Mid-cap companies have shown significant growth in earnings over the years, making them an attractive option for investors. Between FY08 and FY19, midcaps posted an average growth rate of 5.6%, but in the more recent period from FY19 to FY23, this figure surged to 31%.

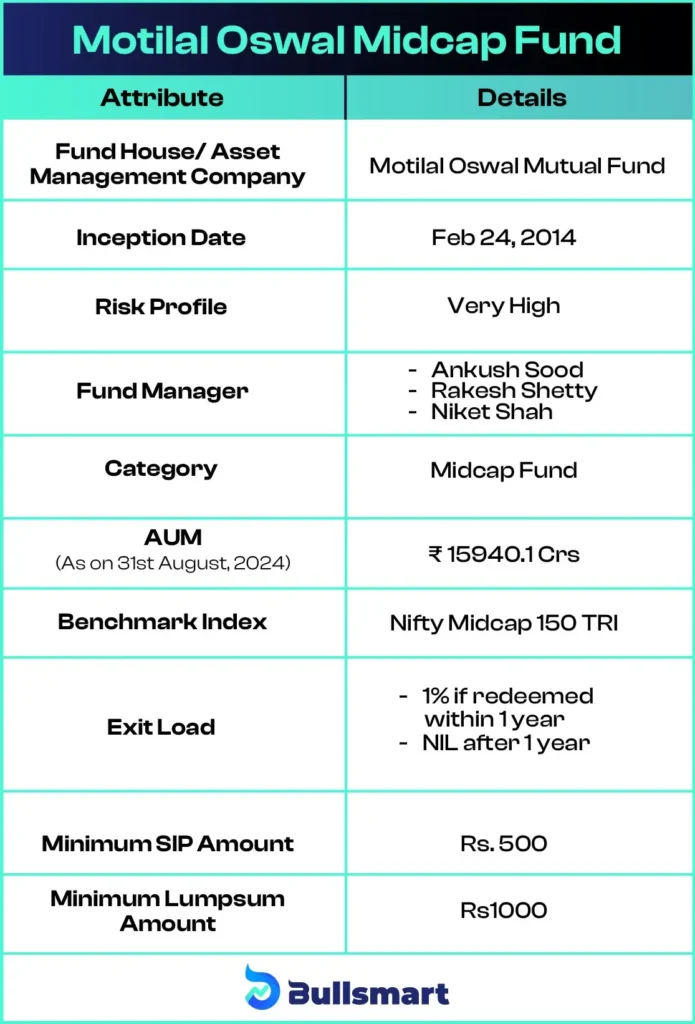

For investors looking to capitalise on the opportunities presented by high-growth mid-cap companies, the Motilal Oswal Midcap Fund offers a compelling investment option.

This growth highlights the wealth creation stage that midcaps are currently in, with high potential for future expansion. Unlike smaller companies, midcaps have already established their track record and possess a stronger ability to scale up, positioning them for further success.

Let’s explore if the fund aligns with your investment objective.

Overview of Motilal Oswal Midcap Fund

The Motilal Oswal Midcap Fund is an open-ended equity scheme that primarily invests in mid-cap stocks. These are companies that are in the growth and expansion phase, offering higher returns than large-cap stocks.

Motilal Oswal Midcap fund follows a disciplined investment approach, focusing on businesses that have strong competitive advantages and the ability to generate high returns on capital over time.

The fund has Nifty Midcap 150 TRI as its benchmark scheme.

Motilal Oswal Midcap Fund’s Core Investment Aim

The investment objective of the Motilal Oswal Midcap Fund is to provide long-term capital appreciation by investing in a portfolio of mid-cap companies with a proven track record of growth.

The fund seeks to identify companies that have a competitive advantage in their respective industries and possess the potential for high growth.

The focus is on capital appreciation over time, making it ideal for investors with a long-term investment horizon and a higher risk tolerance.

Here are some key details about the fund:

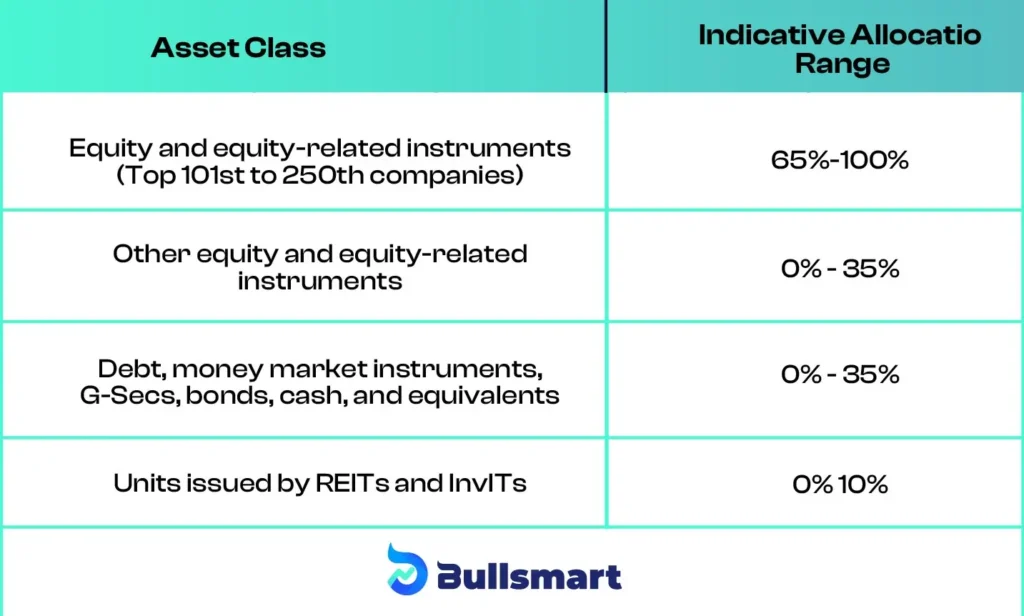

Portfolio Composition

The scheme allocates its assets as follows:

