Stablecoin and CBDC are two buzzwords that keep popping up when people talk about the future of money in India. With digital payments becoming the norm worldwide, India is trying to figure out how to join the party without losing control over its own currency.

The Reserve Bank of India has already started testing its digital rupee, while discussions about rupee-backed stablecoins are gaining steam. Both have big potential to make paying and transferring money quicker and simpler.

But they also raise some important questions:

- How can India encourage these new ideas without risking financial security?

- What kind of rules will keep things safe for everyone?

With 2025 just around the corner, these questions matter more than ever. The choices India makes now will shape how money works for millions in the years to come.

Getting a clear picture of stablecoins and CBDCs helps understand what’s next for the country’s money system.

Let’s dive right in!

What are Stablecoins?

Stablecoins are a special type of cryptocurrency that try to keep their value steady. Unlike regular cryptocurrencies like Bitcoin, which can jump up and down in price, stablecoins are designed to hold a stable value by linking themselves to traditional currencies like the US dollar.

There are a few types of stablecoins: some are backed directly by real money held in reserve (like USDT or USDC), others use other cryptocurrencies as collateral, and some use computer programs to try to keep their price steady. However, the last type can be less reliable.

People use stablecoins mostly for quick payments, sending money across borders, or trading on crypto platforms without worrying about big price swings.

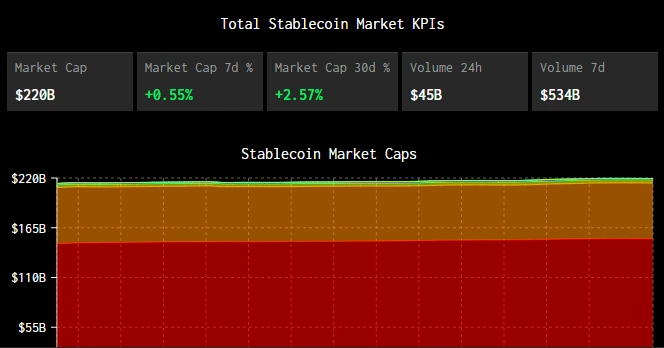

Image Source: Stablecoins.wtf

Global Stable-coin Adoption Overview

This table provides an overview of countries where stablecoins have seen significant adoption, along with the year they began to gain traction and notable aspects of their usage:

| Country | Initiation Year | Notable Details |

| United States | 2014 | Home to major stablecoins like Tether (USDT) and USD Coin (USDC); regulatory frameworks evolving. |

| India | 2017 | High adoption for remittances and trading; regulatory discussions ongoing. |

| Nigeria | 2018 | Significant use for cross-border payments and as a hedge against currency devaluation. |

| Brazil | 2019 | Growing adoption in e-commerce and remittances; regulatory frameworks being developed. |

| Turkey | 2018 | Stablecoins used to combat inflation and currency instability. |

| Argentina | 2019 | Adoption driven by economic instability; used as a store of value. |

| Indonesia | 2018 | Increasing use in digital payments and remittances; regulatory environment maturing. |

| Hong Kong | 2024 | Passed a stablecoin bill establishing a licensing framework for issuers. |

| Singapore | 2019 | Early adopter with clear regulatory guidelines; hub for stablecoin innovation. |

| United Arab Emirates | 2020 | Active development of digital assets; exploring stablecoin use in cross-border transactions. |

| Pakistan | 2025 | Recent initiatives to embrace stablecoins and digital assets; establishment of regulatory bodies. |

| Vietnam | 2019 | High crypto ownership rates; stablecoins used for savings and remittances. |

| Mexico | 2019 | Growing use of stablecoins for remittances and as a hedge against currency volatility. |

| Venezuela | 2018 | Adoption driven by hyperinflation; stablecoins used as a store of value. |

| Kenya | 2023 | Rapid increase in crypto adoption; stablecoins used for peer-to-peer transactions. |

| Ukraine | 2019 | Significant crypto adoption amid economic challenges; stablecoins used for donations and savings. |

| South Africa | 2020 | Stablecoins used for peer-to-peer transfers and small business operations. |

| Russia | 2018 | Stablecoins used to circumvent financial restrictions; growing adoption in trading. |

| Switzerland | 2022 | City of Lugano partners with Tether to accept stablecoins for municipal services. |

| Philippines | 2019 | Stablecoins used for remittances and as an alternative to traditional banking. |

Suggested Read: Pi Coin Mainnet Launch 2025: A Game-Changing Moment for Pi Network

