Hybrid funds have recently captured the spotlight for investors aiming to balance stability with growth. These funds, which combine equities and fixed-income instruments, offer a diversified investment approach, catering to those who seek both income and capital appreciation.

With the hybrid fund sector experiencing unprecedented growth, the Kotak debt hybrid Fund is well-positioned to capitalise on this trend, offering investors a compelling option in the current market environment.

In the financial year 2023-24 (FY24), the mutual fund industry saw a remarkable total inflow of ₹3.55 lakh crore, reflecting a staggering 366% increase from the ₹76,225 crore recorded the previous year.

Let’s understand if it could be the right fit for your investment portfolio.

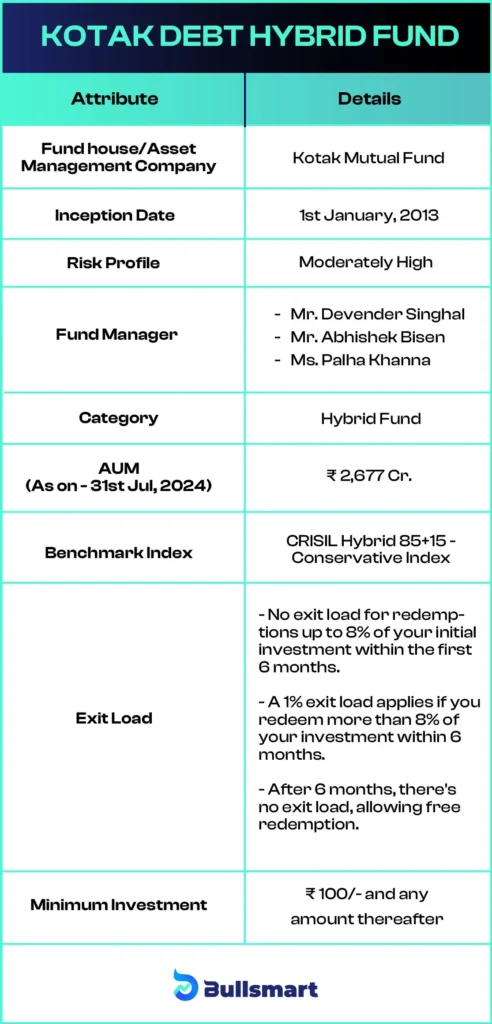

Details of Kotak Debt Hybrid Fund

The Kotak Debt Hybrid Fund is an open-ended hybrid scheme that invests predominantly in debt instruments, with moderate exposure to equity and equity-related instruments. Launched on January 1, 2013, this fund aims to enhance returns over a portfolio of debt instruments while managing risk through diversification.

The fund considers CRISIL Hybrid 85+15 – Conservative Index as the benchmark.

Investment Objective of the fund

The Scheme aims to provide long-term capital growth by investing in companies related to consumption and consumption-related sectors.

Let’s have a quick look at the key basic details of the fund:

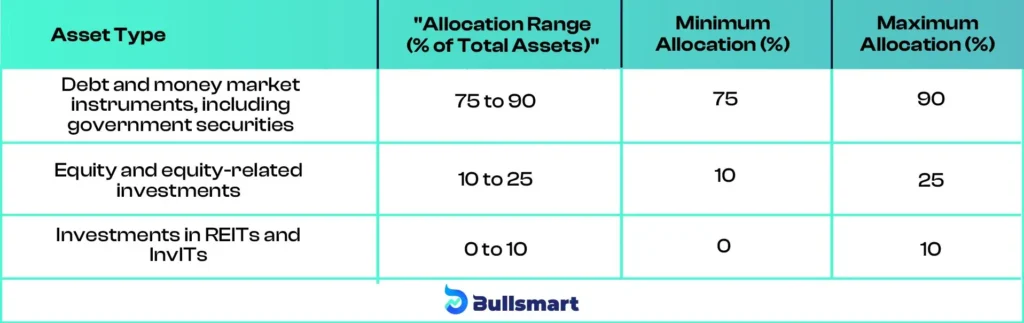

Portfolio Analysis

The asset allocation of the Kotak Debt Hybrid Fund is as follows:

Risks and Returns of Kotak Debt Hybrid NFO

As of July 31, 2024, the Kotak Debt Hybrid Fund has shown impressive performance and has outperformed its benchmark fund i.e. CRISIL Hybrid 85+15 – Conservative Index.

Kotak Asset Management Company

Kotak Mahindra Asset Management Company Limited (KMAMC) was established on August 2, 1994, under the Companies Act 1956, to manage Kotak Mahindra Mutual Fund (KMMF).

Recognized as a prominent asset management firm, Kotak Mahindra Mutual Fund has significantly contributed to the market with several innovative investment schemes.

It was notably the first asset management company to launch a dedicated gilt fund, which focuses solely on government securities. As of June 30, 2024, Kotak Mutual Fund AMC holds assets under management (AUM) totalling INR ₹ 444,792.28 crores, positioning itself among the leading mutual fund companies in India.

Meet the Fund Managers

The fund is managed by Mr Devender Singhal, Mr Abhishek Bisen, and Ms Palha Khanna.

Mr. Abhishek Bisen

With a B.A. in Management and an MBA in Finance, Mr. Bisen has been with Kotak AMC since October 2006, specializing in debt fund management. He previously worked in fixed income sales and trading at Securities Trading Corporation of India Ltd and has merchant banking experience.

Mr. Devender Singhal

Mr. Singhal, with a PGDM in Finance and Insurance and an Honours degree in Mathematics, has managed equity funds at Kotak AMC since August 2015. He has over 22 years of experience, including roles at Kotak, Religare, Karvy, and P N Vijay Financial Services.

Ms. Palha Khanna

Ms. Khanna, holding a Bachelor’s in Commerce and an MBA in Finance, has been with Kotak AMC focusing on debt and credit research. She previously worked in sales of equity and fixed income products at HDFC Asset Management Company Limited.

Who should invest in this fund?

The Kotak Debt Hybrid Fund may be suitable for investors who are seeking income and capital growth over a long-term horizon and are aiming for relatively stable returns with some growth potential. It’s also a great choice for those investors who are looking for a balanced investment approach with predominant exposure to debt and are comfortable with moderate equity exposure for potential higher returns.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.