Finance Minister Nirmala Sitharaman has set the stage for a dynamic year ahead with Budget 2024. The budget has come up with several new tax modifications across income slabs that could shake up your financial plans.

In the latest Union Budget, one of the most talked about changes is the rise of LTCG tax rate which is a key factor in Mutual Fund industry. This is crucial as it directly affect the net returns of investors and their long-term investment strategies.

Hold on to your hats! While we dive into the blog to see how this shift is reshaping investments and could affect your wallet.

What is Capital gain and LTCG on Mutual Funds?

Capital Gain is the profit or gain that occurred from the sale of a Capital Asset. Based on the period of holding they are classified into two ways, Short Term Capital Gain and Long-Term Capital Gain.

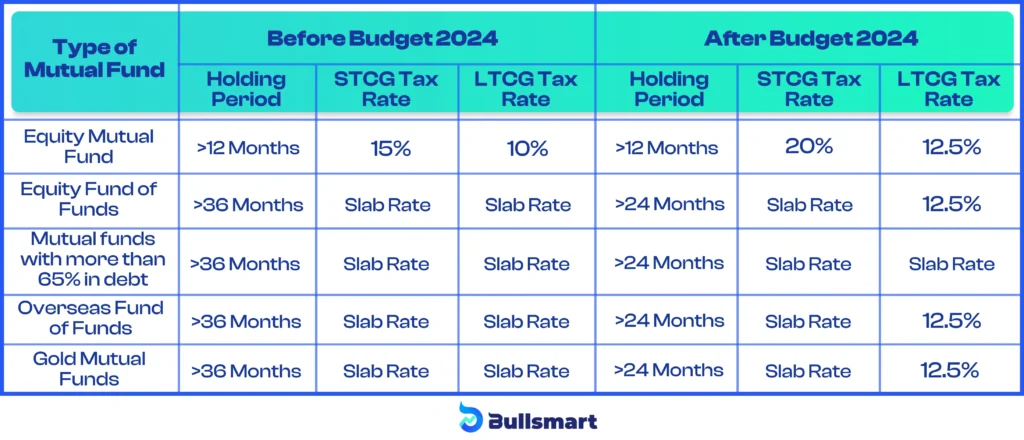

New LTCG changes for Mutual Funds

Long Term Capital Gains on all Financial and Non-Financial assets increased from 10% to 12.5%. However, investors can now avail themselves of an exemption limit of up to 1.25 lakhs, which was previously 1 lakh.

The budget has made it clear about the taxation of various Mutual fund schemes such as Hybrid Funds, Gold ETFs, and Fund of Funds. Hybrid funds with a minimum of 65% allocation to equities can claim LTCG benefit after 24 months of holding. However, Hybrid Funds with 35-65% equity allocation will not enjoy indexation benefits if they are held for more than three years.

Debt funds meaning has been changed to schemes investing more than 65% in debt and money market instruments.

According to the budget 2024, Fund of Funds are classified based on their underlying investments, either as equity or debt funds. Fund of Funds investing in equity can avail LTCG after holding it for a period of 24 months.

Indexation Benefit is removed to benefit some newly launched Hybrid schemes. This benefit allowed taxpayers to adjust the purchase price of an asset for inflation.

Let’s look at the changes in tax slabs for LTCG and STCG on mutual funds:

LTCG Calculation with an example

Say, you invested 5 lakh rupees in equity mutual funds on 1st May 2019. And the value of asset on 1st May 2023 was Rs. 7.5 lakhs.

Let’s understand tax on LTCG before and after the Budget,2024.

Before Budget 2024, with tax rate 10% and exemption up to 1 lakh.

Investment amount: Rs. 5 lakh

Value of the asset after 4 years: Rs. 7.5 lakh

LTCG = Value of asset – Investment amount

= Rs. 7.5 lakh – Rs. 5 lakh = Rs. 2.5 lakh

Exemption limit:

The exemption limit for LTCG on mutual funds is Rs. 1 lakh.

Taxable LTCG = LTCG – Exemption limit

= Rs. 2.5 lakh – Rs. 1 lakh = Rs. 1.5 lakh

Taxable LTCG is

LTCG tax rate: 10%

Taxable amount = Taxable LTCG * Tax rate

= Rs. 1.5 lakh * 10% = Rs. 15,000

So, the taxable amount on LTCG is Rs. 15,000.

After Budget 2024, with tax rate 12.5% and exemption up to 1.25 lakh.

Investment amount: Rs. 5 lakh

Value of the asset after 4 years: Rs. 7.5 lakh

LTCG = Value of asset – Investment amount

= Rs. 7.5 lakh – Rs. 5 lakh = Rs. 2.5 lakh

Exemption limit:

The exemption limit for LTCG on mutual funds is Rs. 1.25 lakh.

Taxable LTCG = LTCG – Exemption limit = Rs. 2.5 lakh – Rs. 1.25 lakh = Rs. 1.25 lakh

Taxable LTCG is

LTCG tax rate: 12.5%

Taxable amount = Taxable LTCG * Tax rate

= Rs. 1.25 lakh * 10% = Rs. 15,625

So, the taxable amount on LTCG is Rs. 15,625.

Expert views on Tax changes

“The recent changes in the Union Budget, particularly the increase in STCG and LTCG tax signal a significant shift. While the market’s initial reaction may seem bearish, we believe these changes will ultimately foster a more stable and mature investment environment,” said Vaibhav Porwal, co-founder, Dezerv.

“The increase in long-term equity capital gains tax from 10% to 12.5% has been a deterrent to the markets. India still has low tax rates as compared to other markets Globally. The markets may consider it negatively initially but considering the future prospects and the potential to make money in India, I think it will be still very insignificant. The Government has also increased the threshold for long-term capital gains exemption from Rs 1 lakh per year to Rs 1.25 lakhs and this is a welcome step. Those investing for the long term could consider capital gains harvesting every year, up to this limit of Rs 1.25 lakhs every year, and reduce the taxation over a long period,” said Rajesh Minocha, a Certified Financial Planner (CFP), Founder of Financial Radiance

Final thought

The increase in LTCG from 10% to 12.5% means investors will have to pay higher taxes than before, though the exemption threshold rises from 1 lakh to 1.25 lakh. However, this boosts the revenue for the government which can ultimately contribute to economic development.