The energy sector in India is on fire right now—literally and figuratively! With rapid advancements in renewable energy, electrification, and grid modernization, the future looks incredibly bright. And riding this wave is Quality Power Electrical Equipments Ltd. IPO, a key player in the high-voltage electrical equipment space.

Now, here’s where it gets exciting: Quality Power landed in the arena for top IPOs of 2025 for February 14, 2025.

This isn’t just another IPO—it’s one that has caught the eye of serious investors.

Why? Because the company plays a crucial role in powering India’s energy transition with cutting-edge electrical solutions.

With a strong market presence and a solid reputation in the industry, this IPO is definitely worth a closer look. Let’s dive into the details!

Quality Power Electrical Equipments Limited IPO Overview

Established in 2001, Quality Power Electrical Equipments Ltd. specializes in manufacturing high-voltage electrical equipment and solutions essential for grid connectivity and energy transitions.

The company’s product portfolio includes reactors, transformers, and converters, catering to power generation, transmission, distribution, and automation sectors.

With manufacturing facilities in Sangli, Maharashtra, and Aluva, Kerala, Quality Power serves over 210 global clients, including power utilities and renewable energy entities.

Quality Power IPO Details

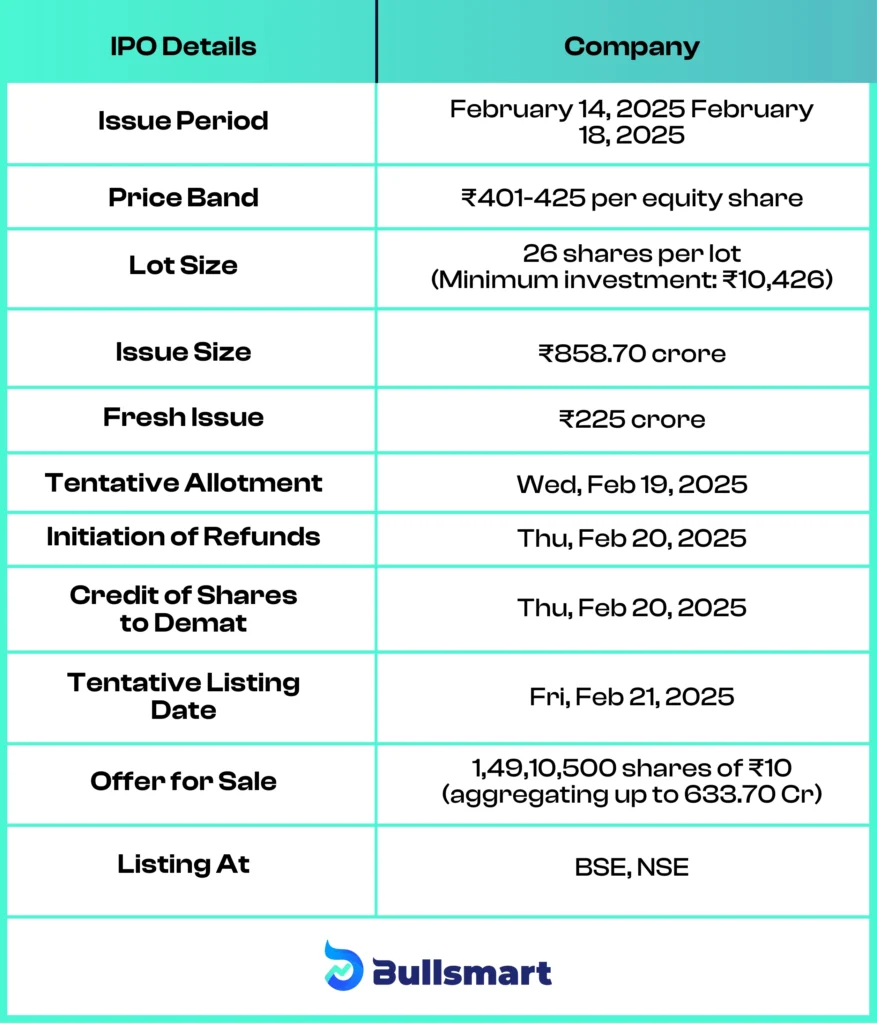

Check out this table for a quick insight into Quality Power IPO Details:

Data as of 17.02.25

Quality Power Electrical Equipments Limited IPO Details

1. Issue Period

- The IPO remains open for subscription from February 14, 2025, to February 18, 2025.

