Investors often seek a balance between stability and growth in their portfolios. ITI Large and mid cap funds offer just that by investing in established companies with stable earnings and emerging firms with high growth potential.

Over the past five years, large and mid cap funds have witnessed significant growth in assets under management (AUM), rising to ₹2.57 lakh crore by July 2024, up from ₹0.50 lakh crore in July 2019.

Amidst this ongoing inclination, the ITI Large & Mid cap Fund, recently launched by ITI Asset Management Company Ltd (ITI AMC), aims to tap into India’s economic expansion by investing in the top 250 companies across various sectors.

Let us understand what ITI Large and Mid cap Fund offers.

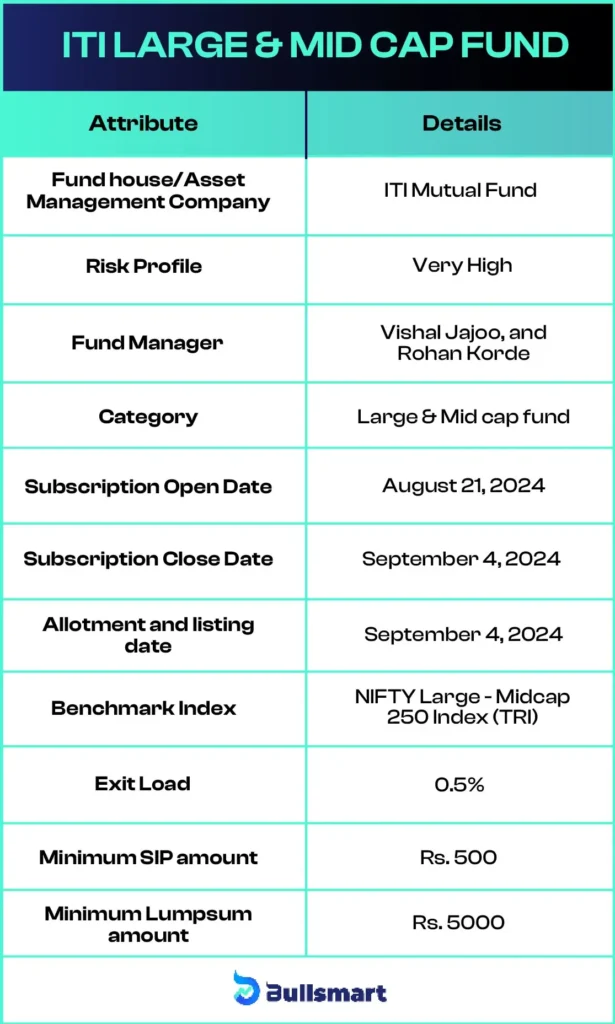

Details of ITI Large & Mid cap Fund

The ITI Large and Mid cap Fund is an open-ended equity scheme by ITI AMC that invests in a mix of large-cap and mid-cap companies. It’s designed to offer long-term capital growth by focusing on companies that are well-positioned to benefit from India’s ongoing structural, cultural, and digital transformations.

The fund considers the NIFTY Large – Midcap 250 Index (TRI) as the benchmark.

Investment Objective of the fund

The Scheme aims to achieve long-term capital growth by investing in equity and equity-related securities of large-cap and mid-cap stocks.

Let’s have a quick look at the key basic details of the fund:

