India’s equity market offers a wide range of schemes that let you cater to market capitalization. Among these is the multi-cap fund.

Multi-cap funds are equity-oriented funds that invest in a variety of market caps and sectors, providing investors with a broad portfolio and exposure to key sectors of the Indian economy.

The PGIM India Multi Cap Fund, managed by PGIM India Mutual Fund, aims to provide investors with exposure to large, mid, and small-cap stocks in a single fund.

Let’s explore this fund to help you decide if it aligns with your investment goals.

Understanding PGIM India Multi Cap Fund

The PGIM India Multi Cap Fund is an open-ended equity scheme investing across large cap, mid cap, and small cap stocks. This fund is designed for investors looking for long-term capital appreciation through a diversified equity portfolio.

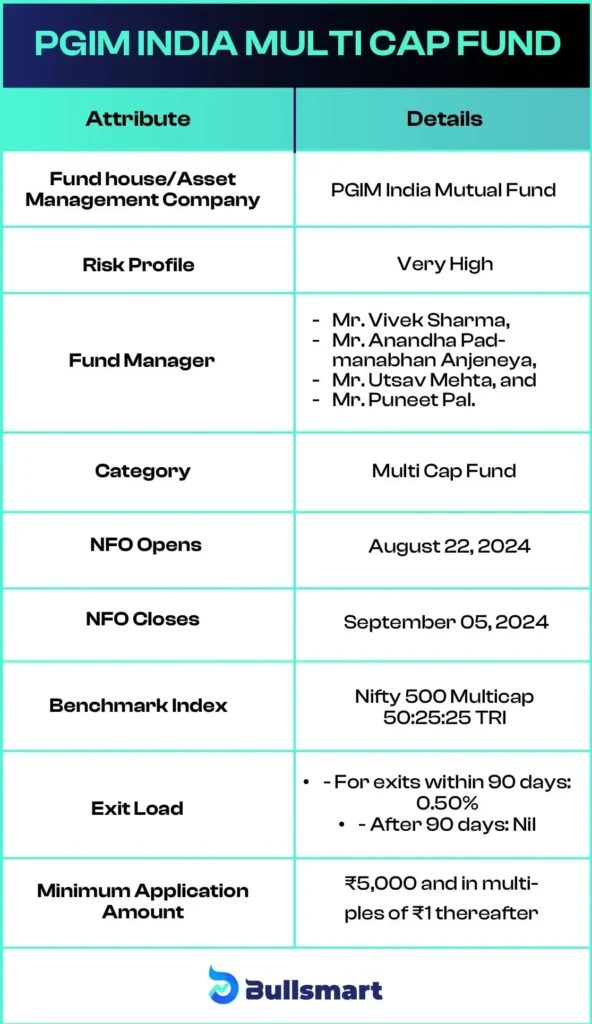

The fund considers the Nifty 500 Multicap 50:25:25 TRI as its benchmark.

Investment Objective of the New Fund Offer

The Scheme aims to generate long-term capital appreciation by investing in a portfolio of equity and equity-related securities across large cap, mid cap, and small cap stocks.

Let’s have a quick look at the key basic details of the fund:

The PGIM India Multi Cap Fund allows both lump sum investments and Systematic Investment Plans (SIPs). The minimum SIP amount is ₹1,000 per installment, with a minimum of 5 installments.

