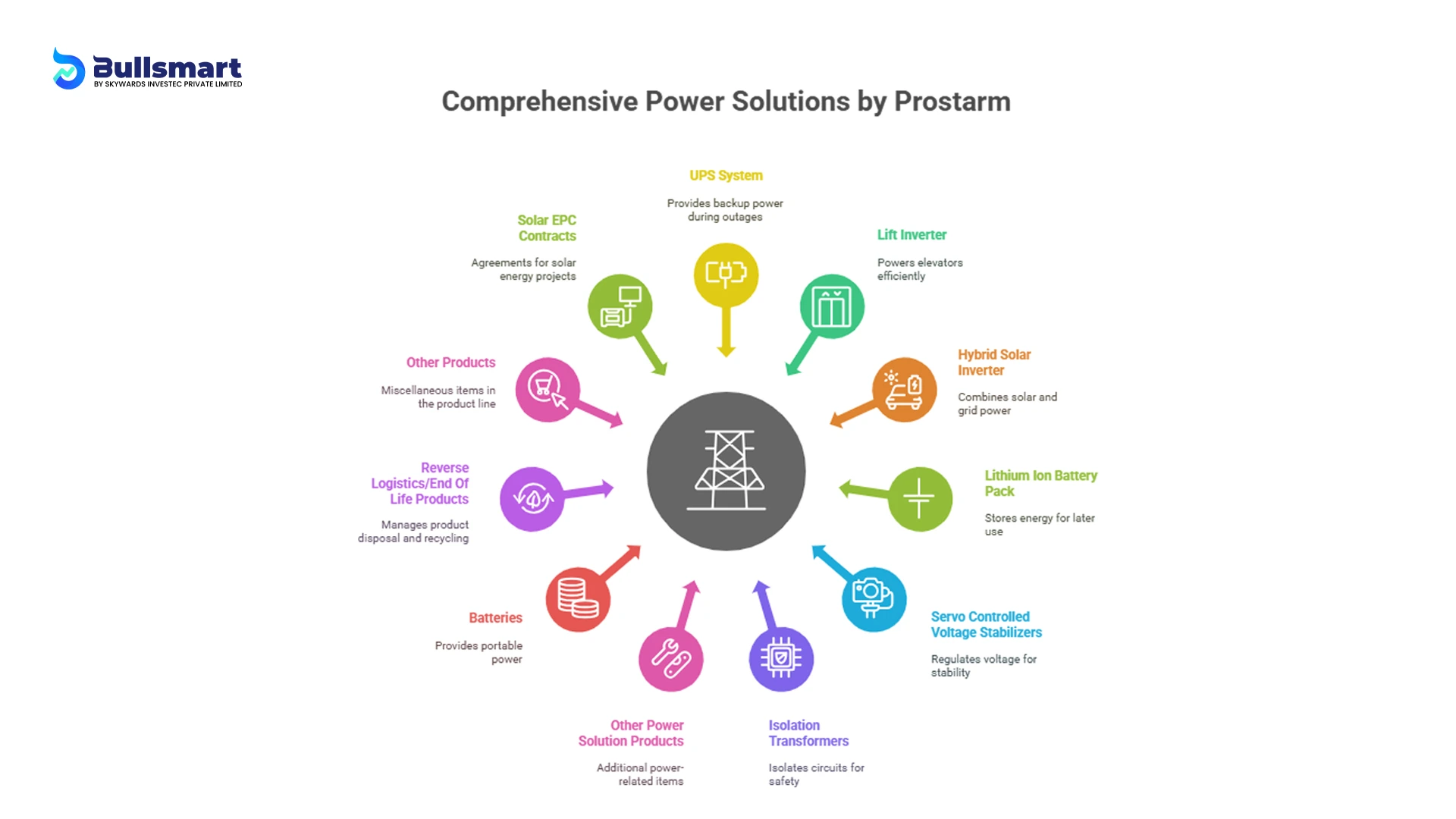

Prostarm Info Systems Limited IPO is all set to hit the stock market with its IPO opening scheduled on May 27, 2025. Known for its strong presence in India’s power solutions space, the company makes everything from UPS systems and solar hybrid inverters to lithium-ion battery packs. Sounds techy? Don’t worry, we’re breaking it all down for you!

In this blog, you’ll find the lowdown on Prostarm Info Systems Limited IPO: think GMP buzz, subscription dates, what the company plans to do with the money, the possible risks, and how the numbers are looking.

