The Indian economy is growing right now and the consumption sector is the kind of sector that is most profitable at the moment. Since more people are spending time and with the emergence of a larger middle class. Let’s talk about the SBI Consumption Opportunities Fund, it is a great time to take part in the growth story.

It is a thematic fund that is also involved in the provision of capital to sectors that are growing rapidly, such as, the retail, hospitality, and consumer goods industries. The fund is structured to leverage the growth of the consumption sector and to harmonies with the expanding economy. In this blog, we will explore how this fund plans to profit from India’s growth and whether it could be the next win for your portfolio.

Ready to dive in? Let’s explore!

About the SBI Consumption Opportunities Fund

The SBI Consumption Opportunities Fund, which is an open-ended equity fund that invests in companies that are into consumption-led growth. The primary purpose is wrapped in enhancing your capital’s worth over the long term on sectors that involves individuals spending on goods that quench their daily needs of consumption (like soap, lentils, cooking oils, etc.).

SBI Consumption Opportunities Fund is incorporated by the SBI Mutual Fund, that is among the largest AMCs in India.

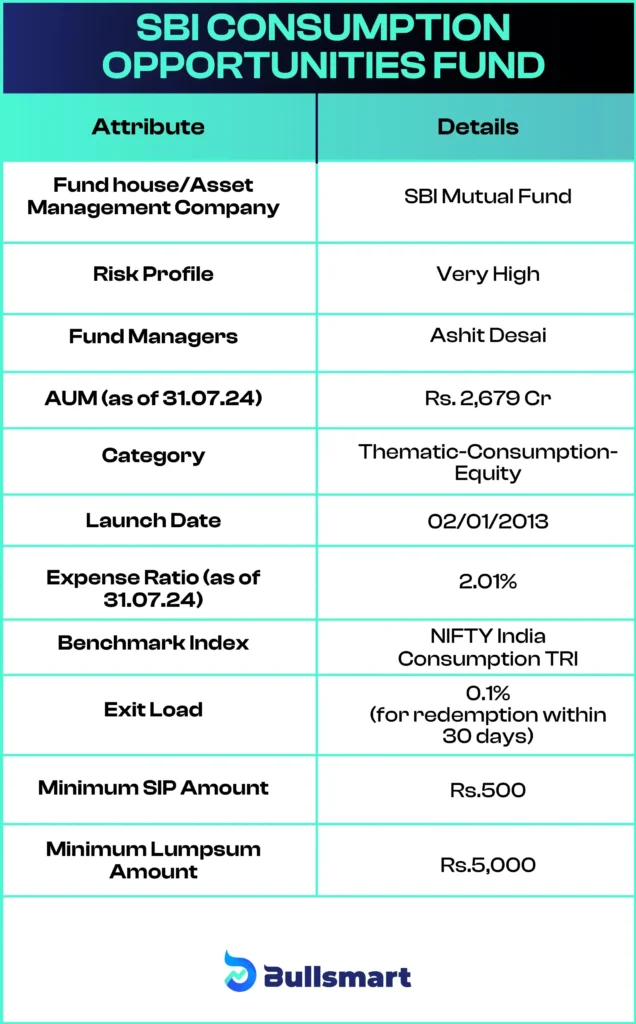

Here’s a quick rundown of what you need to know about the fund:

Caption: Data updated as of 03.09.24

Note: For the SBI Consumption Opportunities Fund’s regular plan, the 2.01% expense ratio is higher than the category average, indicating that it incurs slightly more management costs compared to other funds in its class.

The minimum investment amount for the SBI Consumption Opportunities Fund is Rs 5000 for lumpsum and Rs 500 for SIP. However, if you wish to make additional investments in the scheme, the minimum investment amount will be Rs 1000.

Portfolio Analysis

The fund allocates 96.44% of its investments to domestic equities, with 35.65% in large-cap stocks, 38.38% in mid-cap and 25.96% in small-cap stocks. The remaining 3.56% is held in cash equivalents. The fund currently holds 48 stocks in its portfolio.

These stocks pose as the major holders in this fund’s portfolio: Ganesha Ecosphere Limited, Bharti Airtel Limited, Jubilant Food Works Limited, ITC Limited, Hindustan Unilever Limited, and Whirlpool of India Limited. It is noteworthy that all these companies are important for the fund’s growth potential and match its thematic angle of consumption requirements.

Suggested Read – SBI Innovative Opportunities Fund Review

Understanding Risk-Return Profile of the Fund

This is a high-risk fund as it primarily focuses on equities more specifically, on the consumer sector. What is even more impressive is that this focus on consumption stocks may bring exceptional returns, backed by consumer demands and supply sectors.

However, the fund’s performance may be significantly unpredictable especially when the market fluctuates or makes a shift. Other circumstances affecting the capacity of the consumer, like risk appetite and investment capacity, should also be taken into account.

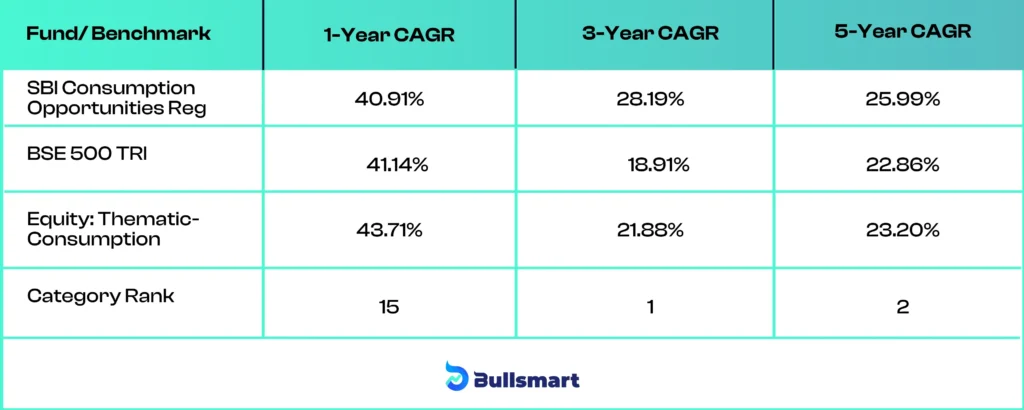

Let us take a short look at the fund’s returns and key metrics:

Caption: The returns stated above are updated up to 02. 09. 24

To be noted: The fund has consistently delivered strong returns over different time periods, indicating solid growth potential and effective fund management. Though for the long term, the returns have showed consistency, indicating a similar performance in the forthcoming days.

Meet the Fund Manager

Mr. Ashit Desai, the current maverick of investment at SBI Mutual Fund since April 2024, has a noteworthy academic background. He carries a degree in B. Com (Bachelors in Commerce), along with that, he’s a PGDM (Post Graduate Diploma in Management) & FR (Fellow Member of the Institute of Chartered Accountants of India) qualified professional.

Who should invest in this fund?

The SBI Consumption Opportunities Fund will suit those investors who don’t mind a few ups and downs in their investment portfolio and are completely bullish on the consumer sector.

If you are okay with high risk and longing for an opportunity of securing high returns on long term growth, it will serve your purpose. It is ideal for investors who lay their hope on the stock market movements and have ample patience to invest through the rough phase of the market.

However, investors with a sensitive core towards volatility should corner from high-risk fund categories (as this fund’s) like Sectoral Thematic to make their investments immune. For an in-depth analysis and risk appetite assessment, it is advised for the investor to consult with your financial advisor before finalizing any investments.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.