Imagine having a smart tool that can do the best possible investing for you from a long list of companies; sounds fascinating, right?

This is where the Nifty 500 Momentum 50 Index Fund comes into the picture. Motilal Oswal Nifty 500 Momentum 50 Index Fund NFO was launched on September 4, 2024 and has already made some headlines.

Something interesting: This fund focuses on the top 50 out of 500 stocks that are performing well and expected to continue the momentum. It focuses on capturing the momentum of these best-performing companies, to make it easy for you to invest in rapidly growing sectors. Below is a deep dive into how this fund operates, what it may mean for your investments and why Motilal Oswal Nifty 500 Momentum 50 Index Fund NFO can suit your investment appetite and your investment strategy.

Let’s get started!

Key Insights : Motilal Oswal Nifty 500 Momentum 50 Fund

The Motilal Oswal Nifty 500 Momentum 50 Index Fund NFO is an passively managed fund that invests in top stocks to mirror the performance of the Nifty 500 Momentum 50 Index. It aims for long-term growth by focusing on stocks with strong recent price trends. The fund regularly adjusts its holdings to stay aligned with top-performing stocks.

Managed by Motilal Oswal Asset Management Company, Motilal Oswal Nifty 500 Momentum 50 Index Fund follows a somewhat dynamic investment approach through the right balance of equity exposure, along with strategic momentum-biased stock selection. Moreover, the scheme promises possibly higher returns with higher volatility and risks associated with market fluctuations and momentum investing. It suits long-term investors better, having a relatively higher risk appetite. This would be an attempt for the fund to seek high returns from those high-momentum stocks while keeping the sectors diversified.

Take a look at this table for a quick summary:

Data updated as of 12.09.24

But before we commence any further, there’s one question that boggles the mind of many investors, i.e., “What is Momentum factor and how does it affect a fund’s performance?”

The momentum factor suggests that the stocks that have been performing well lately are likely to keep doing well. The news produces overreaction or under-reaction by investors, making the fluctuation of price quite unpredictable. You would hope that buying stocks which perform well at the moment will keep on doing so.

About Motilal Oswal Mutual Fund AMC

Once upon a time, in the year 2008, a new entrant arrived on the Indian financial scene: Motilal Oswal Asset Management Company (MOAMC), stemming from the leading Motilal Oswal Group. Only a few years later, the AMC emerged from a new to an important player in the field of asset management. With its philosophy well enamored with “Buy Right, Sit Tight,” the company believes in investing in great companies and then holding on those companies/asset classes for a long time. All in all, this approach not only revitalized confidence for seasoned investors, but also carved a niche in the competitive world of mutual funds and portfolio management services for the company as a whole.

Over the years, the Motilal Oswal Mutual Fund has been adhering religiously to equity funds and doing painstaking stock research. The fund house is known to be quite innovative, with a number of products launched-from ETFs and active mutual funds to thematic investments. With strong belief in solid fundamentals of companies, powered by intensive research, its flagship funds showed tremendous performance versus their respective market indices despite volatility. It has not only been a witness to the growth trajectory that India has followed, but has an uncanny ability to sniff out opportunities and commitment to long-term gains with AMC setting the benchmark in the asset management sector.

Benchmark Overview

The Nifty 500 Momentum 50 Index is intended to deliver returns by investing in the top 50 companies from the larger Nifty 500 Index. Recently, their stock price movements have been relatively good, and this strategy looks at price performance and its derivatives for the past 6 to 12 months. It employs an objective that includes importance and recent price appreciation in selection of the firms.

The index kicked off on April 1, 2005. It gets an update twice a year, in June and December. The Total Returns Index (TRI) version takes into account both changes in stock prices and any dividends paid out. This gives a more complete view of how these companies are doing. Investors find this index helpful to compare fund performance and to create investment products such as index funds and ETFs.

