Multi-cap funds are designed to provide investors with exposure to these various segments, enabling a diversified portfolio with the potential for long-term growth.

The Samco Multi Cap Fund NFO offers a unique 4-in-1 strategy, providing 25% exposure to large-cap, mid-cap, small-cap companies, and small-cap companies beyond the Nifty 500. This balanced approach combines stability, growth potential, and high-growth opportunities across diverse market segments.

The fund uses a proprietary stock selection algorithm that identifies stocks based on trending price action and earnings momentum, focusing on up-trending stocks to maximize growth.

With dynamic flexibility, the fund adjusts portfolio allocation using hedging mechanisms to manage risk and improve long-term returns, making it a smart choice for investors seeking diversified and robust growth

But is this NFO the right fit for your portfolio? Let’s explore!

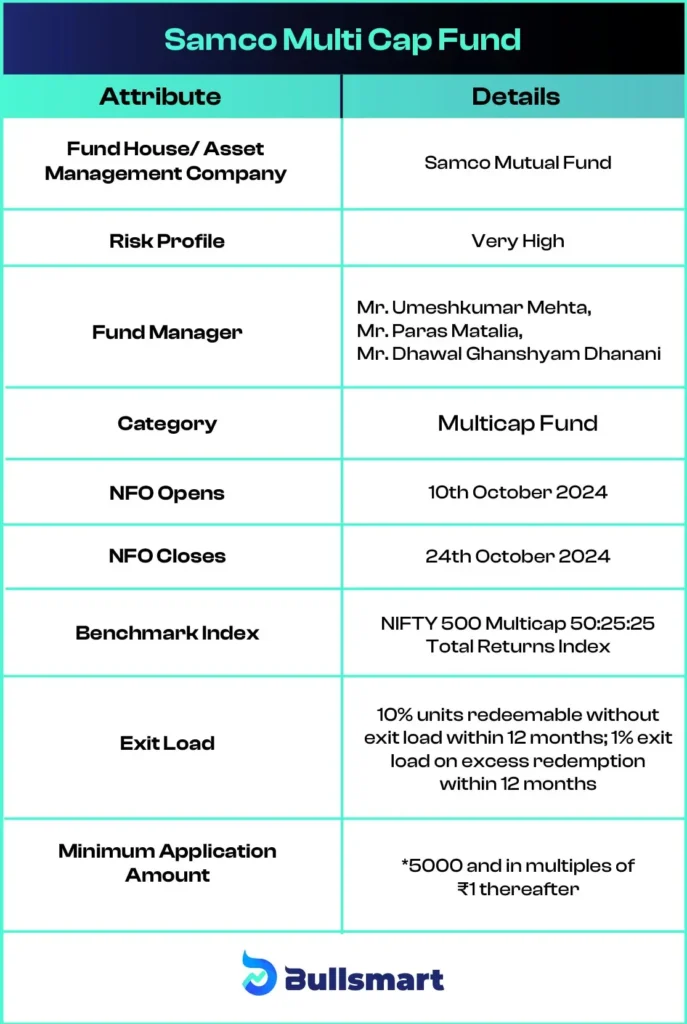

Overview of Samco Multi Cap Fund NFO

The Samco Multi Cap Fund NFO is an open-ended scheme that invests across large-cap, mid-cap, and small-cap stocks, providing balanced exposure to various market segments. The fund aims to deliver long-term capital appreciation through a diversified portfolio based on an equal allocation strategy.

Fund’s Investment Objective

The investment objective of the Samco Multi Cap Fund NFO is to generate long-term capital appreciation by investing in a portfolio of equity and equity-related securities of large-cap, mid-cap, and small-cap companies. However, there is no assurance that the investment objective will be achieved.

Here are the key details of the fund:

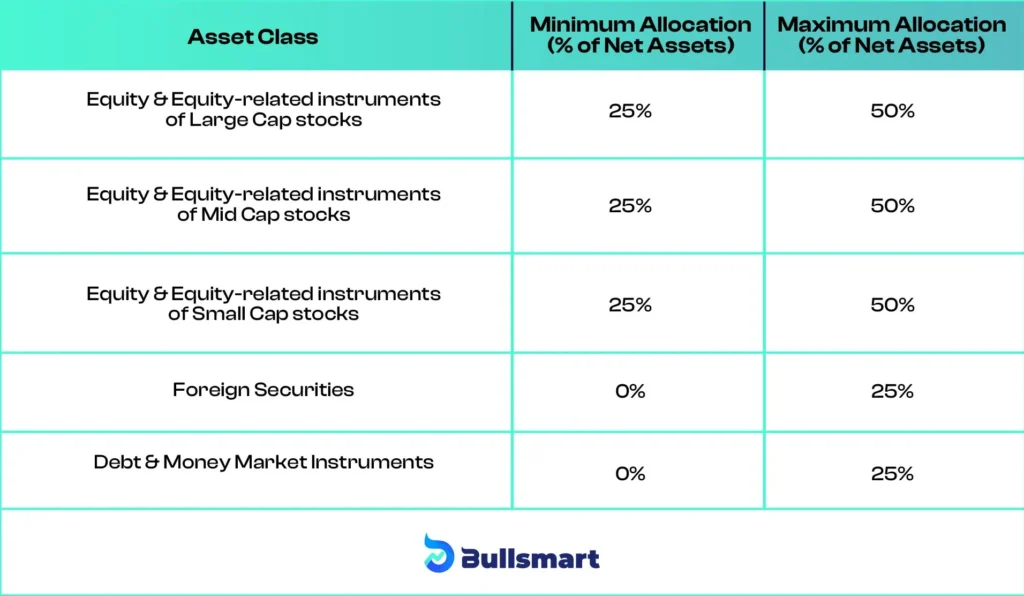

Portfolio Allocation Explained

The Samco Multi Cap Fund focuses on allocating 25% exposure to large-cap companies, mid-cap companies, small-cap companies, and small-cap companies beyond the NIFTY 500 universe. This diversified allocation across various market segments helps mitigate risks and allows investors to capitalize on growth opportunities from companies of different sizes and stages of development.

The asset allocation of the Samco Multi Cap Fund is as follows:

- Large-Cap Stocks: 25%

- Mid-Cap Stocks: 25%

- Small-Cap Stocks: 25%

- Small-Caps beyond NIFTY 500: 25%

Here’s a table representing the asset allocation pattern:

What are the Risks and Potential Returns?

As a multi-cap fund, the Samco Multi Cap Fund NFO carries a very high-risk profile due to its exposure to large-cap, mid-cap, and small-cap stocks. While large-cap stocks tend to provide stability, mid-cap and small-cap stocks offer higher growth potential but are also more volatile.

Investors should be aware that market conditions can lead to fluctuations in stock prices, affecting returns.

However, the fund’s dynamic flexibility and equal allocation strategy aim to minimise downside risk by balancing exposure across different market caps.

The fund’s benchmark is the NIFTY 500 Multicap 50:25:25 Total Returns Index has delivered returns of 45.74%, 21.21% and 25.89% in 1 year, 3 years, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Samco Asset Management Company

Samco Mutual Fund is supported by Samco Securities Limited, a leading wealth technology start-up. The Samco Group began its journey in capital markets in 1993 as Samruddhi Stock Brokers Limited and was rebranded to Samco Securities by Jimeet Modi, the Group CEO, in 2015.

The Samco Group works in several areas, including mutual fund distribution, stock broking, asset management, capital market lending, and advisory services.

Known as one of the most profitable discount brokers, Samco Securities has over 250,000 customers and is based in Mumbai, India.

With a mission to make advanced financial technology accessible to retail investors, Samco aims to help individuals grow their wealth affordably. Samco Mutual Fund was established in 2021, and its first New Fund Offering (NFO) was launched in January 2022.

As of June 30, 2024, the total Assets Under Management (AUM) for the fund stands at ₹ 2,437.41 crore.

The Investment Team Behind the Fund

The fund is managed by experienced fund managers:

Mr. Paras Matalia

Mr. Paras Matalia is the Fund Manager and Head of Equity Research at Samco Mutual Fund, with about 9 years of experience in the capital markets. He has been instrumental in developing the HexaShield framework and manages funds like the Samco Active Momentum Fund and Samco Dynamic Asset Allocation Fund.

Mr. Dhawal Ghanshyam Dhanani

Mr. Dhawal Ghanshyam Dhanani has around 6 years of experience in investment research, starting as an equity research analyst at Samco Securities. He focuses on understanding business models and manages the Samco Flexi Cap Fund and Samco Overnight Fund.

Mr. Umeshkumar Mehta

Mr. Umeshkumar Mehta, with over 25 years in the Indian capital markets, oversees investment strategies and asset management at Samco. He has been with the Samco Group for 15 years and manages funds such as the Samco Flexi Cap Fund and Samco ELSS Tax Saver Fund.

Who should invest in Samco Multi Cap Fund?

The Samco Multi Cap Fund may be suitable for investors who are:

- Seeking long-term capital appreciation through exposure to large, mid, and small-cap companies.

- Interested in a diversified portfolio across market segments.

- Willing to tolerate high risk in pursuit of potentially higher returns.

- Looking to invest for a minimum of 5 years to realize the fund’s growth potential.

As with any equity-oriented scheme, there is a degree of risk involved. Investors should consult their financial advisor to ensure that the fund aligns with their investment objectives.

Suggested Read – PGIM Multicap Fund NFO Review

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.