India’s stock market has attracted interest from a wide range of investors, both domestic and international. The broader market, including large, mid, and small-cap segments, presents significant opportunities for growth. In response to this potential, Mirae Asset Mutual Fund has launched the Mirae Asset Nifty Total Market Index Fund NFO, an open-ended index fund replicating the performance of the Nifty Total Market Index.

This new fund offer investors comprehensive exposure to the entire equity market, providing long-term capital appreciation by tracking a broad range of companies.

Let’s explore the details of this offering and how it can fit into an investor’s portfolio.

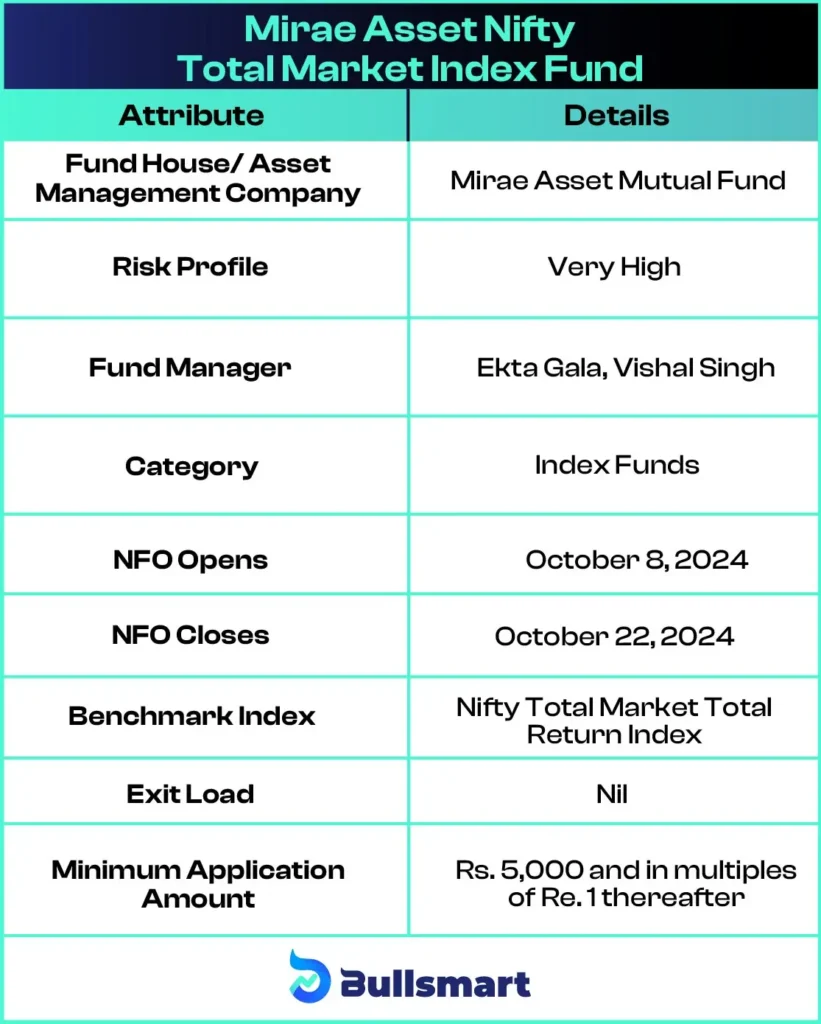

Details of Mirae Asset Nifty Total Market Index Fund

The Mirae Asset Nifty Total Market Index Fund is an open-ended index fund that mirrors the performance of the Nifty Total Market Total Return Index (TRI), offering exposure to a wide spectrum of companies across various market capitalisations.

Investment Objective of Mirae Asset Nifty Total Market Index Fund

The investment objective of the fund is to generate returns before expenses, commensurate with the performance of the Nifty Total Market Total Return Index, subject to tracking error. It aims to provide investors with exposure to the broad market through a single fund, making it suitable for those with a long-term investment horizon and a moderate-to-high-risk appetite.

