The Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund NFO is a great choice for investors seeking a stable income over a defined period. This fund targets high-quality AAA-rated financial services sector bonds, which provide both safety and moderate returns. With a fixed maturity of January 2028, the fund offers investors a clear time horizon, making it ideal for those who wish to plan their investments around a specific date.

According to recent data, AAA-rated bonds have demonstrated stable performance even during volatile market conditions, with lower default risk.

As a result, they offer a reliable source of income with relatively low credit risk.

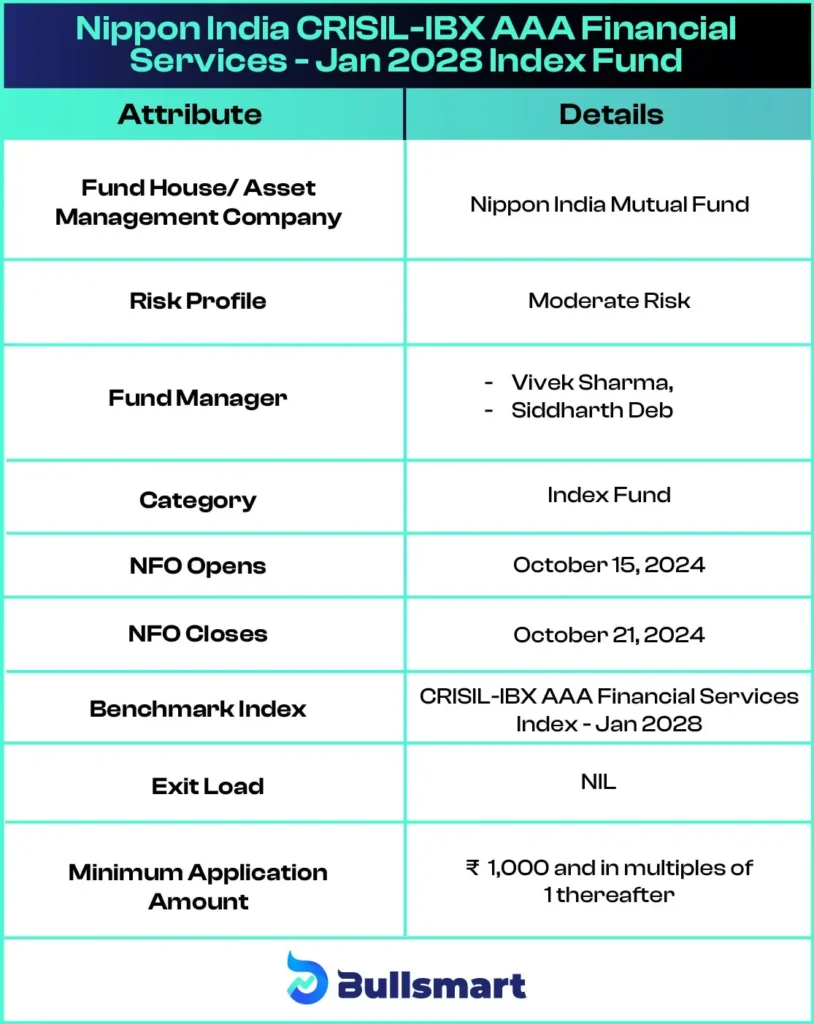

Details of Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund

The Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund NFO is an open-ended scheme that follows the CRISIL-IBX AAA Financial Services Index. It invests primarily in AAA-rated bonds from financial services companies, ensuring a strong and stable portfolio. Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund is perfect for investors looking to align their investments with a defined maturity date.

Investment Objective of the Fund

Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund’s goal is to track the performance of the CRISIL-IBX AAA Financial Services Index – Jan 2028, offering returns that are in line with the total return of the securities represented by this index. The fund aims to achieve this by investing in AAA-rated financial services sector corporate bonds, minimizing risk and providing moderate returns.

As with all index funds, there may be tracking errors due to expenses or market conditions, and there is no guarantee that the fund will meet its objective.

