Transparency has always been at the heart of the Securities and Exchange Board of India’s approach to regulating the markets. Since its establishment in 1988, SEBI has consistently introduced reforms aimed at strengthening investor protection, improving disclosure standards, and building trust in India’s capital market ecosystem.

Over the years, these measures have shaped a more structured and accountable trading environment, giving investors greater confidence in how their transactions are handled.

Continuing in the same direction, SEBI is implementing a new set of rules effective from 14th October 2024. These changes are designed to refine market processes and enhance safeguards around investor assets. One notable impact of these rules is a reduction in certain operational roles and responsibilities traditionally handled by brokers.

By restructuring how specific processes are managed, SEBI aims to create a cleaner and more transparent framework. While brokers will continue to play a central role in trade execution and client servicing, some back-end functions will become more streamlined under the revised system.

What is the New Direct Payout Rule?

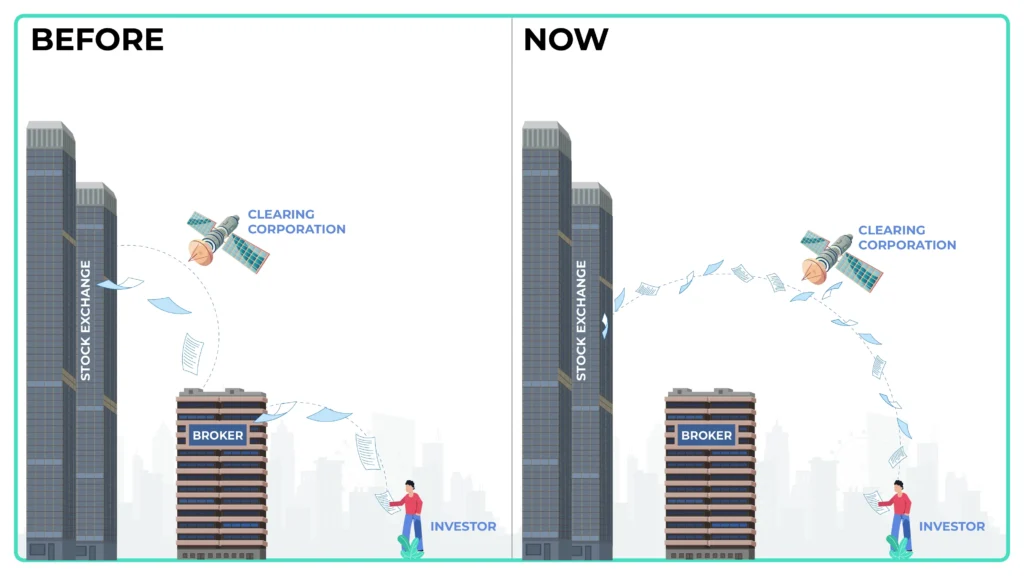

According to the new direct payout rule introduced by SEBI, the securities or stocks purchased by the investors will directly get credited to the investor’s demat account by the clearing corporation (CC).

Previously, the securities were first credited to the broker’s pool account and then they were transferred to the investor’s demat account. In this structure, the securities were temporarily held by the brokers, which carried a slight risk of misuse. However, all registered brokers are regulated by SEBI and cannot easily misuse the securities owned by the clients. Ultimately, removing the role of brokers as intermediaries for holding stocks and securities will add to the efficiency of the Indian stock market.

In cases of rejected payouts or inactive accounts, brokers may still temporarily receive securities, but these cases will be minimal.

The new direct payout rule will be implemented in two phases. The first phase was already rolled out on the 14th of January 2024, which only covers the equity cash segment and physical settlements.

By January 2025, the second phase will expand these changes to cover all types of transactions, including securities lending and borrowing (SLB) and offer for sale (OFS). Mutual fund transactions will not be affected at all by this change in the direct payout rule. Brokers will no longer be involved in handling pledges for margin trading; instead, the CC will manage these processes directly.

What Will be the Consequences?

For Investors:

The new SEBI direct payout rule will bring a more secure and transparent settlement process for investors. Since the Clearing Corporation (CC) will directly credit the securities into the investor’s demat account, the chances of any mishandling by the brokers during the settlement process are completely removed. Investors and traders will experience no change at all in their day-to-day activities.

This shift ensures that your investments are safer than ever before. For retail investors, the process will mostly be behind-the-scenes, so they won’t have to take any additional steps. The primary benefit will be a faster and more secure transaction process.

Additionally, this rule will reduce delays in crediting stocks to your demat account, enhancing your overall trading experience. Since the broker no longer holds any control over your stocks after purchase, the risk of misuse during the settlement process is eliminated.

For Brokers:

The new regulations will reduce the responsibilities of brokers, particularly when it comes to holding and managing clients’ securities. Brokers will now focus more on executing trades and facilitating financial services rather than acting as intermediaries in the settlement process. This could also shift the operational framework for brokers, pushing them toward better client-facing services and technology-driven trading platforms.

In the long term, brokers may experience reduced operational costs because they no longer need to manage large volumes of securities through their pool accounts. However, it may also lead to a slight shift in their traditional revenue models.

Will It Reduce the Fees?

One may think that if the brokers are removed from the settlement process, this will also remove the fees that the investors have to pay to the brokers. However, nothing like that is going to happen. This can only happen if your broker decides to reduce brokerage.

The new direct payout rule isn’t designed specifically to reduce fees, but it could potentially influence brokerage charges in the future. By reducing the role of brokers in the settlement process, some operational costs for brokers might decrease. If brokerage firms choose to pass these cost savings to investors, there could be a reduction in transaction fees. However, this is not guaranteed and will vary based on the business models of individual brokers.

What will likely remain unchanged are the regulatory fees, such as Securities Transaction Tax (STT) and other government-imposed charges. So, while investors might experience safer transactions, any reductions in fees would depend on the brokerage’s pricing policies.

Conclusion

SEBI’s direct payout rule marks an important evolution in India’s stock market framework. By ensuring that securities are credited directly to an investor’s demat account instead of being routed through the broker’s pool account, the regulator has strengthened transparency and asset security.

For investors, this reduces counterparty risk and minimizes the possibility of misuse or delays in credit of securities. The process becomes cleaner, more accountable, and aligned with the core principle that investor assets should always remain under the investor’s control.

For brokers, the shift streamlines operations. With reduced involvement in holding and transferring securities, the focus can move more toward efficient trade execution, risk management, and client servicing rather than heavy back-office handling.

While the rule may not immediately impact brokerage costs, it improves structural safety and enhances trust in the system. Over time, such reforms can contribute to a more robust and efficient transaction ecosystem.

Overall, the direct payout framework reflects SEBI’s continued effort to modernize market infrastructure and prioritize investor protection in India’s rapidly growing capital markets.

Suggested Read – SEBI Approves New Asset Class

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.