India’s consumer market is growing at an incredible pace, and experts predict it will reach $4 trillion by 2030. With rising incomes, urbanisation, and increasing consumer spending driving this growth, sectors like consumer goods, healthcare, automobiles, and e-commerce are benefiting.

To tap into this massive opportunity, SBI Mutual Fund has launched their NFO – SBI Nifty India Consumption Index Fund, an open-ended scheme that tracks the Nifty India Consumption Index.

SBI Nifty India Consumption Index Fund NFO provides a great way to invest in India’s rapidly expanding consumption story by giving investors exposure to companies that are set to gain from this long-term trend.

Let’s explore the key details of SBI Nifty India Consumption Index Fund and how it can fit into your portfolio.

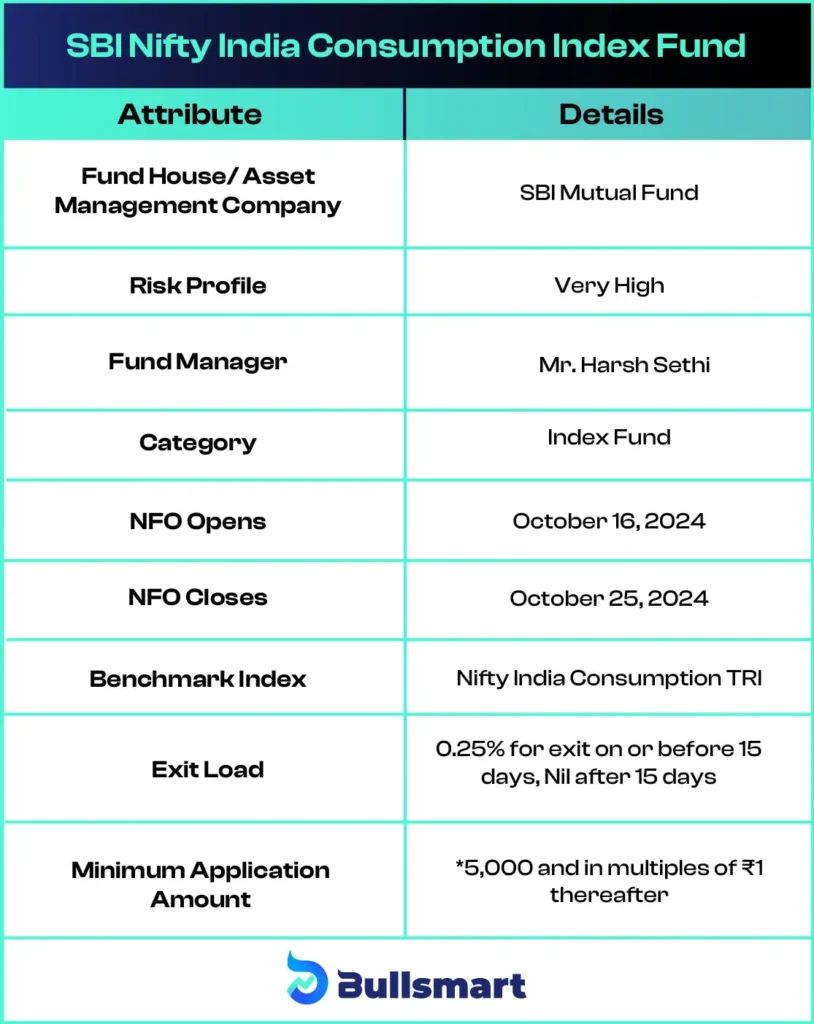

Details of SBI Nifty India Consumption Index Fund

The SBI Nifty India Consumption Index Fund allows investors to gain exposure to India’s growing consumption market. The fund replicates the Nifty India Consumption Index, which comprises 30 companies across various sectors, including Consumer Non-Durables, Healthcare, Automobiles, and Telecom Services.

The fund is benchmarked against the Nifty India Consumption TRI and aims to reflect the performance of companies that generate a significant portion of their revenue from domestic consumption.

Investment Objective of the Fund

The primary investment objective of SBI Nifty India Consumption Index Fund is to generate returns that correspond to the total returns of the securities as represented by the Nifty India Consumption Index, subject to tracking error. The fund provides investors with an opportunity to gain exposure to sectors poised to benefit from India’s rising consumption trends.

