OYO, officially known as Oravel Stays, is set to make its highly anticipated stock market debut in March 2025. OYO IPO is creating major buzz among investors and hospitality industry experts, as OYO IPO has revolutionized the budget hospitality sector on a global scale.

As one of the biggest hospitality brands globally, OYO’s move to go public isn’t just a milestone for the company—it’s a game-changer for the entire travel and hospitality industry.

But what does this mean for potential investors?

In this guide, we’ll break down everything you need to know about the OYO IPO, including its business model, market positioning, and key insights to help you make informed investment decisions.

Stay tuned for all the details!

IPO Analysis & Key Details: Quick Insight

When will the OYO IPO Open?

Well, the details for its launch are much awaited. However, in the meantime, a look can be taken at the company’s overalls.

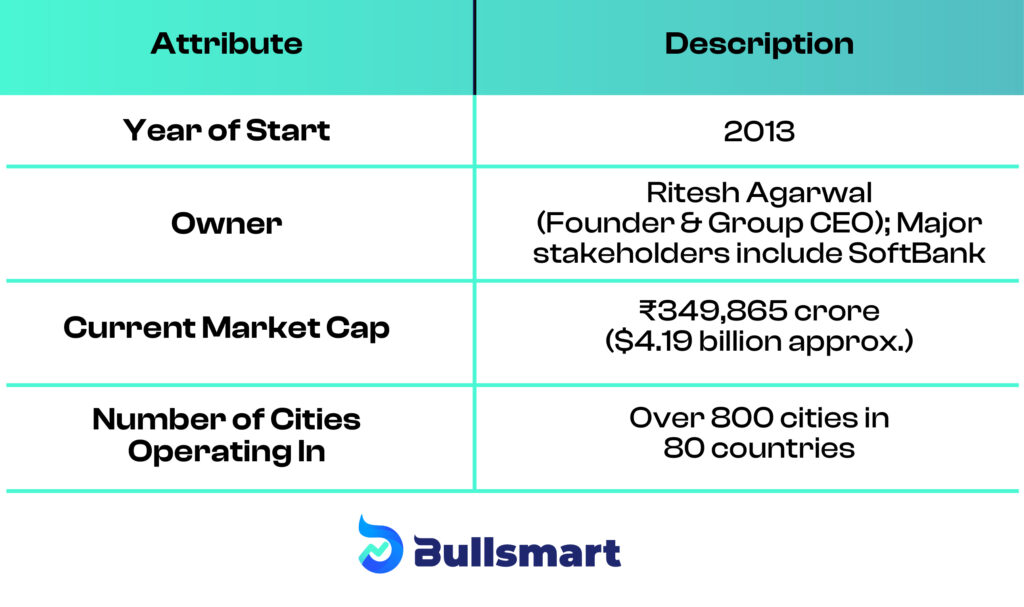

Check out this table showcasing the prime details of the IPO launch:

| Details | Information |

| OYO IPO Opening Date | First week of March 2025 |

| Allotment Finalization | Second week of March 2025 |

| Listing Platforms | NSE and BSE |

| Retail Trading Platforms | After 10 a.m. on the listing day |

| Price Band | ₹55 – ₹58 per share (source) |

| Total IPO Value | ₹8,430 crores (₹7,000 crores fresh issue + ₹1,430 crores OFS) |

| Company | Oravel Stays |

| Minimum Investment | Approximately ₹14,800 |

| GMP | Presently Unknown |

| Registrar | Link Intime India Private Limited |

Data available is as of 24.02.25.

OYO Company: Everything You Need to Know

OYO, or Oravel Stays Limited, has become a global leader in the hospitality space, revolutionizing budget accommodations with its tech-driven approach.

Founded in 2013 by Ritesh Agarwal, OYO’s rise from a small Indian startup to a multinational giant across 80+ countries is nothing short of impressive.

Data available is as of 24.02.25.

Along the way, it’s faced its fair share of challenges, secured major funding, and introduced innovative strategies to stay ahead.

Here’s a look at OYO’s fascinating journey:

Founding and Early Days (2012-2015)

Concept & Inspiration

Ritesh Agarwal, a young entrepreneur from Odisha, noticed a major gap in India’s budget hotel segment.

In 2012, he started Oravel Stays, an Airbnb-like platform for affordable accommodations.

Realizing there was a demand for standardized services, he pivoted in 2013 to launch OYO Rooms, or “On Your Own,” bringing consistency to budget hotels across India.

Early Business Model

Unlike traditional hotels, OYO partnered with small hotel owners to standardize their rooms under the OYO brand.

