India’s midcap companies have consistently demonstrated significant growth and are often seen as drivers of innovation and expansion within the economy. Midcap stocks can be highly volatile, but they also offer substantial growth opportunities for investors looking to diversify beyond large caps. The Kotak NIFTY Midcap 150 Momentum 50 Index Fund NFO provides an opportunity to tap into the momentum of midcap stocks, aiming for returns that align with the performance of the NIFTY Midcap 150 Momentum 50 Index.

The fund is designed to track stocks that show a strong momentum factor, stocks that have performed well relative to their peers, with the potential for continued outperformance.

But is this NFO the right fit for your portfolio? Let’s find out!

Insight into Kotak Nifty Midcap 150 Momentum 50 Fund

The Kotak NIFTY Midcap 150 Momentum 50 Index Fund is an open-ended scheme replicating or tracking the NIFTY Midcap 150 Momentum 50 Index. This index comprises 50 stocks from the NIFTY Midcap 150 that demonstrate the strongest momentum, selected based on their price performance.

Primary Investment Aim of the Fund

The primary investment objective of this scheme is to provide returns, before expenses, that correspond to the total returns of the securities represented by the underlying index, subject to tracking errors. However, there is no assurance or guarantee that the investment objective will be achieved.

The fund focuses on investing in:

- Companies from the midcap category have demonstrated strong momentum.

- Stocks with the potential for continued price performance are in line with the NIFTY Midcap 150 Momentum 50 Index.

- A diversified portfolio that aims to reduce stock-specific risks.

Portfolio Construction

The Kotak NIFTY Midcap 150 Momentum 50 Index Fund NFO focuses on investing in the top 50 companies within the NIFTY Midcap 150 index based on their momentum factor. The portfolio aims to capitalize on midcap stocks that are on an upward price trajectory, thereby offering exposure to high-growth potential companies.

The asset allocation of the Kotak NIFTY Midcap 150 Momentum 50 Index Fund is as follows:

Risk-Return Profile of the Fund

As an index fund focusing on midcap momentum stocks, the Kotak NIFTY Midcap 150 Momentum 50 Index Fund NFO carries a very high-risk profile.

Midcap stocks tend to experience higher price fluctuations compared to large-cap stocks, and the fund’s performance is directly tied to the performance of the NIFTY Midcap 150 Momentum 50 Index.

While the fund aims to track the performance of the underlying index, investors should be prepared for market volatility and potential tracking errors. The momentum factor can lead to outperformance during bullish market phases but may also result in underperformance during periods of market correction.

However, the NIFTY Midcap 150 Momentum 50 Index has delivered returns of 66.13% and 39.93% in the last 1 year and 5 years.

Kotak Mahindra Asset Management Company

Kotak Mahindra Asset Management Company Limited (KMAMC) was established on August 2, 1994, under the Companies Act of 1956 to oversee Kotak Mahindra Mutual Fund (KMMF). As a leading asset management firm, Kotak has made a notable impact on the market with its innovative investment options.

It was the first to launch a gilt fund, which invests exclusively in government securities. As of June 30, 2024, Kotak Mutual Fund manages assets totaling ₹444,792.28 crores, making it one of the largest mutual fund companies in India.

About the Fund Management Team

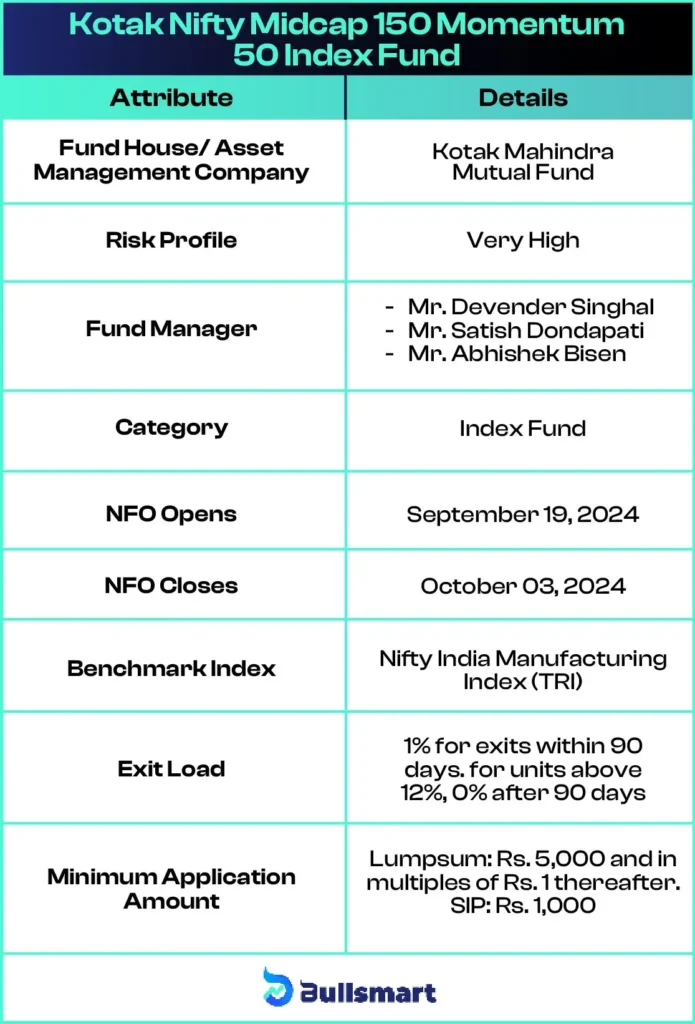

The Kotak NIFTY Midcap 150 Momentum 50 Index Fund is managed by experienced fund managers:

Mr. Devender Singhal

Mr. Devender Singhal has been managing equity funds at Kotak AMC since August 2015, bringing over 22 years of experience in fund management and equity research. He oversees various multicap and hybrid strategies, including the Kotak Multicap Fund and the Kotak Consumption Fund.

Mr. Satish Dondapati

With more than 16 years of experience in ETFs, Mr. Satish Dondapati joined Kotak AMC in March 2008. He has played a key role in product development, managing funds like the Kotak Nifty 50 Index Fund and the Kotak Nifty Bank ETF.

Mr. Abhishek Bisen

Mr. Abhishek Bisen has been with Kotak AMC since October 2006, focusing on the management of debt schemes. He has a strong background in fixed-income products and manages various funds, including the Kotak Bond Fund and the Kotak Dynamic Bond Fund.

Who Should Choose This Fund for Their Portfolio?

The Kotak NIFTY Midcap 150 Momentum 50 Index Fund may be suitable for investors who are:

- Seeking long-term capital appreciation.

- Looking for diversification in their portfolio by investing in midcap companies with strong momentum.

- Comfortable with high-risk, high-reward investments.

- Willing to stay invested for a minimum of 5 years.

As with any equity investment, there is a degree of risk involved. Consult your financial advisor to assess whether Kotak NIFTY Midcap 150 Momentum 50 Index Fund aligns with your investment goals.

Suggested Read – kotak Tourism NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.