Indian investors are increasingly inclined towards passive mutual funds, especially index funds. According to data from the Association of Mutual Funds in India (AMFI), the index funds category has seen the highest growth in Assets Under Management (AUM) over the last four years.

With such impressive growth, the trend toward index funds is hard to ignore. One NFO in this space is the SBI Nifty 500 Index Fund, an open-ended scheme tracking the Nifty 500 Index.

The category, which includes both equity and debt index funds, grew by 2,131% to Rs 2.3 lakh crore as of May 2024. Specifically, the AUM of equity index funds surged by 1,049% in this period.

SBI Nifty 500 Index Fund NFO provides a great opportunity for investors looking to participate in the overall market through a diversified basket of 500 companies, reflecting the performance of large, mid, and small-cap stocks in India.

Let’s explore if the fund aligns with your financial goals.

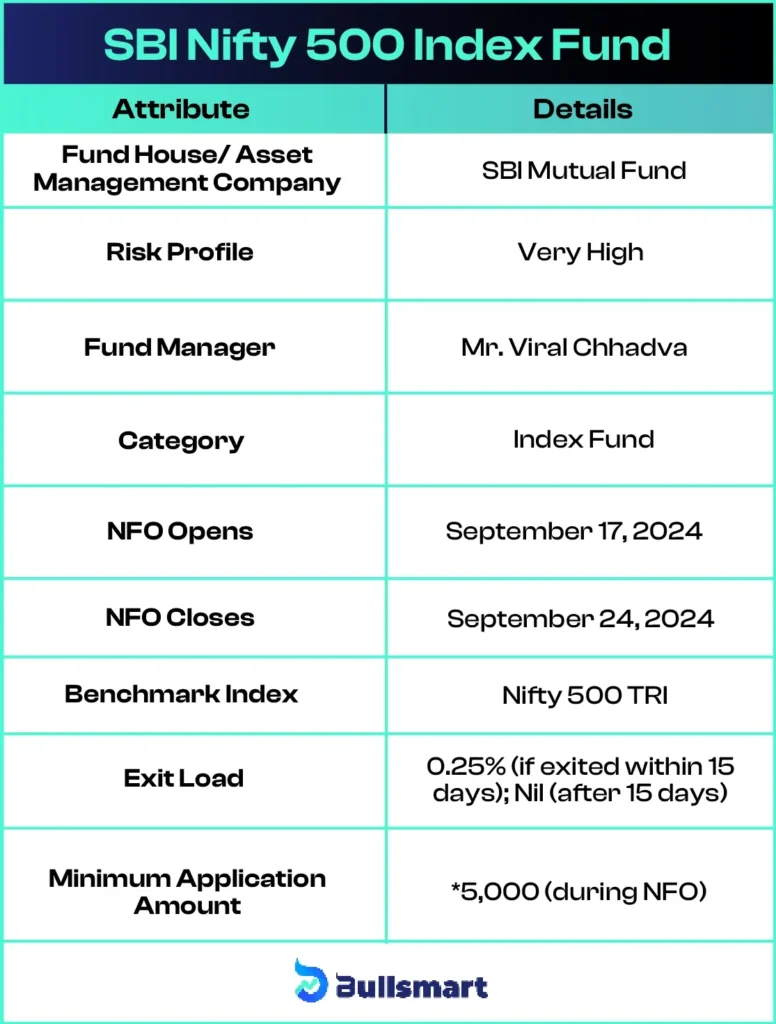

Key Facts About SBI Nifty 500 Index Fund

The SBI Nifty 500 Index Fund is an open-ended scheme that aims to replicate the Nifty 500 Index, which includes 500 companies across different sectors and market capitalizations.

The objective of the fund is to generate returns that closely mirror the performance of the Nifty 500 TRI (Total Return Index).

Understanding the NFO Fund’s Investment Goal

The scheme seeks to provide returns that correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. However, there is no guarantee that the fund’s objective will be achieved, and investors should be aware of the inherent risks.