- During this period, investors can place their bids within the designated time slots on trading days.

- The allotment process will begin shortly after the closure of the IPO.

2. Price Band

- The price range for the shares is set between ₹401 and ₹425 per equity share.

- Investors must bid within this price range, with final allotment based on the demand and subscription levels.

- The upper price band of ₹425 is the maximum price per share, while ₹401 is the lowest bid price accepted.

3. Lot Size & Minimum Investment

- Investors are required to bid in multiples of 26 shares per lot.

- The minimum investment amount at the highest price band (₹425 per share) would be: ₹425 × 26 shares=₹11,050 (Previously stated as ₹10,426, but recalculated).

- Retail investors can apply for a maximum of 13 lots, meaning they can purchase up to 338 shares in one application.

- Larger investments are allowed beyond retail limits for high-net-worth individuals (HNIs) and institutional investors.

4. IPO Issue Size & Breakdown

The total IPO issue aggregates to ₹858.70 crore, which consists of:

- Fresh Issue: ₹225 crore, which will be used for business expansion, acquisitions, and other corporate needs.

- Offer for Sale (OFS): 1.50 crore shares, worth ₹633.70 crore at the upper price band.

- The OFS allows existing shareholders (promoters and early investors) to sell part of their holdings, reducing their stake in the company while allowing public participation.