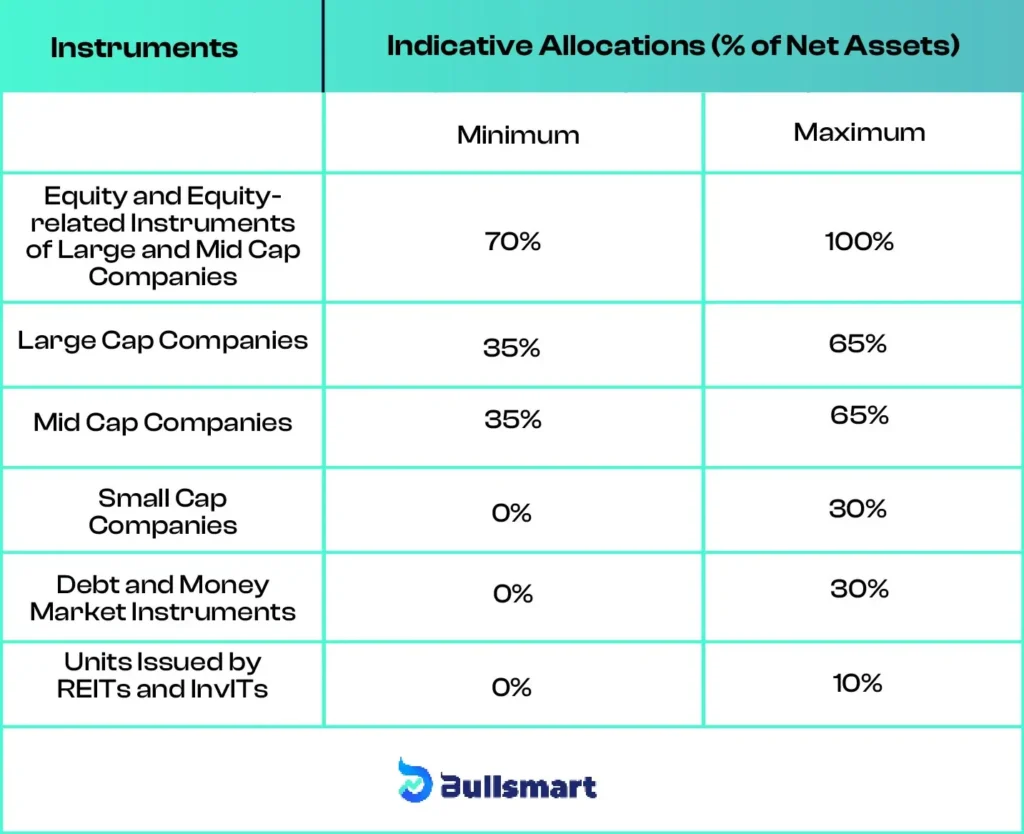

Portfolio Construction

The asset allocation of the ITI Large & Mid cap Fund is as follows:

Understanding Risks and Returns

The ITI Large and Mid Cap Fund carries a very high-risk profile but is equally capable of generating high returns for its investors.

As of 21st August 2024, the NIFTY Large – Midcap 250 Index (TRI) has delivered returns of 32.66%, 37.04%, and 6.03% over 1-year, 3-year, and 5-year periods, respectively. Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

ITI Asset Management Company

Founded in 2018, ITI Mutual Fund is dedicated to providing investor-focused investment solutions managed by a team of seasoned professionals in research and portfolio management.

ITI Mutual Fund is promoted by Investment Trust of India Ltd. (ITI Ltd.).

Part of the ITI Group of Companies, ITI MF is an emerging financial conglomerate offering a wide range of services, including equity research, equity broking, asset-based lending, investment banking, and alternative investment funds.

The asset management company operates through approximately 29 branches across India and manages an (AUM) of ₹ 8,292.68 crore (as of 30 June 2024).

Meet the Fund Managers

The fund is managed by Vishal Jajoo, and Rohan Korde.

Mr. Jajoo is a CA with a PGDM in Finance and an MBA in Investments. Before joining ITI Mutual Fund, he gained experience working with Tata Investment Corporation Ltd.

Mr. Korde holds a Master’s in Management Studies with a specialization in Finance and a Bachelor’s in Commerce. Before joining ITI Mutual Fund, he served as Vice President at BOB Capital Markets.

Who should invest in ITI Large and Mid Cap Fund NFO?

The ITI Large and Mid cap Fund may be suitable for investors who have a long-term investment horizon and are looking for both growth and stability in their portfolio.

Investors seeking very high returns and with a very high-risk appetite can consider this fund.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.