Mutual fund industry has shown spectacular growth over the years especially in 2024. Envision the thrill of watching your investments fly up, that’s exactly what is happening in the mutual fund industry.

In just the first half of 2024, the Asset Under Management (AUM) of equity mutual funds skyrocketed by 23%, that is from Rs.22.50 lakh crore in January to Rs.27.67 lakh crore by June.

These numbers reflect investors’ confidence in the growth and opportunities of the Mutual Fund Industry. For investors with long-term financial goals, lumpsum investments could be their go to choice as they allow money to grow and compound over time.

Let’s delve into the blog to know more about the lumpsum investments and discover the top 5 mutual funds for such investments.

What are Lumpsum Investments?

It is a one-time payment or investment in Mutual funds at the beginning of the investment period. Lumpsum Investments allow money to compound over a time that makes it suitable to meet long-term financial goals.

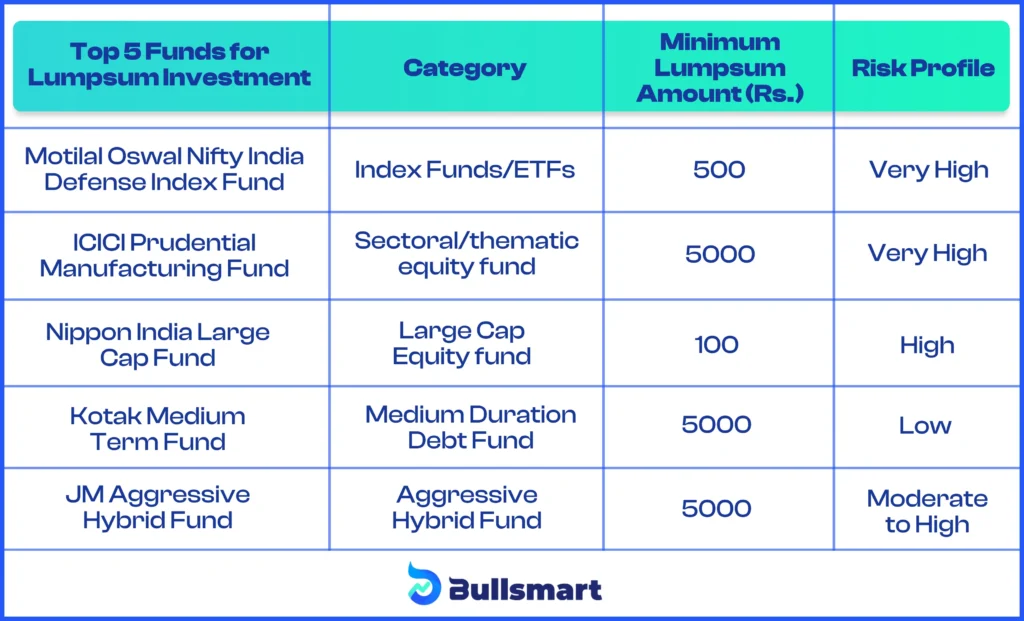

Top 5 Mutual funds for Lumpsum Investment

Let’s have a quick sneak peek into top 5 mutual funds for lumpsum investment:

1. Motilal Oswal Nifty India Defense Index Fund

The rise of geopolitical tensions has led governments, including Indian government to focus on increasing their investment in the defense sector, thereby driving its growth.

In the interim budget for 2024-25, Union finance minister allocated a whooping Rs.6.22 lakh crore to the defense sector, which is approximately 12.9% of total Budget and it is 4.79% higher compared to last year’s Budget estimates.

This surge in investment signals robust growth prospects for the defense sector, presenting a golden opportunity for investors.

A fund focusing solely on this sector such as “Motilal Oswal Nifty India Defense Index Fund” offers positive returns and a lumpsum investment into this fund could be advantageous in the coming years for investors.

2. ICICI Prudential Manufacturing Fund

The Union Budget 2024 emphasized transforming India into a developed economy by focusing on the manufacturing sector. The manufacturing sector has attracted substantial government investments and is boosting economic growth.

Key measures such as Make in India, adjustments in custom duty, sector specific initiatives and MSME support makes it an appealing option for investors.

A standout option is “ICICI Prudential Manufacturing Fund” from one of the top fund houses which solely focus on this sector.

A Lumpsum investment in this fund can grow your money through the power of compounding, that rides on promising growth of manufacturing sector.

3. Nippon India Large Cap Fund

Large cap funds offer stable returns as funds are invested in top companies and they carry less risk than mid and small cap companies.

One of the top funds under this category is Nippon India Large Cap Fund where it holds an AUM of 29533.68 Cr.

Investing a Lumpsum in this fund for medium to long term can be highly rewarding as the fund generated phenomenal returns of 31.87%, 20.94%, 15.91% over 1yr, 3yr and 5yr respectively, outperforming others in the category.

4. Kotak Medium Term Fund

Investors looking for a safer lumpsum option can consider adding the Kotak Medium Term Fund to their portfolio, as it balances long-term and short-term bonds.

The fund aims to generate regular income and capital appreciation with an average maturity of 3-7 years. By operating on a Hold-Till-Maturity strategy, it offers stability and predictable returns, making it an attractive choice for lumpsum investments.

5. JM Aggressive Hybrid Fund

Aggressive hybrid funds are the talk of the town recently, many top fund managers and market experts highlighting their potential.

Strategic asset allocation and risk management have driven the exceptional performance of these funds, making them attractive for investors with higher risk appetite.

The JM Aggressive Hybrid fund is top performer in this category, where it delivered 53.14% returns over the last year significantly higher than the category average of 30.97%.

A lumpsum investment in this fund has potential to give stellar returns to investors.

Conclusion

The top 5 mutual funds mentioned above can be beneficial additions to your portfolio. They cover funds from different categories and come with varying risk profiles. Investors can choose funds based on their risk appetite.

It is always necessary for investors to conduct research or consult financial advisors to pick the top 5 mutual funds that best suit your investment objectives and financial goals.