Markets are swinging harder than ever. In April 2025, the Nifty 50 briefly crossed 22,700, only to slide nearly 4% amid global uncertainty. The India VIX has also climbed past 17, signaling rising fear.

In these choppy markets, it’s natural to look for stability without missing out on growth.

That’s why Nippon India Mutual Fund has launched the Nippon India Nifty 500 Low Volatility 50 Index Fund–a new option built for today’s market reality.

It focuses on India’s 50 least volatile companies from the Nifty 500, aiming to offer smoother returns even when the broader market gets rough.

Let’s break down why this NFO could be the smart move your portfolio needs in 2025.

Why Stability Matters in 2025: A Quick Look at Market Volatility

The markets in 2025 have been nothing short of unpredictable.

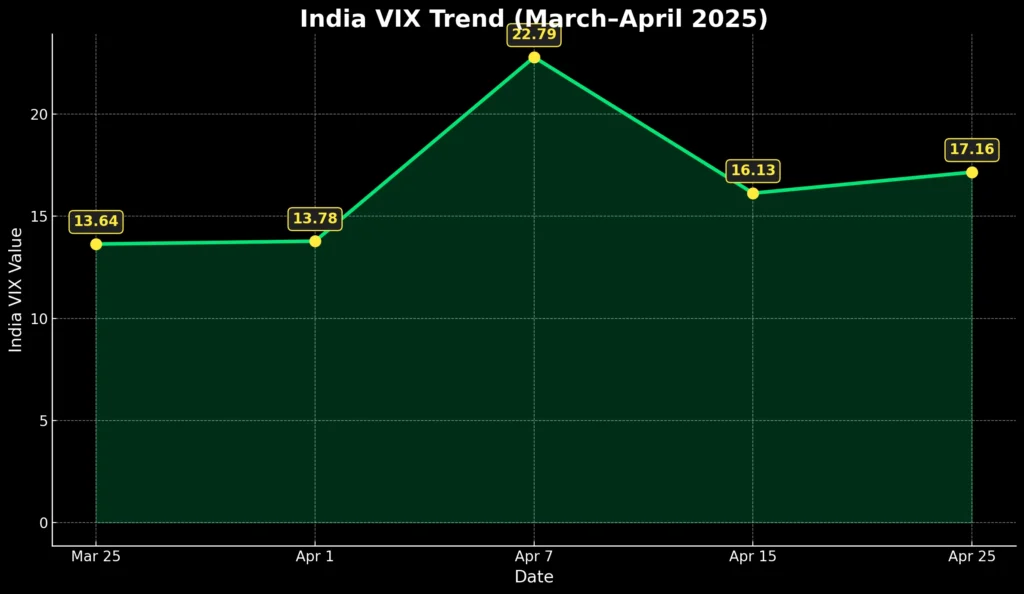

One quick way to measure how nervous investors are is by looking at the India VIX, which is also known as the “fear gauge.”

When VIX is low, markets are calm. When it spikes, it usually means uncertainty is brewing.

Over the past few months, we’ve seen exactly that:

- In March 2025, the India VIX was hovering around 13.5, suggesting steady sentiment.

- But by early April, it suddenly jumped to 22.8, a massive 65% spike in just a week (Source).

- As of April 25, 2025, it settled around 17.1, but that’s still significantly higher than normal.

Check this graph to and glide through the VIX’s performance over the time:

What does this mean for you as an investor?

Simply put–the market expects sharper ups and downs ahead.

When volatility rises, portfolios that are heavily tilted toward aggressive sectors can see wild swings — and that’s where low-volatility strategies come into play.

Understanding this, Nippon India Mutual Fund has launched the Nippon India Nifty 500 Low Volatility 50 Index Fund—designed to help investors stay invested in equities but with exposure to companies that have historically shown more stable, predictable price movements.

In today’s environment, having a core portfolio tilted toward lower volatility companies isn’t just a defensive move—it’s smart investing for the long term.

Suggested Read: India VIX Surges 65%: How Global Trade War Fears Are Shaking Up Stock Markets in 2025

About Nippon India Nifty 500 Low Volatility 50 Index Fund

The Nippon India Nifty 500 Low Volatility 50 Index Fund is an open-ended index fund that aims to replicate the Nifty 500 Low Volatility 50 Index.

This index focuses on selecting 50 stocks from the Nifty 500 universe that have shown the least volatility over the past year, helping investors navigate market swings without giving up equity exposure.

The fund passively tracks the performance of this basket, offering broad diversification across sectors and market caps–all based on a rules-based and transparent methodology.

