Energy is the foundation of industrial growth and economic development. India has set a target of reaching net-zero emissions by 2070. As the transition towards renewable energy gains momentum and the government prioritizes the goal of zero emission, the energy sector provides substantial growth potential.

The Indian energy market ranks 3rd in the world. Further, it is set for explosive growth, with its energy needs expected to double by 2050.

Government is spending to develop this sector, particularly the renewable energy sector. In the interim Union Budget of 2024, Rs.19,100 crore has been allocated to the Ministry of New and Renewable Energy.

Backed by the Government and boom of clean energy revolution offers investors a chance to tap into a diverse portfolio within the energy sector.

ICICI Prudential Mutual Fund has released a new fund, the “ICICI Prudential Energy Opportunities Fund” to explore the opportunities in the energy industry.

Buckle up as we delve into the details of this fund and determine whether it’s a good fit for you and your wealth-building goals.

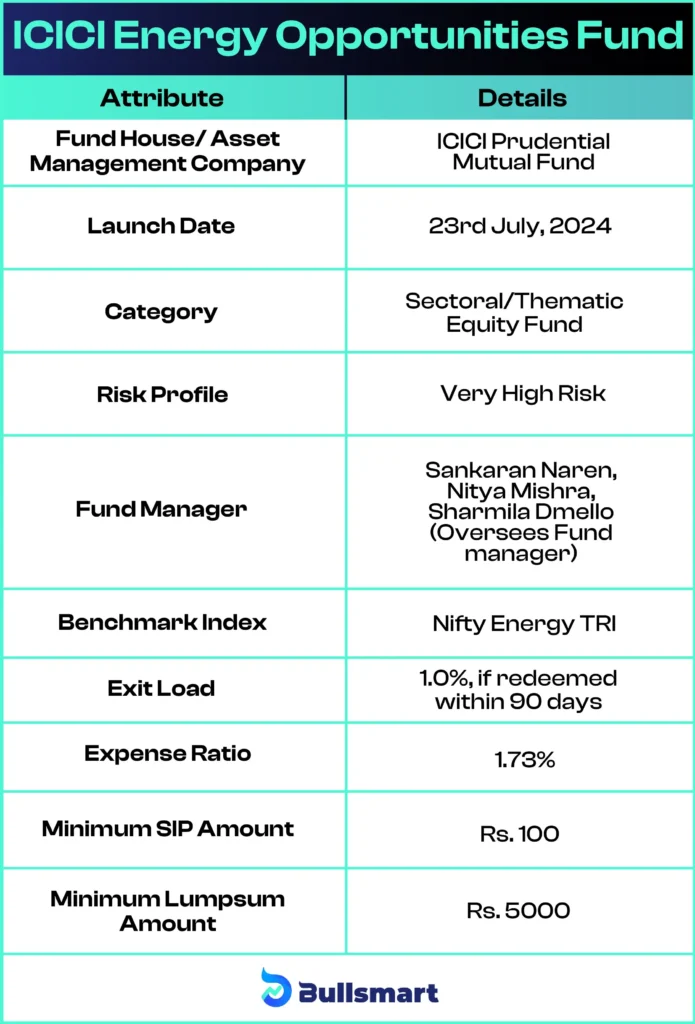

Details of ICICI Energy Opportunities Fund

ICICI Energy Opportunities Fund is an open-ended equity scheme where it predominantly invest in Energy sector.

The fund considers “NIFTY Energy TRI” as its Benchmark Index. This index includes stocks engaged in petroleum, gas and power sectors.

Investment Objective of fund

ICICI Energy Opportunities Fund provide investors with opportunities for long term capital appreciation by investing in equities of companies involved in activities such as exploration, production, distribution, transportation and processing of traditional & new energy including but not limited to industries such as oil & gas, utilities and power.

Let us have a quick glance at the details of the fund:

It has an expense ratio of 1.73% which is less than the category average of 1.95% making it more affordable to investors.

Portfolio Construction

The scheme will allocate 80-100% in equities of companies engaged in Energy (traditional and new) and allied sectors, 0-20% in other equities and debts. 0-10% in REITs/InvITs.

Navigating Risks and Returns

ICICI Energy Opportunities Fund is a sectoral/thematic equity fund, where it carries a very high-risk profile but also has the potential to generate higher returns for its investors.

As of 8th August 2024, the NIFTY Energy TRI has delivered returns of 65.38%, 32.21%, and 27.37% over 1-year, 3-year, and 5-year periods, respectively. Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Meet the Fund Management Team

The fund is actively managed by seasoned professionals, Sankaran Naren, Nitya Mishra, Sharmila Dmello (Overseas Fund Manager).

Sankaran Naren holds a B.Tech from IIT and an MBA in Finance from IIM. Before joining ICICI Prudential AMC, he worked with Refco Sify Securities India Pvt. Ltd., HDFC Securities Ltd., and Yoha Securities.

Nitya Mishra holds a B.Tech, an MBA, and a CFA holder. Prior to joining ICICI Prudential Mutual Fund, she worked with SBI Capital Markets and CRISIL Ltd.

Sharmila Dmello is an overseas fund manager who has been associated with ICICI Prudential since September 2016.

ICICI Prudential Asset Management Company

ICICI was founded in 1993 as a joint venture between ICICI and prudential plc. It is one of the largest Fund house in India. It is focused on bridging the gap between savings and investments.

Currently this AMC holds an Asset Under Management of Rs. 781394.3 crores and actively manages 98 schemes

Who should invest in this Fund?

Investors with advanced knowledge of macro trends and seeking very high returns and with a very high-risk appetite can consider the ICICI Energy Opportunities Fund.

As the fund aims to provide long-term capital appreciation, it is best suited for investors who are optimistic about the growth of the manufacturing sector.

As always, investors should conduct thorough analysis before investing or seek professional advice if needed.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.