India’s GDP growth, rising middle-class population, and export incentives are boosting demand for manufactured goods. Manufacturing will play a critical role in making India a $5-trillion economy by 2027.

The LIC MF Manufacturing Fund offers a unique opportunity to capitalize on India’s rapidly growing manufacturing sector. The LIC MF Manufacturing Fund NFO primarily invests in equity and equity-related instruments of companies that are part of the manufacturing industry.

The fund aims for long-term capital appreciation, tapping into the potential of sectors aligned with the “Make in India” initiative and the government’s production-linked incentive (PLI) schemes.

But is this NFO the right fit for your portfolio? Let’s know!

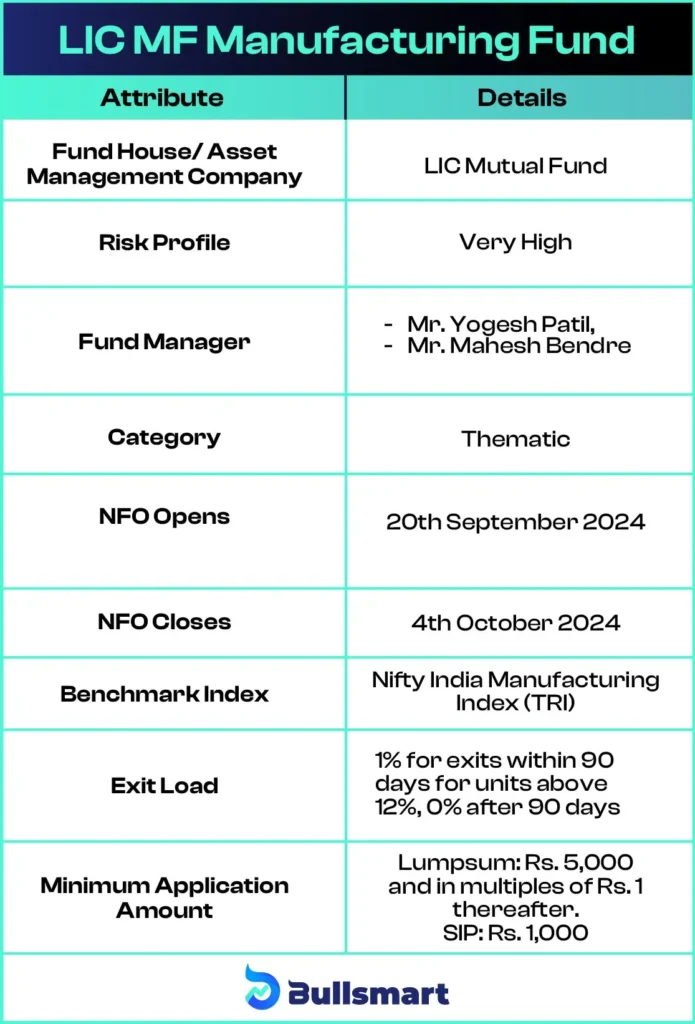

Important Details of LIC MF Manufacturing Fund

The LIC MF Manufacturing Fund NFO is an open-ended equity scheme focusing on companies operating within India’s manufacturing sector. The fund employs top-down and bottom-up approaches for stock selection, ensuring diversified exposure to industries that are key to India’s manufacturing future.

Understanding the Fund’s Investment Aim

The scheme aims to achieve long-term capital appreciation by predominantly investing in equity and equity-related instruments of companies following the manufacturing theme. While the fund strives for growth, there is no assurance that the investment objective will be met.

The fund focuses on several types of companies:

- Companies engaged in manufacturing activities.

- Companies that are well-positioned to replace imports with local manufacturing.

- Companies that benefit from the “Make in India” initiative and PLI schemes.

- Companies exporting goods made in India.

- Companies developing new-age technology solutions in India and abroad.