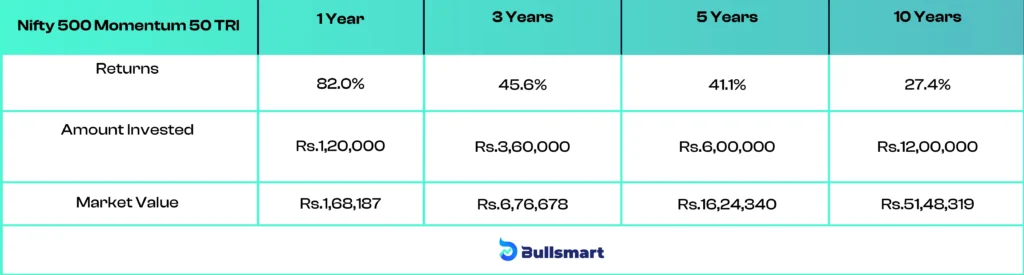

Here’s a tabular insight into the benchmark’s performance:

Note: Data updated as of August 30, 2024.

SIP Index Returns

Note: Data as on Jul 31, 2024 For SIP returns, monthly investment of INR 10,000/- invested on the first business day of every month has been considered. Performance is calculated using Total Return Index, with zero cost/expenses.

Investment Distribution

The Motilal Oswal Nifty 500 Momentum 50 Index tweaks its sector mix often to stay in sync with market shifts. Between December 2020 and June 2024, the index changed its sector focus. Financial Services, once a key part of the index, lost its top spot by June 2024. Meanwhile, Industrials and Consumer Discretionary grew more prominent showing how the index adapts to market winners.

Information Technology and Healthcare also experienced shifts in their importance over time. Commodities, Utilities, and Telecommunications played smaller or more varied roles in the index. This flexible approach helps the index zero in on sectors gaining steam, enabling it to expand as market conditions change.

Risk Analysis

The Motilal Oswal Nifty 500 Momentum 50 Index Fund uses a momentum strategy to pick stocks. This means it chooses stocks that have done well in the past 6-12 months. This method connects to market trends and can be quite risky when markets gets volatile, and during these times, the value of these stocks might fall. The fund focuses on sectors that are strong right now, so its investments can change often. This leads to higher costs and might make returns less stable.

Motilal Oswal Nifty 500 Momentum 50 Index Fund might make your investments seem to be a bit under the weather because it depends on stocks doing well, which isn’t a sure thing in all market situations, such as during a downturn. So, it’s better suited for people who are okay with big risks and ready to invest for the long haul to get through rocky patches.

Suggested Read – Motilal Oswal Manufacturing Fund NFO Review

Meet the Fund Managers Team

Swapnil Mayekar

- M.Com degree secured from University of Mumbai.

- Advanced Diploma in Business Administration acquired from Welingkar, Mumbai.

- Presently employed by Motilal Oswal AMC.

- Previously worked for Business Standard Limited between August 2005 and February 2010.

Rakesh Shetty

- B.Com degree holder.

- Prior to joining Motilal Oswal Mutual Fund, was employed in a capital market firm.

- Managed equity and debt ETFs, as well as developing tailored indices.

- Worked in the capital market sector and experienced in the area of product development.

Who should invest in the Motilal Oswal Nifty 500 Momentum 50 Index Fund NFO?

The Motilal Oswal Nifty 500 Momentum 50 Index Fund works best for investors who can handle high risks and want to earn more from stocks that have done well . It’s a good choice for people who don’t mind market ups and downs and plan to invest for 5-7 years. The fund picks stocks that are doing great and changes its mix to include top performers.

Motilal Oswal Nifty 500 Momentum 50 Index Fund fits experienced investors who are okay with fast-changing market trends and want to add variety to their investments using a momentum-based method. If you like to follow market trends and don’t worry about the highs and lows, Motilal Oswal Nifty 500 Momentum 50 Index Fund could be a great addition to your current investments.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.