelligence, and fintech; each supported by policy incentives and digital infrastructure development.