Many fund managers are buzzing about aggressive hybrid funds, where investors can enjoy the best of both worlds i.e., Equity growth and Debt stability. These types of funds are a smart choice for those who want to explore equities without taking on too much risk.

One standout option in this category is the SBI Equity Hybrid Fund, which holds the largest AUM among aggressive funds.

Let’s explore this fund to help you decide if it fits your investment goals.

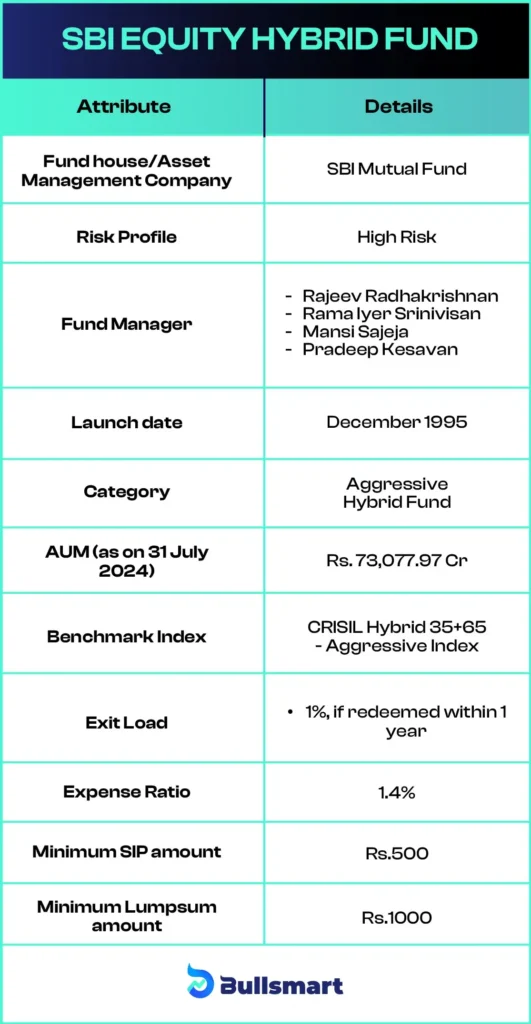

Details of SBI Equity Hybrid Fund

The SBI Equity Hybrid Fund is an open-ended aggressive hybrid fund launched by SBI Mutual Fund which one of India’s largest AMCs. As of July 31, 2024, this fund holds an AUM of ₹73,077.97 crores which is the highest in its category.

The fund has an expense ratio of 1.4% which is less than the category average of 2.02% making it more affordable to investors. The fund considers CRISIL Hybrid 35+65 – Aggressive Index as its benchmark index.

Let’s have a quick look at the key basic details of the fund:

Portfolio Construction

SBI Equity Hybrid Fund aggressively allocates 72.32% of its portfolio to equities, aiming for high-growth opportunities. The fund strategically spreads this across 51.75% in Large Cap stocks, 8.7% in Mid Cap stocks, and 4.94% in Small Cap stocks.

On the debt side, the fund maintains a balanced 21.44% allocation, with 12.29% in Government securities and 8.99% in low-risk securities. This mix ensures a robust balance between growth and stability.

The top 10 holdings of the fund are as follows:

Note: The holdings mentioned above are as of 31 July 2024.

How to invest in SBI Equity Hybrid fund?

Investors can tap into this fund through two flexible options: SIP or lump sum. With a minimum SIP investment of just ₹500 and a lump sum starting at ₹1,000, it’s accessible to a wide range of investors.

Investors can choose between two investment routes: the Direct Plan and the Regular Plan. The Direct Plan lets you invest directly with the fund house, cutting out the middleman. However, the Regular Plan involves investing through agents or intermediaries, offering guided assistance.

Meet the Fund Management Team

The fund is managed by a team of seasoned professionals, Rajeev Radhakrishnan, Rama Iyer Srinivisan, Mansi Sajeja, Pradeep Kesavan, where each bring significant experience to the table.

R Srinivasan has over 30 years of rich experience in the financial services. He has been associated with SBI Funds Management Limited since 2009.

Mr. Rajeev Radhakrishnan has over 22 years of experience in the Asset Management industry. Prior to joining SBI Mutual funds, he worked with UTI Asset Management

Ms.Mansi Sajeja joined SBI in 2009. Before joining SBI Funds Management Ltd, Mansi was a senior rating analyst at ICRA Limited for 3 years.

Mr. Pradeep Kesavan has over 18 years of experience in the financial services sector. Prior to joining SBI, he was associated with Elara Securities Private Limited, Accenture Solutions Private Limited and Morgan Stanley India Private Limited.

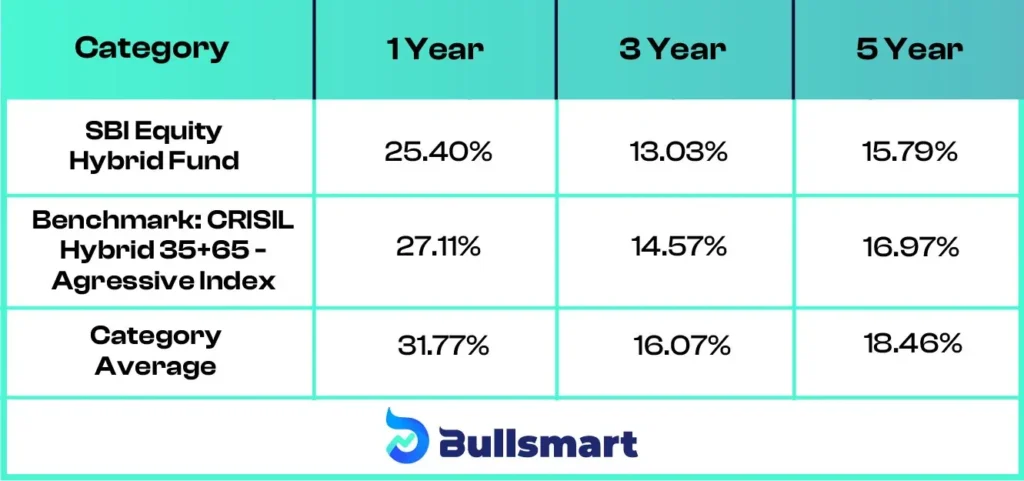

Analyzing the risks and returns of fund

SBI Equity Hybrid Fund is classified as a high-risk fund due to its aggressive focus on equity investments. While equities dominate the portfolio, a smaller yet strategic allocation to debt instruments adds a layer of stability in the pursuit of higher returns.

Let’s have a look at the returns generated by the fund and its benchmark over the years:

Note: The returns mentioned above are as of August 21, 2024. However past performance is not an indicator of future returns.

Suggested read: SBI Innovative Opportunities Fund NFO

Who should invest in this Fund?

SBI Equity Hybrid Fund strategically invests in a diverse range of high-growth equities and balances the risk by allocating the rest to fixed-income securities. Hence it is perfect for investors with a high-risk appetite who want to capitalize on equity growth while benefiting from the stability of debt instruments.

This fund is also perfect for those focused on long-term wealth creation, particularly with an investment horizon of over 5 years.

It is always advisable to conduct thorough research or consult a financial advisor before investing in the fund.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.