India proudly stands as the 4th strongest military power in the world according to the Forbes, and Global Fire Power Ranking, 2024. With a strategic allocation of around 2.5% to 3% of its GDP to defence annually, India showcases its commitment to robust national security. This percentage can fluctuate yearly, influenced by budgetary priorities and economic conditions.

For FY 2024-25, the Indian government has allocated a substantial ₹6,21,940.85 crore to the Ministry of Defence (MoD), which constitutes 12.9% of the total Union Budget for the year. This allocation reflects India’s significant investment in its defence sector, which is crucial to give the global defence spending landscape.

India’s defence sector is booming, spurred by strong government support and investment. The Motilal Oswal Defence Index Fund recently raised ₹1,676 crores with its NFO, showing growing investor interest. The “Make in India” initiative has indigenized 2,920 out of 4,666 defence items, and the government is boosting foreign investments and restructuring the Ordinance Factory Board into seven entities for better efficiency. With plans to triple annual defence production to ₹3 lakh crore by 2028-29 and a focus on increasing exports, the sector is projected to grow at 13% CAGR, despite some R&D challenges.

Why Choose Motilal Oswal Defence Index Fund?

The Motilal Oswal Defence Index Fund is a compelling choice for investors keen on the dynamic growth of India’s defence sector. This is an open-ended fund (investors can enter & exit at any time they want), tracks the Nifty India Defence Total Return Index, giving the investor direct exposure to defence stocks that are benefiting from the “Make in India” initiative. With stellar 5-year CAGR of over 58%, it’s designed to reflect the index’s performance, minus the usual expense drag.

Starting with just ₹500, you can tap into the sector’s potential, and enjoy moderate exit costs if you stay invested beyond 15 days. It’s a great way to align your investment with a rapidly evolving sector that’s pivotal to India’s future.

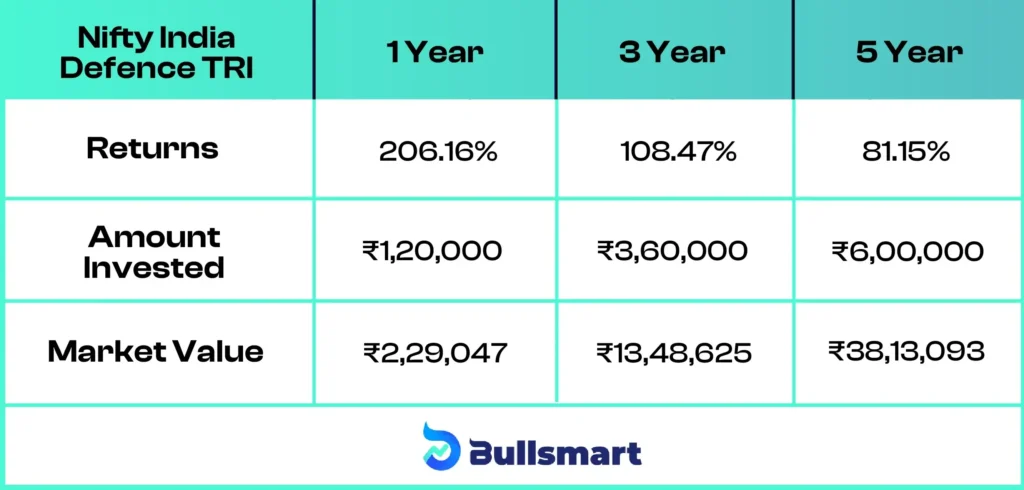

Benchmark index of the fund

Data as of June 30, 2024, with monthly investment of ₹10,000/-

To be noted: the past performance of the index is not guaranteed for future.

