Small-cap funds have become increasingly popular among investors due to their potential for high growth. With India’s economy on a robust growth trajectory and small-cap companies playing a pivotal role in this journey, small-cap mutual funds offer a promising investment opportunity. Mirae Asset, a trusted name in the mutual fund industry, has launched the Mirae Asset Small Cap Fund, designed to tap into the immense potential of small-cap stocks. This New Fund Offer (NFO) provides an opportunity to invest early in small-cap companies with growth potential.

What is a Small-Cap Fund?

A smallcap fund is an equity mutual fund that predominantly invests in small-cap companies. According to SEBI’s classification, small-cap companies are those ranked below 250 in terms of market capitalisation. These funds aim to generate substantial returns by identifying and investing in emerging businesses with high growth potential.

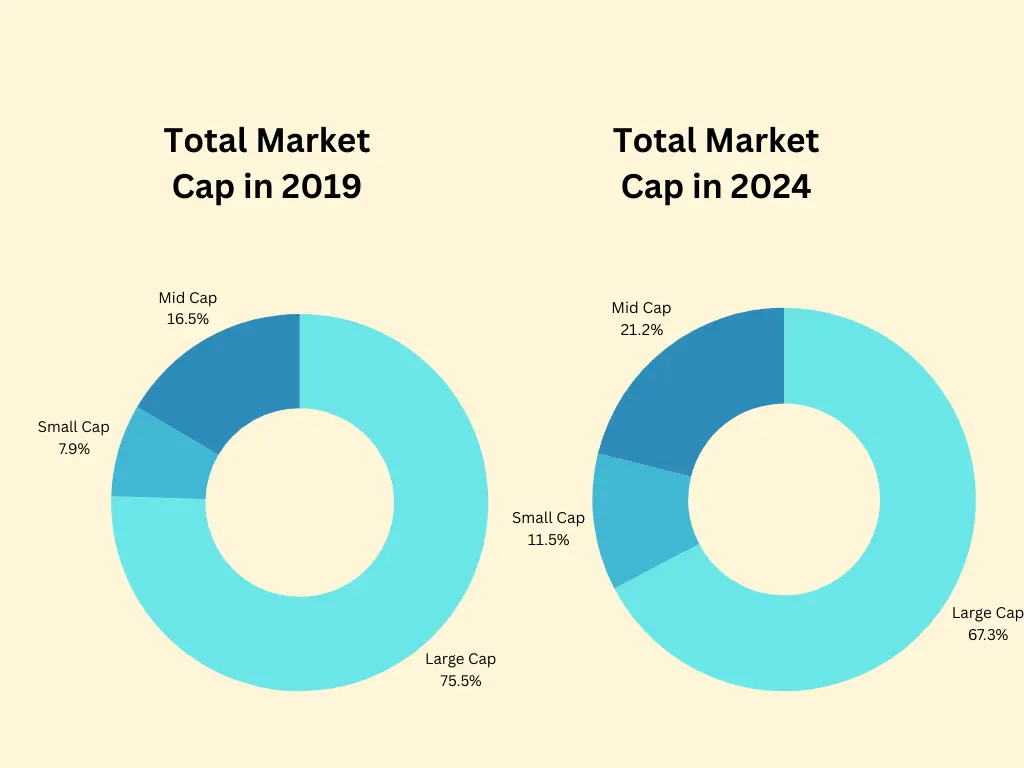

There has been a substantial increase in their total market capital from 2019 to 2024. Let’s have a look:

One of the main reasons for the popularity of small-cap funds is their ability to outperform large- and mid-cap funds during bullish market conditions. Here is a look at the CAGR (Compound Annual Growth Rate) of market caps:

This data underscores the higher growth potential of small-cap funds compared to their counterparts. If you’re looking to invest in both large-cap and mid-cap industries, the Mirae Asset Large & Midcap Fund is an excellent choice. The fund is designed to give you exposure to a diverse range of market leaders while tapping into the growth opportunities of mid-cap companies.

Details of Mirae Asset Small Cap Fund NFO

Mirae Asset Small Cap Fund is an open-ended equity scheme primarily investing in small-cap stocks. Let’s dive deeper into the key features and investment objective of this fund:

Investment Objective of the NFO Fund

The investment objective of the Mirae Asset Small Cap Fund is to generate capital appreciation by predominantly investing in small-cap stocks. Additionally, the fund manager may participate in other equity and equity-related securities to ensure optimal portfolio construction. While the scheme aims to achieve this objective, there is no guarantee of returns.