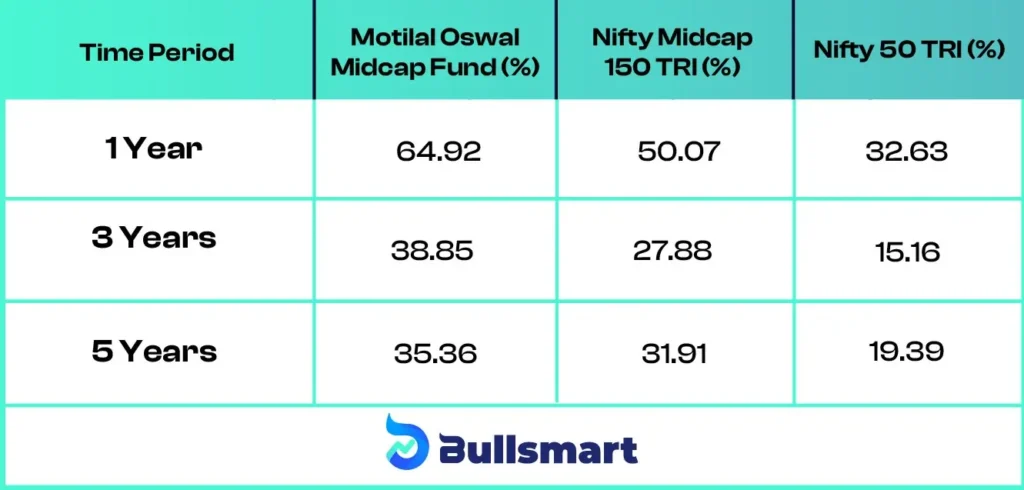

Assessing Risks and Returns

Since its inception, the Motilal Oswal Midcap Fund has delivered a CAGR of 26.2%, significantly outperforming many of its peers.

While the midcap segment has a history of delivering higher returns, it also comes with higher risk due to the market volatility often associated with mid-sized companies.

However, for investors with a long-term investment horizon and a high-risk appetite, this fund offers an excellent opportunity for capital growth.

Here’s a table showing how the fund has outperformed its benchmark over a 1 year, 3-year, and a 5-year time frame.

About the Motilal Oswal Asset Management Company

Motilal Oswal Asset Management Company (MOAMC) is a SEBI-registered portfolio manager that operates the Motilal Oswal Mutual Fund (MOMF). It is supported by Motilal Oswal Financial Services Limited (MOFSL), which is publicly traded on major Indian stock exchanges, BSE and NSE. MOAMC received its SEBI registration in 2009.

In addition to asset management, it offers advisory services for offshore funds, including portfolio management, business consulting, and research.

As of June 30, 2024, Motilal Oswal Mutual Fund manages assets totalling over ₹ 66,452.27 crore and offers more than 40 mutual fund schemes.

Some of its notable schemes are the Motilal Oswal Flexi Cap Fund, Motilal Oswal Nifty India Defence Index Fund, and Motilal Oswal NASDAQ 100 ETF, based on their assets under management (AUM).

Fund Manager Profiles

The fund is managed by a team of experienced fund managers:

Mr. Niket Shah

Mr. Niket Shah, 38 years old, has been managing the equity component of various funds since July 1, 2020, and holds an MBA in Finance. With 14 years of experience, he oversees multiple funds including the Motilal Oswal Large and Midcap Fund and the Motilal Oswal Flexi Cap Fund.

Mr. Rakesh Shetty

Mr. Rakesh Shetty, aged 43, has managed the debt components since November 22, 2022, and holds a Bachelor’s in Commerce. He has over 15 years of experience in equity and debt trading, managing funds such as the Motilal Oswal Liquid Fund and the Motilal Oswal UltraShort-Termm Fund.

Mr. Ankush Sood

Mr. Ankush Sood, 27 years old, has been managing foreign securities since November 11, 2022, and holds a B.Tech and an MBA in Finance. He has experience in institutional sales trading and manages funds like the Motilal Oswal S&P 500 Index Fund and the Motilal Oswal Nasdaq 100 ETF.

Who should invest in this fund?

The Motilal Oswal Midcap Fund is best suited for investors who:

- Have a high-risk tolerance and can handle the volatility associated with mid-cap stocks.

- Are looking for long-term capital appreciation and are willing to stay invested for a period of at least 5 years.

- Wish to gain exposure to India’s growing mid-cap companies that have the potential to become future leaders.

This fund is ideal for investors seeking to tap into the growth potential of mid-cap companies and are willing to endure short-term market fluctuations for long-term gains.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.