Gold remains a trusted asset class for investors seeking a hedge against inflation and market volatility. With gold prices often rising during times of economic uncertainty, many investors turn to gold for portfolio diversification and long-term stability. To tap into this trend, Mirae Asset Mutual Fund has introduced an NFO – the Mirae Asset Gold ETF Fund of Fund, an open-ended fund of fund scheme investing in units of the Mirae Asset Gold ETF.

Mirae Asset Gold ETF Fund of Fund NFO aims to provide returns that closely mirror the domestic price of gold by investing primarily in the Mirae Asset Gold ETF.

Let’s explore the key details of this fund and its suitability for your portfolio.

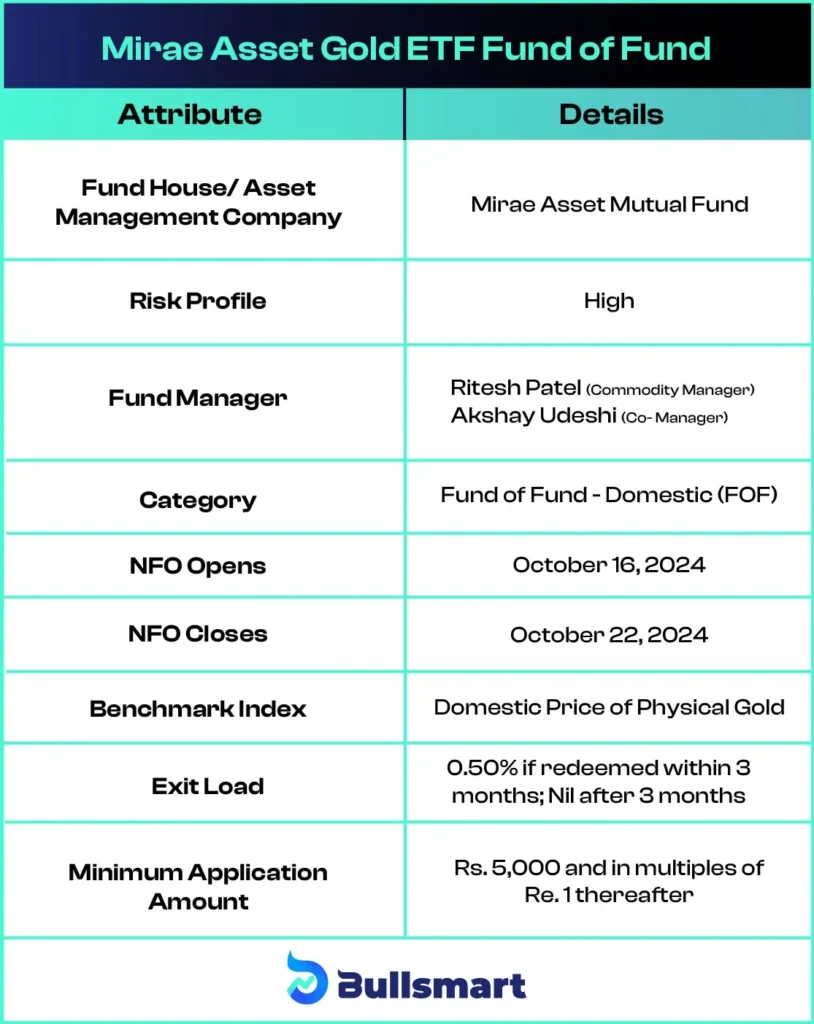

Details of Mirae Asset Gold ETF Fund of Fund

The Mirae Asset Gold ETF Fund of Fund NFO allows investors to gain exposure to gold through a Mutual Fund structure by investing in the Mirae Asset Gold ETF. This provides a convenient way to invest in gold without needing to physically hold the metal.

Mirae Asset Gold ETF Fund of Fund is benchmarked against the Domestic Price of Physical Gold, based on the LBMA Gold daily spot fixing price.

Investment Objective of the Fund

The fund’s primary objective is to generate returns by investing in units of the Mirae Asset Gold ETF, which tracks the domestic price of gold. The goal is to deliver returns closely aligned with the performance of gold, subject to tracking errors.