Whether you’re totally new to IPOs or just curious about investing in the energy-tech space, this guide’s got you sorted with all the need-to-know details.

Prostarm Info Systems Limited IPO Key Details

You can find all relevant details related to the Prostarm Info Systems Limited IPO in this table:

| Details | Information |

| Prostarm Info Systems IPO Opening Date | May 27, 2025 |

| Prostarm Info Systems IPO Closing Date | May 29, 2025 |

| Prostarm Info Systems IPO Allotment Finalization | May 30, 2025 |

| Prostarm Info Systems IPO Tentative Listing Date | June 3, 2025 |

| Prostarm Info Systems IPO Face Value | ₹10 per share |

| Prostarm Info Systems IPO Price Band | ₹95 to ₹105 per share |

| Prostarm Info Systems IPO Lot Size | 142 shares |

| Prostarm Info Systems Limited IPO Minimum Retail Investment | ₹14,910 |

| Prostarm Info Systems Limited IPO Total Issue Size | ₹168 crore |

| Prostarm Info Systems Limited IPO Issue Type | Bookbuilding (Fresh Issue) |

| Prostarm Info Systems Limited IPO Listing Platforms | BSE, NSE |

| Registrar | KFin Technologies Limited |

| Book-running Lead Manager | Choice Capital Advisors |

Data available is as of 22.05.25.

Prostarm Info Systems Limited IPO GMP Day-wise Trend Table

Here’s a clean and easy-to-read table for the GMP (Grey Market Premium) with all current details:

| Date | IPO GMP (₹) | GMP Trend |

| 22 May 2025 | – | – |

| 21 May 2025 | – | – |

Note: GMP, Kostak, and Subject to Sauda rates for Prostarm Info Systems Limited IPO haven’t started yet. Stay tuned for real-time updates once grey market activity picks up closer to the IPO opening date (May 27, 2025).

What This Means for the IPO

Currently, there’s no premium in the grey market, reflecting cautious optimism.

As the Prostarm Info Systems Limited IPO progresses, watch for changes in GMP which can hint at listing expectations.

Why Prostarm Info Systems Limited is Raising Money Through the Prostarm Info Systems Limited IPO

ProstarmInfo Systems Limited is planning to raise ₹168 crore through this IPO, and here’s how they plan to use it:

- ₹72.5 crore will be used to keep the business running smoothly by covering daily expenses and operations (this is called working capital).

- ₹17.95 crore will go towards paying off some of the loans the company has taken.

- The rest of the money will be used for growing the business; this could mean buying other companies or expanding their current operations.

Bringing in this money will also give Prostarm Info Systems Limited more financial breathing room and help it grow faster in the future.

Suggested Read: Belrise Industries IPO 2025: GMP, Price Band, Key Dates & All Important You Need to Know

Prostarm Info Systems Limited Company Overview: Powering Up India, One Industry at a Time

Started in 2008 and based in Pune, Prostarm Info Systems Limited has quietly become a behind-the-scenes hero for some of the country’s most important sectors; think aviation, healthcare, defence, banking, and IT.

Their specialty? Designing both ready-to-use and tailor-made energy storage solutions that keep things running when power cuts in.

The market capitalization of Prostarm Info Systems Limited IPO is Rs 618.18 Cr.

With a strong presence across 21 branch offices and 2 major storage hubs, Prostarm Info Systems Limited’s reach now spans 18 states and a union territory. Backed by a team of 423 dedicated employees, they’ve built a solid name for themselves in both the public and private sectors.

They’ve even got some heavyweight clients on board, including:

- Airports Authority of India

- RailTel

- West Bengal Electronics Industry Development Corporation

- NTPC Vidyut Vyapar Nigam

In short, Prostarm Info Systems Limited isn’t just powering systems; they’re powering progress.

Prostarm Info Systems Limited Financial Performance Overview

A company’s financial overview gives a hint about how the IPO might perform once it comes into action.

Take a look at the Prostarm Info Systems Limited company’s financial performance over the years:

| Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 230.04 | 203.05 | 155.39 | 98.03 |

| Revenue | 270.27 | 259.23 | 232.35 | 172.05 |

| Profit After Tax | 22.11 | 22.8 | 19.35 | 10.87 |

| Net Worth | 107.24 | 84.3 | 61 | 40.95 |

| Reserves and Surplus | 64.37 | 41.42 | 18.13 | 31.87 |

| Total Borrowing | 60.37 | 43.47 | 24.85 | 3.21 |

| Amount in ₹ Crore | ||||

Data available is as of 22.05.25.