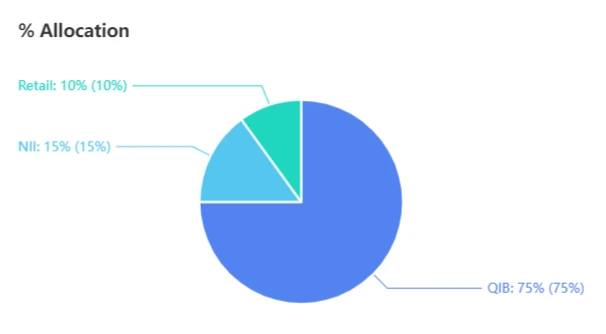

Allocation

- Qualified Institutional Buyers (QIBs): 75%

- Non-Institutional Investors (NIIs): 15%

- Retail Investors: 10%

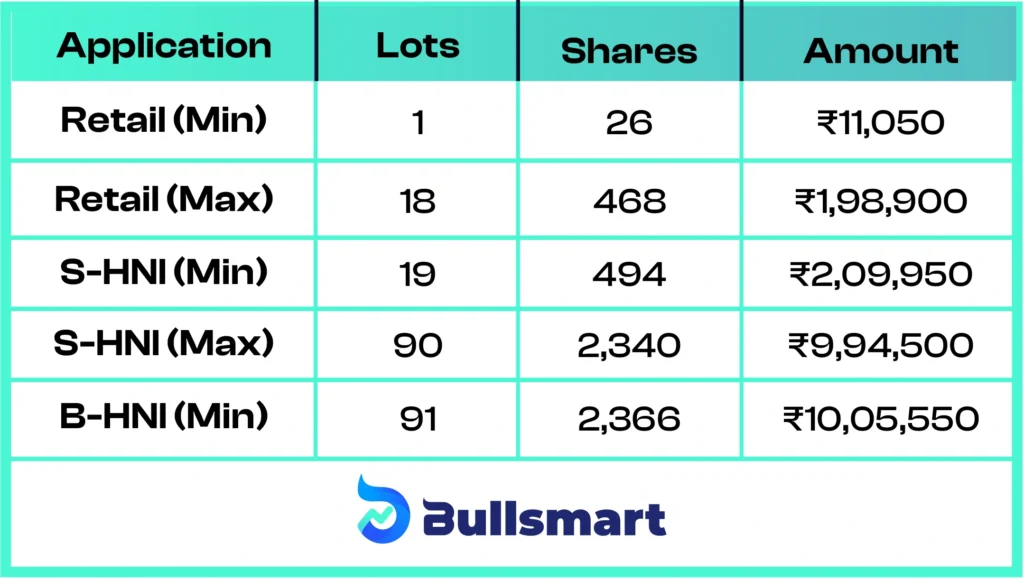

Quality Power IPO Lot Size

Investors must bid for at least 26 shares, and any additional bids must be in multiples of 26.

The table below shows the minimum and maximum investment limits for retail investors and HNIs, both in terms of shares and amount:

Data is as of 17.02.25

Quality Power IPO Day-wise GMP Trend

The Grey Market Premium (GMP) serves as an indicator of investor sentiment towards an IPO before its official listing.

As of February 17, 2025, here’s what the GMP trends for Quality Power IPO look like:

| GMP Date | IPO Price | GMP | Estimated Listing Price | Last Updated |

| 17-02-2025 | 425 | ₹5 | ₹430 (1.18%) | 2/17/2025 9:36 |

| 16-02-2025 | 425 | ₹5 | ₹430 (1.18%) | 2/16/2025 23:33 |

| 15-02-2025 | 425 | ₹5 | ₹430 (1.18%) | 2/15/2025 23:29 |

| 14-02-2025 Open | 425 | ₹5 | ₹430 (1.18%) | 2/14/2025 23:37 |

| 13-02-2025 | 425 | ₹14 | ₹439 (3.29%) | 2/13/2025 23:32 |

| 12/2/2025 | 425 | ₹28 | ₹453 (6.59%) | 2/12/2025 23:32 |

| 11/2/2025 | 425 | ₹35 | ₹460 (8.24%) | 2/11/2025 23:30 |

| 10/2/2025 | 425 | ₹27 | ₹452 (6.35%) | 2/10/2025 23:37 |

| 9/2/2025 | NA | ₹96 | ₹96 (0.00%) | 2/9/2025 23:35 |

| 8/2/2025 | NA | ₹135 | ₹135 (0.00%) | 2/8/2025 23:35 |

Observations for Quality Power IPO GMP

IPO Price is ₹425: This is the price set for the new stock before it starts trading in the market.

1. GMP (Grey Market Premium) Was High, Then Crashed

- On Feb 8, people were willing to pay ₹135 extra, meaning the stock could list at ₹560 (₹425 + ₹135).

- By Feb 9, this dropped to ₹96 (expected price ₹521).

- Then, day by day, the extra price kept shrinking—₹35, ₹28, ₹14… until it hit just ₹5 by Feb 14.

2. Expected Listing Price Also Dropped

- At first, the stock looked like it might open at a much higher price.

- But as GMP fell, the estimated price settled at ₹430 (just ₹5 above IPO price) from Feb 14 onwards.

What This Means for You

- Initially, everyone was excited about this IPO—demand was high.

- But then, the hype died down, and the extra premium almost disappeared.

- If you applied for this IPO hoping for big profits on listing day, there might not be much left.

A quick recap to what the GMP means for an IPO/stock:

Industry Details and Competitors

The Indian energy and electrical equipment industry is at a pivotal moment, driven by rapid industrialization, urbanization, and the government’s aggressive push toward renewable energy and infrastructure development.

With India’s power demand expected to double in the next decade, the need for high-voltage electrical equipment, transformers, and grid connectivity solutions is skyrocketing.

This sector is witnessing massive investments in smart grids, sustainable energy projects, and modernization of aging power infrastructure, creating a lucrative market for companies like Quality Power Electrical Equipments Ltd.