Portfolio Allocation

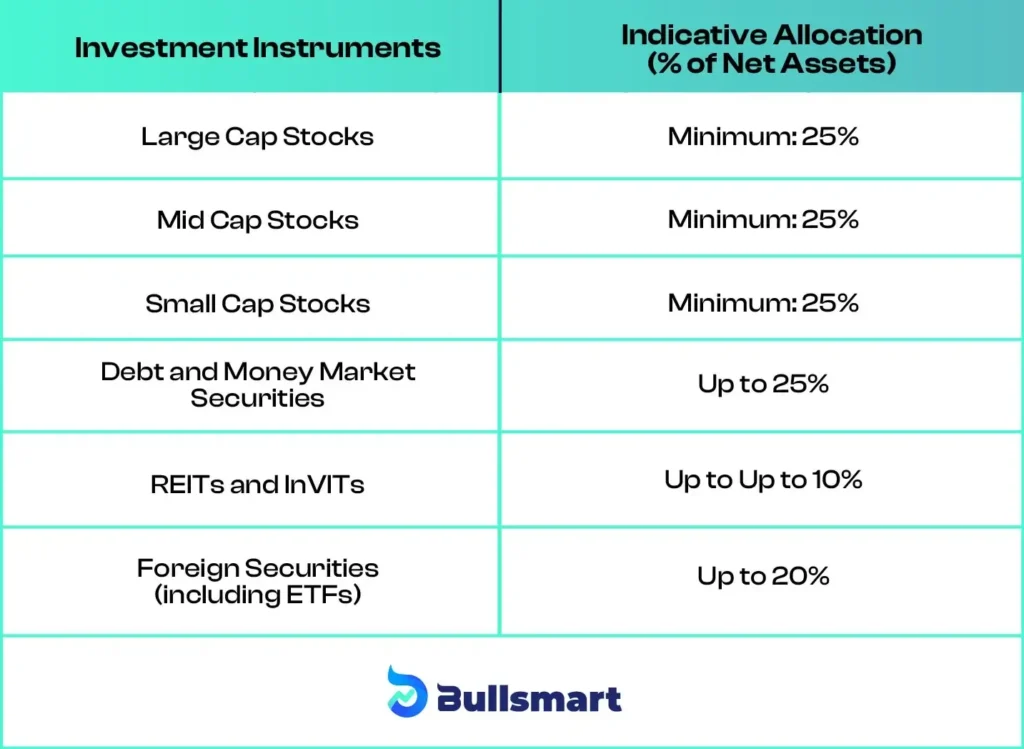

The asset allocation of the PGIM India Multi Cap Fund is as follows:

Risks and Returns in PGIM India Multi Cap Fund

The PGIM India Multi Cap Fund carries a very high-risk profile due to its equity-focused nature. However, it also has the potential to generate significant returns over the long term.

The fund’s diversification across market caps aims to balance the stability of large-caps with the growth potential of mid and small caps.

Nifty 500 Multicap 50:25:25 TRI has delivered returns of 44.83%, 23.37%, and 26.90% over the past 1 year, 3 years, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

PGIM India Asset Management

PGIM India Mutual Fund, previously known as DHFL Pramerica Mutual Fund, is now a wholly-owned subsidiary of PGIM, the global investment management arm of Prudential Financial. As a prominent global investment manager, PGIM Mutual Fund offers a diverse range of actively managed asset classes and investment strategies, including equities, fixed income, and real estate.

PGIM India oversees around 25 open-ended funds, supported by a team of 17 investment professionals. In addition to managing domestic mutual funds, PGIM India also offers offshore funds and portfolio management services.

As of 30 June 2024, PGIM India Mutual Fund manages assets worth ₹ 25,189.59 crore.

Meet the Fund Managers

The fund is managed by a team of experienced professionals.

Mr. Vivek Sharma (Equity Portion)

Mr. Sharma, a PGDM in Finance, has over 14 years of experience in equity markets and fund management and is currently serving as a Fund Manager – Equity at PGIM India Asset Management. He previously managed equity portfolios at Edelweiss Asset Management and ICICI Securities.

Mr. Anandha Padmanabhan Anjeneyan (Equity Portion)

With a B.Com, ACA, CFA, and FRM, Mr. Anjeneyan brings over 15 years of experience in equity research and fund management. He has worked at PGIM India Asset Management and previously at Renaissance Investment Managers and Canara Robeco Asset Management.

Mr. Utsav Mehta (Equity Portion)

Mr. Mehta, holding a B.Com and CFA, has 13 years of experience in equity markets and fund management. He is currently a Vice President and Fund Manager – Equity at PGIM India Asset Management, having previously worked at Edelweiss Asset Management and Ambit Capital.

Mr. Puneet Pal (Debt Portion)

Mr. Pal, an MBA in Finance, has over 20 years of experience in debt markets. He is the Head of Fixed Income at PGIM India Asset Management and has previously held senior roles at BNP Paribas Asset Management and PGIM India Asset Management.

Who should invest in this NFO?

The PGIM India Multi Cap Fund may be suitable for investors who are:

- Seeking long-term capital appreciation

- Comfortable with high-risk investments

- Looking for exposure across market capitalisations

- Willing to invest for at least 5 years or more

This fund is designed for those who want to benefit from the stability of large caps and the growth potential of mid and small caps through a single investment vehicle.

However, it’s important to keep in mind that all investments carry some level of risk, and investors should consult with a financial advisor to determine if this fund fits well within their overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.