The company offered tech support, marketing, and operational help while taking a commission from its hotel partners.

Seed Funding & Growth

In 2013, Ritesh Agarwal became a Thiel Fellow, earning a $100,000 investment from Peter Thiel’s program.

OYO’s early growth took off with a $1 million seed round from investors like Lightspeed Venture Partners and DSG Consumer Partners.

Rapid Expansion & Funding Boom (2016-2019)

Aggressive Expansion in India

By 2016, OYO had expanded to hundreds of cities across India, onboarding thousands of hotel partners.

The company also introduced OYO Townhouse, a mid-market offering catering to a more premium segment.

International Expansion

In 2016, OYO made its first international move into Malaysia, quickly expanding to other countries.

By 2019, OYO had expanded into China, Indonesia, the UAE, the UK, the US, Japan, and several more markets, with China quickly becoming its second-largest market after India.

Major Funding Rounds

OYO attracted significant investments, including:

- $250 million from SoftBank Vision Fund in 2017.

- 1 billion in 2018, raising its valuation to 5 billion.

- Another $1.5 billion in 2019, led by SoftBank, Sequoia, and Lightspeed.

Key Acquisitions of OYO

OYO also made some key acquisitions to expand its reach:

- Acquired Leisure Group, a European vacation rental company.

- Acquired Qianyu, a Chinese hotel brand.

- Acquired Innov8, a co-working space provider, expanding into office spaces.

Challenges & Market Struggles (2019-2021)

Operational Issues & Hotel Partner Backlash

With rapid expansion came some challenges. Quality control issues and disputes with hotel partners emerged, leading many hotels to delist from the OYO network due to dissatisfaction with revenue-sharing and pricing models.

Layoffs & Cost-Cutting

To streamline operations, OYO had to lay off thousands of employees in India and China in 2020 as part of a major restructuring effort.

Impact of the COVID-19 Pandemic on OYO

Like many in the hospitality industry, OYO was hit hard by the COVID-19 pandemic. With travel restrictions and lockdowns in place, the company saw a sharp drop in revenue, forcing it to downsize and exit less profitable markets.

OYO’s journey has been full of ups and downs, but its resilience and adaptability have set it apart as a key player in the global hospitality industry.

As the company gears up for the launch of OYO hotels IPO in March 2025, investors are closely watching the next chapter in OYO’s growth story.

OYO’s Current Status & Future Plans: What’s Next for the Hospitality Giant?

Market Position

- Operating in 35+ countries with thousands of partner hotels.

- A leader in tech-driven budget and mid-range accommodations, offering affordable stays worldwide.

Growth Strategy

- Expanding into premium hotels and co-living spaces.

- Strengthening its presence in Southeast Asia, Europe, and the US.

- Boosting tech-driven solutions to enhance customer experience and hospitality offerings.

