Investing in companies that have performed quite well in the past with the expectation that they would continue to perform better based on their current trend and vice versa is known as the momentum approach. Using the momentum method, Nippon India Nifty 500 Momentum 50 Index Fund NFO invests in the top 50 businesses from the Nifty 500 Universe that have the greatest momentum score in order to capitalize on their potential for dynamic growth.

Motilal Oswal Nifty 500 Momentum 50 Index Fund (and ETF) and Nippon India Nifty 500 Momentum 50 Index Fund NFO are the two NFOs that are presently in operation. In the next section, we examine the underlying index’s potential for both risk and return as well as what you should know before investing in a momentum index.

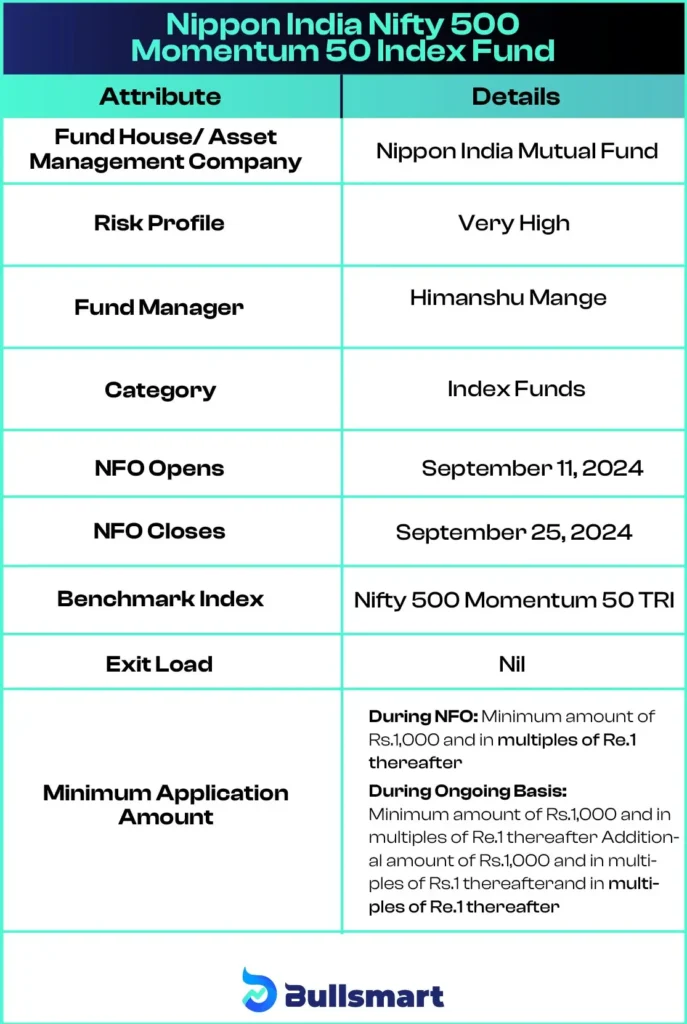

Overview of Nippon India Nifty 500 Momentum 50 Index Fund

The Nippon India Nifty 500 Momentum 50 Index Fund NFO seeks to monitor the performance of the top 50 Nifty 500 firms, chosen based on their Normalized Momentum Score, which is derived from their 6- and 12-month price returns that have been volatility-adjusted.

A stock’s Normalized Momentum Score and free-float market capitalization are combined to determine its weight.

How to Compute the Normalized Momentum Score

- Momentum ratios and Z-scores are calculated for 12-month and 6-month periods.

- A weighted average Z-score is computed to assess overall momentum.

- The Normalized Momentum Score is derived from the Z-score.

- Top 50 stocks are selected based on the score.

- Stock weights are capped to prevent excessive concentration.

Understanding the Index Methodology

The index tracks the performance of stocks that are a part of the Nifty 500 index and have high Normalized Momentum Scores.

Overview

- Tracks high-momentum stocks from Nifty 500.

- Base date: April 1, 2005; Base value: 1000.

Inclusion Criteria

- Minimum 1-year listing history.

- No more than 20% circuit hits in the past 6 months.

- Promotor share pledge under 20%.

- Not in the bottom 10% by average daily turnover or turnover ratio.

Weighting

- Factor tilt methodology: Free-float market cap * Normalized Momentum Score.

Selection

- Top 50 stocks based on Normalized Momentum Score.