Let’s take a quick look at the key basic details of the fund:

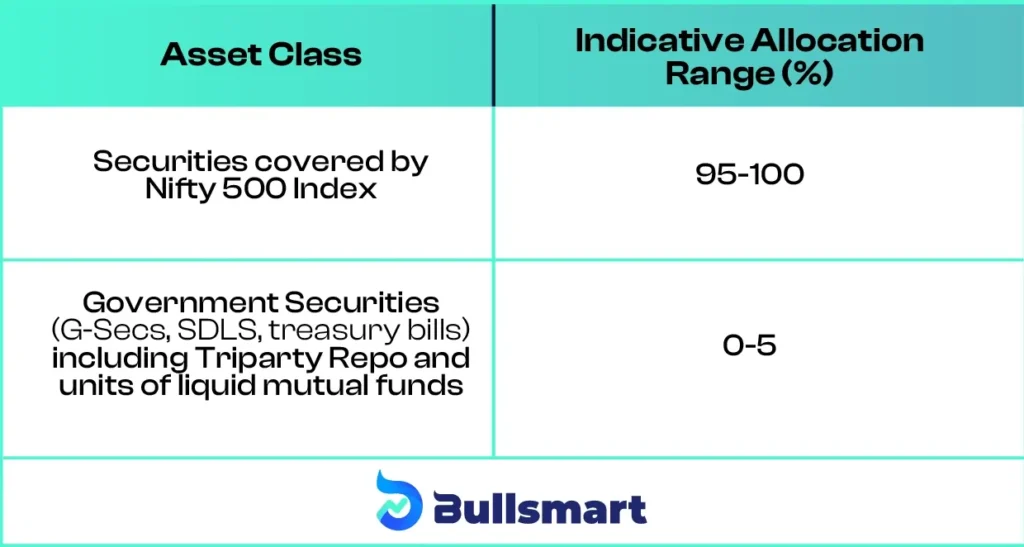

Portfolio Allocation

SBI Nifty 500 Index Fund NFO allocates its assets as follows:

Risks and Returns Explained

The SBI Nifty 500 Index Fund is designed to replicate the performance of the Nifty 500 Index, which inherently carries a very high-risk profile due to its equity-focused nature.

Investors should be prepared for market fluctuations as the fund will move in line with the index it tracks. However, the broad market exposure can provide long-term growth potential.

The Nifty 500 Index has delivered returns of 37.13%, 17.84%, and 22.62% in the last 1 year, 3 years, and 5 years.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Suggested Read – SBI Innovative Opportunities Fund Review

SBI Mutual Fund AMC

SBI Mutual Fund (SBIMF) is a leading asset management company in India. It was established as a partnership between the State Bank of India and the French asset manager Amundi. As of June 30, 2024, the company manages assets worth ₹1,039,785.49 crore.

Founded on June 29, 1987, SBI Mutual Fund has a long history of helping investors grow their wealth in India. In 2004, SBI sold a 37% stake in the company to Amundi.

The company is known for launching India’s first ‘Contra’ and ESG (Environmental, Social, and Governance) funds. With the backing of SBI, it has gained strong public trust and currently offers a diverse range of 146 funds.

Among its popular schemes, the SBI PSU Fund stands out for delivering the highest returns in the PSU Theme Fund category over the past three years. Additionally, the SBI Small Cap Fund is highly regarded for its ability to provide protection against market volatility.

Introducing the Fund Managers

Mr Viral Chhadva

Mr Viral Chhadva will manage the fund. Aged 40, he has managed the scheme since its inception and holds a CFA Charter and a Master’s in Financial Management. With over 17 years of experience, he also oversees the SBI Nifty50 Equal Weight Index Fund and SBI Nifty50 Equal Weight ETF.

Is SBI Nifty 500 Index Fund NFO Right for You?

The SBI Nifty 500 Index Fund is suitable for investors who:

- Are looking for long-term capital appreciation.

- Want to invest in a diversified portfolio that spans across large, mid, and small-cap companies

- Prefer a low-cost investment option that tracks a broad market index.

- Have a high-risk tolerance and are comfortable with market volatility.

- Want to invest in a fund with minimal active management, focusing on replicating an index

This fund is ideal for those who believe in the long-term growth potential of the Indian equity market and are seeking broad market exposure through a passive investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.