OYO Financials: Revenue, Total Assets & Profits

Revenue Trends of OYO

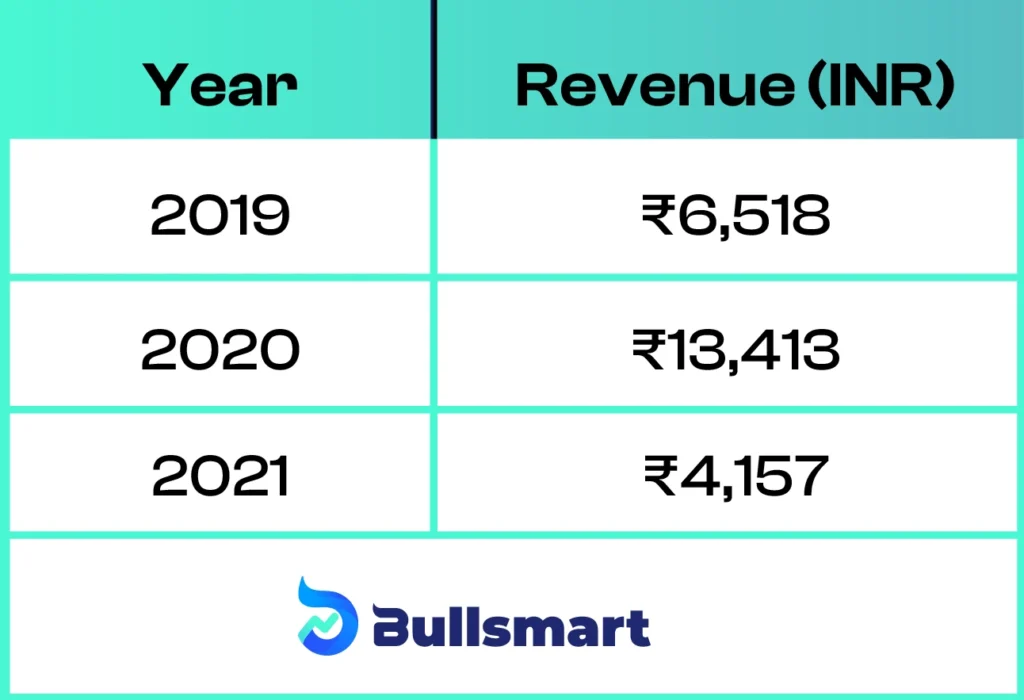

Check this table:

- 2019: ₹6,518 crores, which means revenue was moderate, reflecting OYO’s early expansion stage.

- 2020: ₹13,413 crores, which means significant growth, likely due to OYO’s increased market presence.

- 2021: ₹4,157 crores, which means a sharp decline caused by the pandemic’s impact on the hospitality industry.

What This Means for the OYO IPO

The revenue fluctuations suggest that OYO has experienced both strong growth and setbacks.

Investors will be keen to see how the company plans to sustain revenue growth post the launch of the IPO, especially after the challenges faced in 2021.

Total Assets

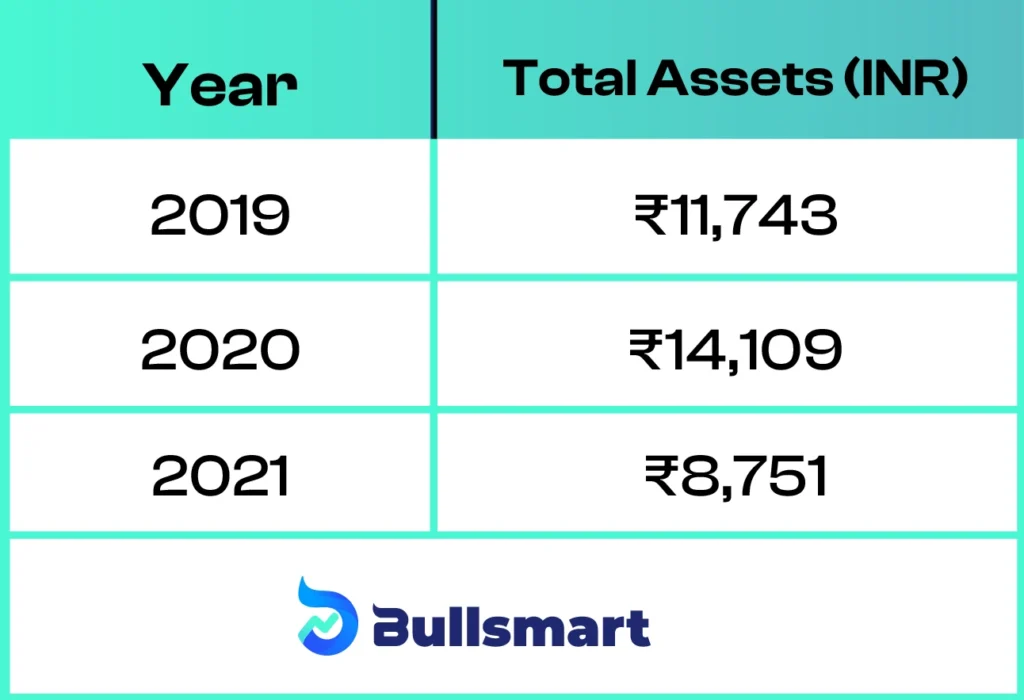

Check this table:

- 2019: ₹11,743 crores, which means a solid asset base, supporting expansion plans.

- 2020: ₹14,109 crores, which means growth in assets, likely due to acquisitions and increased investment.

- 2021: ₹8,751 crores, which means a notable decrease, likely due to pandemic-related write-downs and reduced operations.

What This Means for the OYO IPO

The drop in assets in 2021 could raise concerns about OYO’s ability to manage assets during downturns.

Investors will closely monitor the company’s asset management strategies to assess its stability and growth potential moving forward, focusing on the launch of the IPO.

OYO’s Recovery & IPO Plans: From Restructuring to a Potential 2025 Debut

Focus on Profitability & Restructuring (2022-Present)

After years of aggressive expansion, OYO shifted its focus towards achieving profitability and sustainable growth.

The company undertook a major restructuring effort, revising hotel contracts, prioritizing premium properties, and strengthening relationships with hotel partners to ensure long-term stability.