Key Details of the Mirae Asset Small Cap Fund

| Attributes | Details |

| Fund House/ Asset Management Company | Mirae Asset Investment Managers |

| Risk Profile | Very High |

| Fund Manager | Mr. Varun Goel, Mr. Siddharth Srivastava |

| Category | Small Cap Fund |

| NFO Opens | January 10, 2025 |

| NFO Closes | January 24, 2025 |

| Benchmark Index | NIFTY Small Cap 250 Total Return Index |

| Exit Load | 1% if redeemed within 1 year; NIL after 1 year |

| Minimum Application Amount | Lumpsum: Rs. 5,000/-; SIP: Rs. 99/- |

Asset Allocation Strategy of Mirae Asset Small Cap Fund:

| Asset Type | Maximum Allocation (% of total assets) |

| Equity and Equity-Related Securities of Smallcap Companies | 100 |

| Equity & Equity-Related Securities of Other Companies | 35 |

| Debt and Money Market Instruments | 35 |

| Overseas Mutual Fund Schemes/ETFs/Foreign Securities | 35 |

| Units Issued by REITs and InvITs | 10 |

Asset Management Company

Mirae Asset, founded during the 1997 Asian financial crisis, began with a cautious focus on the Korean market. After securing its position in Korea, it expanded internationally, opening its first overseas office in Hong Kong in 2003. Today, Mirae operates in countries like India, Australia, Canada, the UK, the USA, Brazil, and Vietnam.

In 1998, Mirae became the first AMC in Korea to offer top mutual funds to retail investors. It introduced the Mirae Asset Retirement Pension Fund in 2005 and entered the Indian and US markets in 2007. Mirae Asset Global Investments (India) Pvt. Ltd. was established in 2007, marking its second international office after Hong Kong. It began operations in India in 2008 and has grown rapidly since then, managing 54 mutual fund schemes with an AUM of INR 1,62,320.58 crore as of March 31, 2024.

Mirae’s growth in India has been impressive, with its investor base growing from 51,304 folios in 2013 to over 61 lakh folios in 2024. Notable performing funds include Mirae Asset Large Cap Fund and Mirae Asset ELSS Tax Saver Fund, both of which have shown strong returns and contributed to Mirae’s success in India’s mutual fund market.

Meet the Fund Managers

The Mirae Asset Small Cap Fund is managed by a highly experienced team:

- Mr. Varun Goel: With over 18 years of experience in fund management and equity research, Mr. Goel brings in-depth expertise to this fund. He has previously worked with reputed organizations like Nippon Life India AIF Management and Motilal Oswal Asset Management.

- Mr. Siddharth Srivastava: Mr. Srivastava has 14+ years of experience in financial services and stock markets. His expertise in passive investment products and overseas investments adds immense value to the fund’s portfolio.

Who Should Invest in this NFO Fund?

The Mirae Asset Small Cap Fund is suitable for investors who:

- Have a high-risk appetite and are willing to endure short-term volatility for long-term gains.

- Are looking to diversify their portfolio with exposure to small-cap stocks.

- Believe in India’s growth story and want to invest in emerging businesses.

- Are planning for long-term financial goals like wealth creation, retirement, or education.

Why Invest in Mirae Asset Small Cap Fund NFO?

- Diversification: Small-cap funds add depth to your portfolio by investing in companies from various sectors and industries, reducing over-reliance on large-cap stocks.

- Sector Breadth: Unlike large-cap funds, small-cap funds explore under-researched sectors, leading to potential opportunities.

- Growth Potential: Small-cap companies are in their early growth stages and have the potential to grow faster than established large-cap firms.

- Portfolio Efficiency: Adding small-cap funds to your portfolio can enhance returns and improve risk-adjusted performance.

Conclusion

The Mirae Asset Small Cap Fund NFO is a compelling choice for investors aiming to capitalize on the growth potential of small-cap companies. With its robust portfolio strategy, experienced fund managers, and focus on emerging businesses, the fund is well-positioned to deliver long-term capital appreciation.

If you’re planning your investments for the year-end, consider the Mirae Asset Small Cap Fund as a part of your portfolio. Alternatively, if you’re looking for tax-saving options, Motilal Oswal ELSS Tax Saver Fund could be another choice.

Whether you prefer SIP investment for disciplined investing or a lumpsum approach for wealth creation, Mirae Asset Small Cap Fund caters to all. Use tools like the SIP Calculator, and Lumpsum Calculator to plan your investments effectively. Explore the best SIP platform to start your journey and invest in mutual funds that align with your financial goals.

Don’t miss out on this opportunity to participate in India’s growth story through the Mirae Asset Small Cap Fund’s NFO. Act now and make a smart move toward securing your financial future!

Suggested Read – Gold ETFs vs. Gold Mutual Funds

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.