With initiatives like “Make in India” and “Atmanirbhar Bharat,” the government is actively encouraging domestic manufacturing, reducing import dependence, and boosting local production. As industries, metros, and rural electrification projects expand, the demand for efficient, high-quality electrical equipment will only grow, positioning Quality Power in a sweet spot to capitalize on this booming sector.

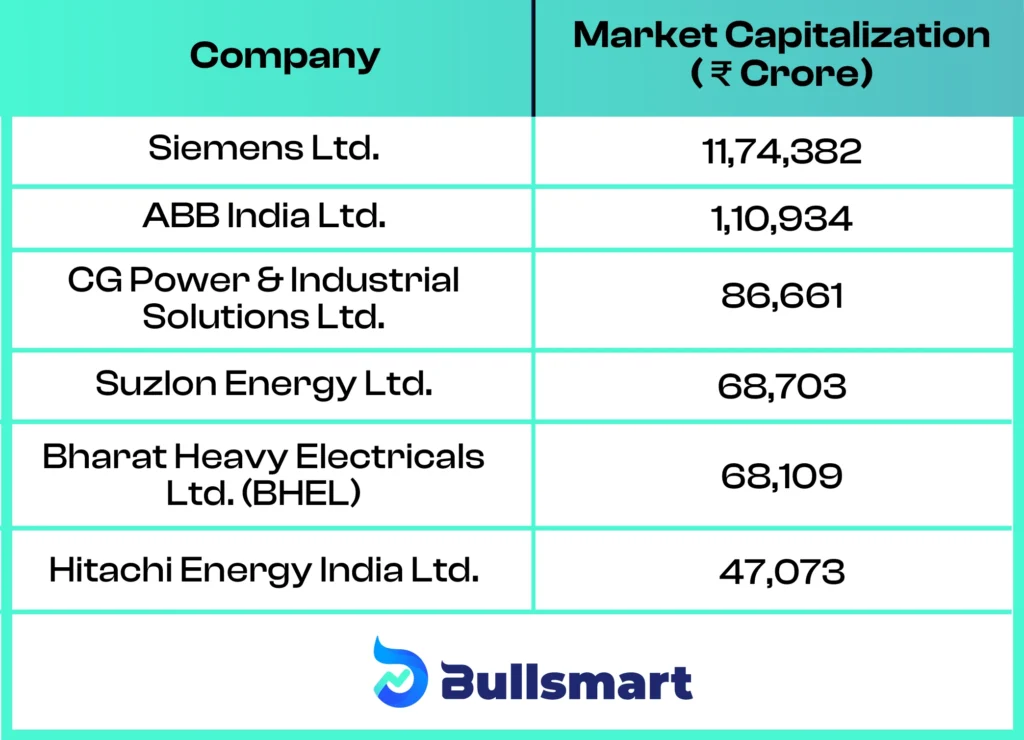

Their market capitalizations:

Market capitalization data is as of 17th Feb 2025.

Objectives of the IPO

The net proceeds from the IPO are intended to:

- Fund the acquisition of Mehru Electrical and Mechanical Engineers Private Limited.

- Support the company’s capital expenditure requirements.

- Address general corporate purposes.

About Quality Power Electrical Equipments Limited

Founded in 2001, Quality Power Electrical Equipments Limited is a key player in the energy transition and power technology space.

The company specializes in high-voltage electrical equipment and grid solutions, ensuring seamless connectivity between power sources and grids worldwide.

Driving Energy Transition with Cutting-edge Technology

With over two decades of expertise, Quality Power manufactures critical high-voltage equipment for HVDC (High Voltage Direct Current) and FACTS (Flexible AC Transmission Systems)–both essential for integrating renewable energy into power grids.

From power generation to transmission, distribution, and automation, the company provides advanced solutions that support a cleaner, more efficient energy future.

