Small-cap funds have consistently outperformed large-cap indices in recent years, making them a popular choice among aggressive investors. In this blog, we will compare two popular small-cap schemes: Nippon India Small Cap Fund and Quant Small Cap Fund, and explore which one might be the right fit for your investment portfolio.

Over the last year, the best-performing small-cap funds have delivered an impressive return of 75.0%, while even the worst performers have managed 41.4%. In comparison, the Nifty 50, India’s benchmark large-cap index, has given a return of 28.15% during the same period.

Looking at the last two years, the best small-cap funds have generated a CAGR of 55.3%, with the worst delivering 35.6%. Meanwhile, the Nifty 50 has provided a more modest CAGR of 24.01%. This significant outperformance highlights the potential of small-cap funds for those willing to accept higher volatility and risk in exchange for greater growth.

What Are Small-Cap Funds?

Small-cap mutual funds are equity schemes that must invest at least 65% of their assets in small-cap stocks. Small-cap companies are ranked after the top 250 companies in terms of market capitalization. These funds are suitable for investors with a high-risk appetite and a long-term investment horizon, as small-cap stocks are highly volatile but offer significant growth potential.

Investment Objective of Schemes

Both Nippon India Small Cap Fund and Quant Small Cap Fund are open-ended equity schemes that primarily focus on small-cap stocks.

- Investment Objective of Nippon India Small Cap Fund: The scheme aims to generate long-term capital appreciation through investments predominantly in small-cap companies. The scheme also has a secondary objective of generating consistent returns by investing in money market and debt instruments.

- Investment Objective of Quant Small Cap Fund: The scheme seeks to achieve capital appreciation by investing in small-cap stocks with strong growth potential.

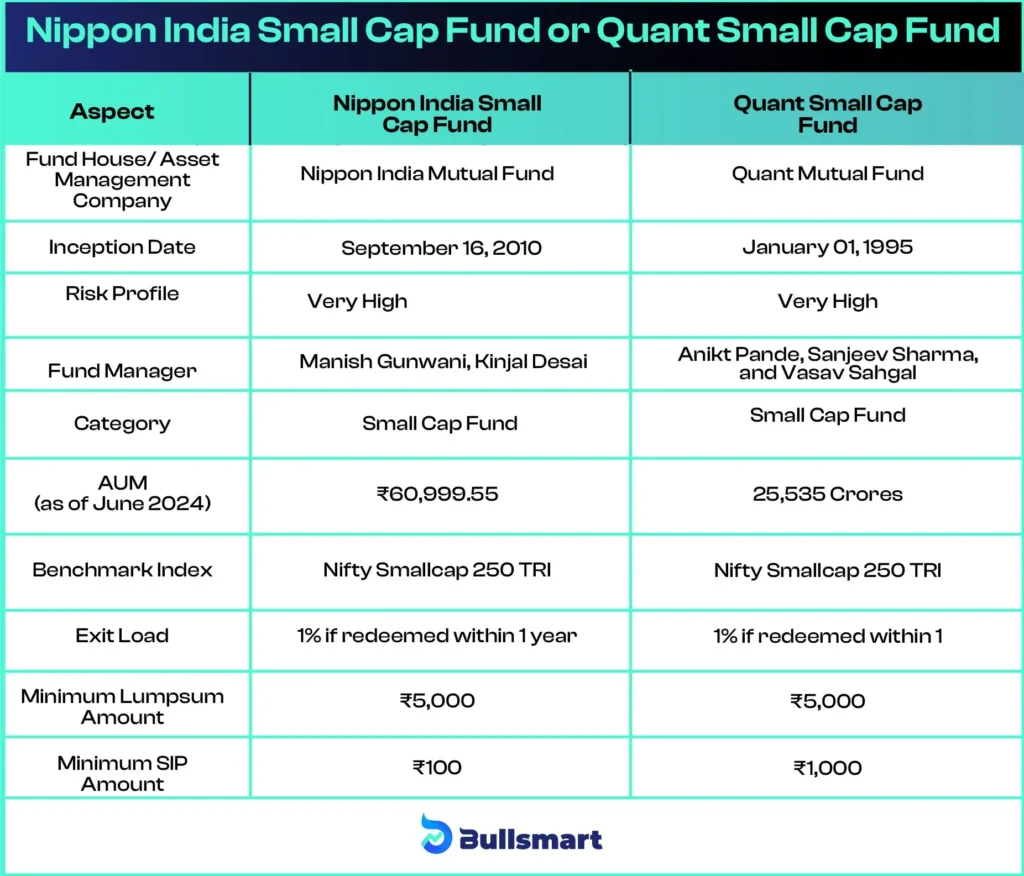

Comparison of Key Fund Details

Here is a comparison of the basic details of the Nippon India Small Cap Fund and Quant Small Cap Fund:

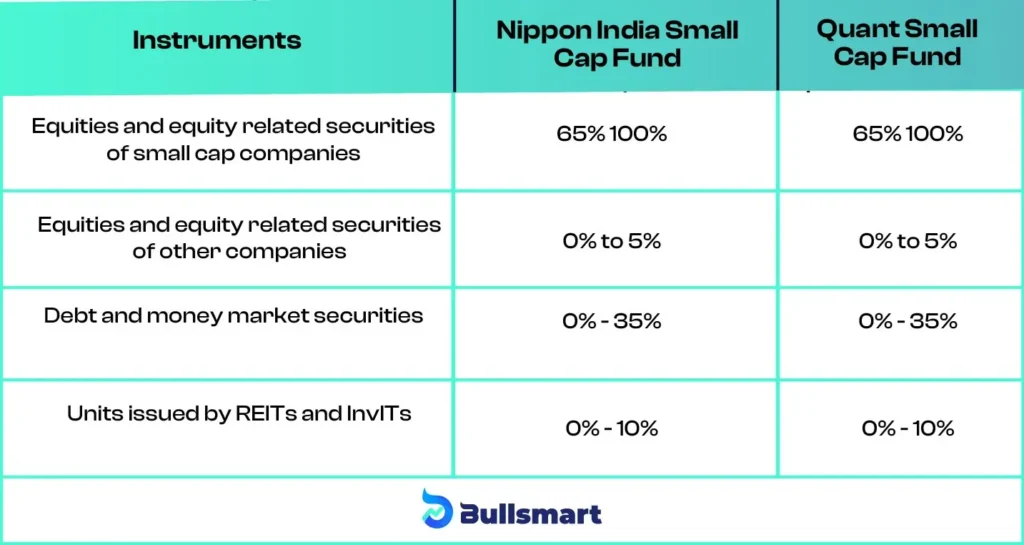

Portfolio Comparison

Here’s a comparison of how Nippon India Small Cap Fund and Quant Small Cap Fund allocate their assets:

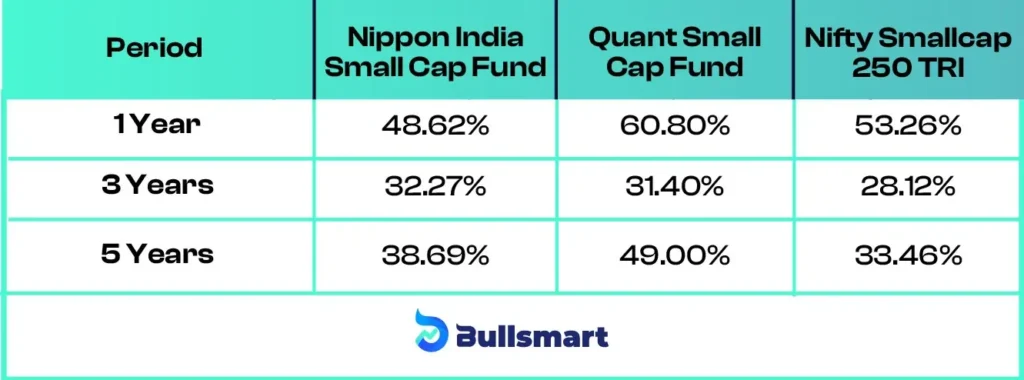

Comparison of Risk and Returns

Small-cap funds are known for their high-risk, high-reward nature. Both Nippon India Small Cap Fund and Quant Small Cap Fund follow the Nifty Small Cap 250 TRI as their benchmark index.

Here’s a comparison of their performance against each other and their benchmark:

Asset Management Company

Nippon India Mutual Fund

Nippon India Mutual Fund (NIMF), originally called Reliance Mutual Fund, was established in June 1995 through a partnership between Reliance Capital and Japan’s Nippon Life Insurance Company. In October 2019, Nippon Life took full ownership of Reliance’s shares, leading to the rebranding. Notably, Nippon India Mutual Fund became the first Asset Management Company (AMC) to list on stock exchanges in 2017.

Nippon Life India Asset Management Limited (NAM India) oversees NIMF’s assets, with Reliance Capital and Nippon Life holding a combined 75.93% stake in the company. As of June 30, 2024, NIMF managed assets worth ₹ 516,267.80 crore, including Mutual Fund, alternative investments, pension funds, and offshore funds.

Quant Mutual Fund

Quant Mutual Fund aims to stay relevant by using predictive analytics to adapt to market changes. Their investment approach combines data analysis, behavioral finance, and sentiment analysis to make smart decisions. They offer a variety of funds, such as Quant Absolute Fund, Quant Active Fund, and Quant Consumption Fund, designed to meet different investor needs with flexible asset allocation options. As of July, 2024, the fund manages an AUM of ₹94,000 crore

Which Fund is Right For You?

Nippon India Small Cap Fund could be a suitable choice for:

- Investors with a long-term horizon looking to invest in a well-diversified portfolio of small-cap stocks.

- Those seeking a large and established fund with a consistent track record.

Quant Small Cap Fund might be ideal for:

- Investors who prefer a tactical and quantitative approach to investing in small-cap stocks.

- Those looking for higher returns and are willing to accept a higher degree of risk for aggressive growth.

Both Nippon India Small Cap Fund and Quant Small Cap Fund are strong contenders in the small-cap category, offering high growth potential.

Nippon India is more suited for investors seeking a larger, more stable portfolio, while Quant Small Cap Fund caters to aggressive investors looking for outperformance through a data-driven, dynamic strategy. As always, consider your risk appetite and long-term goals before making any investment decision.

Suggested Read – Parag Parikh Flexi Cap vs HDFC Flexi Cap

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.