Key Fund Details of Nippon India Nifty 500 Low Volatility 50 Index Fund NFO

In the table below, you can find all details of the NFO:

| Particulars | Details |

| Asset Management Company | Nippon India Mutual Fund |

| Category | Equity: Thematic – Low Volatility |

| Benchmark | Nifty 500 Low Volatility 50 TRI |

| Risk Profile | Very High |

| Nippon India Nifty 500 Low Volatility 50 Index Fund NFO Opening and Closing Dates | Opens: April 16, 2025 Closes: April 30, 2025 |

| Minimum Investment (During NFO) | ₹1,000 and multiples of ₹1 thereafter |

| Minimum Investment (Post NFO) | ₹1,000 and multiples of ₹1 thereafter |

| Exit Load | NIL |

| Fund Manager | Yet to be announced |

Investment Objective

The Nippon India Nifty 500 Low Volatility 50 Index Fund is built to mirror the performance of the Nifty 500 Low Volatility 50 TRI, offering investors an opportunity to participate in the growth of India’s least volatile companies.

Instead of actively picking stocks, the fund adopts a passive approach, aiming to replicate the returns of the index by investing in the same 50 carefully selected stocks that the index tracks. This ensures investors gain broad diversification across sectors and market caps, along with the potential stability that a low-volatility strategy offers.

While the fund is structured to move in line with the index, small variations in performance may occasionally occur due to practical factors such as expenses and portfolio rebalancing — a standard characteristic in any index-based strategy.

Overall, the fund offers a simple, low-cost way to access a well-curated basket of stable companies, without the need for constant monitoring or active decision-making.

Why You Should Consider Investing in Nippon India Nifty 500 Low Volatility 50 Index Fund NFO

- Low Volatility Exposure: Focuses on companies with more stable price movements, reducing emotional ups and downs during market turbulence.

- Smart Diversification: Covers large, mid, and small-cap companies across diverse sectors like Financial Services, Healthcare, Automobiles, FMCG, and IT.

- Rules-Based Stock Selection: Companies are selected based on quantitative low volatility scores and free-float market capitalization–no fund manager bias.

- Risk Mitigation: Passive investing in a low-volatility index eliminates non-systematic risks like poor stock picking.

- Easy Access: No demat account needed; invest conveniently like a regular mutual fund.

- SIP Friendly: You can start small and build wealth gradually through Systematic Investment Plans (SIPs).

- Low Cost: Being an index fund, it’s expected to have a lower total expense ratio compared to actively managed equity funds.

Benchmark Index Details: Nifty 500 Low Volatility 50 TRI

About the Nifty 500 Low Volatility 50 Index

The Nifty 500 Low Volatility 50 Index is designed to capture the performance of the 50 least volatile stocks within the broader Nifty 500 universe. Volatility is measured using the standard deviation of stock returns over the past year, and companies with the lowest price fluctuations are selected.

To maintain balance, stocks are weighted based on a combination of their low volatility score and free-float market capitalization.

The index is reviewed and rebalanced semi-annually (in June and December) to ensure it remains aligned with its objective of offering more stable equity exposure.

It provides diversification across sectors like Financial Services, Healthcare, Automobiles, FMCG, and IT, while aiming to deliver a smoother investment experience compared to more aggressive equity indices.

Here’s how the Nifty 500 Low Volatility 50 TRI has performed as of March 28, 2025:

| Period | Returns (%) |

| 1 Year | 24.69% |

| 5 Years (CAGR) | 17.95% |

| Since Inception (CAGR) | 17.95% |

Returns are based on Total Return Index (TRI) values, which include dividends reinvested.

Nippon India Mutual Fund AMC: A Legacy of Trust and Innovation

Established in June 1995 as Reliance Mutual Fund, Nippon India Mutual Fund has evolved into one of India’s premier asset management companies.

In October 2019, a significant transformation occurred when Japan’s Nippon Life Insurance Company acquired full ownership, leading to the rebranding of the fund house as Nippon India Mutual Fund

Over the years, the company has demonstrated consistent growth and resilience, navigating through various market cycles. As of March 31, 2025, Nippon India Mutual Fund manages assets worth ₹5.65 lakh crore, reflecting its robust presence in the Indian mutual fund industry.

Key Details at a Glance

| Attribute | Details |

| Inception Date | June 30, 1995 |

| Original Name | Reliance Mutual Fund |

| Current Name | Nippon India Mutual Fund |

| Ownership | Nippon Life Insurance Company |

| CEO | Sundeep Sikka |

| Assets Under Management | ₹5.65 lakh crore (as of March 31, 2025) |

| Headquarters | Mumbai, India |

| Number of Schemes | 109 |

| Presence | Over 260 locations across India |

Top Sectors (as of March 28, 2025)

You can find the top sectors in this table:

| Sector | Weight (%) |

| Financial Services | 37.36% |

| Healthcare | 16.16% |

| Automobile & Auto Components | 16.14% |

| FMCG | 7.68% |

| Information Technology | 7.39% |

Top Constituents by Weight

You can find how much the top sectors weigh in this table:

| Company | Weight (%) |

| Bajaj Finance Ltd. | 6.77% |

| Kotak Mahindra Bank Ltd. | 6.39% |

| Bajaj Finserv Ltd. | 5.27% |

| Maruti Suzuki India Ltd. | 5.18% |

| Axis Bank Ltd. | 4.80% |

Other notable names include Titan Company, SBI, Dr. Reddy’s Laboratories, Apollo Hospitals, and Tech Mahindra.