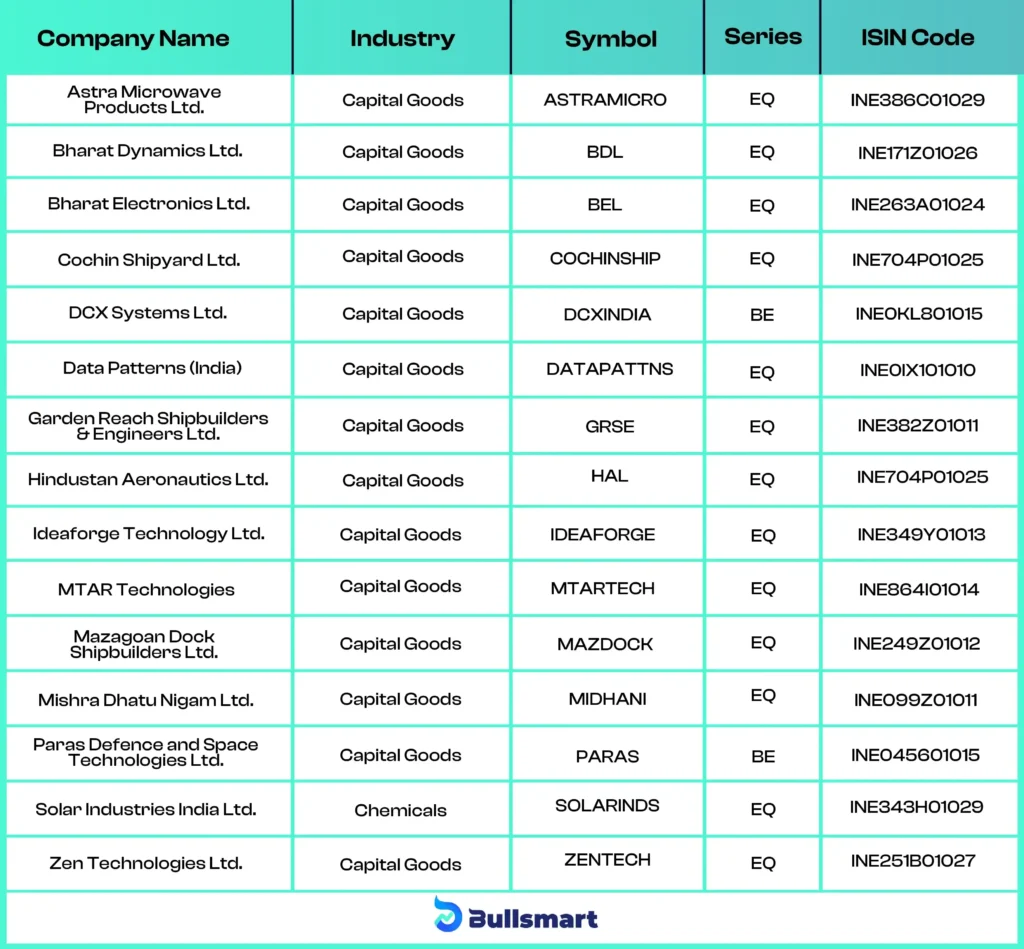

Portfolio allocation of the fund

Motilal Oswal AMC – Asset Management Company

Once upon a time in 2008, a new chapter in India’s financial saga began with the founding of Motilal Oswal mutual Fund. This venture emerged from the established Motilal Oswal Financial Services Ltd., known for its legacy of trust and innovation. The AMC made its grand debut in the mutual fund arena with its first scheme in 2010, setting the stage for its remarkable journey.

In 2011, the company’s achievements reached a new height as it became the first AMC (Asset Management Company) to ring the NASDAQ Stock Market opening bell–a symbolic gesture of its growing influence. The tale of success continued as, by 2016, this fund crossed the $1billion mark in assets, marking a meteoric rise in the financial world.

Today, this illustrious AMC manages over ₹45,000 crores in assets, offering a rich tapestry of investment schemes. This fund house’s journey from its humble beginnings to becoming a key player in India’s financial arena is a story of vision, growth, and unwavering dedication to excellence.

Meet the Fund Managers

This fund is managed by two financial virtuosos, namely Swapnil Mayekar & Rakesh Shetty.

Swapnil Mayekar is an M.Com from Mumbai University with an Advanced Diploma in Business Administration from Welingkar Institute, Mumbai, bringing extensive experience to his role at the AMC. Before joining the company, he worked at Business Standard Limited from August 2005 to Feburary 2010.

Rakesh Shetty holds a B.Com degree and has a background in capital markets. Before his tenure at the AMC, he managed equity and debt ETFs, customized indices, and contributed to product development in a company specializing in capital market business.

Suggested read: Motilal Oswal Manufacturing Fund NFO Review

Who should invest in this fund?

Investing in the Motilal Oswal Defence Index Fund is more than just a financial move; it’s an opportunity to be part of India’s growing defence sector. This fund lets one benefit from the sector’s expansion and gain exposure to companies that enjoy strong government backing and supportive policies.

The investor will get to invest in a field renowned for its technological innovation and ability to weather economic challenges. Plus, by aligning your portfolio with the nation’s strategic priorities, you’re contributing to a vital sector that plays a crucial role in national security and progress.

Thrilled to dive-in?