Here are the key details of Mirae Asset Gold ETF Fund of Fund:

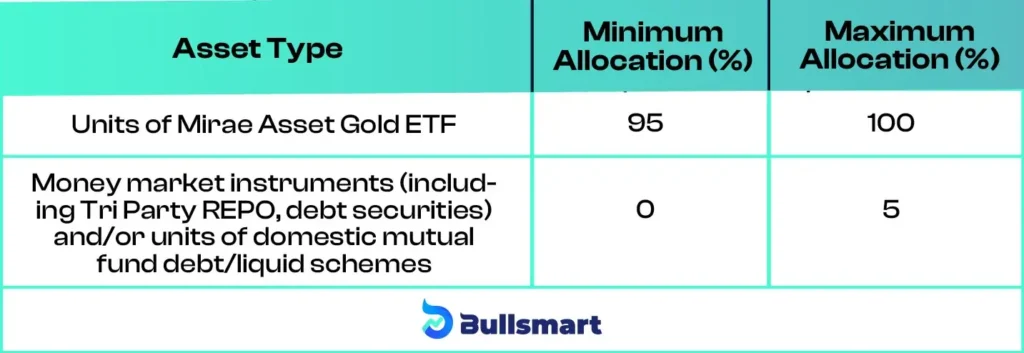

Portfolio Allocation

The asset allocation of the Mirae Asset Gold ETF Fund of Fund is as follows:

Understanding Risks and Returns

As a gold-focused fund of fund, the Mirae Asset Gold ETF Fund of Fund carries a moderately high risk profile. Gold is typically seen as a safe-haven asset, but it can also be subject to price fluctuations, particularly in the short term.

However, gold has historically provided stability during periods of market downturns, making it a valuable asset for long-term investors seeking to hedge against volatility.

Mirae Asset Mutual Fund

Mirae Asset Mutual Fund was founded during the Asian financial crisis in 1997. It started by focusing on the Korean market and later expanded internationally, opening its first office in Hong Kong in 2003. Today, Mirae Asset Mutual Fund has a presence in countries like India, Australia, Canada, and the USA.

The company made important advancements in the industry, becoming the first asset management company to offer mutual funds to everyday investors in 1998. In 2005, it launched the Mirae Asset Retirement Pension Fund.

Mirae entered the Indian market as a foreign institutional investor in 2004 and began local operations in 2008. Now, Mirae Mutual Funds has a fast-growing portfolio with 56 schemes and total Assets Under Management (AUM) of ₹ 184,361.08 crore as of June 30, 2024.

Some of the popular schemes served by the AMC include The Mirae Asset Midcap Fund, which has delivered the highest returns among mid-cap funds over the past five years. Similarly, the Mirae Asset Large & Midcap Fund has performed best among large and mid-cap funds in the last decade.

Meet the Fund Managers

The scheme is managed by Ritesh Patel and Akshay Udeshi, both of whom bring significant experience in managing commodity-linked funds:

Ms. Ritesh Patel

Ms. Ritesh Patel is a dedicated fund manager with over 10 years of experience in the commodities market. She manages several schemes, including the Mirae Asset Gold ETF, the Mirae Asset Silver ETF, and the Mirae Asset Multi Asset Allocation Fund (Commodity Portion).

Mr. Akshay Udeshi

Mr. Akshay Udeshi is a co-fund manager with 4 years of experience in financial services. He has been with Mirae Asset since June 2021 and co-manages schemes like the Mirae Asset Nifty 100 ESG Sector Leaders Fund of Fund, the Mirae Asset Nifty EV and New Age Automotive ETF, and the Mirae Asset Gold ETF.

Who Should Consider This Fund?

The Mirae Asset Gold ETF Fund of Fund is suitable for:

- Investors seeking long-term capital appreciation through gold investments

- Those looking for portfolio diversification with gold as an asset class

- Investors with a moderately high risk tolerance, looking to invest in a fund that tracks the domestic price of gold

This fund is ideal for those who want the convenience of investing in gold without holding physical gold, offering a low-cost entry into gold investing through a fund structure.

Suggested Read – Mirae Asset Large and Midcap Fund Review

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.