Here are the key details of SBI Nifty India Consumption Index Fund NFO:

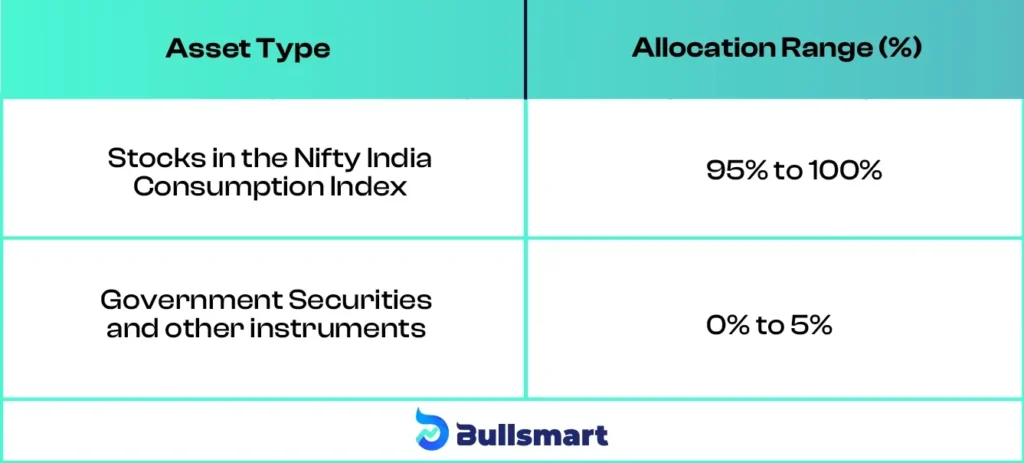

Investment strategy and portfolio construction

The asset allocation of the SBI Nifty India Consumption Index Fund NFO is as follows:

This allocation ensures that SBI Nifty India Consumption Index Fund NFO closely tracks the Nifty India Consumption Index while maintaining liquidity through minimal investments in government securities.

Navigating the risks and returns of fund

As an index fund that tracks the Nifty India Consumption Index, SBI Nifty India Consumption Index Fund carries a moderately high risk profile. While the consumption sector has long-term growth potential, short-term volatility may affect performance.

However, consumption-driven companies are expected to benefit from long-term trends, including rising income levels, urbanization, and increased discretionary spending.

The Nifty India Consumption TRI has achieved returns of 26.9% and 19.3% over the last 1 and 3 years.

Looking at a longer time frame, the Nifty India Consumption Index has outperformed larger market indices like the Nifty 500 in 12 out of the last 17 years.

Moreover, during market downturns, the consumption index typically sees smaller declines. As this is the fund’s benchmark, the aim is to match or surpass these returns.

SBI Mutual Fund

SBI Mutual Fund (SBIMF) is one of the leading asset management companies in India. It was established as a partnership between the State Bank of India and the French firm Amundi. As of June 30, 2024, it manages assets totaling ₹1,039,785.49 crore.

Founded on June 29, 1987, SBI Mutual Fund has a long track record of helping Indian investors grow their wealth. In 2004, SBI sold 37% of its stake to Amundi. The fund house is known for launching India’s first ‘Contra’ and ESG funds and has built strong public trust, offering a diverse range of 146 funds.

Among its popular schemes are the SBI PSU Fund, which has achieved the highest returns in the PSU Theme Fund category over the last three years, and the SBI Small Cap Fund, recognised for providing good protection against market volatility.

Meet the Fund Management team

The SBI Nifty India Consumption Index Fund NFO is managed by Mr Harsh Sethi, who brings significant expertise in managing index and ETF funds.

Mr. Harsh Sethi

Mr. Sethi has a Bachelor’s degree in Commerce (Hons.), and he is also a Chartered Accountant (CA) and Company Secretary (CS). He joined SBI Mutual Funds Management Private Limited (SBIFMPL) in May 2007 as a Product Manager, focusing on product development and management. Before that, he worked at J. P. Mangal & Co. as a Senior Assistant from March 2005 to March 2007, where he handled auditing and taxation tasks also managed top schemes SBI Nifty Smallcap 250 Index Fund & SBI Nifty Midcap 150 Index Fund.

Who Should Consider This Fund?

The SBI Nifty India Consumption Index Fund is ideal for:

- Investors seeking long-term capital appreciation through investments in consumption-driven companies

- Those looking for portfolio diversification through sector-focused index funds

- Investors with a moderately high-risk tolerance, willing to invest in a fund that tracks a specific sector of the economy

SBI Nifty India Consumption Index Fund NFO is a suitable option for those who believe in the long-term growth potential of India’s consumption sector and want to gain exposure to this theme through a diversified portfolio.

The SBI Nifty India Consumption Index Fund provides a convenient way to invest in the rising consumption trends in India, offering investors a strong opportunity to benefit from one of the key drivers of India’s economic growth.

Suggested Read – SBI innovative Opportunities Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.