Global Reach & Strong Manufacturing Capabilities

Quality Power operates state-of-the-art manufacturing facilities in Sangli, Maharashtra, and Aluva, Kerala. Expanding its global footprint, the company acquired 51% of Endoks, a Turkey-based power technology firm, in 2011, strengthening its design, assembly, and project management capabilities.

As of March 31, 2024, the company serves 210 customers worldwide, including power utilities, industries, and renewable energy companies, reflecting its strong industry presence and reputation.

Comprehensive Product Portfolio

- Power Products: Reactors, Line Traps, Transformers, Instrument Transformers, Line Tuners, Metal-Enclosed Capacitor Banks, and Composites.

- Power Quality Systems: Static VAR Compensators (SVCs), STATCOMs, Harmonic Filters, Capacitor Banks, and Shunt Reactors.

With 163 full-time employees and 372 contractual workers, the company remains committed to innovation and excellence.

Competitive Strengths That Set Quality Power Apart

- Global Leader in Energy Transition: Positioned to leverage the worldwide shift toward decarbonization and renewable energy adoption.

- Proven Track Record: Consistent growth and financial performance, backed by long-standing industry expertise.

- Diverse & Loyal Customer Base: Strong relationships with global power utilities and industries, ensuring business stability.

- Robust Product Portfolio: A one-stop solution for energy transition equipment and power technologies with high trade barriers.

- Strategic Growth & Acquisitions: Expansion through acquisitions and a growing order book, driving sustained progress.

- Innovative R&D: Investing in future-ready solutions to stay ahead in the evolving energy landscape.

- Experienced Leadership: A seasoned management team with deep domain expertise, steering the company toward continued success.

With a strong foundation and a vision for the future, Quality Power Electrical Equipments Limited is at the forefront of the global energy revolution, bridging the gap between traditional and renewable energy sources.

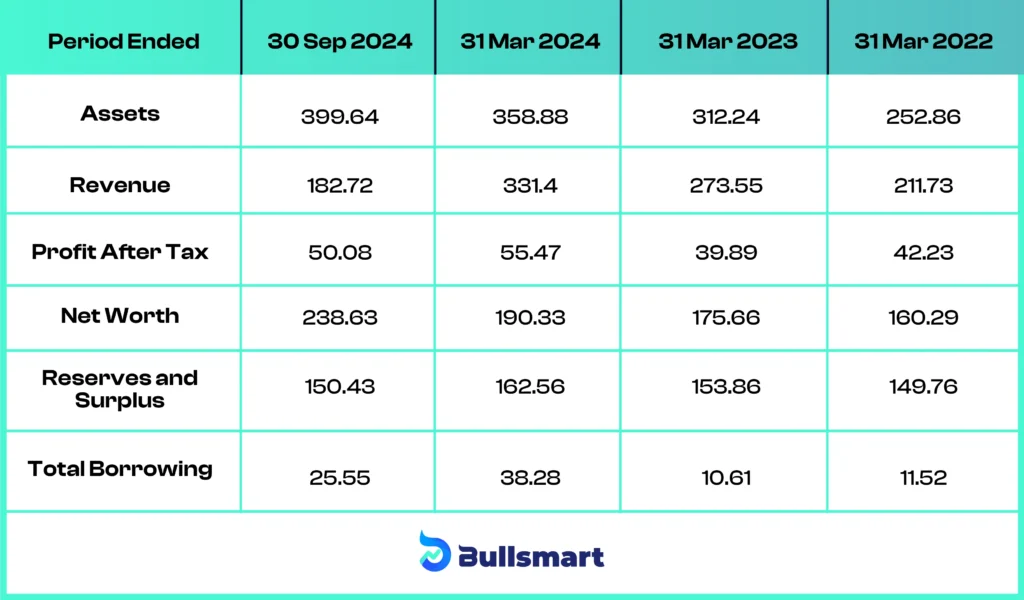

Financial Highlights of Quality Power Electrical Equipments Limited

Quality Power Electrical Equipments Limited is on a strong financial growth path, with rising assets, revenue, and profitability year after year.

