The Indian mutual fund industry has witnessed significant growth across various categories, and one fund making headlines is the Quant Mid Cap Fund. Specialising in mid-cap investments, the fund has become a popular choice for investors seeking exposure to companies with high growth potential.

The fund’s assets under management (AUM) surged an impressive 5,340% from ₹172 crore in August 2021 to ₹9,367 crore in August 2024, highlighting its growing appeal among investors.

Let’s explore the details of this fund and see if it aligns with your investment goals.

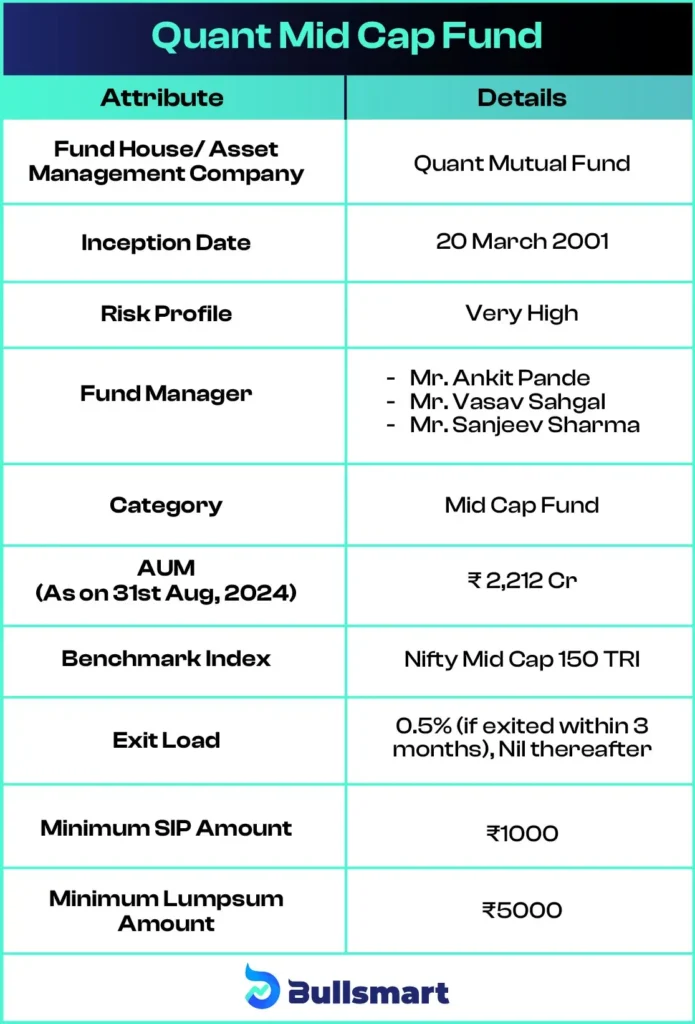

Overview of Quant Mid Cap Fund

The Quant Mid Cap Fund is an open-ended equity scheme predominantly investing in mid-cap stocks. Its primary goal is to offer long-term capital growth by targeting companies within the mid-cap category.

Understanding the Fund’s Investment Objective

The scheme aims to generate capital appreciation and provide long-term growth opportunities by investing in a diversified portfolio of mid-cap companies. While there is no guarantee of returns, the fund leverages the growth potential of mid-cap stocks, which often perform well in dynamic market conditions.

Let’s take a quick look at the key details of the fund:

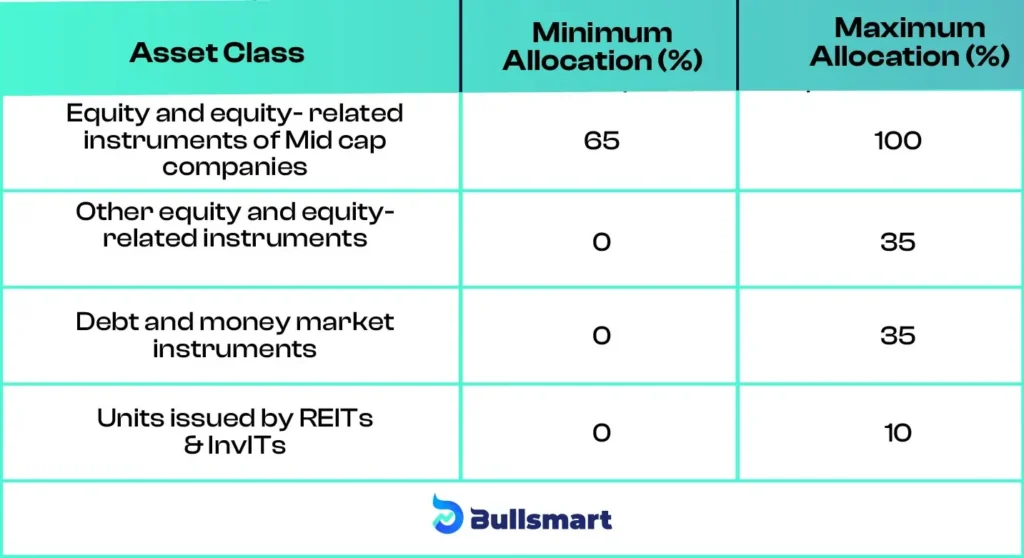

Portfolio Allocation Strategy of Quant Mid Cap Fund

The scheme allocates its assets as follows:

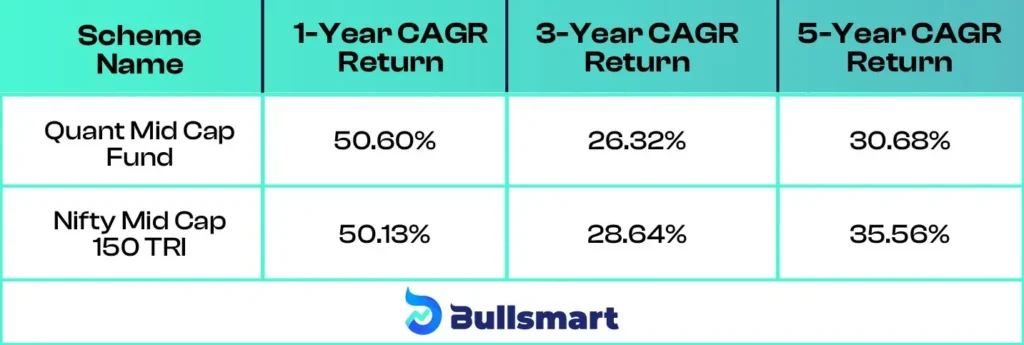

Insights on Risk and Return

The Quant Mid Cap Fund carries a high-risk profile due to its focus on mid-cap equities. These companies, while offering substantial growth potential, can experience higher volatility than their large-cap counterparts. However, mid-cap stocks have historically demonstrated strong long-term returns for investors who can withstand short-term market fluctuations.

Here’s a comparison of the scheme with its benchmark index:

Quant Mutual Fund

In 2018, Quant Capital Finance & Investments Private Limited acquired Escorts Mutual Fund, rebranding it as Quant Mutual Fund. Founded in 1996, Escorts was one of India’s first fund houses. The company focuses on two key principles: “Being Relevant,” which means adapting to change to protect and grow wealth, and “Predictive Analytics,” which involves understanding global markets.

Quant offers a wide range of investment products, including the Quant Absolute Fund, Quant Active Fund, Quant Small Cap Fund, and many more, all designed to meet various investor goals with flexible asset allocation strategies.

Meet the Investment Experts

The fund is managed by experienced fund managers:

Mr. Ankit Pande

Mr. Ankit Pande is a Fund Manager specializing in equity with 9 years of experience in Indian markets, including a background in software products. He holds a CFA and an MBA and has received the Thomson Reuters StarMine Award for best stock picker in the IT sector.

Mr. Sanjeev Sharma

Mr. Sanjeev Sharma is a Fund Manager focused on debt investments, bringing 18 years of overall experience, including 13 years in financial markets. He is skilled at identifying key inflexion points in securities and holds a PGDBA in Finance and an M.Com.

Mr. Vasav Sahgal

Mr. Vasav Sahgal is a Fund Manager for international equities with over four and a half years of experience in equity and fixed-income research and portfolio management. He holds a B.Com and has passed CFA Level 3, showcasing his expertise in finance.

Suggested Read – Quant Infrastructure Fund Returns

Who should invest in this fund?

The Quant Mid Cap Fund is ideal for investors who:

- Are looking for long-term capital growth.

- Want to invest in mid-cap companies with strong growth potential

- Have a high-risk tolerance and can endure market volatility.

- Are aiming for inflation-beating returns over a period of 3 to 5 years.

Quant Mid Cap Fund is suitable for investors with a long-term investment horizon who believe in the growth potential of mid-cap stocks and are willing to accept higher risks for the possibility of better returns in Mutual Fund.

However, it’s always recommended to consult a financial advisor before making investment decisions to ensure the fund aligns with your financial objectives and risk appetite.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.