Key Details of Mirae Asset Nifty Total Market Index Fund NFO:

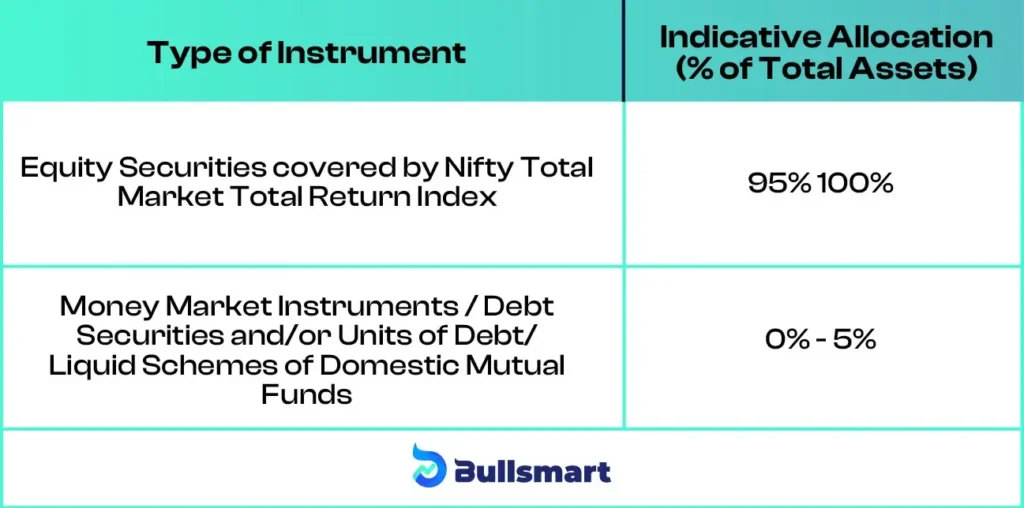

Portfolio Allocation

Mirae Asset Nifty Total Market Index Fund allocates its assets as follows:

Navigating the Risks and Returns of Fund

As an index fund, the Mirae Asset Nifty Total Market Index Fund NFO seeks to match the performance of the Nifty Total Market Total Return Index. Given its broad market exposure, the fund is suitable for investors who are comfortable with market fluctuations and have a high-risk tolerance.

The index covers a wide range of companies, providing diversification across market capitalizations, from large to small-cap stocks. While the fund aims to mirror the returns of the benchmark, investors should expect some level of tracking error.

Mirae Asset Mutual Funds

Founded during the Asian financial crisis in 1997, Mirae initially focused on the Korean market before expanding internationally, opening its first overseas office in Hong Kong in 2003. Today, Mirae operates in several countries, including India, Australia, Canada, and the USA.

Mirae made significant strides in the industry, becoming the first AMC to offer Mutual Funds to retail investors in 1998 and launching the Mirae Asset Retirement Pension Fund in 2005.

After entering the Indian market as a foreign institutional investor in 2004, it began domestic operations in 2008. Currently, Mirae Asset Mutual Funds has a rapidly growing portfolio of 56 schemes, with Assets Under Management (AUM) of ₹ 184,361.08 crore as of June 30, 2024.

Meet the Fund Management team

The fund is managed by two experienced professionals:

Ms. Ekta Gala

Ms. Ekta Gala, aged 31, holds a B.Com and is an Inter CA (IPCC) with over 6 years of experience as a dealer, previously working at ICICI Prudential Asset Management. She manages the Mirae Asset Nifty 100 ESG Sector Leaders Fund of Fund and the Mirae Asset NYSE FANG+ ETF Fund of Fund.

Mr. Vishal Singh

Mr. Vishal Singh, 30 years old, is a qualified C.A., C.F.A., and F.R.M., bringing over 5 years of experience in financial services from his prior role at NSE Indices Limited. He oversees the Mirae Asset Nifty 100 Low Volatility 30 ETF and the Mirae Asset Nifty India Manufacturing ETF Fund of Fund.

Who Should Invest in This NFO?

The Mirae Asset Nifty Total Market Index Fund is ideal for:

- Investors looking for long-term capital appreciation through broad market exposure.

- Those seeking diversification across large, mid, and small-cap stocks in a single fund.

- Investors with a high-risk tolerance who are comfortable with the inherent market volatility associated with equity investments.

This fund is well-suited for investors aiming to benefit from the overall growth of India’s equity market while keeping costs low due to its index-tracking nature.

Suggested Read – Mirae Asset Large and Midcap Fund Review

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.