Observations of the financial overview

- Revenue has grown steadily YoY

- Profitability and return metrics are strong

- Financial risk is moderate with manageable debt

Benefits vs Constraints of Applying for the Prostarm Info Systems Limited IPO

No IPO can be labeled as good or bad; however, based on applicant’s desires and requirements, certain parameters can suit or baffle them.

Check out this interesting table of comparison between benefits and constraints of investing in Prostarm Info Systems Limited’s IPO:

| Benefits | Constraints |

| Strong financial performance with rising revenue and PAT | No grey market premium as of now (flat GMP) |

| Wide product portfolio across critical industries | Market volatility could affect short-term listing outcome |

| Proceeds to reduce debt and fund growth | Faces competition from both listed and private players |

| Promoter group retains significant post-issue holding | Relatively unknown brand among retail investors |

Who Should and Shouldn’t Consider Applying for Prostarm Info Systems Limited IPO

Who Should Apply for Prostarm Info Systems Limited IPO

- Long-term investors seeking exposure to India’s power and energy infra-space.

- Investors with confidence in industrial product companies.

- HNIs or QIBs seeking undervalued IPOs with solid financials.

Who Should NOT Apply for Prostarm Info Systems Limited IPO

- Retail investors expecting immediate listing gains (no GMP yet).

- Traders focused on grey market sentiment.

- Those unfamiliar with cyclical capital goods and power solution sectors.

Final Thoughts

Is the Prostarm Info Systems Limited IPO worth a shot?

Well, that depends on your investing style. If you’re someone who’s in it for the long haul, loves spotting future potential in under-the-radar companies, and believes in India’s growing energy and infra story; Prostarm might just be worth a closer look.

The company’s got a solid foundation, a diversified client base (including some big government names), and a consistent financial track record.

Plus, the ₹168 crore they’re raising is set to fuel growth, ease debt, and strengthen their balance sheet; all signs of a company gearing up for its next big leap.

That said, the current lack of grey market buzz means this isn’t your classic “quick flip” IPO. If you’re hoping to double your money on listing day, this one may not hit the spot.

But if you’re patient and see value in businesses building India’s power backbone, Prostarm could be a smart long-term bet.

As always, do your research, know your risk appetite, and never invest just because of hype. IPOs can be exciting, but they should always be approached with clarity, not just curiosity.

Happy investing!

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

FAQ

Which upcoming IPO is best to buy in 2025?

The best IPOs to consider in 2025 are those backed by strong financials, operating in high-growth sectors like fintech, infrastructure, or consumer tech.

Look for companies with low debt, clear revenue visibility, and strong brand equity. Prioritize fundamentals over hype and align choices with your investment goals.

What is the IPO listing price?

The IPO listing price is the price at which shares begin trading on the stock exchange. It’s determined by market demand on listing day and often differs from the issue price.

It reflects investor sentiment, grey market trends, and overall market conditions.

What was CMS Infosystems IPO price?

The CMS Info Systems IPO was priced at ₹205 per share. It launched in December 2021 and was entirely an offer-for-sale of ₹1,100 crore.

The stock listed at a slight premium, reflecting cautious optimism about India’s cash logistics and ATM management sector.

Is flair writing IPO good?

Flair Writing IPO showed promise with strong revenue growth and brand recall in the stationery market. It closed with oversubscription, signaling demand.

However, retail investors should consider listing-day pricing, competitive risks, and input costs before applying. It suits long-term holders with moderate risk tolerance.

What is the size of Prostarm IPO?

The Prostarm Info Systems Limited IPO is valued at ₹168 crore. It’s a pure fresh issue of 1.6 crore equity shares, with no offer-for-sale.

The funds will be used for working capital, debt repayment, and inorganic growth via strategic acquisitions.

What is the company profile of ProstarM?

Prostarm Info Systems Limited, founded in 2008 and based in Pune, designs and manufactures energy storage and power conditioning products like UPS systems, solar inverters, lithium-ion batteries, and stabilizers.

It serves industries including BFSI, healthcare, defence, and IT, and has over 700 institutional clients across India.