List of Stablecoins and Price in India

Here is a table of prominent stable-coins available in India, along with their approximate prices in Indian Rupees (INR):

| Stablecoin Name | Ticker | Price (INR) | Notes |

| Tether | USDT | ₹85.67 | Widely used for trading and remittances. |

| USD Coin | USDC | ₹85.62 | Known for regulatory compliance and transparency. |

| Pax Dollar | USDP | ₹85.08 | Issued by Paxos, emphasizing regulatory oversight. |

| Dai | DAI | ₹85.62 | Decentralized, crypto-collateralized stablecoin. |

| TrueUSD | TUSD | ₹85.61 | Offers real-time reserve attestations. |

| PayPal USD | PYUSD | ₹85.64 | Issued by PayPal, focusing on digital payments. |

| Binance USD | BUSD | ₹85.22 | Previously issued by Paxos; support has been phased out. |

| sUSD | SUSD | ₹94.18 | Synthetic USD backed by crypto assets. |

| Gemini Dollar | GUSD | ₹85.68 | Issued by Gemini exchange, targeting regulated markets. |

| Euro Coin | EURC | ₹96.76 | Euro-pegged stablecoin issued by Circle. |

| Tether Gold | XAUT | ₹2,82,222.75 | Gold-backed token representing one troy ounce of gold. |

Data available is as of 28.05.25.

Note: Prices are approximate and subject to market fluctuations.

What is a CBDC?

A Central Bank Digital Currency, or CBDC, is a digital form of a country’s official money, created and managed by the government’s central bank. Unlike stablecoins, which are made by private companies, CBDCs are the digital version of real money you already use.

India’s digital rupee, called the e₹, is an example of a CBDC. It’s meant to make everyday payments easier and faster while helping the government keep track of the money flow.

CBDCs aim to improve payment systems, bring more people into the formal financial system, and help the central bank carry out monetary policies more effectively.

CBDC India Pilot Timeline: e₹-W and e₹-R

| Phase | Date | Details |

| Concept Exploration | 2017–2021 | RBI begins studying CBDC; government considers legal framework |

| Concept Note Released | Oct 7, 2022 | RBI publishes official CBDC concept note outlining objectives and design considerations |

| Wholesale Pilot (e₹-W) | Nov 1, 2022 | Launched for interbank government securities settlement; 9 major banks participated |

| Retail Pilot Launch | Dec 1, 2022 | Retail e₹ launched in 4 cities with 4 banks (SBI, ICICI, Yes Bank, IDFC First) |

| Retail Expansion | Jan–Mar 2023 | Added 4 more banks and expanded to 4 more cities |

| Adoption Milestone | Dec 2023 | Reached 1 million daily transactions; ~1.46M users and 3L+ merchants |

| Offline & Programmable e₹ | 2023–Early 2024 | RBI tests offline mode and programmable features for targeted use cases |

| Wider Distribution | April 2024 | Non-bank apps (Paytm, PhonePe, GPay) integrated; user base grows to 4.3M, merchants to 4M |

Key Differences Between Stablecoins & CBDCs

Check the key differences between both in the table below:

| Feature | Stablecoins | CBDCs (e.g., Digital Rupee) |

| Issuer | Private entities (e.g., Circle for USDC, Tether for USDT) or decentralized organizations (e.g., MakerDAO for DAI) | Central banks (e.g., Reserve Bank of India for the Digital Rupee) |

| Backing Mechanism | Typically backed by fiat reserves, commodities, or cryptocurrencies; some use algorithms to maintain stability (e.g., TerraUSD) | Fully backed by the issuing central bank’s reserves; represents a direct liability of the central bank |

| Legal Status | Not recognized as legal tender; acceptance is voluntary and based on mutual agreement between parties | Recognized as legal tender; must be accepted for all debts and payments within the jurisdiction |

| Regulatory Oversight | Subject to varying degrees of regulation depending on jurisdiction; oversight often focuses on reserve audits and compliance with financial laws | Subject to comprehensive regulation by the issuing central bank; encompasses monetary policy, financial stability, and legal frameworks |

| Monetary Policy Impact | Limited direct impact; however, widespread use could influence monetary policy effectiveness and financial stability | Integral tool for implementing monetary policy; allows for direct control over money supply and interest rates |

| Use Cases | Primarily used for trading, remittances, and as a medium of exchange within decentralized finance (DeFi) platforms | Designed for a wide range of uses including retail payments, government disbursements, and enhancing financial inclusion |

| Transaction Finality | Depends on the underlying blockchain; finality can vary and may be subject to network congestion or reversibility issues | Offers near-instant settlement with finality guaranteed by the central bank |

| Privacy | Varies by design; some stable-coins offer pseudonymity, while others may implement Know Your Customer (KYC) and Anti-Money Laundering (AML) measures | Typically designed with traceability to comply with regulatory requirements; degree of user privacy depends on the specific implementation and policies of the central bank |

| Technology Platform | Built on existing blockchain platforms like Ethereum, Binance Smart Chain, or Solana; leverages smart contracts for functionality | May utilize blockchain or other distributed ledger technologies; infrastructure is often developed or approved by the central bank to meet specific requirements |

| Risk Factors | Subject to counterparty risk, reserve mismanagement, and potential de-pegging from the underlying asset; regulatory uncertainties can also pose risks | Considered low-risk due to backing by the central bank; however, concerns include cybersecurity threats, potential for misuse of transaction data, and the impact on traditional banking systems |

India’s CBDC (e₹): What’s the Vision and How’s the Rollout Going?

India’s digital rupee journey kicked off with the Reserve Bank of India running two pilot programs; one aimed at big banks (wholesale) and another for everyday users (retail).

The wholesale pilot focused on smooth interbank transactions, while the retail version let a select group of people pay using mobile wallets in a closed test environment.

By early 2024, over 1.3 million transactions had already happened on the retail side, involving big names like SBI, ICICI, and HDFC.

From petrol stations to local Kirana stores, many merchants joined in to test how this new digital cash could work in real life.

The goal? To cut down on cash usage, make money smarter and trackable, lower payment costs, and keep India’s financial control strong.

While the rollout showed great promise in making cash-heavy sectors digital and raised public awareness, there were some bumps, like limited infrastructure, confusion about wallets, and unclear incentives for merchants.

Still, the RBI is laying solid groundwork. The plan is to grow the digital rupee alongside popular payment systems like UPI, blending the best features of public and sovereign money networks.

Rupee-Backed Stablecoins: A Big Opportunity or a Risk for India?

There’s growing excitement among fintech experts and crypto enthusiasts about the possibility of rupee-backed stable-coins. Many see them not as rivals to India’s digital rupee but as potential partners that could bring new benefits.

What Makes Rupee-Backed Stable-coins Interesting

- Cross-Border Trade: Could reduce India’s dependence on the US dollar for regional payments.

- DeFi Access: Allow Indian users and platforms to join global decentralized finance without currency conversion hassles.

- Programmable Payroll: Startups and freelancers could receive payments in rupee stable-coins, making transactions smoother and faster.

Risks & Considerations

- Capital Flight: Stable-coins might be used to bypass foreign exchange controls, leading to money leaving the country unchecked.

- Dollarization Threat: USD-backed stablecoins like USDT could dominate, overshadowing India’s own digital currency efforts.

- Regulatory Challenges: Without clear rules, these stablecoins could disrupt monetary policy and financial stability.

Legal experts like Cyril Amarchand suggest using a regulatory sandbox approach, testing rupee-backed stable-coins in limited environments before a full rollout, to manage these risks carefully.

Comparison: e₹ vs. USDT vs. INR-Backed Stablecoin

| Feature | Digital Rupee (e₹) | Tether (USDT) | INR-Backed Stable-coin |

| Issuer | Reserve Bank of India (RBI) | Tether Limited, a private company | Private Indian entities (e.g., INRGrid, INRC) |

| Pegged To | Indian Rupee (INR) | US Dollar (USD) | Indian Rupee (INR) |

| Legal Status in India | Legal tender; regulated by RBI | Not legal tender; permitted under Virtual Digital Asset (VDA) framework with taxation | Not legal tender; operates in a regulatory grey area |

| Regulatory Oversight | Fully regulated by RBI | Subject to varying degrees of regulation globally; limited oversight in India | Limited regulation; subject to future RBI guidelines |

| Use Cases | Domestic retail and wholesale transactions, government disbursements, financial inclusion | Crypto trading, cross-border payments, decentralized finance (DeFi) | Potential for domestic payments, remittances, and integration with DeFi platforms |

| Technology Platform | RBI’s proprietary platform; exploring blockchain and distributed ledger technologies | Primarily operates on Ethereum and Tron blockchains | Typically built on Ethereum or other blockchain platforms |

| Monetary Policy Impact | Direct tool for implementing monetary policy and reducing reliance on cash | Minimal direct impact; widespread use could influence monetary policy effectiveness | Potential to affect monetary policy if widely adopted without regulation |

| Transaction Finality | Near-instant settlement with finality guaranteed by RBI | Depends on blockchain network; subject to network congestion and confirmation times | Varies based on underlying blockchain; generally offers quick settlement |

| Privacy | Designed with traceability to comply with regulatory requirements; degree of user privacy depends on RBI policies | Varies by design; some offer pseudonymity, others implement Know Your Customer (KYC) and Anti-Money Laundering (AML) measures | Varies by design; privacy features depend on the specific implementation and regulatory compliance |

| Interest Bearing | No; functions as a digital equivalent of cash | No; designed to maintain a stable value equal to USD | No; designed to maintain a stable value equal to INR |

| Availability in India | Available through select pilot programs with participating banks | Widely available on Indian crypto exchanges like WazirX, CoinDCX, and CoinSwitch | Limited availability; emerging platforms are exploring INR-backed stable-coin offerings |

| Price Stability | Maintains a 1:1 value with INR; backed by RBI reserves | Aims to maintain a 1:1 value with USD; backed by a mix of reserves | Aims to maintain a 1:1 value with INR; backing mechanisms vary by issuer |

| Risk Factors | Low risk due to central bank backing; concerns include cybersecurity threats and technological infrastructure | Subject to counterparty risk, reserve transparency issues, and regulatory uncertainties | Risks include regulatory ambiguity, reserve management, and potential for misuse |

Why RBI is Cautious About Stablecoins

The Reserve Bank of India (RBI) has been pretty clear about its worries about stable-coins. According to a recent SwarajyaMag report, here are the main reasons the RBI is cautious:

- Financial Stability: Stable-coins act like bank deposits but don’t follow the same rules. This could mess with how banks lend money.

- Monetary Control: If lots of people start using stable-coins backed by foreign currencies like USDC, the RBI might lose some control over India’s money supply.

- Illegal Activities: Without proper checks, stable-coins could be used for tax evasion, money laundering, or black-market deals.

An editorial on Moneycontrol called “Stable-coins are Bank Deposits” sums up the RBI’s fear that stable-coins might pull money away from regular banks, weakening the banking system.

On taxes, GoodReturns points out that India taxes virtual digital assets at 30% plus 1% TDS, but paying salaries for stable-coins is still unclear and tricky for startups.

While the RBI’s concerns make sense, outright banning stable-coins might stop India from playing a role in the future of global finance. A careful, balanced approach to regulation could be the best path forward.

Global Regulatory Trends and India’s Response

Globally, regulators are taking divergent approaches:

- Europe: Markets in Crypto Assets (MiCA) framework brings stablecoin issuance under strict reserve and transparency norms.

- Singapore: MAS has introduced clear licensing for stablecoin providers.

- USA: Ongoing Congressional debates aim to treat stable-coins as bank-like entities.

India’s Approach towards Stablecoin

India has neither fully banned nor embraced stable-coins. The government and RBI are waiting on the full framework under the Digital India Act and updates to the VDA bill.

As per Cyril Amarchand’s legal insights, India’s evolving stance is aimed at FATF compliance and global interoperability. FTI Consulting notes that while CBDC is a positive signal, lack of clarity around stable-coin regulations is causing uncertainty in the ecosystem.

Can Stablecoins and CBDCs Co-Exist in India?

Instead of seeing stablecoins and CBDCs as competitors, it’s better to think of them as partners playing different roles in India’s digital future.

The CBDC, which is India’s digital rupee, is perfect for everyday things like paying bills, government disbursements, and managing the country’s money flow.

Meanwhile, stable-coins shine in areas like decentralized finance (DeFi), international trade, remittances, and smart contracts that can automate payments.

Imagine a system where all three work together smoothly:

- UPI handling quick domestic money transfers

- The e₹ powering official government and bank-backed payments

- An INR-backed stablecoin opening doors to global DeFi and cross-border payments

Experts from Livemint and FTI believe India could lead the way by connecting these pieces, making a super-flexible, secure, and regulated payment network.

This would not only keep innovation local but also give Indian developers a chance to compete on the global stage.

Policy Recommendations and What’s Next

- Try Out Regulatory Sandboxes: RBI should let rupee-backed stable-coins be tested in safe, controlled environments like cross-border trade and fintech payrolls.

- Clear Tax Rules: It’s important to define how stable-coins are taxed; whether as digital assets, e-money, or deposits, and set clear rules for TDS, GST, and income reporting.

- Work Together on Infrastructure: Fintech companies, banks, and regulators should join forces to build open systems that connect stable-coins with IndiaStack smoothly.

- Keep Regulations Balanced: Too many strict rules might drive innovation away. The focus should be on helping local players grow with clear compliance paths.

As legal expert Cyril Amarchand says, India has a real chance to lead the way in regulated Web3 payments if the policies stay smart and future-ready.

Bottom Line

Could the Digital Rupee and Stablecoins Together Build India’s Digital Future?

India is at an important point in financial innovation. With the digital rupee (e₹) laying the groundwork and interest growing around rupee-backed stable-coins, the country could develop a digital economy with two different but connected paths.

CBDCs and stable-coins serve different purposes: one backed by the government, the other offering flexibility and wider use cases.

When they work together, they could support faster trade, new financial tools, and easier payments while staying within the rules.

Finding the right balance in regulation will play a big role in shaping how these digital currencies develop in India.

And who knows…maybe someday digital rupees and stable-coins will get along better than some relatives at a family gathering!

FAQs

Is stablecoin legal in India?

Yes, holding and trading stable-coins is legal in India. However, they are not recognized as legal tender, meaning you can’t use them to settle debts or make payments in the same way as the Indian Rupee.

The Reserve Bank of India (RBI) maintains a cautious stance, and the regulatory framework is still evolving.

What are the 4 types of stablecoins?

Stable-coins are categorized based on their backing mechanisms:

- Fiat-Collateralized: Backed by traditional currencies like the USD or INR. Example: Tether (USDT).

- Crypto-Collateralized: Backed by other cryptocurrencies, often over-collateralized to account for volatility. Example: DAI.

- Commodity-Backed: Pegged to tangible assets like gold or oil. Example: Paxos Gold (PAXG).

- Algorithmic: Use algorithms to control supply and maintain price stability, without direct backing.

What are the top 4 stablecoins?

As of 2025, the leading stablecoins by market capitalization are:

- Tether (USDT): The most widely used, pegged to the USD.

- USD Coin (USDC): Known for transparency and regulatory compliance.

- Dai (DAI): Decentralized and backed by crypto assets.

- PayPal USD (PYUSD): Issued by PayPal, gaining traction for payments.

What is the difference between CBDC and stablecoins?

CBDCs like India’s Digital Rupee are digital money issued and backed by the government. Stablecoins are digital coins created by private companies, linked to money or assets to keep their value stable.

CBDCs focus on public payments and economic control, while stablecoins are mainly used for crypto trading and cross-border transfers.

The big difference is trust: CBDCs are guaranteed by the state, stablecoins depend on their issuers.

How can I buy stablecoins in India?

You can purchase stablecoins like USDT or USDC through reputable crypto exchanges operating in India. Such platforms allow you to deposit INR via bank transfers or UPI and then trade for stablecoins.

Ensure the exchange is registered with the Financial Intelligence Unit (FIU) and complies with Know Your Customer (KYC) regulations.

Is it safe to keep money in stablecoins?

Stablecoins aim to maintain a stable value by pegging to assets like the US dollar, making them less volatile than other cryptocurrencies. However, they are not without risks.

Potential concerns include regulatory changes, the financial health of the issuing entity, and market liquidity.

It’s advisable to use stablecoins for short-term transactions or as a bridge between trades rather than long-term storage.

Is CBDC available in India?

Yes, the Reserve Bank of India (RBI) has introduced the Digital Rupee (e₹) under its CBDC initiative.

The retail pilot began in December 2022 and has expanded to include multiple banks and cities. Users can transact using the e₹ through participating banks’ digital wallets.

What is the price of 1 CBDC coin in India?

The Digital Rupee (e₹) is pegged 1:1 with the Indian Rupee. Therefore, 1 e₹ equals ₹1. It’s a digital representation of the physical currency and maintains the same value.

How to buy CBDC in India?

To acquire the Digital Rupee, you need to have an account with one of the participating banks like State Bank of India, ICICI Bank, Yes Bank, or IDFC First Bank.

Download the respective bank’s Digital Rupee app, complete the registration process, and you can load e₹ into your digital wallet for transactions.

What are the effects of CBDC in India?

The introduction of the Digital Rupee aims to enhance the efficiency of the payment system, reduce the cost of currency management, and promote financial inclusion.

It offers a secure and real-time payment option and can potentially reduce reliance on cash. However, widespread adoption requires addressing challenges like technological infrastructure and user awareness.