Key Details of Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund:

Portfolio Analysis

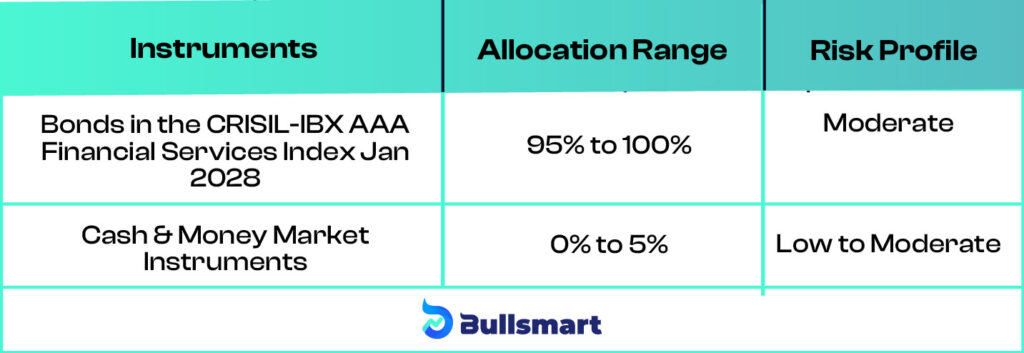

The Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund NFO will primarily invest in the AAA-rated bonds of financial services companies that make up the CRISIL-IBX AAA Financial Services Index. A small portion of the portfolio may be held in cash and cash equivalents, ensuring liquidity for daily operations.

Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund asset allocation strategy ensures moderate interest rate risk and low credit risk.

Understanding Risks and Returns

The Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund is well-suited for conservative investors who seek predictable income over a fixed time horizon.

While it carries a moderate interest rate risk, the low credit risk due to the high-quality bonds in its portfolio offers stability. Investors can expect steady returns over the investment period, with minimal fluctuations, as the bonds are of the highest rating (AAA).

Nippon India Mutual Fund

Nippon India Mutual Fund (NIMF), formerly known as Reliance Mutual Fund, was founded in June 1995 through a collaboration between Reliance Capital and Japan’s Nippon Life Insurance Company. In October 2019, Nippon Life acquired all of Reliance’s shares, leading to the name change. Notably, Nippon India MF became the first asset management company (AMC) to be listed on stock exchanges in 2017.

Nippon Life India Asset Management Limited (NAM India) manages NIMF’s assets, with Reliance Capital and Nippon Life owning a combined 75.93% of the company. As of June 30, 2024, NIMF managed assets totalling ₹516,267.80 crore, which includes Mutual Funds, alternative investments, pension funds, and offshore funds.

Fund Management Team

Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund NFO is managed by experienced fund managers:

Vivek Sharma

Vivek Sharma has over 18 years of experience in fund management. Since the launch of various schemes, he has been responsible for managing multiple funds, including the Nippon India Income Fund and the Nippon India Short-Term Fund, focusing on fixed-income investments. He also oversees the Nippon India Dynamic Bond Fund, which aims to provide returns through diversified bond investments.

Siddharth Deb

Siddharth Deb brings more than 17 years of experience in capital markets to his role. He has been managing several key schemes, including the Nippon India Liquid Fund, which focuses on short-term investments for liquidity. He also oversees the Nippon India Overnight Fund, designed for ultra-short-term investments, and the Nippon India Arbitrage Fund, which seeks to generate returns through price discrepancies in the market.

Who Should Invest in this NFO?

Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund NFO is ideal for:

- Investors seeking income stability over a targeted maturity period.

- Those looking for a low-risk option in the fixed-income category.

- Individuals who want to diversify their portfolio with high-quality AAA-rated bonds.

- Investors who prefer index-linked returns with lower expenses and predictable outcomes.

Why Choose Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund NFO?

- AAA-rated bonds: These are the highest-rated bonds, offering low default risk and stable returns.

- Target maturity: The fund matures in January 2028, making it a clear choice for goal-based planning.

- Index-linked strategy: As a passive fund, it aims to mirror the performance of the CRISIL-IBX AAA Financial Services Index, providing transparent and cost-effective returns.

In conclusion, the Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund is an excellent option for investors seeking safety, stability, and moderate returns over a fixed period.

With a portfolio focused on AAA-rated financial sector bonds, Nippon India CRISIL-IBX AAA Financial Services – Jan 2028 Index Fund offers predictable income with minimal risk, making it a solid addition to any fixed-income portfolio.

Suggested Read – Nippon India Nifty 500 Momentum 50 Index Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.