Technology & Innovation

OYO doubled down on enhancing its tech capabilities, refining its AI-driven pricing model and customer experience tools to stay competitive in a fast-evolving industry.

Additionally, the company launched OYO Wizard, a subscription-based loyalty program designed to increase customer retention and engagement

OYO IPO Attempts & Delays

OYO’s journey toward going public has seen several twists and turns:

- In 2021, OYO filed for a ₹8,430 crore IPO, but it was delayed in January 2023 due to challenging market conditions.

- In 2024, a revised, smaller IPO proposal was withdrawn in May.

- Now, OYO is preparing for a much-anticipated IPO set for the first week of March 2025, as it aims to make a successful public debut.

As OYO works towards its IPO, it’s clear that the company is focused on stability and growth, leveraging technology and innovation to lead the charge in the hospitality industry.

OYO IPO Funding Plans

As of February 2025, OYO (Oravel Stays Limited) is gearing up for its much-anticipated Initial Public Offering (IPO), set to launch in the first week of March 2025.

Here’s a detailed breakdown of what’s in store:

OYO IPO Structure & Financial Goals

- Total Issue Size: ₹8,430 crore

- Fresh Issue: ₹7,000 crore

- Offer for Sale (OFS): ₹1,430 crore

The primary goal? To clear off some debt, fuel expansion (both organic and through acquisitions), and take care of general corporate needs.

Pre-IPO Funding Moves

Ahead of the big launch, OYO has been actively securing funds:

- August 2024: Raised ₹1,457 crore (~$175 million) in a Series G round led by Patient Capital, a Singapore-based fund set up by OYO’s founder and CEO, Ritesh Agarwal. This round valued the company at $2.4 billion.

- January 2025: Pulled in another ₹550 crore (~$65 million) from Redsprig Innovation Partners, another Ritesh Agarwal-backed firm, to fuel global expansion. This pushed OYO’s valuation to $3.79 billion.

OYO’s Valuation Rollercoaster

- 2019: Hit a peak valuation of $10 billion.

- August 2024: Dropped to $2.4 billion after Series G funding.

- January 2025: Climbed to $3.79 billion after a fresh ₹550 crore investment.

Where Will the OYO IPO Funds Go?

- Debt Repayment: Cutting down financial liabilities.

- Expansion Plans: Entering new markets and strengthening existing ones.

- Tech & Operations: Investing in technology and customer experience improvements.

Key Things for Investors to Know About OYO

- Market Presence: OYO operates in 800+ cities across 80 countries, making it a global hospitality powerhouse.

- Financial Health: The company reported ₹229 crore in net profit for FY2023-24, signaling stronger operations.

- Valuation Swings: OYO’s valuation has fluctuated significantly, reflecting market conditions and internal strategies.

With the OYO IPO just around the corner, potential investors should dive into the final prospectus and consult financial experts before making a move.

Final Take: Will OYO IPO be Successful?

OYO IPO isn’t just another stock market debut—it’s a pivotal moment for one of the biggest names in the global hospitality industry.

From revolutionizing budget stays to navigating market challenges and bouncing back stronger, OYO’s journey has been nothing short of eventful.

For investors, the upcoming OYO IPO presents a mix of opportunity and risk. With its tech-driven approach, massive market presence, and ambitious growth plans, OYO is aiming to make a strong comeback. However, factors like financial stability, market sentiment, and post-IPO performance will be crucial in determining its long-term success.

As March 2025 approaches, all eyes are on OYO’s stock market entry. Will it deliver on expectations?

Stay tuned for more updates on OYO IPO news, GMP trends, listing details, and expert insights to make informed investment decisions!

Suggested Read: Geopolitical Events: The Profound Shockwaves Shaping Financial Markets in 2025

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

FAQs

What are the open and close dates of OYO IPO?

Opening Date: Expected in the first week of March 2025.

Closing Date: Specific closing date has not been announced yet.

Note: These dates are subject to final confirmation.

What is the lot size and minimum order quantity of the OYO IPO?

Lot Size: Expected to be 255 shares per lot.

Minimum Order Quantity: 1 lot (255 shares).

Minimum Investment: Approximately ₹14,800 for retail investors.

Note: These details are based on current expectations and may be updated upon official announcement.

Where is OYO IPO Getting Listed?

The shares are proposed to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

When is the OYO IPO Launching?

The IPO is anticipated to launch in the first week of March 2025. However, the exact dates are yet to be officially confirmed.

Investors are advised to stay updated through official channels for the final dates and details.