Peer Comparison

Low-volatility investing strikes a sweet spot that many traditional funds miss.

It lets you stay invested in equities, while offering a smoother experience during market ups and downs–something that aggressive sectoral or midcap strategies often struggle with.

By focusing on stability and following a disciplined, rules-based approach, this strategy can help investors ride out market turbulence with greater confidence. In fact, during more volatile periods, it has the potential to hold up better than many actively managed funds that rely heavily on stock-picking.

How to Invest in Nippon India Nifty 500 Low Volatility 50 Index Fund NFO

How to Invest

- During the NFO period (April 16 to April 30, 2025): You can invest directly in the fund during the New Fund Offer window.

- After the NFO closes: Continue your investment journey through a lumpsum investment or by setting up a Systematic Investment Plan (SIP).

Pro Tip: Use a SIP calculator or lumpsum calculator to plan your contributions smartly and align them with your financial goals.

About the Index Methodology

- Eligible stocks are drawn from the Nifty 500.

- Stocks with high promoter pledge (>20%) or low liquidity are excluded.

- Top 50 stocks are selected based on the lowest volatility scores.

- Weights are assigned using a combination of volatility score and free-float market capitalization.

- Rebalancing happens twice a year, with plenty of notice to maintain transparency.

Who Should Consider This Fund?

Ideal for

- Long-term investors seeking steady returns with lower price swings.

- Investors aiming to reduce portfolio volatility but still participate in India’s equity growth story.

- New mutual fund investors looking for a lower stress equity option.

Not ideal for

- Very aggressive investors chasing maximum short-term returns.

- Investors unwilling to stay invested for 3-5 years minimum.

Conclusion

The Nippon India Nifty 500 Low Volatility 50 Index Fund offers a compelling proposition for today’s equity investors. Stay invested in equities while smoothing out the bumps.

Built on a transparent, rules-driven methodology, diversified across leading sectors, and crafted for lower emotional stress, this fund could be your calm amid the market storm.

If you believe in smart, steady wealth creation—not just chasing returns; this NFO could be a smart move in 2025.

As always, make sure to match any investment to your personal risk appetite, goals, and investment horizon.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

Which Nifty 500 Index Fund is best in India?

Choosing the “best” Nifty 500 index fund really depends on what you value most: low tracking error, low expense ratio, consistent tracking to the Nifty 500 TRI, and strong fund management.

As of 2025, some of the top Nifty 500 index funds in India include:

- HDFC Nifty 500 Index Fund

- UTI Nifty 500 Index Fund

- SBI Nifty 500 Index Fund

These funds offer broad exposure across large, mid, and small caps, and closely mirror the overall Indian equity market.

When comparing, look for funds that have lower expense ratios and minimal deviation from the Nifty 500 benchmark over time.

What is the Nifty 500 Next 50 fund?

There is currently no official index called the “Nifty 500 Next 50.” However, two separate indices are often referenced:

- Nifty 50: Representing India’s 50 largest companies by market capitalization.

- Nifty Next 50: Comprising the next 50 largest companies after the Nifty 50.

The Nifty 500 represents a much broader universe, covering the top 500 companies across large, mid, and small-cap segments.

If a product mentions “Nifty 500 Next 50,” it is important to verify, as it may refer either to a custom strategy or a mid-large blend, but it is not an officially recognized index by NSE.

Which is better, SIP or index fund?

It is important to distinguish between the two:

- An index fund is an investment product that tracks a specific market index.

- A Systematic Investment Plan (SIP) is a method of investing small, regular amounts into a fund over time.

They are complementary rather than alternatives. Investing in a good index fund through a SIP allows investors to benefit from rupee-cost averaging, market discipline, and long-term compounding, without the need to time the market.

Thus, for most investors, using SIP as a strategy within a well-chosen index fund is considered an effective approach to building long-term wealth.

Which is best Nifty 50 index Mutual Fund?

Rather than focusing on a single “best” fund, investors should evaluate Nifty 50 index funds based on:

- Expense ratio: Lower costs generally help enhance returns over time.

- Tracking accuracy: How closely the fund replicates the Nifty 50 Total Return Index (TRI).

- Fund stability: Including how consistently the fund performs across different market conditions.

Choosing a Nifty 50 index fund with a good balance of low cost and strong tracking discipline can serve as a strong core for a long-term equity portfolio.