Here’s a look at the key basic details of the fund:

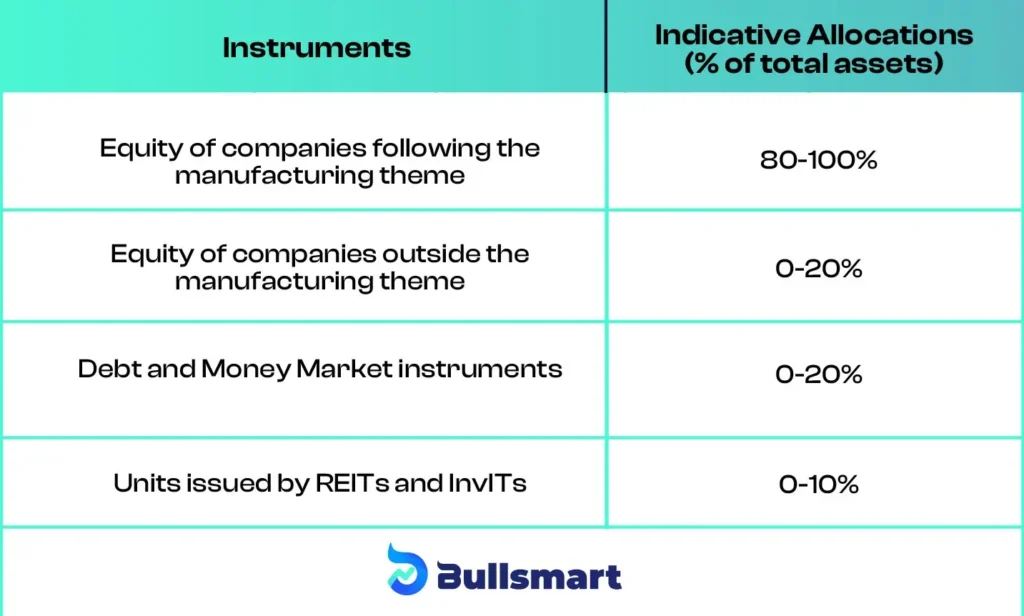

Portfolio Allocation

The LIC MF Manufacturing Fund NFO focuses on dynamic allocation across companies in the manufacturing sector. The portfolio will also include up to 20% of investments in non-manufacturing companies, providing an additional layer of diversification.

The asset allocation of the LIC MF Manufacturing Fund is as follows:

Risk and Return Overview

As a sectoral or thematic fund, the LIC MF Manufacturing Fund carries a very high-risk profile, particularly because it is equity-oriented and focused on a single theme. Investors should be prepared for market volatility and the potential for fluctuations in value.

However, the fund aims to deliver superior returns by investing in companies that are positioned to benefit from India’s manufacturing growth.

Since the fund’s benchmark is the Nifty India Manufacturing Index (TRI), the goal is to match or exceed the returns of this index.

About LIC Asset Management Company

The Life Insurance Corporation of India (LIC) is a well-known financial institution in India, mainly recognized for its strong position in the insurance sector. Recently, it announced a partial stake sale to private companies, reflecting changes in its structure.

While LIC’s involvement in Mutual Funds is modest, its management has set ambitious goals to reach an Assets Under Management (AUM) of ₹1 lakh crore by FY27.

As of June 30, 2024, LIC Mutual Fund manages an AUM of ₹ 32,423.29 crore and offers around 38 different schemes. Investors can easily explore the details of LIC MF offerings, compare their past performances, and select funds that match their investment goals and risk preferences.

Suggested Read – Motilal Oswal Manufacturing Fund NFO Review

About the Fund Management Team

The fund is managed by experienced fund managers:

Mr. Yogesh Patil

With 22 years of experience in the finance sector, Mr. Yogesh Patil is currently the Chief Investment Officer of Equity at LIC Mutual Fund. He has successfully managed several schemes, including the LIC MF Large & Mid Cap Fund and LIC MF ELSS Tax Saver.

Mr. Mahesh Bendre

Mr. Mahesh Bendre brings 18 years of expertise in equity management, recently stepping into the role of Fund Manager at LIC Mutual Fund. He has contributed to various initiatives, notably managing the LIC MF Multicap Fund and serving as Senior Equity Analyst for the firm.

Is LIC Manufacturing Fund NFO Right for You?

The LIC MF Manufacturing Fund may be suitable for investors who are:

- Seeking long-term capital appreciation.

- Comfortable with high-risk, sector-focused investments.

- Looking for exposure to companies benefiting from India’s manufacturing growth.

- Willing to stay invested for a minimum of 5 years.

As with any equity investment, there is a degree of risk involved. Consult your financial advisor to assess whether this fund aligns with your investment goals.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.