The company’s net worth keeps climbing, showcasing financial stability, while healthy reserves and surplus reinforce its strength.

Despite a recent uptick in borrowings, its solid balance sheet and consistent performance position it well for future expansion. With a steady rise in revenue and profits, Quality Power is powering ahead in the energy transition space, backed by a resilient financial foundation.

Take a look at this table for a better understanding:

Data as of 17.02.25

Who Should Apply for the Quality Power IPO and Who Should Skip?

Who Should Apply for Quality Power IPO?

- Long-Term Investors in the Power Sector: If you believe in India’s growing energy demand, grid modernization, and the push for renewable energy, Quality Power’s role in high-voltage electrical equipment makes it a relevant player.

- Investors Looking for Industry Expansion: The company plans to use IPO proceeds for acquisitions, capital expenditure, and business growth, which could strengthen its market position.

- Investors Seeking Exposure to Infrastructure Growth: With government initiatives like “Make in India” and “Atmanirbhar Bharat,” domestic manufacturing and energy infrastructure are expected to grow, benefiting companies in this sector.

Who Should Skip Quality Power IPO?

- Short-Term Investors Expecting High Listing Gains: The Grey Market Premium (GMP) has declined sharply from ₹135 to just ₹5, indicating lower enthusiasm for immediate listing gains.

- Investors Concerned About Competition: The company faces competition from well-established players like Siemens, ABB, and CG Power, which have larger market capitalizations and stronger financial positions.

- Risk-Averse Investors: The IPO includes a significant Offer for Sale (OFS), meaning a large portion of funds will go to existing shareholders instead of business expansion, which might not align with all investment strategies.

As always, do your due diligence before investing.

Bottom Line

Is Quality Power Electrical Equipments Ltd. IPO a bright opportunity or just another market buzz? If you’re bullish on India’s energy transition and the booming power infrastructure space, this one’s definitely worth keeping on your radar.

With a strong market presence, cutting-edge tech, and a solid financial track record, Quality Power is positioning itself as a key player in the high-voltage electrical equipment sector.

But as with any IPO, it’s not just about the hype–it’s about the fundamentals.

The company’s steady growth, strategic acquisitions, and robust order book make a strong case for long-term investors. However, short-term traders banking solely on Grey Market Premium (GMP) movements might want to tread carefully, given the recent volatility.

At the end of the day, investing is all about aligning opportunities with your risk appetite and financial goals.

If you believe in the future of India’s energy revolution and want to be part of a company that’s powering it, Quality Power’s IPO might just be the spark your portfolio needs.

Just remember–do your research, weigh the risks, and invest wisely!

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Investors are advised to consult with financial advisors before making investment decisions.

FAQs

What is the IPO price and minimum investment for Quality Power Electrical Equipments Limited?

The Quality Power IPO price band is set between ₹401 and ₹425 per share.

The minimum lot size is 26 shares, requiring a minimum investment of ₹11,050 at the upper price band.

What is the latest Grey Market Premium (GMP) for the Quality Power IPO?

As of February 17, 2025, the Quality Power IPO Grey Market Premium (GMP) is ₹5, suggesting an estimated listing price of ₹430.

However, GMP fluctuates daily, so investors should track live updates before making investment decisions.

When will the Quality Power IPO allotment and listing take place?

The Quality Power IPO allotment date is February 19, 2025, with refunds initiated on February 20, 2025.

Shares will be credited to Demat accounts the same day, and the IPO listing is scheduled for February 21, 2025, on both NSE and BSE.

Is Quality Power IPO a good investment for 2025?

Quality Power is a leading player in high-voltage electrical equipment, benefiting from India’s energy transition.

With strong financials and a global customer base, it may appeal to long-term investors. However, short-term traders relying on GMP for quick gains should proceed with caution due to recent price volatility.

Suggested read: Hexaware Technologies IPO 2025: Booming Growth, Price, Dates, GMP & Latest Updates

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing.