In the current pace of the financial industries, navigating the various sectors and new opportunities can be daunting. One needs to be astute and strategic in order to stay ahead of continual fluctuations.

In terms of growth over time, perhaps one of the most exciting avenues is in special situations like the events of companies and corporate events. These can be anything from significant merger deals to management changes, each providing unique investment opportunities. Changes in law and regulations matter too. New rules and regulations can alter the investment landscape directly and therefore are opportunities for wise investors.

It is also important to keep an eye on technological advancements and newly emerging technologies, as these can radically transform paradigms and create novel areas of growth. There are no guarantees, but understanding how to dive into such dynamics is part of the investment potential for willing investors. This is where Kotak Special Opportunities Fund enters the picture, as this fund focuses on white hot and emerging sectors to deliver returns.

Curious? So are we – let’s explore together.

Details of Kotak Special Opportunities Fund

The Kotak Special Opportunities Fund is an equity-focused fund that targets unique market opportunities and special situations. The fund is managed by Kotak Mahindra Asset Management Co. Ltd and considers Nifty 500 TRI as its benchmark.

The fund aims to capitalize on economic recovery, regulatory shifts, and market dislocations by investing in sectors poised for growth. It focuses on financials (banking, NBFCs, insurance), technology (IT services), and also holds stakes in consumer goods, industrials, and healthcare.

With flexible management style, it adapts to market changes to maximize returns and capitalize on emerging opportunities.

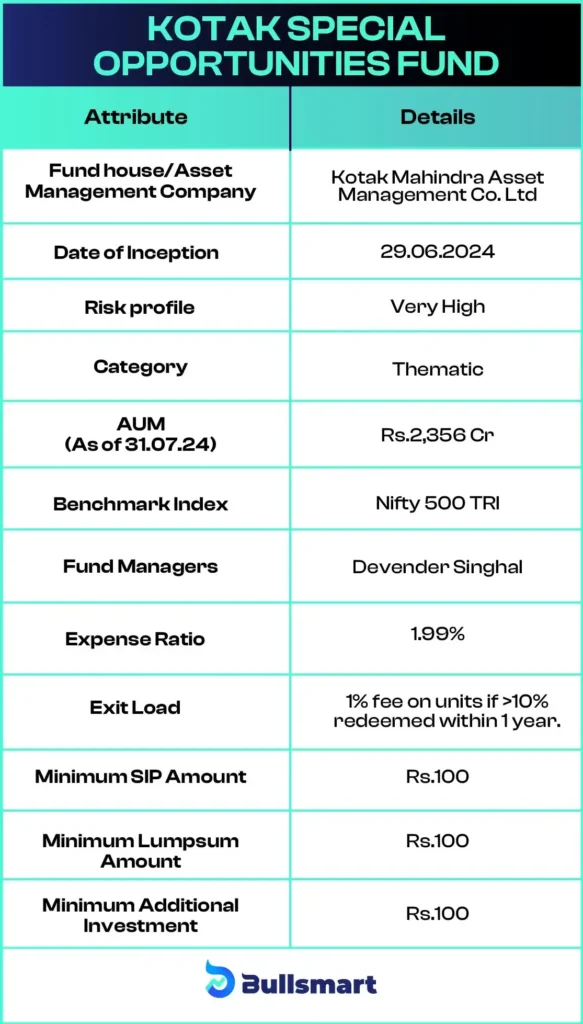

Here’s a quick summary of the fund’s deets for you to hover over:

Caption: Data updated as of 03.09.24

While the expense ratio, which is at 1.99%, may seem to be on the higher side, is still less when compared to the category average of sectoral/thematic funds category, i.e., 2.08%.

It may be acceptable if the fund’s thematic strategy delivers strong, consistent returns and aligns with your investment goals.

Portfolio Allocation

The Kotak Special Opportunities Fund invests 52.5% of its corpus in large-cap stocks, 30.96% in mid-cap stocks, and 1.3% in small-cap stocks. It holds shares in 32 different companies, with its top 10 holdings making up to 41% of the portfolio.

Some of the main stocks in this fund are Maruti Suzuki India Ltd (7.12% of the portfolio), Hero MotoCorp Ltd(4.85%), ITC Ltd (4.77%), Oracle Financial Services Software Ltd (4.7%), and Hindustan Unilever Ltd(3.95%). This mix of investments gives you a good idea of the fund’s focus and strate.

Risk Profile Analysis

This fund is still in its early days and hasn’t had the chance to show what it’s made of just yet, so its risk level isn’t clear. But generally, thematic funds like this one tend to be pretty high-risk and can swing a lot with market ups and downs.

Suggested Read – Kotak Debt Hybrid Fund

Meet the Fund Managers

Devender Singhal is a finance maverick with 16 years of experience in equity research and fund management. He had a stellar career with top names like Kotak’s PMS divisions, Religare, Karvy, and P N Vijay Financial Services before joining Kotak Mahindra Mutual Fund in 2007.

Since then, he’s been the go-to man for insights into the FMCG, Automobiles, and Media sectors. With a BA in Mathematics, he’s got some quirky tricks up his sleeves and being a PGDM in Finance is like the cherry on top.

Mr. Singhal combines deep expertise with a knack for spotting market trends.

Who should invest in Kotak Special Opportunities fund?

If you thrive on applying high conviction investment strategies or identifying investments with great opportunity, the Kotak Special Opportunities Fund might just suit your approach to investing. It is designed to maximize returns over the long-term using special situations like key corporate events, corporate restructuring, changing financial policies, or technological innovation.

Although this fund is targeting high returns by making concentrated investments in the aforementioned contexts, there is no guarantee that the Kotak Special Opportunities Fund approaches will be successful. Therefore, if you have a strong risk tolerance and enjoy finding the first-mover advantage to emerging trends, this will align well with your interests!

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.