India’s journey towards becoming a $26 trillion economy is set to be powered by significant advancements in several key sectors, with infrastructure development being one of them.

Investing in infrastructure is essential for increasing efficiency and reducing costs, especially as India aims to enhance its ease of doing business.

If you are planning to tap on the potential of this growing industry, the Quant Infrastructure Fund could be an option to consider. This fund is designed to invest specifically in companies that are integral to infrastructure development.

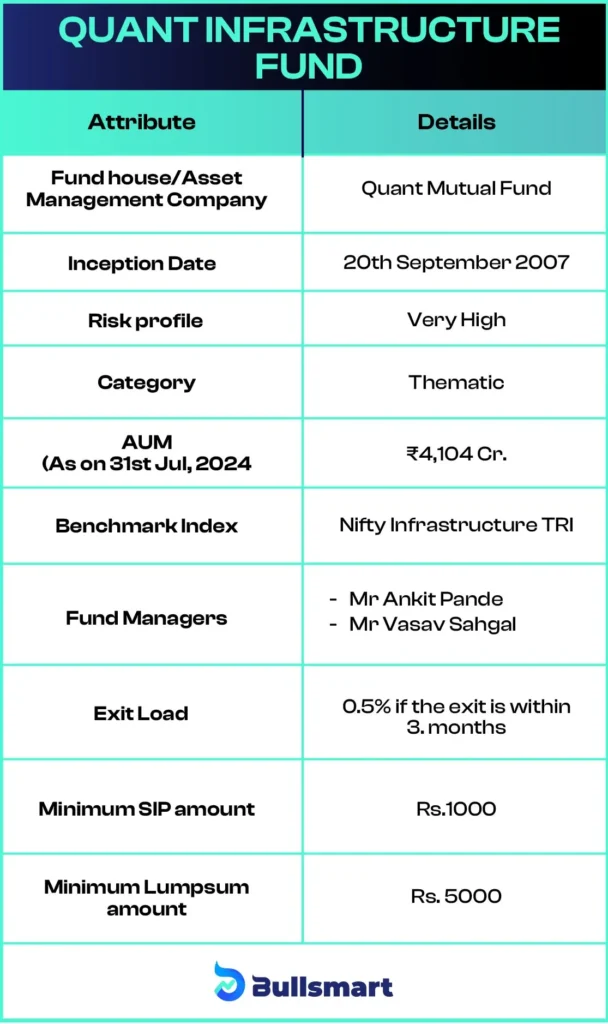

Details of Quant Infrastructure Fund

Quant Infrastructure Fund is an open-ended equity scheme that primarily invests in infrastructure-focused companies. The goal is to provide long-term growth opportunities and capital appreciation by leveraging the growth potential in the infrastructure sector.

The fund considers the Nifty Infrastructure TRI as its benchmark.

Investment Objective of the fund

The primary objective of the Quant Infrastructure Fund is to seek capital appreciation and provide long-term growth opportunities by investing in companies within the infrastructure sector.

Let’s have a quick look at the key basic details of the fund:

Portfolio Construction

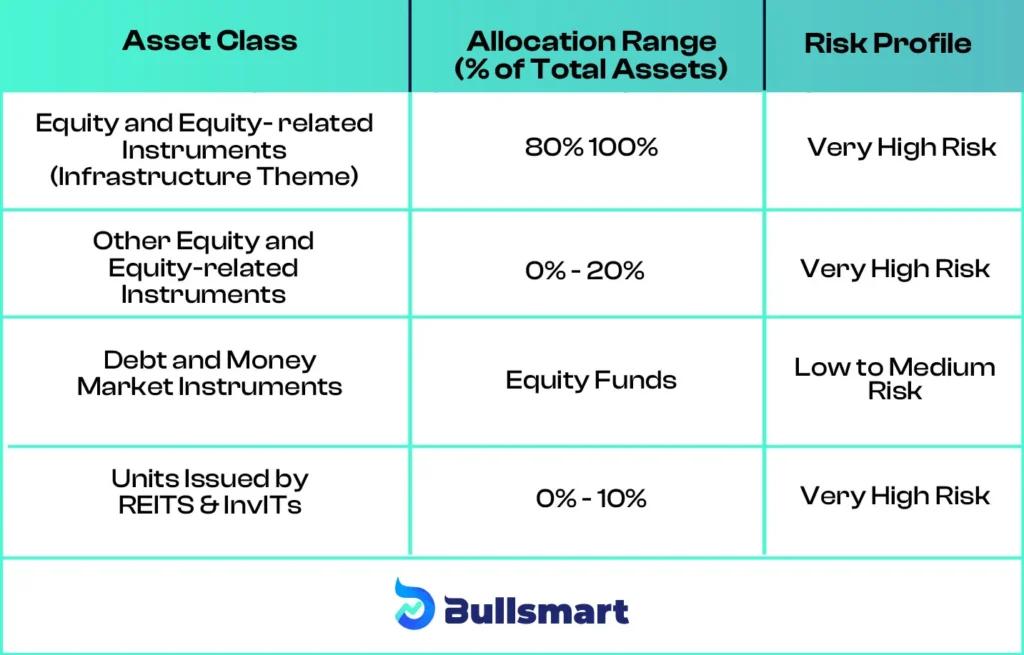

The fund aims to allocate its assets as follows:

The fund retains the flexibility to invest across securities and derivatives as permitted by SEBI, including up to 20% in foreign assets.