Capping

- Maximum weight: Lower of 5% or 5 times weight based on free-float market capitalization.

Rebalancing

- Semi-annual (June and December).

- Replacements based on momentum score ranking.

Here are some basic details about Nippon India Nifty 500 Momentum 50 Index Fund:

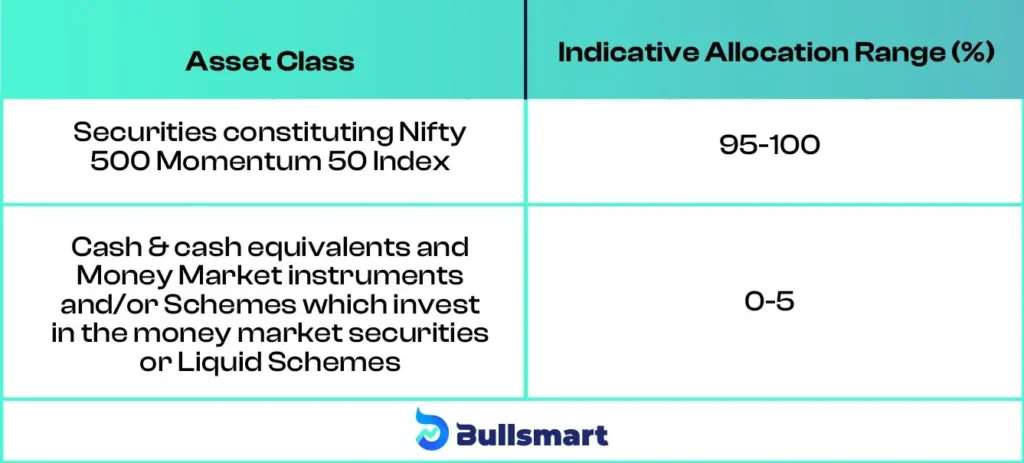

Portfolio Allocation

Under normal circumstances, the anticipated asset allocation would be:

Risks and Returns Explained

Subject to tracking mistakes, the scheme’s investment objective is to provide returns that are consistent with the total returns of the stocks as represented by the Nifty 500 Momentum 50 Index before expenditures. However, there is little to no assurance that the investment goals of the scheme will be met due to the funds’ high risk nature. In favorable markets, momentum stocks can perform well; nevertheless, in volatile or bearish markets, they may suffer large losses.

A quick look into the Nippon India Nifty 500 Momentum 50 Index Fund TRI’s performance provides a deeper understanding:

Suggested Read – Nippon India Nifty 500 Equal Weight Index Fund NFO

The Experts Behind the Fund

Mr. Himanshu Mange

- Mr. Himanshu Mange is the fund manager for Nippon India Nifty 500 Momentum 50 Index Fund and has over 5 years of experience

- He has worked previously on ETF, NAM India and TATA AIA Life Insurance Co. Ltd.

- A few schemes he has worked on previously include Nippon India Index Fund – Nifty 50 Plan, Nippon India Gold Savings Fund, and Nippon India Nifty 50 Value 20 Index Fund.

About the Nippon India Mutual Fund

Nippon India Mutual Fund (NIMF), formerly known as Reliance Mutual Fund, was established in June 1995 through a partnership between Reliance Capital and Japan’s Nippon Life Insurance Company. In October 2019, Nippon Life acquired Reliance’s stake, prompting the rebranding to Nippon India Mutual Fund. Notably, in 2017, NIMF became the first asset management company (AMC) to be listed on stock exchanges in India.

Nippon Life India Asset Management Limited (NAM India) acts as the asset manager for NIMF. The major stakeholders, Reliance Capital Limited and Nippon Life Insurance Company, together hold 75.93% of the company’s issued and paid-up equity share capital.

As of June 30, 2024, Nippon India Mutual Fund managed assets totalling ₹ 516,267.80 crore across various categories, including Mutual Funds, alternative investments, pension funds, and offshore funds.

Who should invest in this NFO?

- Investors use passive investing to seek capital growth over extended investment periods.

- Investors seeking to make a momentum-based factor index investment.

- Investors who are extremely willing to take risks.

- A minimum three- to five-year investment tenure is recommended.

- If investors are unsure if the Nippon India Nifty 500 Momentum 50 Index Fund is right for them, they should speak with mutual fund distributors or financial advisors.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.