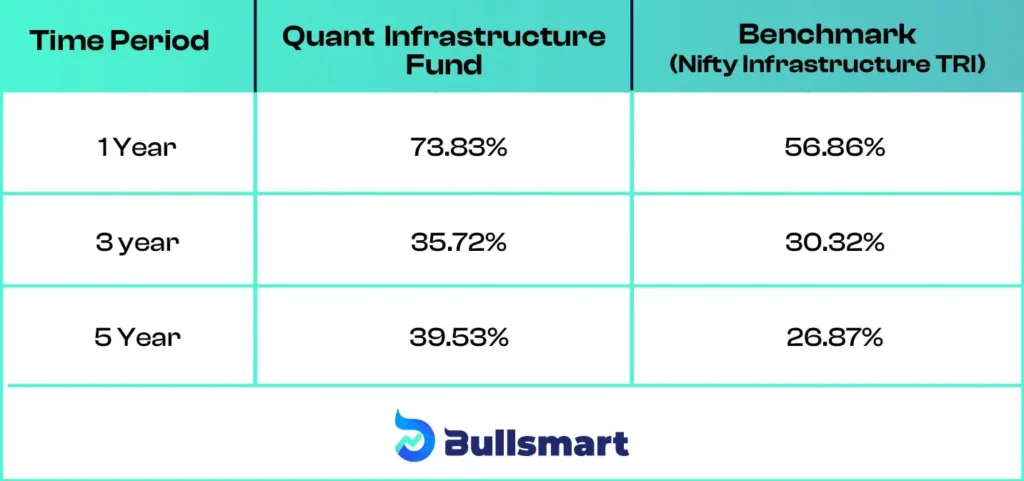

Analyzing Risks and Returns

The Quant Infrastructure Fund carries a very high-risk profile, given its significant exposure to equities within the infrastructure sector. However, this risk is balanced by the potential for substantial returns, especially if the infrastructure sector performs well.

Here is a comparison of the performance of the Quant Infrastructure Fund with its benchmark over different time periods:

Quant Mutual Fund AMC

In 2018, Quant Capital Finance & Investments Private Limited acquired Escorts Mutual Fund, rebranding it as Quant Mutual Fund. Originally established in 1996, Escorts Mutual Fund was one of India’s earliest fund houses.

Quant Mutual Fund emphasises staying relevant and using predictive analytics to navigate market changes. Their approach integrates data analytics, including behavioural finance and sentiment analysis, to make informed investment decisions.

Quant Mutual Fund offers a diverse range of products, including Quant Absolute Fund, Quant Active Fund, Quant Consumption Fund, Quant Dynamic Bond Fund, Quant Focused Fund, Quant Infrastructure Fund, Quant Large and Midcap Funds, Quant Liquid Fund, Quant Midcap Fund, Quant Money Market Fund, Quant Multi Asset Fund, Quant Smallcap Fund, and Quant Tax Plan.

These funds are designed to cater to various investor needs and goals with flexible asset allocation strategies.

Meet the Fund Managers

The fund is managed by a team of experienced professionals, including:

Mr. Ankit Pande

Mr. Ankit Pande is a Chartered Financial Analyst (CFA) and holds an MBA. Before joining Quant Mutual Fund, he worked at Infosys Finacle. He began his career in equity research in 2011 and has developed extensive experience over the years. His background includes roles in equity and fixed income research, portfolio management, data analytics, and Python programming.

Mr Vasav Sahgal

Mr. Vishal has over four and a half years of experience in various front-office functions. His career in these areas began in 2011, reflecting a strong foundation in financial research and analytical skills.

Suggested read: Quant Small Cap Fund Review

Who should invest in this fund?

The Quant Infrastructure Fund is suited for investors with a high-risk tolerance who are looking to invest specifically in the infrastructure sector. It may be a good option for those who believe in the long-term growth potential of infrastructure projects and can withstand market volatility.

Before investing, it’s essential to consider your financial goals, risk appetite, and overall portfolio strategy. Consulting with a financial advisor can help ensure that this fund aligns with your investment objectives and risk profile.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.